The Best HSA Providers

Learn how you could benefit from a health savings account and see our assessment of top providers.

If you’re looking for a way to stretch your healthcare dollars, you might consider a health savings account.

Thanks to its flexible withdrawal rates and powerful tax benefits, an HSA can be a powerful tool. It can be used as a healthcare checking account or a long-term investment vehicle, and varying degrees in between. But the slew of HSA providers out there, with differing account features and characteristics, can make it a daunting task to sort through all your options. That’s why Morningstar evaluates the top HSA providers that offer retail accounts for those looking to shop around.

Even if you already have access to an HSA provider through your employer, our assessments can help you get the most out of your HSA.

We cover the inner workings of HSAs, address frequently asked questions, and rate HSA providers for different uses. If you decide that an HSA is right for you or you want to see how your employer-sponsored plan stacks up, consider our list of the best HSA providers for 2024.

What Is an HSA?

An HSA is an account that allows you to spend and invest money for healthcare expenses. An HSA is only available with a high-deductible healthcare plan, and it’s subject to annual contribution limits.

There are rules around who can qualify and how you contribute to and use the money in an HSA, but you don’t have to worry about using all the funds in the account in any given year. Unspent funds are not forfeited, unlike a flexible spending account. Plus, you can keep the same account even if you change employers or leave the workforce.

You can use an HSA like a spending account to help cover current medical expenses, or you can use it as an investment account to help plan for future costs. Either way, HSAs offer a triple tax advantage:

- Money enters tax-free.

- Money grows tax-free.

- Money can be withdrawn tax-free if spent on qualified medical expenses.

People who use their HSA dollars on current healthcare expenses benefit because HSA contributions are excluded from income, Medicare, and Social Security taxes. People who invest and grow their HSA dollars to pay for future medical costs further benefit from the tax-free growth of HSA dollars.

Based on the tax merits alone, HSAs are more attractive than other retirement-savings vehicles like IRAs and 401(k)s.

5 Tips for Getting the Most Out of a Health Savings Account

Using your HSA for “qualified medical expenses” is key to getting the full tax advantage of the account. These qualified expenses generally include dental, vision, and prescription costs for you, your spouse, and your dependents. You can see a full list of qualified medical expenses on the IRS website.

People who are younger than 65 are subject to ordinary income taxes plus a 20% tax penalty on withdrawals for nonqualified expenses. Those 65 and older can withdraw funds without the 20% penalty but will still pay income tax if the money is not used for healthcare expenses.

The Best HSAs for Spending

When using an HSA as a spending account to cover current healthcare costs, the best HSAs do the following:

- Offer spending accounts without maintenance fees regardless of account size.

- Pay reasonable interest rates on deposits.

- Eliminate or limit additional fees.

- Offer FDIC insurance on the spending account.

The Best HSAs for Investing

When using an HSA as an investment account to cover future healthcare expenses, the best HSAs follow these practices:

- Offer investment strategies in all core asset classes while limiting overlap.

- Provide strong investment strategies that earn Morningstar Medalist Ratings of Gold, Silver, or Bronze.

- Charge low fees for active and passive strategies.

- Don’t require investors to keep money in spending accounts before investing.

HSA Providers

Get more detail on what’s behind our HSA ratings. Below, we lay out what these top 11 HSA providers are doing well and what we think they need to improve. They are listed in the order of their investing evaluations.

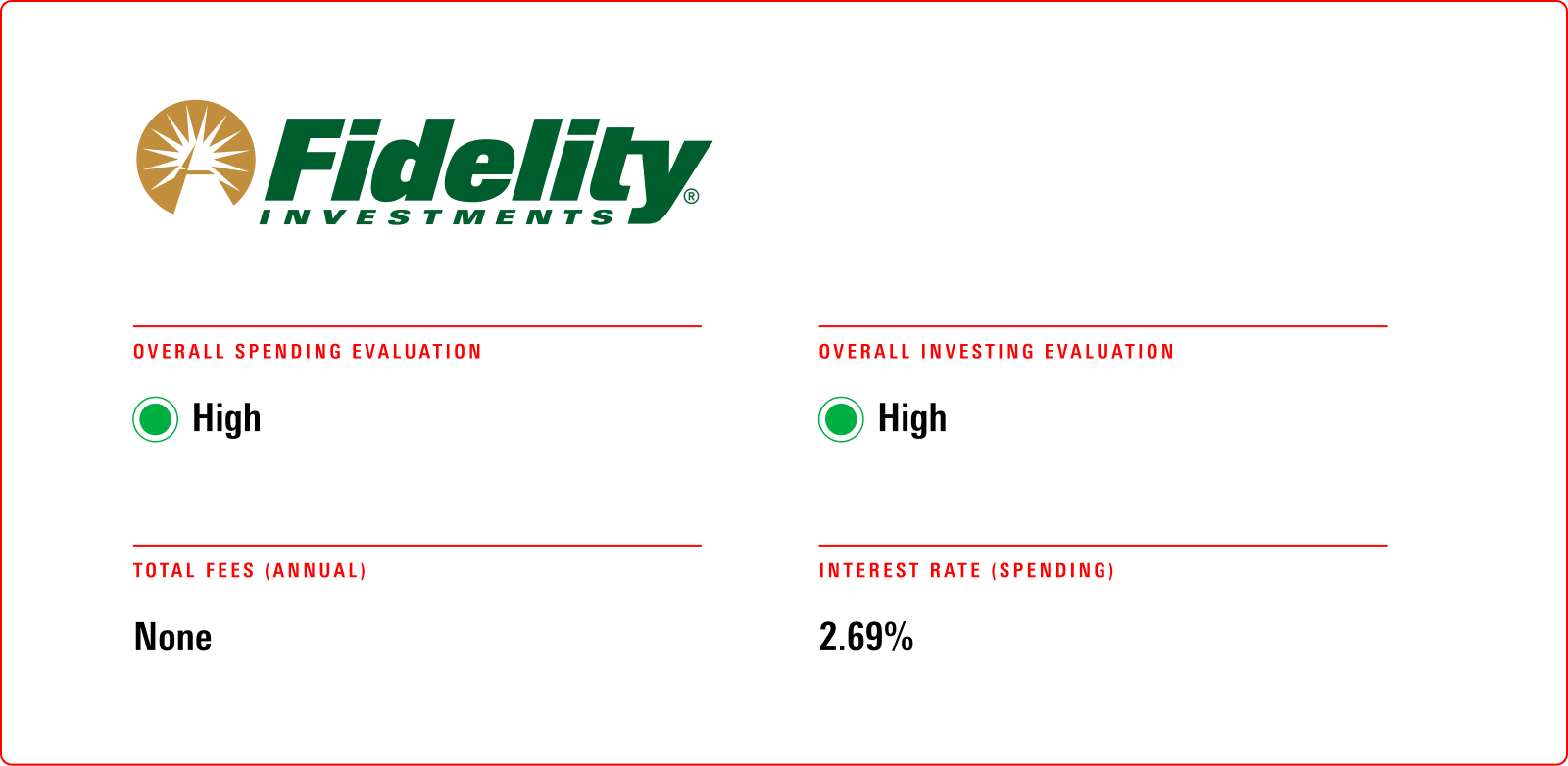

Fidelity

Pros

- The spending account comes free of charge and pays an exceptional interest rate.

- The investment account is low-cost with no investment threshold.

Cons

- The investment account has some redundancy in its fund lineup.

Fidelity is the only provider to receive the top billing for the spending or investment account, let alone both.

