Black Friday Bargains in Retail

These stocks have sale tags on them.

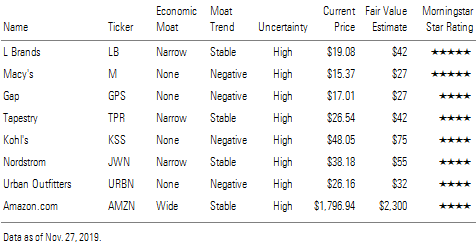

As retailers come out of earnings season and look ahead to the holidays, here are updates on a few of the most undervalued stocks in our coverage of the industry.

L Brands, Macy's, Gap, Tapestry, Kohl's, Nordstrom, Urban Outfitters, Amazon.com

Struggles Persist at Victoria's Secret, Crimping L Brands' Profitability L Brands' LB third-quarter results indicated that efforts to turn around Victoria's Secret have yet to take hold, with the segment posting an 8% comparable sales decline and digesting a nearly $250 million write-down on stores and other assets, on top of an $81 million charge in the year-ago period. Victoria's Secret's operating margin also tipped into negative territory, at a 6% shortfall, hindered by declining merchandise margins. As usual, Bath & Body Works provided the enterprise with support, delivering 5% comp growth, lapping a robust 10% comp increase in the year-ago period. With Bath & Body Works' operating margin contracting only 20 basis points to 18.4%, we believe pricing held up well. Despite that, L Brands' portfolio is run at the enterprise level, and the bifurcation of segment performance provides an impetus to potentially split up the company, allowing each segment to focus on its respective strengths and weaknesses. This is a change that could be more likely with Barington Capital working alongside the company.

L Brands refined its full-year outlook, calling for flat comps (from low-single-digit growth prior) and earnings per share of $2.40 (from $2.30-$2.60). Given that this doesn't vary materially from our 0% comps and $2.48 EPS forecast before the print, we plan to maintain our fair value estimate and view the shares as undervalued. Our intrinsic value is predicated on average sales growth of 2%, supported by 1% comp increases, leading to 4% EPS expansion over the next five years. The majority of these gains stem from 3% average comp growth at Bath & Body Works, while flat Victoria's Secret comps act as a drag as the lingerie segment continues to struggle to turn around, with competition remaining a headwind. (Jaime M. Katz, CFA)

Macy's Enters Critical Holiday Season With Little Momentum Macy's M missed our expectations for the third quarter and provided disappointing sales guidance. The company reported a same-store sales (owned plus licensed) decline of 3.5% in the third quarter, below our forecast of a 0.1% decline. Macy's blamed the slow sales on a soft market for women's and cold weather apparel, continuing weakness in international tourism (down 6.3% after a 4% drop last year), and poor results at stores in lower-tier malls. We think the apparel retail market continues to be promotional as many retailers have excess inventory. However, Macy's exited the quarter with inventory up just 1.5% from last year and did not match some competitors' markdowns. While this strategy probably hurt sales in the quarter, it also resulted in a gross margin on net sales that, at 40.0%, was 30 basis points better than our forecast and better than the sub-39% levels of the previous three quarters. As Macy's expects slow sales trends to persist into the holiday period, it guided to a full-year same-store sales decline of 1%-1.5% versus our prior forecast of a 0.7% increase.

We estimate Macy’s outlook implies a same-store sales drop of about 2% (versus our prior forecast of a 1.6% increase) in the fourth quarter, which accounts for most of its annual profit. The company cut its 2019 EPS range to $2.57-$2.77 from $2.85-$3.05. We had been at the low end of Macy’s prior 2019 EPS guidance, but given the sales trends in the third quarter and guidance, we expect to cut our fourth-quarter EPS forecast by about 10%. However, we do not expect to change our long-term view on Macy’s and believe the company has strengths, including e-commerce, the growing Bluemercury chain, and large real estate holdings. We expect no significant change to our fair value estimate and view the shares as undervalued.

We believe Macy’s will continue to generate adequate free cash flow to pay down debt, which it has cut by $800 million over the past year, and still pay its very high dividend, which currently yields nearly 10%. Moreover, Macy’s now expects $150 million in real estate sales gains in 2019, $50 million above our prior forecast.

