Does Dow 20,000 Mean Stocks Are Overvalued?

Our analysts still see the market as only modestly pricey. Plus a look at the cheapest, and priciest, Dow components.

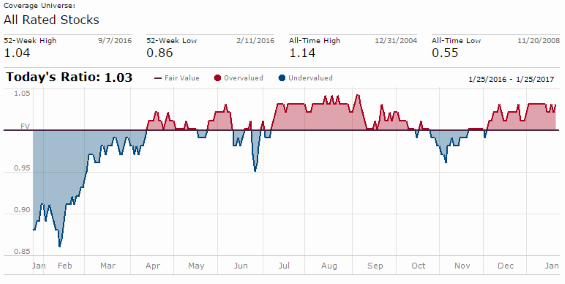

With the Dow crossing the hurdle of 20,000 this morning, many investors are wondering if this is a sign that the bull market is nearing its end or if stocks have become significantly overvalued. In short, Morningstar’s stock analysts see stocks, as a whole, trading at only slightly above their fair value estimate and that there are some values out there, even among Dow components.

However, this is not to say that a correction or even a bear market is not in the cards. Current market valuations don't tell us very much about where stocks are going in the near term; the market can stay overvalued for a long time, could become deeply undervalued or could bounce along at current levels. This unpredictability is one the reasons that trying to time the market around major news events, index milestones. and broad valuations is exceedingly difficult.

Take recent market movements around the election, for example. Before the vote, news events that seemed to boost Donald Trump's chance of victory would send stocks lower, and after Trump's victory the futures markets tanked. But when markets opened Wednesday after Election Day, stocks were off to the races and are now back at record levels. That unexpected movement should give investors who think they are going to be able to predict short-term market movements pause.

We think investors need to take a long-term view. That means setting an appropriate asset allocation and making sure that any money you have tied up in the stock market won't be needed to meet short- or medium-term cash demands. It also means rebalancing regularly to ensure that your asset allocation doesn't get out of whack. Stocks hitting new records can be a good time to check in on your portfolio and to make sure your equity exposure hasn't grown larger than you want.

It should also be noted that there isn't just one way to look at market valuations. Some measures, like the Shiller PE, that looks at inflation-adjusted earnings over the past decade and compares it to current prices, are pointing to a market that is much pricier than normal. Christine Benz recently did a roundup of market return expectations, and there is a large spread of potential returns depending on how the experts think about valuations. In general, the sources she surveyed had muted return expectations for both U.S. stocks and bonds over the next seven to 10 years; the experts she surveyed tended to see better prospects for foreign equities than U.S.

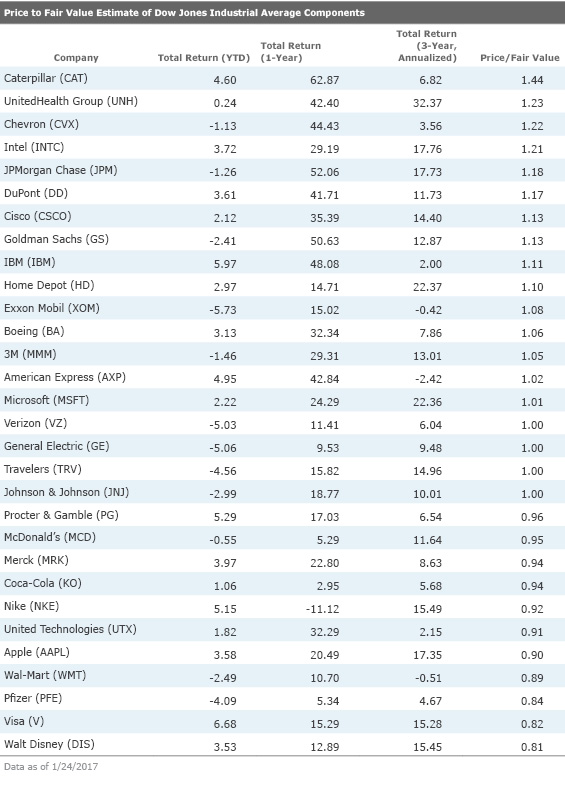

Dow Valuations

Taking a closer look at just the Dow Jones Industrial Average, you can see the big spread in valuations among the components. At the high end,

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HU3X6PAILNCOVAUSKMJBJCVK6U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOFK3IUSBRF5XHSFKBZHOG4J5A.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VLPSPWICTVB3NF2JSCHV5CQWNU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)