The Fidelity spending account cemented its place as the industry’s top offering by delivering significantly larger returns on cash balances. Fidelity’s 2.69% interest rate, regardless of account balance, stands far above rates paid by other providers: The next-highest is First American Bank, with an interest rate that’s still less than half of what Fidelity offers (and is only paid on balances of $100,000 or more). Fidelity has also shunned both maintenance and additional fees since first offering its HSA to individuals in 2018.

The investment offering checks the key boxes, too. Fidelity follows industry best practices by not charging an investment fee—it is the only provider that doesn’t levy any expenses outside of the underlying fund fees—and by not requiring an investment threshold. That means participants don’t need to retain a balance in the spending account to invest. It offers a sensible menu of funds offered up for investment. It covers all the broad asset classes and mixes in Parnassus Core Equity PRILX and Calvert International Equity CWVIX, which earn Morningstar Medalist Ratings of Gold and Silver, respectively, for investors prioritizing sustainability.

The lineup has redundancy, though—two strategies in the diversified emerging-markets Morningstar Category. Fidelity is one of six providers we cover that offers a brokerage window for those looking for additional investment choices.

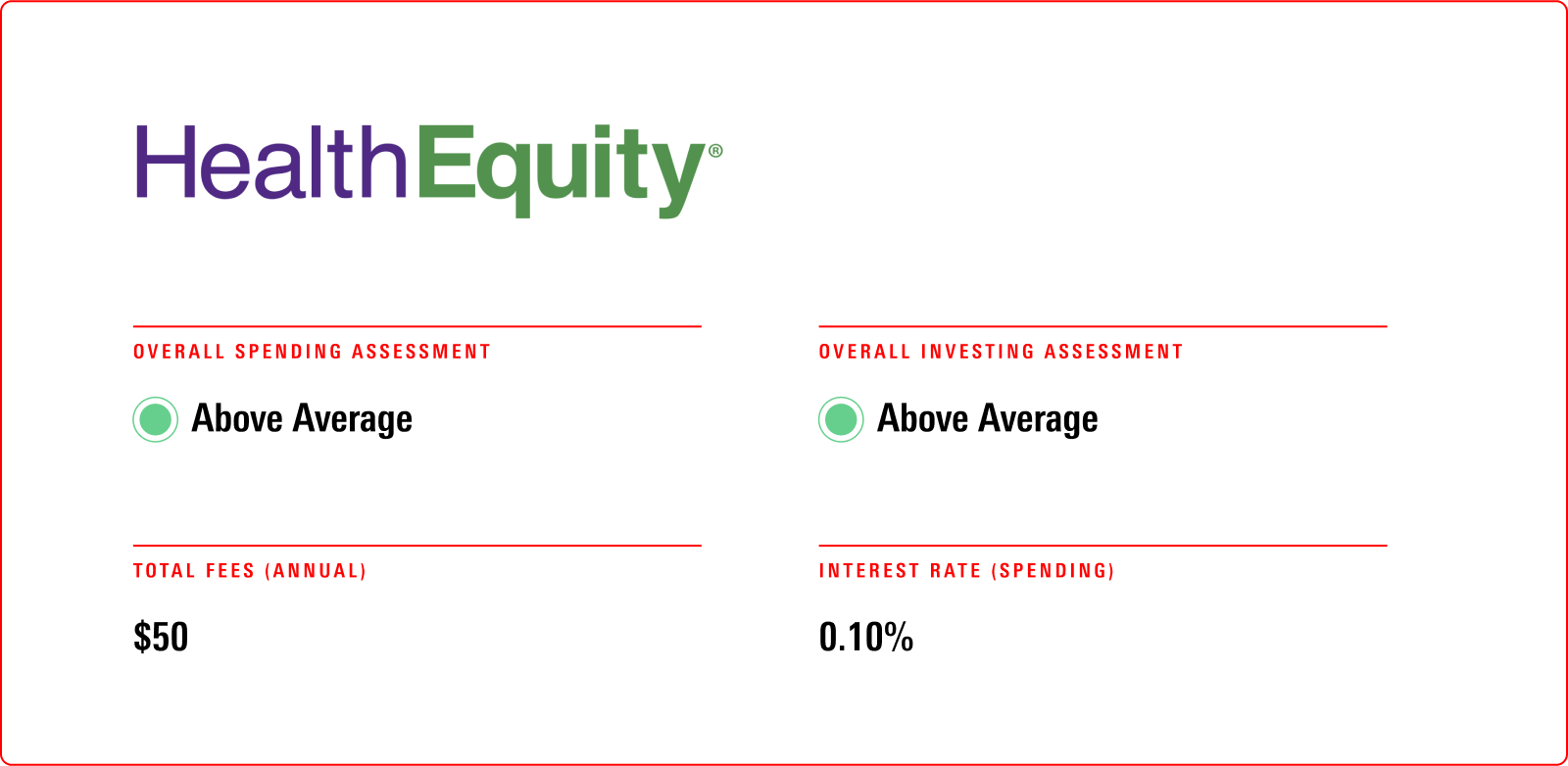

HealthEquity

Pros

- There are no maintenance fees for the spending account.

- The investment account comprises cheap strategies and has a relatively small investment threshold.

Cons

- Smaller balances are stuck with meager interest rates.

- The investment menu is a bit heavy on specialty options.

HealthEquity is a solid, low-cost HSA provider.

Like other topnotch spending accounts, HealthEquity does not levy a maintenance fee. It pays interest rates of up to 0.40%—close to the national average for FDIC-insured accounts—but savers at HealthEquity only receive that rate on balances greater than $10,000, far greater than the $767 median spending account.

Although its 0.31% charge on investment accounts is higher than the 0.23% average, HealthEquity’s lineup of cheap Vanguard strategies more than makes up the difference. The 0.08% average expense ratio of its underlying funds is 16 basis points cheaper than the 0.24% of the average provider. HealthEquity allows accountholders to invest once they hit a $500 balance.

There is some room for improvement, though. HealthEquity’s lineup, while cheap, includes a number of narrowly focused options, some of them volatile.

