Is General Electric Stock a Buy, a Sell, or Fairly Valued Following Earnings?

With strong margins and revenues, here is what we think of GE stock.

General Electric GE released its first-quarter earnings report on April 26. Here’s Morningstar’s take on what to think of General Electric’s earnings and stock.

General Electric Stock at a Glance

- Fair Value Estimate: $110

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

What We Thought of General Electric’s Q1 Earnings

Results were superb, and they materially outpaced our expectations, particularly on the bottom line. We were hoping to see over $13.1 billion of adjusted revenue (sale of equipment and services but excluding insurance). GE moved past this figure with $13.7 billion of adjusted revenue, a 17% year-over-year increase.

On a segment operating margin basis (before the allocation of corporate and other expenses), we were hoping to see margins of 5.6%, but GE posted a 7.2% figure, or 260 basis points ahead of expectations. On an earnings basis, we were expecting $0.00 of adjusted EPS, while GE posted $0.27, meaningfully greater than our estimate. That’s impressive because typically GE’s earnings are weighted toward the fourth quarter. It was also the first time GE has posted positive free cash flow in the first quarter of a calendar year since 2015, which was long before CEO Larry Culp took over as CEO. The primary reason for the margin discrepancy relative to our expectations was less of a mix headwind from the LEAP engine ramp (engine deliveries weigh down margins because parts and services are the profit pools of the commercial aero engine business).

Nothing in the results materially altered our long-term view of the stock. Management raised the bottom end of both its adjusted EPS and free cash flow guidance, but we were already modeling at the upper end of both guides. Though we made minor adjustments upward, it really only pulled forward our estimates. There’s probably some conservatism baked in management’s guide, but given that first-quarter adjusted EPS is only between 13% and 14% of our full-year 2023 outlook, and there’s some macroeconomic uncertainty, we thought it best not to overreact to the print. As an aside, first-quarter free cash flow is an even smaller proportion of our full-year outlook, at only 2% to 3% of our anticipated full-year number. That’s because GE builds inventory throughout the first three quarters and liquidates it in the fourth quarter, hence the discrepancy between earnings and free cash.