We think Macy’s continues to show progress with its e-commerce and growth initiatives. It was the fifth-largest e-commerce retailer in the United States in 2018 (according to Internet Retailer), and its vendor direct and mobile businesses continue to grow rapidly. Vendor direct now accounts for about 10% of Macy’s online sales, and mobile sales are expected to reach $1.5 billion in 2019, up from $1 billion in 2018. Further, we think Macy’s Backstage concept makes the chain more competitive against its many off-price rivals. Macy’s has expanded Backstage to more than 200 stores and reports mid-single-digit sales increases for shops open more than one year. Finally, Macy’s completed its Growth150 remodels in October, which we believe we will boost sales in its highest-volume stores. However, these remodels will not be extended to its hundreds of stores in struggling malls. Macy’s has not revealed any clear plan for these stores and deferred difficult strategic questions on the subject to its February analyst day. It remains noncommittal on closing or downsizing these stores.

Macy's, like all other U.S. retailers, faces an unusually short selling period between Thanksgiving and Christmas in 2019--six days shorter than last year. (David Swartz)

Gap Spinning Off Old Navy Despite Abundant Problems Gap GPS confirmed the poor third-quarter sales and earnings that it had announced earlier in November when it fired CEO Art Peck. During the earnings call, interim CEO Robert Fisher (of Gap's controlling family) insisted the Old Navy separation is still the best course of action, with the split expected to close in mid-2020. Gap argues that Old Navy and its other chains are too different to stay together. However, we think Gap has still not provided a strong rationale for the deal, which is expected to result in direct costs, capital expenditures, and gross dissynergies of $1 billion or more. Moreover, the Old Navy spin-off is a huge distraction while Gap searches for a permanent CEO and tries to reverse terrible sales trends.

Same-store sales were negative at Old Navy (down 4%), Gap global (down 7%), and Banana Republic (down 3%) in the third quarter, and the company provided no confidence they would improve in the fourth quarter, guiding to total same-store sales down by the midsingle digits for 2019. Further, Gap disclosed that Old Navy, which we believe generates about 80% of Gap’s operating income, has experienced “meaningful” margin degradation in 2019. Based on the limited data provided by Gap, we estimate Old Navy’s operating margins have dropped from the midteens to about 10% this year. Gap’s adjusted operating margin of 7.5% in the quarter represented a 140-basis-point decline and missed our forecast by 20 basis points.

We expect to reduce our 2019 EPS forecast of $2.09 by approximately 18% to reflect the quarter’s earnings miss (adjusted EPS of $0.53 versus our $0.58 forecast) and weak sales trends heading into the holiday season. We also expect to reduce our fair value estimate by a mid-single-digit percentage. However, we still think Gap is undervalued, as Old Navy remains solidly profitable and Athleta has growth prospects.

Gap’s problems go beyond slow sales. The company plans to close about 230 of Gap global’s 727 North America stores, including about 130 in 2019. We view this plan as prudent because Gap has too many stores and too much selling space, especially as in-store sales are lost to e-commerce and many malls may go dark. However, Gap admits negotiations with landlords have been more difficult than expected. We think Gap needs to recruit a strong CEO to deal with this and other problems.

Gap said that even Athleta, its most promising growth brand, experienced slow sales and traffic in the third quarter. Gap believes that it has solved the problem through marketing and a better assortment mix (less performance and more lifestyle) and that fourth-quarter sales will improve. Gap has provided minimal financial data on Athleta but has disclosed that the brand is on track for $1 billion in sales in 2020. We think Athleta would increase in importance if Old Navy were separated from the rest of Gap as proposed.

Gap announced the closure of all Old Navy stores in China, which it entered in 2014, to focus on North America growth. We believe this is wise because Old Navy operates fewer than 20 stores in China and we did not anticipate it would ever grow to be a large business. We had expected that North America would constitute more than 97% of Old Navy's sales for at least the next 10 years. The Old Navy concept has never worked outside North America; it exited Japan in 2016. We believe Old Navy failed in Asia because it had no advantage over entrenched discount apparel competition, including multinational fast fashion companies like Inditex's Zara and Fast Retailing's Uniqlo. (David Swartz)

Coach Holds Steady, but Tapestry's Other Brands Are Works in Progress Tapestry's TPR results for its first quarter of fiscal 2020 largely met our expectations. We plan no significant change to our fair value estimate and view the shares as undervalued at current levels.