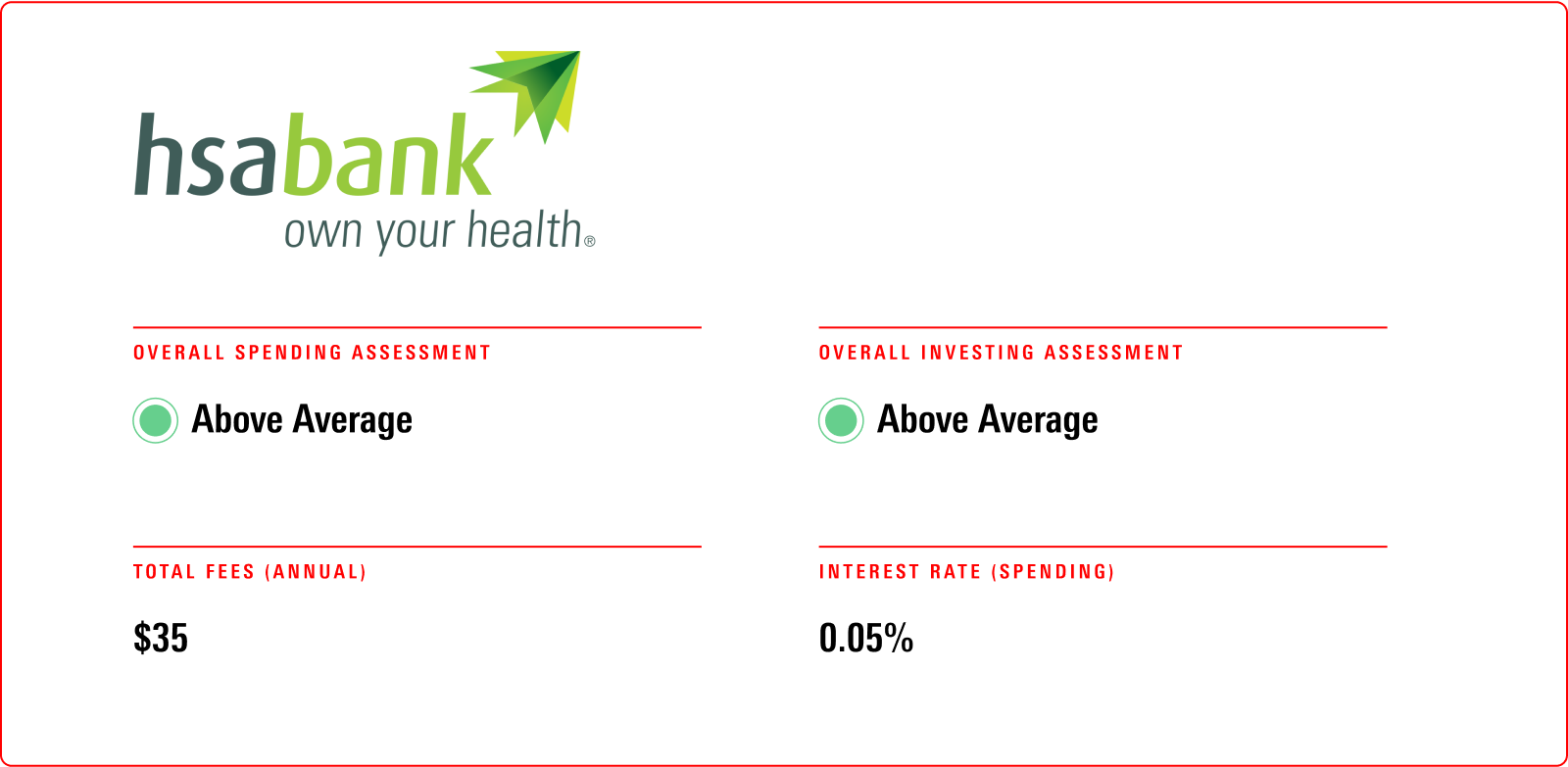

HSA Bank

Pros

- The spending account comes with no maintenance fee and very few additional fees.

Cons

- A $1,000 spending account balance is required before using the investing account, which includes redundant offerings in the lineup.

- It pays a decent interest rate, but only with an account balance of at least $50,000.

HSA Bank’s move to eliminate its maintenance fee bolstered its spending account offering in 2021, but the provider’s spending account payout has failed to keep pace with steadily rising interest rates. The provider recently paid no more than 0.30% for balances under $50,000.

Its investment offering rates better than average. The price tag is a bit cheaper than the typical competitor; although it eliminated the maintenance fee, it still levies a 0.25% investment charge. The average expense ratio of its underlying funds is a little cheaper than the average. The investment menu offers the full suite of State Street target-date funds at industry standard of five years, as well as a decent mix of active and passive funds.

The menu also has some overlap. There are three core bond strategies, and the menu includes two TIPS funds as well. HSA Bank offers a brokerage window, but savers must keep at least $1,000 in the spending account before investing either way.

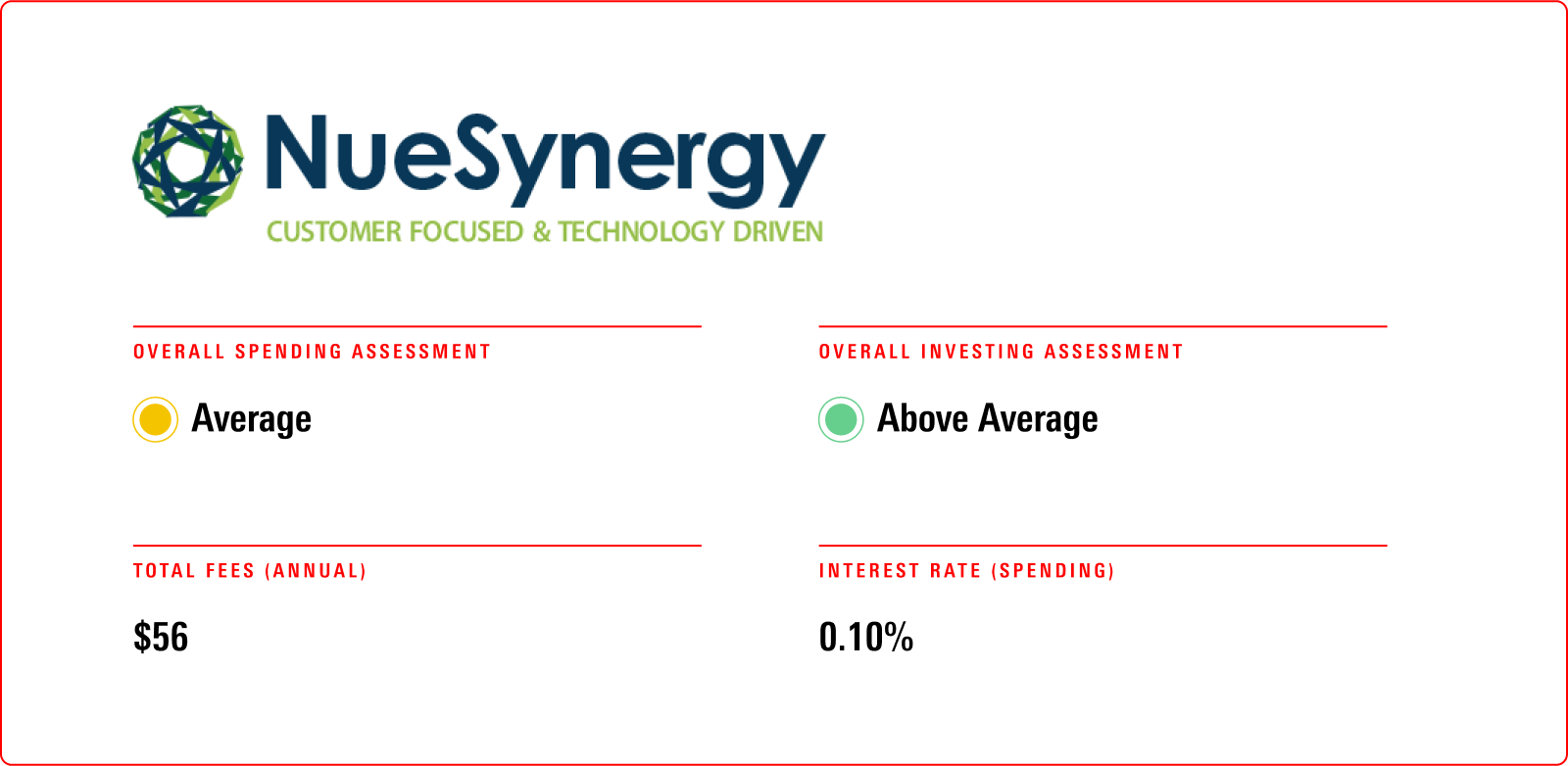

NueSynergy

Pros

- Offers one of the strongest fund lineups around.

- The investment account looks cheap because of its menu of very low-cost exchange-traded funds.