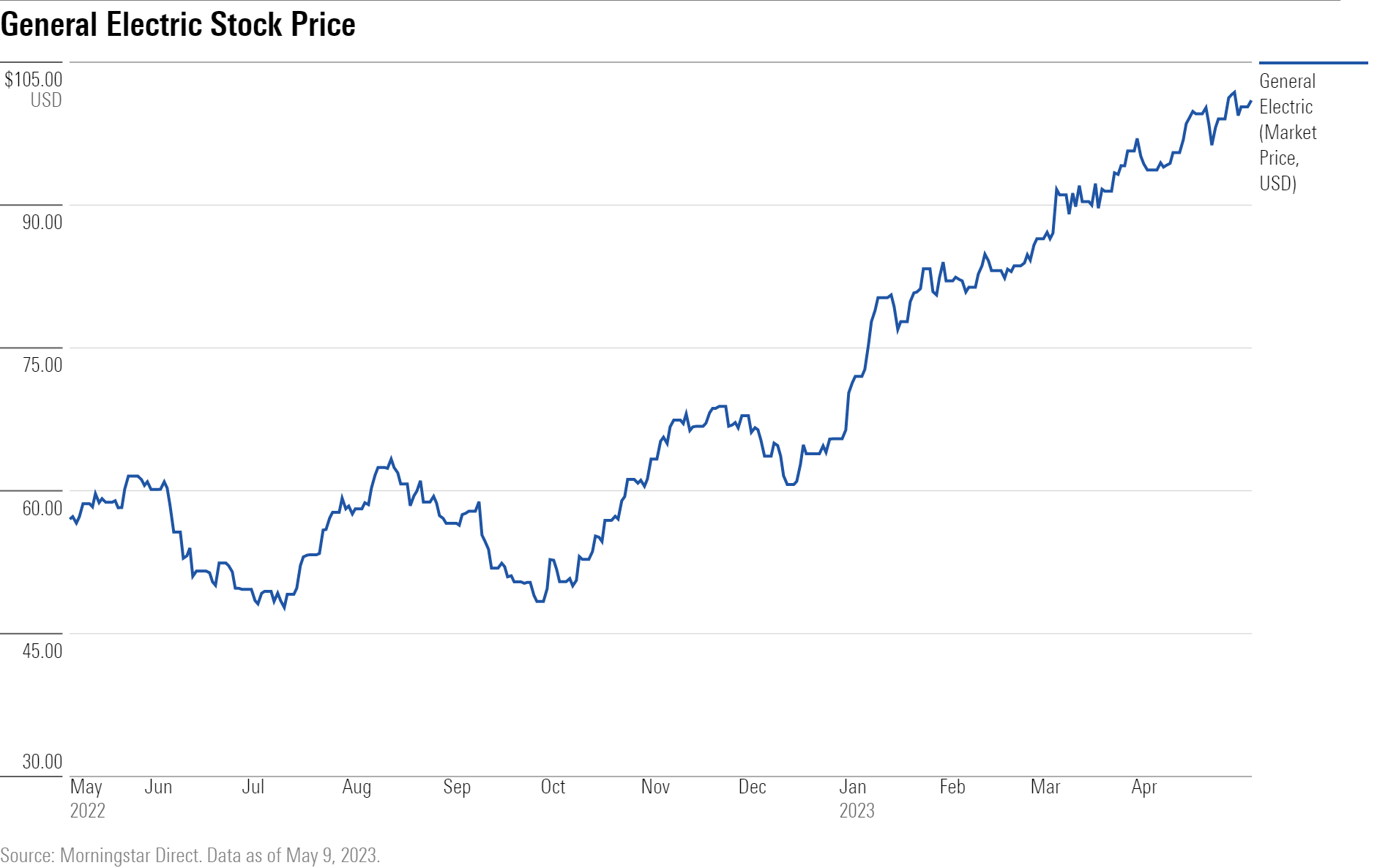

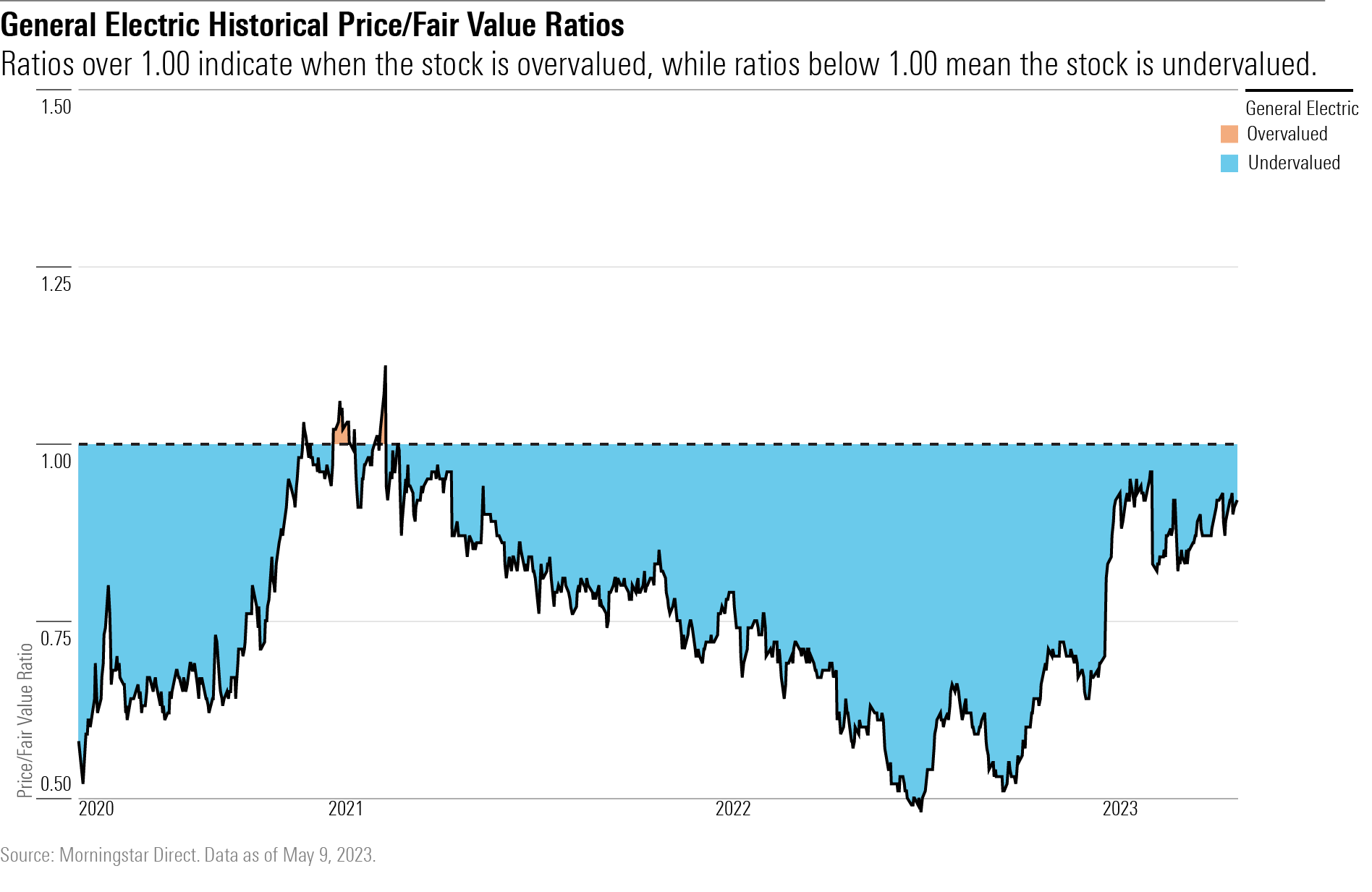

We see no reason to be wary of owning the stock, barring some unforeseen macroeconomic shock. The one exception is the price, since GE only trades at less than an 8% discount, so investors have to consider their opportunity cost and may have more attractive risk/reward opportunities, even in the industrials space.