Coach met our forecast of a 1% sales increase in the quarter as strength in Asia and Europe overcame weak international tourism in North America. While we believe the Coach brand--the source of our narrow moat rating--is solid, the U.S. handbag market is suffering a long-term downward trend. According to NPD, the U.S. handbag market was 20% lower in the first eight months of 2019 compared with the first eight months of 2016. We believe this dynamic has been especially difficult for Kate Spade, which is much less international than Coach. While Kate Spade met our sales forecast of a 6% sales decline in the quarter, its same-store sales decline of 16% was disappointing. We believe Kate Spade lacks the brand strength of Coach and is insufficiently differentiated from many other handbag brands in its price category. Stuart Weitzman remains challenged as well, and its 9% sales decline in the first quarter missed our forecast of a 1% increase. We think Stuart Weitzman, best known for boots and sandals, is struggling with its wholesale partners as its styles do not fit the current casual athletic fashion trend. While Tapestry plans to expand Stuart Weitzman’s line of sneakers, we think it will be difficult to make headway against established sneaker brands like Adidas and Vans. Overall, Tapestry’s sales of $1.36 billion in the quarter fell slightly short of our forecast of $1.37 billion, but adjusted EPS of $0.40 beat our forecast of $0.36. The adjusted operating margin of 12.3% beat our 11.3% expectation on expense control and the shift of some expenses out of the first quarter. Also, Tapestry’s margins benefited from the relative strength of Coach, which has higher margins than its other brands.

Tapestry’s earnings report was its first since CEO Victor Luis was terminated and replaced on an interim basis by longtime board member Jide Zeitlin in early September. The move followed a difficult fiscal 2019 and a disappointing outlook for fiscal 2020. While Luis deserves credit for fixing Coach, we believe the board made a change because the Kate Spade and Stuart Weitzman acquisitions have been largely unsuccessful. Stuart Weitzman has been beset by management and execution problems, and it has taken much longer than expected to fix Kate Spade. We have rated Tapestry’s stewardship as poor largely because of the Kate Spade and Stuart Weitzman deals. We do not believe either brand has the pricing power or broad appeal of Coach.

We do not foresee any change to our stewardship rating or Tapestry's overall strategy under Zeitlin's guidance. He has been involved with Tapestry as an advisor or director since its initial public offering in 2000. Tapestry has announced an "in-depth, comprehensive, and efficient review" of its business, and we do not expect the company to pursue further acquisitions in the near term. We think management has its hands full with finding new sources of growth for Coach and fixing the other two brands. Rather, we expect nearly all Tapestry's free cash flow, which we forecast at about $1 billion in fiscal 2020, to be returned to shareholders as dividends and share repurchases. Tapestry repurchased $300 million worth of stock in the first quarter, more than we had anticipated. We view this move as beneficial to shareholders as the shares trade well below our fair value estimate. (David Swartz)

Kohl's Spends More to Stand Still Against Relentless Competition Kohl's KSS reported soft sales and profits in the third quarter and provided a disappointing outlook for the critical holiday season. As in the prior two quarters, women's clothing was cited as the weakest category. We believe many of Kohl's competitors are struggling in women's apparel, leading to pricing pressure. Kohl's same-store sales growth of just 0.4% in the quarter missed our forecast of 1.5% even though the company implemented discounts and promotions to drive traffic. Further, Kohl's guided to fourth-quarter same-store sales growth of flat to 1% (we had forecast 1.5%), suggesting no immediate relief from the competitive pressures. Kohl's lowered its 2019 adjusted EPS target to $4.75-$4.95, well below our previous forecast of $5.21. We expect to reduce our fair value estimate by a single-digit percentage, but we still view the shares as attractive. We estimate Kohl's will generate nearly $1 billion in free cash flow to equity in 2019 and return much of it to shareholders.