Cons

- Spending account pays a low interest rate.

- The investment menu is a bit limited, with no allocation options.

New to coverage, NueSynergy’s spending account doesn’t stand out.

It charges a maintenance fee on balances below $2,500, while most of the providers surveyed don’t levy one at all. And the interest it pays is, at best, just 0.2% for balances below $40,000.

On the other hand, the investment account is appealing. The fund menu consists solely of very cheap ETFs; the lineup’s average expense ratio is just 0.05%. The lineup is also one of just two to earn a score of High on fund quality. That said, the fund menu would look better if it offered participants an allocation option and more than just one mid- or small-cap stock fund.

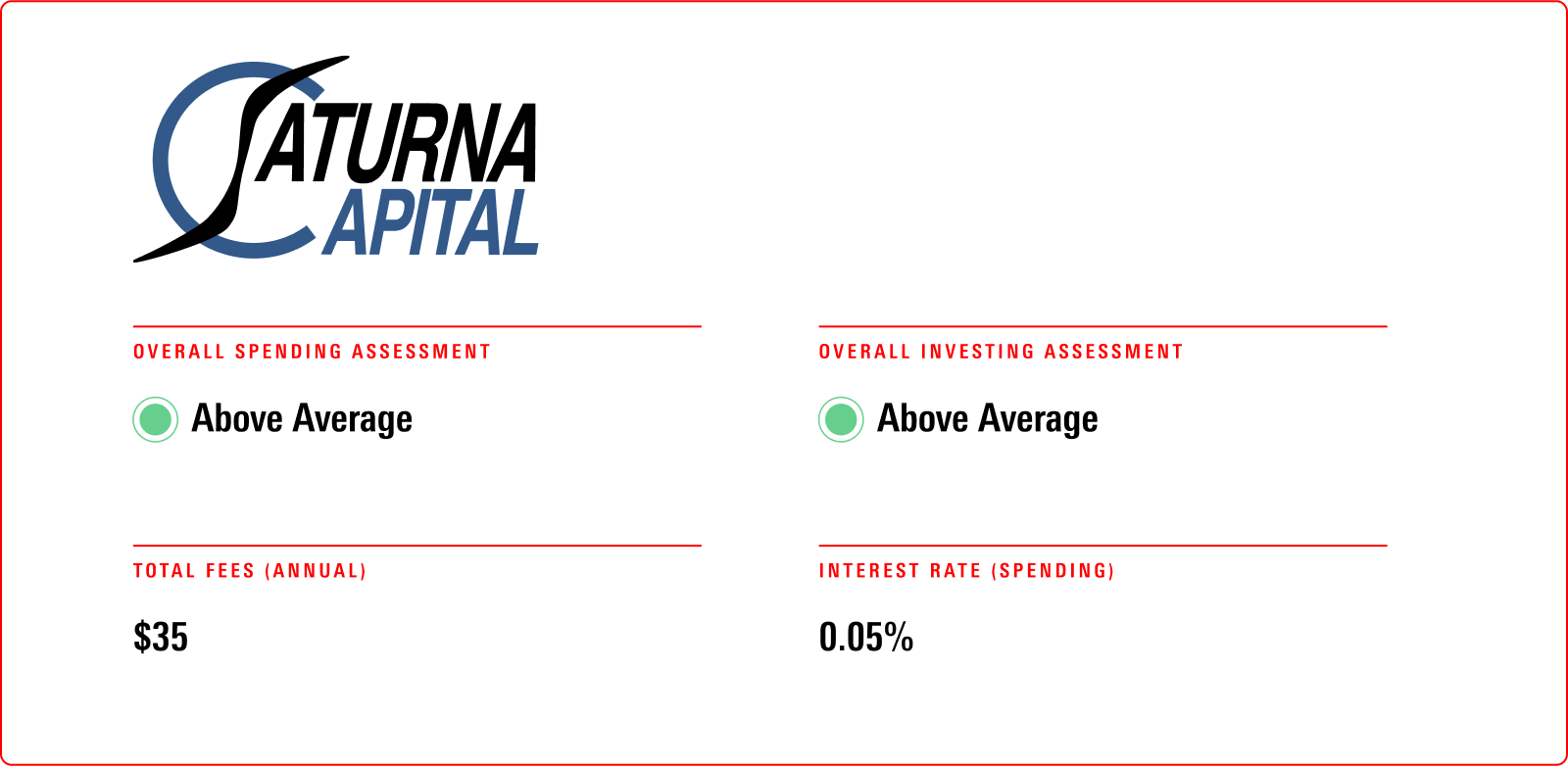

Saturna

Pros

- The account has a below-average investment threshold.

- The investment menu is compact but full of higher-quality options.

Cons

- The spending account pays a paltry interest rate.

- It has a relatively pricey fund menu.

Saturna’s HSA offering holds promise.

Its spending account pays a low interest rate—0.05% to 0.20% for accounts under $50,000, depending on the balance. But its $30 maintenance fee was eliminated over the past year. The firm’s investing account has some appeal, too. The menu is compact and features strong offerings, and participants can begin investing when their balance reaches a modest $500. But because active funds predominate, the menu’s average expense ratio is one of the highest in the group. There’s also a 0.30% investment fee for non-Saturna funds.

