Investing in Travel in Uncertain Times

Demand has been hindered but not permanently impaired by COVID-19.

We believe now is an opportune time to review investment opportunities in the travel industry, given that demand and share prices have been disproportionately affected by the global spread of COVID-19, which we see as largely transitory. In fact, as of July 31, shares of our cruise line, hotel, online travel, global distribution system, and gaming coverage were down 35% on average year to date versus a 2.5% increase in the Morningstar Total U.S. Market Index. This has left investors questioning when demand will return for travel operators and, importantly, which companies have the financial health to weather the storm.

In building out our travel and leisure coverage forecast, we’ve reviewed decades of historical travel demand and overlaid that analysis with Morningstar’s near-term and long-term GDP forecasts. The result is our bifurcated outlook, which incorporates a more difficult near-term prognosis with a relatively sanguine long-term outlook. We assume that travel demand will normalize over an extended time horizon, once either the COVID-19 outbreak is managed at a global level or a vaccine is proved effective at stemming the spread.

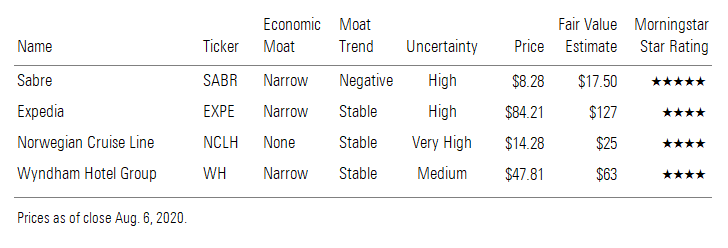

That said, this viral disruption has caused significant dislocation in travel valuations, providing an opportunity for long-term investors to pick up shares at a material discount. As a result, we find companies like Sabre SABR, Expedia EXPE, Norwegian Cruise Line NCLH, and Wyndham WH attractive.

Sabre, Expedia, Norwegian Cruise Line, Wyndham Hotel Group

- Our short-term outlook assumes leisure, local, and car travel will rebound ahead of corporate, international, and air trips in the 2020 upcycle.

Companies like Wyndham and Choice Hotels CHH are positioned to benefit from this near-term trend over Sabre, Amadeus AMS, and Hyatt H. Our analysis finds that lower-price-point hotels like economy and midscale units outperformed higher-price-point ones in the initial stages of the economic recovery after 9/11. In fact, economy and midscale hotel revenue per available room bottomed at less than 10% of prior peak 9/11 levels versus luxury revPAR, which bottomed close to 20% of 2000 demand. These economy and midscale hotels are often found off interstate and in nonurban areas and serve as a proxy for drive-to travel. And these lower-price-point hotels have outpaced the industry thus far during the COVID-19 period, with economy revPAR down 24% through July 31 versus 51% and 75% declines for U.S. industry and luxury units, respectively.

- Our long-term outlook assumes a full recovery in travel demand, mimicking past demand shocks like 9/11 and the Great Financial Crisis.

We find that demand for travel made a full return to prior demand-shock levels in a three- to four-year time frame. At an industry level, we expect Macau gaming revenue to return to 2019 levels in early 2022, Las Vegas sales in 2023, hotels (revPAR) in 2023, and cruise line per diems in 2023 at the earliest. For operators, we expect hoteliers (aided by positive unit growth), gaming operators, and Booking Holdings BKNG to recover to 2019 revenue in 2022, followed by Amadeus, Expedia, and TripAdvisor TRIP in 2023, Sabre in 2024, and the cruise lines in 2022 and beyond (with Carnival CCL/CUK taking nearly eight years to get back to the same net revenue base).

- We see limited solvency risk across our coverage universe.

Most travel and leisure operators have been able to secure enough liquidity to operate at near zero revenue through 2021, as there has been a strong monetary and fiscal response in the United States and globally, helping foster availability to capital markets. Within hotel operators, we highlight Accor AC and Wyndham as holding strong financial health positions. Within online travel, Booking Holdings and TripAdvisor have strong liquidity profiles, while Expedia is a touch weaker. Within global distribution system companies, Sabre has a much more strained financial health position than Amadeus. In gaming, Las Vegas Sands LVS has a stout balance sheet, while Caesars CZR faces elevated credit risk. In cruise lines, Norwegian and Royal Caribbean RCL have secured large amounts of liquidity ensuring that cash is available through the second half of 2021, although it has come at a high relative cost.

- Outside of cruise lines, COVID-19 is not expected to materially change travel and leisure moats.

We recently lowered our economic moat ratings to none for the cruise operators, as factors that supported our narrow moat ratings have been competed away, hindered by the global spread of COVID-19 and its corresponding travel restrictions. However, we don’t expect hotel operators’ intangible asset advantages to be materially affected by COVID-19. In fact, we believe scale advantages could help accelerate unit conversions in the near term, as independent hotel operators see the importance of this value proposition in lower-demand environments. We also expect online travel operators’ network effect moats should remain intact and may strengthen as smaller peers struggle to keep up with the critical mass of the market incumbents. We still see global distribution system network effects as tough to replicate. Within gaming, regulatory asset advantages in Asian markets are also expected to see little sustained disruption.

This information was published June 23 as part of a Consumer Observer, which is available to Morningstar’s institutional clients.

/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)

/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MX3XFKYTXVG2RGAL3JZKVC526Y.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)