Having said that, GE stock trades relatively in line on a price/fair value ratio with the rest of the sector and the broader market, and there’s a lot of upward momentum in the business. Demand is very strong, as evidenced by the firm’s strong book/bill (orders divided by revenue) of just under 1.3 times. And one could argue there’s a lot of incremental upside in the energy business from Congressional action like the Inflation Reduction Act. Finally, we’d point out that these are long-cycle, mission-critical businesses, so even in a recession, it’s easier for airline customers to reduce head count than it is to defer engine service, particularly after deferring this maintenance during the coronavirus pandemic.

Fair Value Estimate for General Electric

With a 3-star rating, we believe General Electric stock is fairly valued when compared with our fair value estimate.

Nothing in GE’s latest print materially alters our long-term view of the stock. We are raising our fair value estimate to $110 from $108 owing exclusively to time value of money. We think there’s probably some conservatism baked into these numbers, but given the uncertain macroeconomic environment and most of the year remaining, we hesitate to move ahead of the company’s guide, for now. GE’s first-quarter results were superb, materially outpacing our expectations. We were hoping to see over $13.1 billion of adjusted revenue (sale of equipment and services but excluding insurance). Despite macroeconomic headwinds, evidence of pent-up demand in strong backlog and order strength (1.2 book/bill ratio) gives us continued confidence that aerospace revenue will grow at a high-teens percentage in 2023 relative to 2022 results.

Read more about General Electric’s fair value estimate.

Economic Moat Rating

We assign General Electric a narrow economic moat based on switching costs and intangible assets stemming from its massive installed base of industrial equipment and differentiated technology. GE Aerospace meets our highest standard of a wide-moat business and is GE’s crown jewel. The segment benefits from intangible assets and switching costs, and we think it is the premier commercial engine manufacturer that can deliver at scale. We believe intangible assets are particularly critical for engine deliveries—the razor in the razor-and-blade model. The technical knowledge needed to design and manufacture a jet engine is GE’s main source of intangible assets. Other intangible assets include the firm’s patents, a long track record of success, and its customer relationships with both Boeing BA (primarily) and Airbus. GE’s switching costs are a result of the firm’s engines and associated equipment’s strong integration into customers’ airframes and landing systems. After GE Aerospace, GE’s competitive position fares far worse, with its other businesses facing secular pressure. GE Power faces pricing pressures and a shifting energy mix in its end markets toward renewables. Furthermore, GE was late to realize the inevitable transition from fossil fuels to renewables, which is predicted to compete with fossil fuels subsidy-free from a levelized cost of electricity standpoint. GE Renewable Energy suffers from many of the same competitive dynamics that plague GE Power, including even greater price competition to gain market share, and cheaper alternatives from other forms of energy, like solar, and depends heavily on production tax credits.

Read more about General Electric’s moat rating.

Risk and Uncertainty

GE’s principal risk is related to COVID-19 fallout on its commercial aerospace business, including government interventions and acceleration of infections, which ultimately affect both revenue passenger kilometers (demand) and load factors (utilization). Additional risks include GE’s significant cash burn amid pricing pressures in some of its operating businesses, including renewable energy, and its insurance liabilities (though they’ve been less of a concern in recent years given a rising interest-rate environment). Finally, GE has large key-person risk in CEO Larry Culp. From an environmental, social, and governance standpoint, we think GE faces a few risks that by now are well-known to investors, including government investigations into its accounting practices, shareholder lawsuits, potential embargoes from defense sales, and the impact of the global energy transition on GE’s gas and steam turbine business (though GE exited its new coal build business and the energy transition mostly helps it with sales of renewables). We think the greatest ESG risk relates to fallout related to the climate impact from aerospace engines, though we don’t think the fallout is enough to be material, and we point out that GE is developing a next-generation sustainable engine within its CFM RISE program.

Read more about General Electric’s risk and uncertainty.

GE Bulls Say

- Sell-side bears vastly underestimate the incremental profits GE will make through operating leverage when commercial aerospace fully recovers and the windfall from the Inflation Reduction Act.

- GE is led by, in our view, the premier U.S. multi-industry CEO Larry Culp. Culp has assembled a team of leaders who are steadily changing GE’s culture to one embracing Lean principles.

- GE’s installed base boasts the youngest fleet, with nearly 50% of its CFM fleet yet to make its first shop visit, which still bodes well for its high-margin aftermarket business.

GE Bears Say

- GE’s turnaround has a lot of unknowns, including when renewables will finally reach profitability and when the Inflation Reduction Act moves toward full implementation.

- While GE will generate orders from the energy transition, the company has consistently made negative earnings from both power and renewables, and new equipment orders will only pressure and dilute margins further.

- Bulls vastly underestimate the amount of contingent liabilities GE will have to contend with.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MX3XFKYTXVG2RGAL3JZKVC526Y.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)