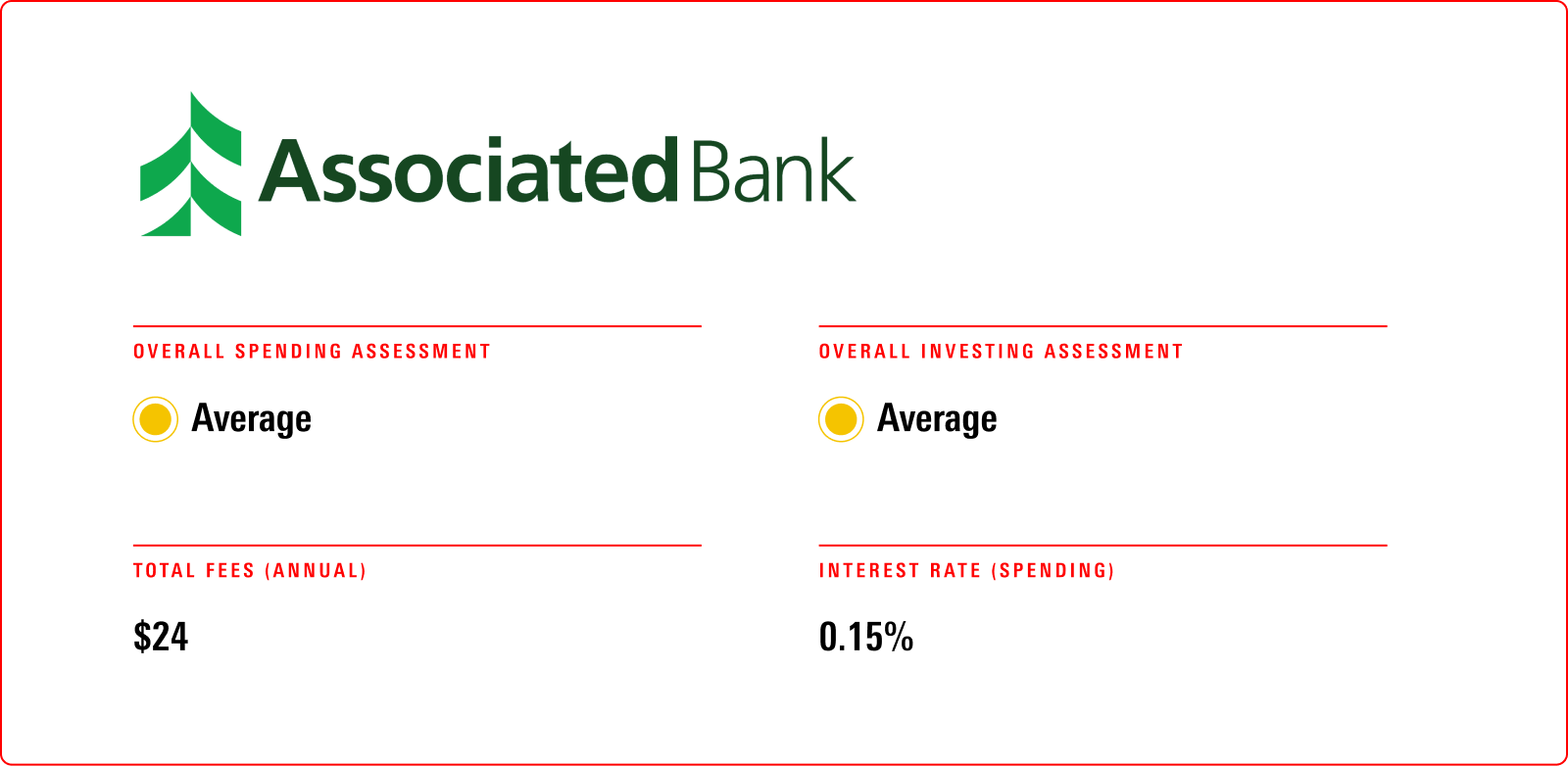

Associated Bank

Pros

- A well-rounded investment lineup and relatively small investment threshold highlight the investment account.

Cons

- The spending account interest rate peaks at 0.25%.

- The investment account comes with relatively pricey underlying funds and significant administrative fees.

Associated Bank has some pockets of strength but needs work elsewhere.

Spending-account holders must maintain an account balance of at least $2,500 or have an account with a firm that has a “preferred relationship” to have the yearly maintenance fee of $36 waived. The spending account also pays a relatively modest interest rate.

While a thoughtfully designed investment menu gives the investment account an edge, excessive costs weigh on the account’s overall score. It features well-regarded investment managers including American Funds, T. Rowe Price, and Vanguard while giving investors a good balance of passive and active options. It also includes straightforward allocation funds, and the investment threshold of $500 is lower than most providers covered. Still, the investment account charges a hefty investment ($24) fee, and its fund lineup is pricey.

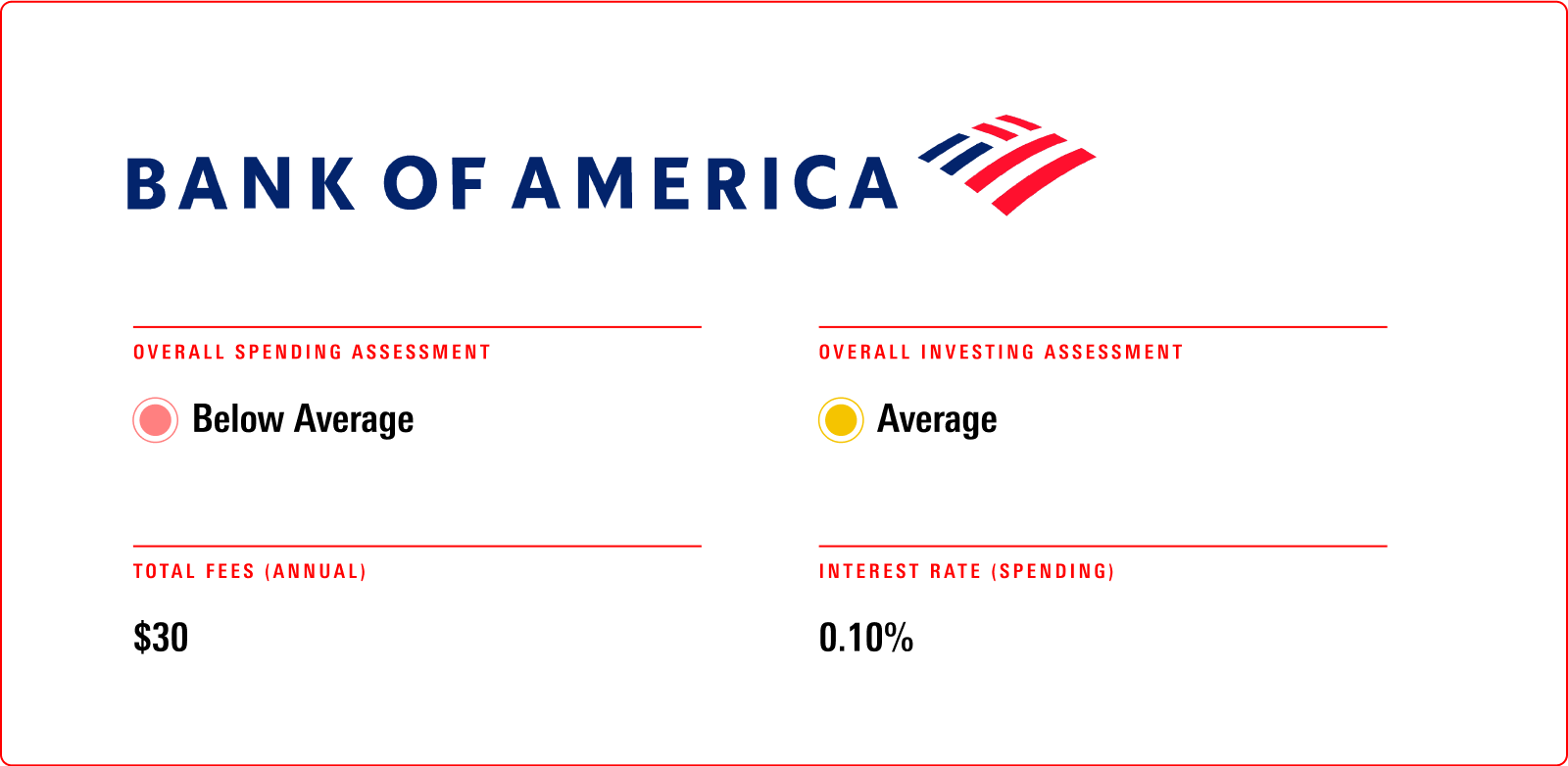

Bank of America

Pros

- The investment account offers higher-quality strategies.

Cons

- The spending account is one of just two offerings to receive a Below Average overall assessment, owing to its rigid maintenance fee.

- The relatively large fund lineup in the investment account has several narrow offerings.

Bank of America’s spending account is one of just two offerings, investment or spending, that received a Below Average assessment.

It charges accountholders a yearly maintenance fee of $30 no matter the account size. And while it provides somewhat higher interest rates on larger balances, the typical accountholder will earn just 0.1% annually.

The investment account is mostly average. Bank of America’s relatively large menu includes a couple redundancies, including four small-cap funds, with two in the small-blend category. The plan also includes Pimco Commodity Real Return Strategy PCRIX, which, while Silver-rated, is too far afield for an HSA. The lack of an investment fee makes the account somewhat attractive, especially for those with larger plan balances, though its investment lineup is one of the pricier menus around.