Kohl’s expanded some marketing initiatives and introduced new merchandise in the quarter. While we think these efforts are necessary, they are weighing on margins and are somewhat unproven. Kohl’s selling, general, and administrative expenses as a percentage of sales were 30.7%, 50 basis points above our forecast. Among the initiatives, Kohl’s introduced a few brands, including 9 West and Elizabeth and James, increased floor space for activewear in 130 stores, and added 100 more Adidas shop-in-shops (now 175 total). We view the increased space for activewear as logical, given the ongoing athleisure fashion trend. However, we are uncertain if the new brands will draw much customer interest, as Kohl’s already has many exclusive brands. We think it is likely that 9 West (which went bankrupt last year) and Elizabeth and James (a fallen former luxury brand) will just be viewed as two more captive brands.

Kohl’s sales of $4.36 billion in the third quarter missed our forecast of $4.42 billion and declined 0.3% year over year. The discounting and promotion weighed on profitability, as the operating margin of 4.4% was 60 basis points below our forecast and represented a 120-basis-point drop (albeit partly due to new lease accounting). Kohl’s adjusted EPS of $0.74 missed our forecast of $0.88.

The company reported its first full quarter with its Amazon returns program in all stores. While Kohl’s claimed the program was meeting expectations and would contribute positively to operating income in 2019, it provided little evidence to support this. We appreciate Kohl’s efforts to drive customer traffic but view the Amazon program as risky, given the additional effort and cost and the possibility that the program could make the e-commerce giant an even stronger competitor in apparel.

Kohl's opened four small-format stores in the quarter, effectively replacing the four Off/Aisle discount stores shuttered in August. These smaller stores are 35,000 square feet, less than half the size of a standard Kohl's location (90,000 square feet). We think it makes sense for Kohl's to open smaller stores as traffic declines and e-commerce increases. However, as small stores account for only about 15 of Kohl's 1,159 stores, we believe the company will be stuck with far too much selling space for years to come. We believe it needs a more aggressive plan to close or downsize stores. (David Swartz)

Rack and Expense Control Offset Nordstrom's Slow Full-Line Sales Nordstrom JWN reported third-quarter earnings that exceeded our expectations despite disappointing full-price sales. Rack achieved sales growth of 1.2%, outperforming our forecast of a 0.5% drop and ending a string of three quarters of sales declines. We believe Rack is benefiting from service enhancements (such as online pickup) in some stores and the trend toward off-price apparel. We are encouraged that Rack achieved growth with less inventory and increased inventory turns for the eighth consecutive quarter. However, Nordstrom's full-line stores suffered a 4.1% sales decline in the quarter, missing our forecast by 60 basis points. We believe Nordstrom's full-line stores, like those of Macy's and other apparel stores, were affected by elevated inventory levels and markdowns in women's apparel. Nordstrom did resist heavy discounting in the quarter, likely impacting sales but benefiting its gross margin, which at 34.3% was a year-over-year improvement of 100 basis points and 20 basis points better than we expected. Further, Nordstrom has reduced operating expenses faster than we anticipated, resulting in a 5.4% operating margin, 60 basis points above our forecast. Overall, Nordstrom's EPS of $0.81 beat our $0.66 expectation but was aided by interest expense that was $12 million below our forecast. We believe this expense has shifted to the fourth quarter, when Nordstrom will no longer capitalize interest related to its new Manhattan store.

We are cautious on the outlook for holiday retail sales and do not expect a sizable increase to our prior 2019 EPS forecast of $3.33 on Nordstrom. We expect to make no material change to our fair value estimate and view the shares as undervalued. We believe the market undervalues the long-term potential of Nordstrom’s Rack, e-commerce, and other initiatives.

The big event in the third quarter, the opening of Nordstrom’s new women’s store in Manhattan, has attracted considerable consumer interest but had minimal impact on third-quarter sales (it opened Oct. 22). Nordstrom reported $35 million in preopening expenses related to the store, $25 million of which were realized in the third quarter. As we estimate the total cost of the store at more than $500 million, the ultimate success or failure of the store will take a long time to judge. In the short term, we expect the store to add about 150 basis points of growth to fourth-quarter sales, possibly leading to positive full-line sales growth for the first time this year.