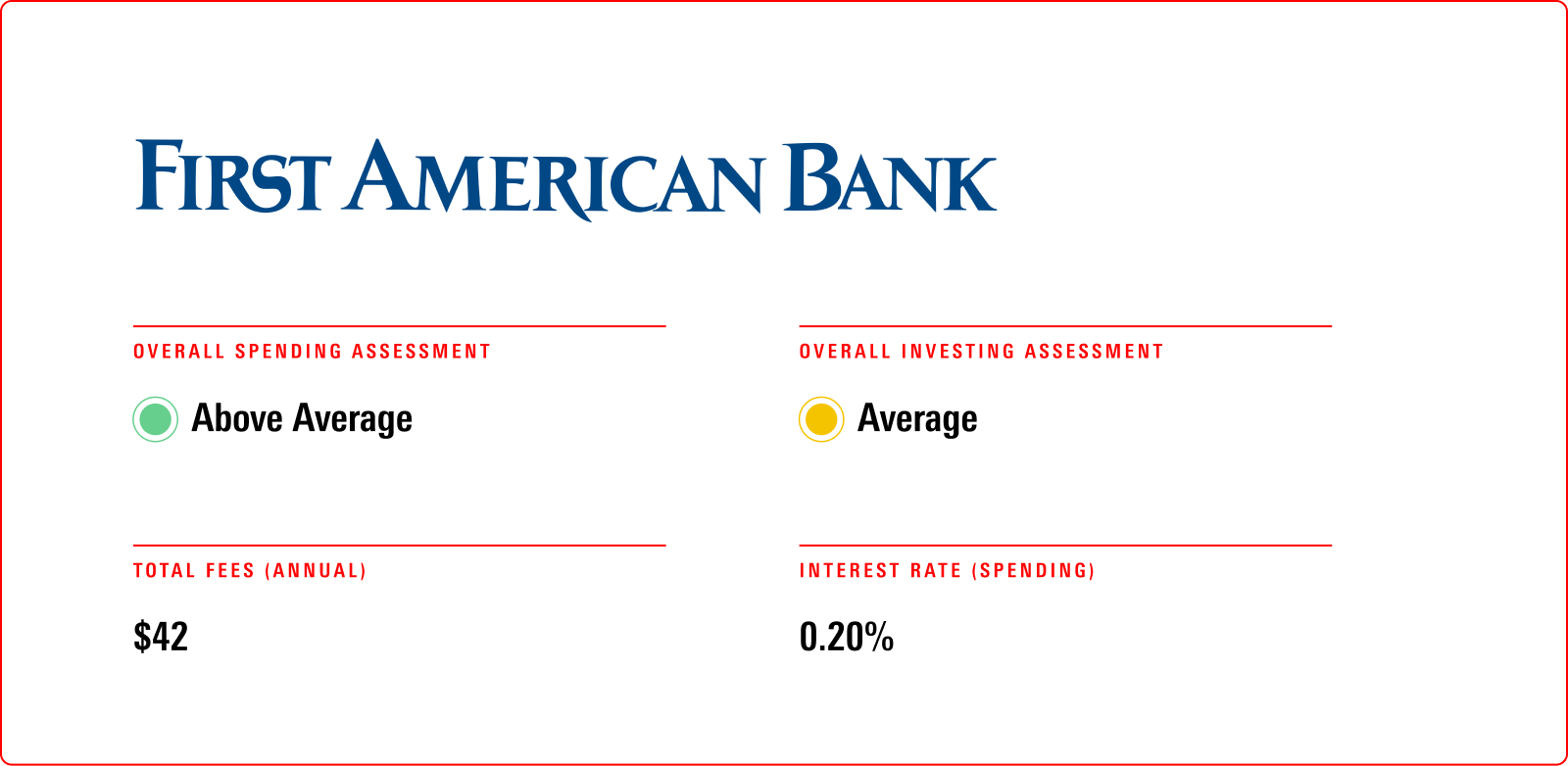

First American Bank

Pros

- There are no maintenance fees, and the spending account has reasonable interest rates.

Cons

- The investment account features a complicated investment menu of overly complex and questionable funds and a $1,000 investment threshold.

First American Bank offers a compelling spending account as it shuns maintenance charges. It also offers a decent interest-rate schedule; while it starts at just 0.10%, it does increase to roughly 0.30% for balances over $5,000.

Its investment account, however, is merely average. First American Bank has a group of funds that charges above-average fees, and the firm levies a 0.30% investment fee. Its investment menu includes the Vanguard Target Retirement series in 10-year increments and strategies in risk-heavy or narrow parts of the market like high yield.

It also comprises a few strategies that are either too specialized or overly complex for the typical HSA investor. For instance, First American offers tactical-allocation strategy Pimco All Asset PAAIX. Like HSA Bank, First American requires that savers maintain a $1,000 spending account balance before investing and offers a brokerage window.

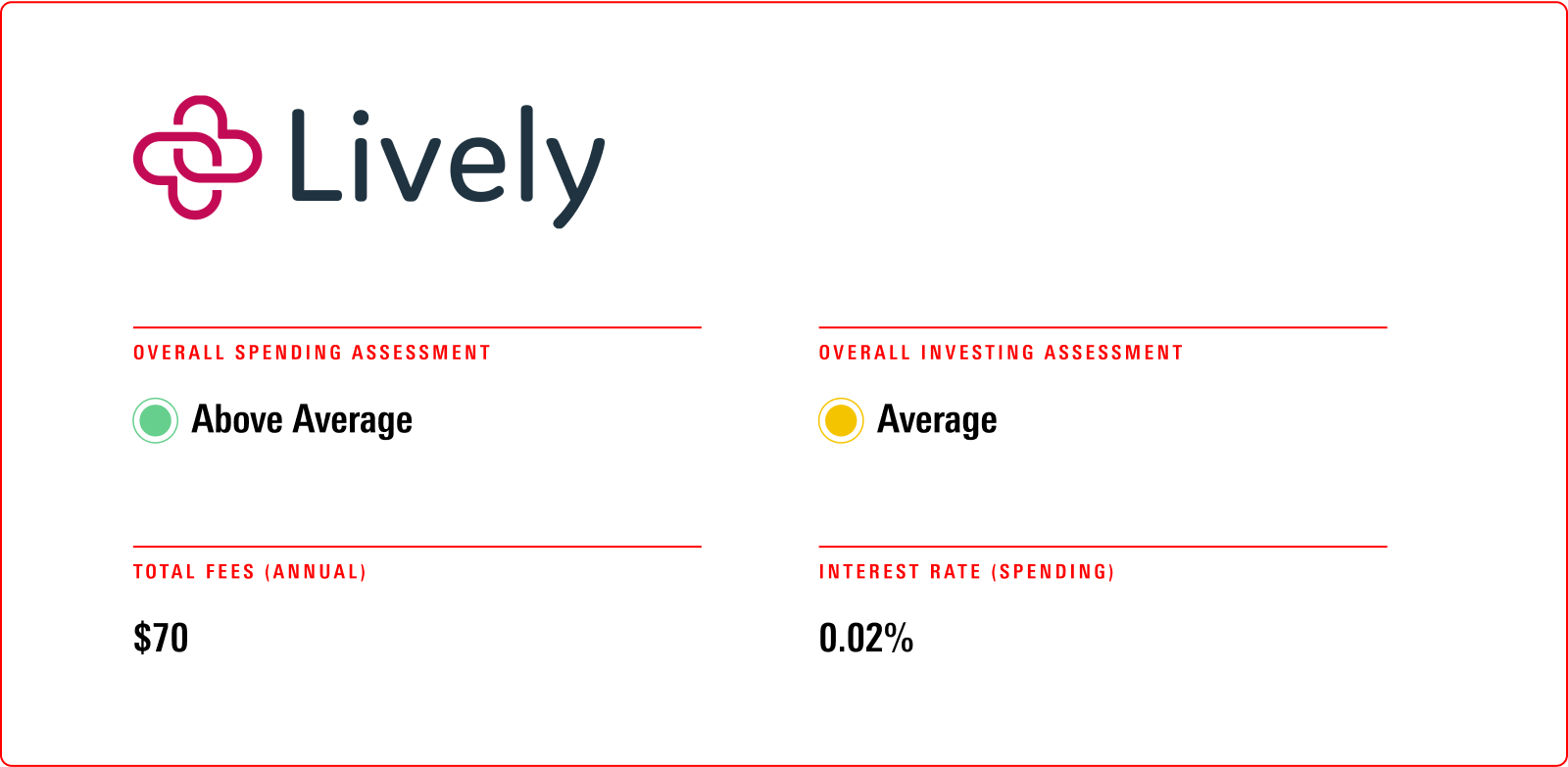

Lively

Pros

- The spending account has no fees, maintenance or otherwise.

- The investment account has no investment threshold and comes with an exceptionally designed investment menu.

Cons

- The spending account offers low interest rates.

- There’s a hefty custodial fee on the investment account.

Lively’s spending account comes without a maintenance fee or any additional fees, such as account transfer charges. Lively’s recently updated interest-rate schedule, however, starts at 0.02% on smaller plan balances and peaks at just 0.09%.

Lively’s investment account boasts a compact yet well-rounded investment menu and no investment threshold, meaning investors don’t need to retain certain balances in the spending account to invest. Yet, Lively’s hefty 0.50% investment charge overwhelms its relatively cheap group of funds and waters down its investment offering.

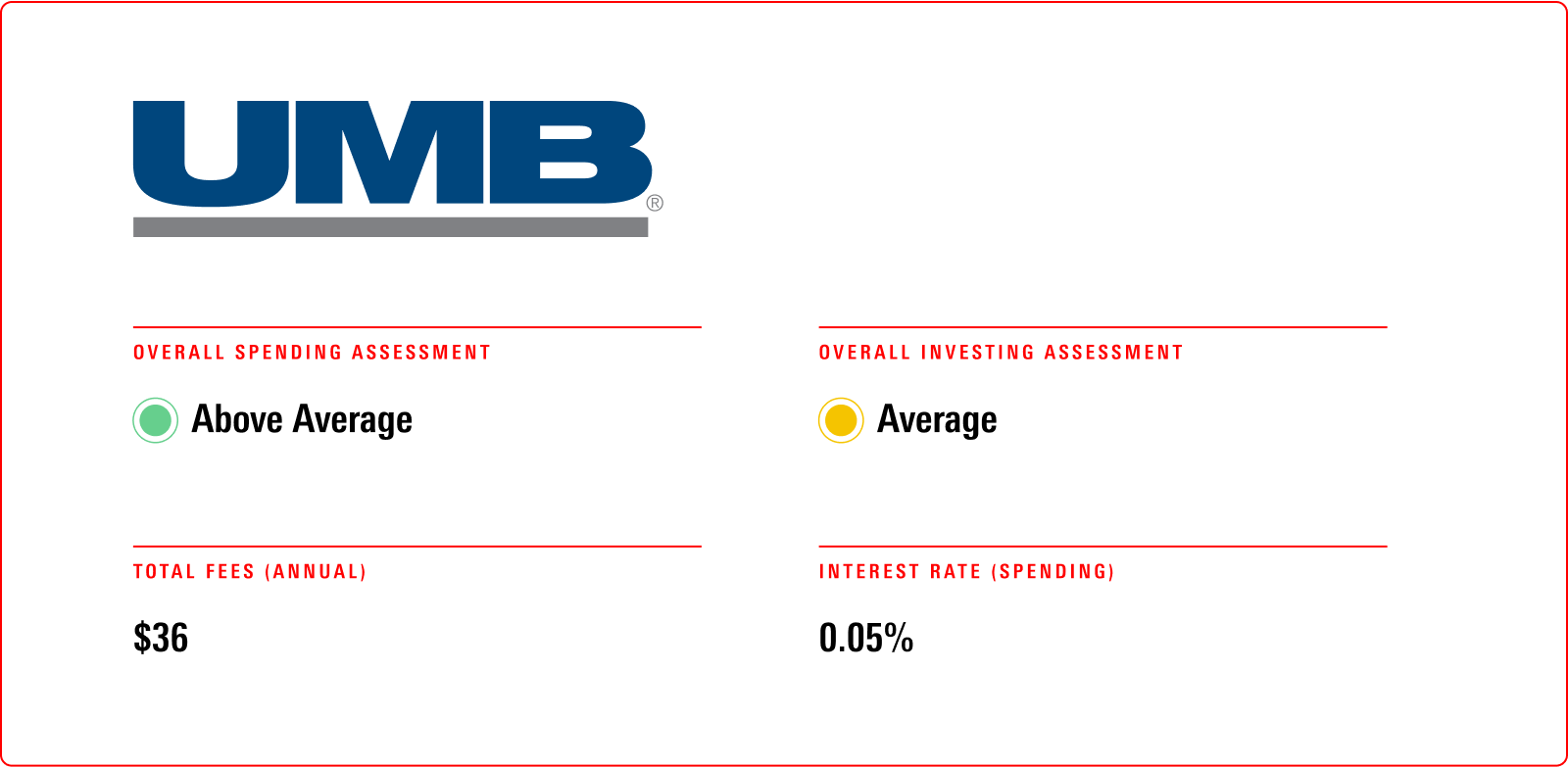

UMB

Pros

- The spending account doesn’t charge a maintenance fee.

Cons

- The spending account has a subpar interest-rate schedule for smaller plan balances.

- The investment menu is unwieldy.

UMB has improved its HSA offering.

The firm eliminated its $35 maintenance fee as of 2023, a growing trend in the industry as seven providers covered don’t charge one. However, like most providers, interest rates are low on modest account balances.

The investment account’s once-exceptional investment menu is now bursting at the seams with 40-plus options, which can be tough to navigate given the large number of specialty options and substantial strategy overlap. It does, however, include both Vanguard’s target-risk and Target Retirement series and a solid environmental, social, and governance option in Gold-rated Parnassus Core Equity PRILX.

UMB’s investment fees have come down. In addition to dropping the maintenance fee, an infusion of more Vanguard options has dropped the average underlying fund fees to just below the group average. UMB still charges a $36 investment fee and mandates a $1,000 investment threshold. In all, it continues to have an average investment offering.