We view Nordstrom's e-commerce offering as a competitive advantage and a key factor in our narrow-moat rating. We appreciate that Nordstrom continues to invest heavily in digital enhancements that boost e-commerce and in-store traffic. Its e-commerce sales grew 7% in the quarter, with half of the growth from in-store pickup. Digital sales represented 34% of total sales, an increase of 3 percentage points from last year. (David Swartz)

Urban Outfitters' Holiday Outlook Murky Urban Outfitters URBN generally met our expectations for the third quarter despite soft sales of women's apparel and a difficult wholesale market. Total company same-store sales growth of 3% (against a difficult 8% comparison) matched our forecast. However, wholesale sales dropped 7%, and the company exited the quarter with inventory up 18% year over year. We believe Urban Outfitters had to cut prices to compete with discounting of women's apparel at department stores, causing a year-over-year gross margin decline of 217 basis points to 32.5%, 20 basis points below our expectation. The company suggested the elevated inventory would necessitate further markdowns and promotions in the fourth quarter, resulting in a year-over-year operating expense increase of about 6% (versus our forecast of 4.7%) and a year-over-year gross margin drop of about 200 basis points (versus our forecast of a 100-basis point decline). More positively, Urban Outfitters reported that early holiday sales trends look favorable, suggesting that our forecast of 3% same-store sales growth in the fourth quarter is achievable. We acknowledge the near-term outlook as difficult but see positive signs, such as e-commerce growth and good sales trends at Anthropologie. We do not expect to make any significant change to our fair value estimate and view the shares as attractive.

Anthropologie achieved solid sales in the quarter, as the chain’s 4% same-store sales growth beat our 3% forecast. Free People also reported strong retail sales (9% growth) but suffered a 10% decline in wholesale sales. Urban Outfitters’ overall wholesale sales of $88 million in the quarter missed our forecast of $95 million. We view the segment’s exposure to department stores as a competitive weakness. Meanwhile, the Urban Outfitters chain underperformed at retail, as flat same-store sales missed our forecast of 3% growth. We believe the chain continues to struggle with changing trends and competition in women’s fashion.

Urban Outfitters matched our EPS forecast of $0.56 in the third quarter. While total sales fell a bit short of our forecast ($987 million versus $1.002 billion), the operating margin of 7.6% beat our view by 30 basis points. Given the difficult environment, we think Urban Outfitters demonstrated solid expense control in the quarter, especially as Nuuly recorded a $6.3 million operating loss on just $2.0 million in sales. We do not view Nuuly, Urban Outfitters' new subscription service, as material and expect it will be a drag on earnings for some time. Still, we understand that Urban Outfitters must try new concepts to keep pace with competitors. (David Swartz)

And Then There's Amazon Like last quarter, the cost of Prime One-Day shipping was the focal point of Amazon's AMZN third-quarter update, while we believe the focus should have been on the revenue growth acceleration across many of its business segments. It's fair to ask whether Amazon's longer-term cash flow algorithm has changed with Prime One-Day, with fourth-quarter guidance for operating income of $1.2 billion-$2.9 billion versus $3.8 billion a year ago. While one-day shipping is costly, we ultimately believe it will strengthen Amazon's third-party seller offering while unlocking new subscription revenue opportunities. In our view, this will bolster the network effect behind our wide moat rating and keep Amazon on pace for high-single-digit operating margins the next five years.

It's clear that consumers are buying more on Amazon and vendors are using Amazon's logistics services to make this happen, with online retail revenue growth accelerating 6 points to 21% and third-party services revenue growth accelerating 4 points to 27% in the third quarter. Management confirmed that Prime members are increasing order frequency--including an acceleration in lower-average-selling-price products--and units shipped by Fulfillment by Amazon are accelerating under Prime One-Day. While management said it expects one-day shipping to result in a $1.5 billion penalty in the fourth quarter and operating margin contraction for 2019, we still believe the buyer/seller engagement will drive longer-term margin expansion while neutralizing competition from Walmart and others.

Amazon saw strong growth from its subscription services (34%), advertising (45%-plus), and Amazon Web Services (35%) segments. Taken together, we still see a path to high teens average annual revenue growth and operating margins exceeding 9% the next five years, and we plan to maintain our fair value estimate. For more on Amazon, see our Oct. 14 Stock Strategist. (R.J. Hottovy, CFA)

/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)

/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MX3XFKYTXVG2RGAL3JZKVC526Y.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)