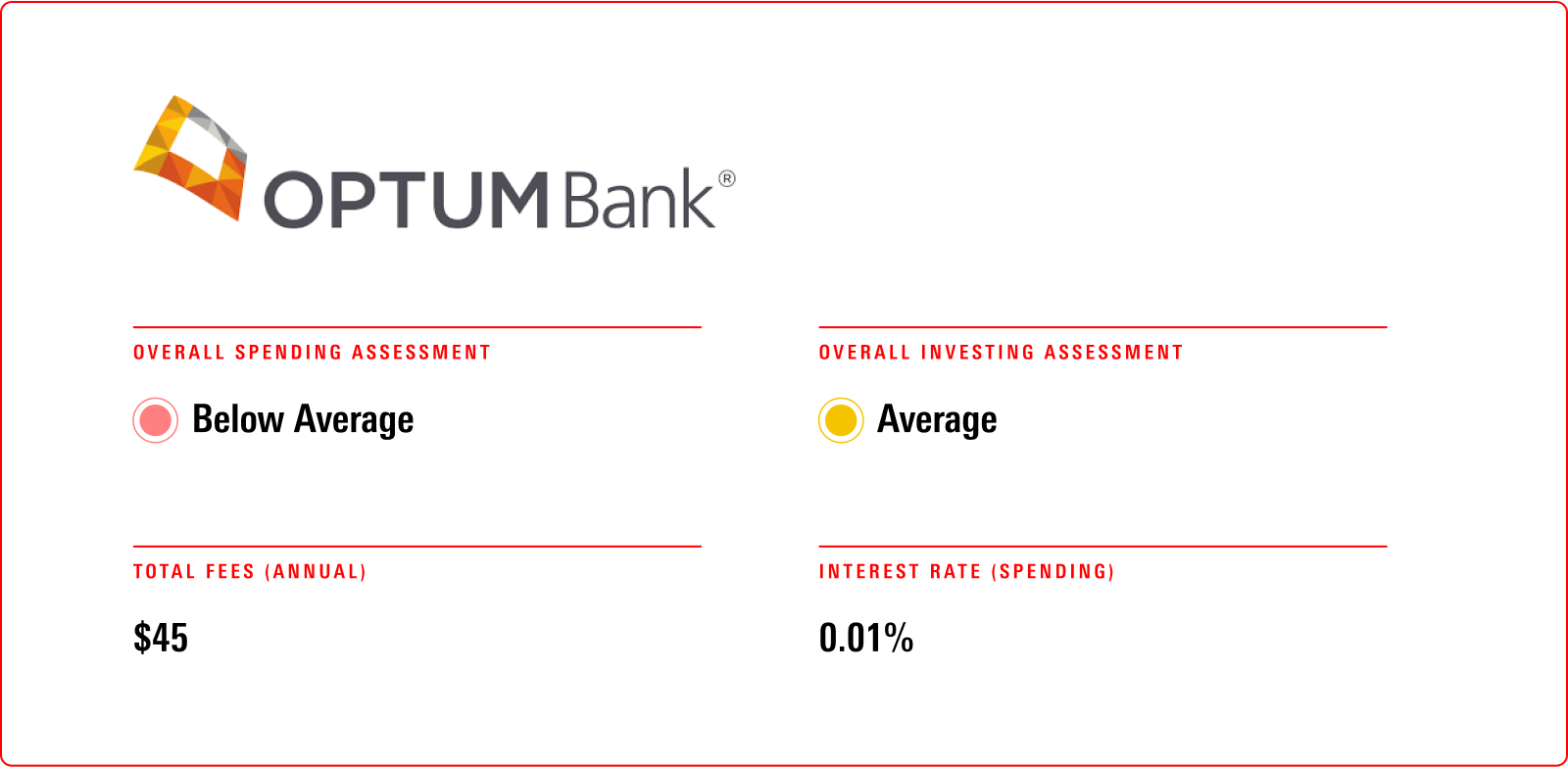

Optum

Pros

- All of the funds on the investment menu earn a Morningstar Medalist Rating of Bronze or better.

Cons

- Its interest rate is stuck at 0.01%.

- The investment menu design has room for improvement.

Optum’s investment account looks cheaper now after the elimination of investment and custodial fees. That said, its minuscule 0.01% interest rate limits the attractiveness of the spending account.

On the investment account, Optum’s investment threshold rose to $2,000, while the 0.23% average expense ratio of funds offered is just below the group average of 0.24%. The middling investment menu design includes three of the four Vanguard target-risk funds and the Schwab Target Index series at 10-year increments, rather than the preferred five-year steps. Its relatively deep menu also has redundancies—with two actively managed strategies apiece in the large-value and global large-stock blend categories—and narrow offerings such as Gold-rated Vanguard Real Estate Index VGSNX and Neutral-rated Lord Abbett High Yield LHYRX. Optum is one of the six providers to feature a brokerage window.

HSA FAQs

Who qualifies for an HSA?

HSAs are available to people with HDHPs (with deductibles of at least $1,650 for individuals or $3,300 for families in 2025). Your health insurance plan’s out-of-pocket maximum also cannot exceed $8,300 (or $16,600 for family coverage).

You also cannot be a dependent on a tax return, enrolled in Medicare, or enrolled in another health insurance plan (unless permitted under other health coverage).

What are the HSA contribution limits?

In 2024, the combined contributions of you and your employer must be at or below $4,150 for a self-only insurance plan and $8,300 for a family plan. If you’re 55 and older, you can contribute $1,000 more each year. You can make 2024 contributions until tax day, April 15, 2025.

The 2025 HSA contribution limits are higher. The limit is $4,300 for self-coverage and $8,550 for family coverage. You can still contribute an extra $1,000 each year if you’re 55 or older.

How is an HSA different from an FSA?

Both HSAs and FSAs offer tax advantages. You can elect for your employer to defer pretax dollars into the account, and you can withdraw these funds tax-free to cover qualified medical expenses. FSAs and HSAs have some key differences, and even if you qualify for both, the IRS only lets you have one given their overlapping tax benefits.

What if my company-provided HSA isn’t the best?

Even if it isn’t your first pick, don’t abandon your company-provided HSA. Take advantage of the option to defer pretax dollars to the account as well as any company match your employer offers. From there, you can periodically transfer money out to your HSA of choice. Assuming the money stays within the HSA, you won’t have to worry about taxes on the transfers.

How We Evaluated HSA Providers

Our report on the HSA landscape was designed to provide useful information to individuals either enrolled in or considering an HSA. Morningstar evaluates the largest and most popular HSAs available to individuals and also smaller HSAs if their features merit attention. The report does not include HSAs available through employers, as fees in such plans can vary, making comparisons difficult.

Morningstar’s analysts evaluated the providers on two use cases: as spending accounts to cover current medical costs, and as investment accounts to save for future medical expenses. Morningstar scored both account types on a 5-point scale (High, Above Average, Average, Below Average, and Low).

Three factors potentially drive the quality of HSA spending accounts: interest rates, maintenance fees, and additional fees. Morningstar evaluated the spending accounts along two dimensions: maintenance fee (70% weighting) and interest rates (30%). Morningstar weighted each category score and summed it to arrive at an overall score, which was then used to rank the providers.

In assessing HSA investment accounts, Morningstar’s analysts prioritized low, transparent fees; sound investment menus that steer clear of questionable asset classes and limit overlapping positions; high-quality investment strategies that earn Morningstar Medals of Gold, Silver, or Bronze; and no required spending account balance in order to invest. Morningstar scored each investment account on four criteria: price (40% weighting); menu design (20%); quality of investments (20%); and investment threshold (20%). Morningstar weighted and combined each category score to arrive at an overall score and rank the providers.

In our evaluation of each provider, we assumed a $2,500 spending account balance and a $14,000 investment account balance for ease of comparison, and we have noted providers whose fees increase or decrease for higher investment amounts.

Contributors

- Research Contributors: Stephen Margaria, Morningstar Manager Research

- Design Editors: Zhan Su, Alex Skoirchet

- Editors: Emelia Fredlick, Ann Sanner King

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)

/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EM5S5PPZOBAPZAXTPIQY2RBDYI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F4LLDEXKHBDARJDJB7US5S66YU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BCW5OCOH7NBMVNF7A2767XTQCM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)