Is Oracle Stock a Buy, Sell, or Fairly Valued After Earnings?

Following an 80% rally and strong earnings, here’s what we think of Oracle stock.

Oracle ORCL released its fiscal fourth-quarter earnings report on June 12, 2023. Here’s Morningstar’s take on what to think of Oracle’s earnings and stock.

Oracle Stock at a Glance

- Fair Value Estimate: $76

- Morningstar Rating: 1 star

- Morningstar Uncertainty Rating: Medium

- Morningstar Economic Moat Rating: Narrow

What We Thought of Oracle Earnings

Narrow-moat Oracle’s fourth quarter exceeded expectations on the top and bottom lines, as the growth rate of its nascent cloud infrastructure business nearly doubled from last year, showing solid health. Nonetheless, our concerns remain for what we believe is a more limited upside to the cloud infrastructure market than what the market is baking in.

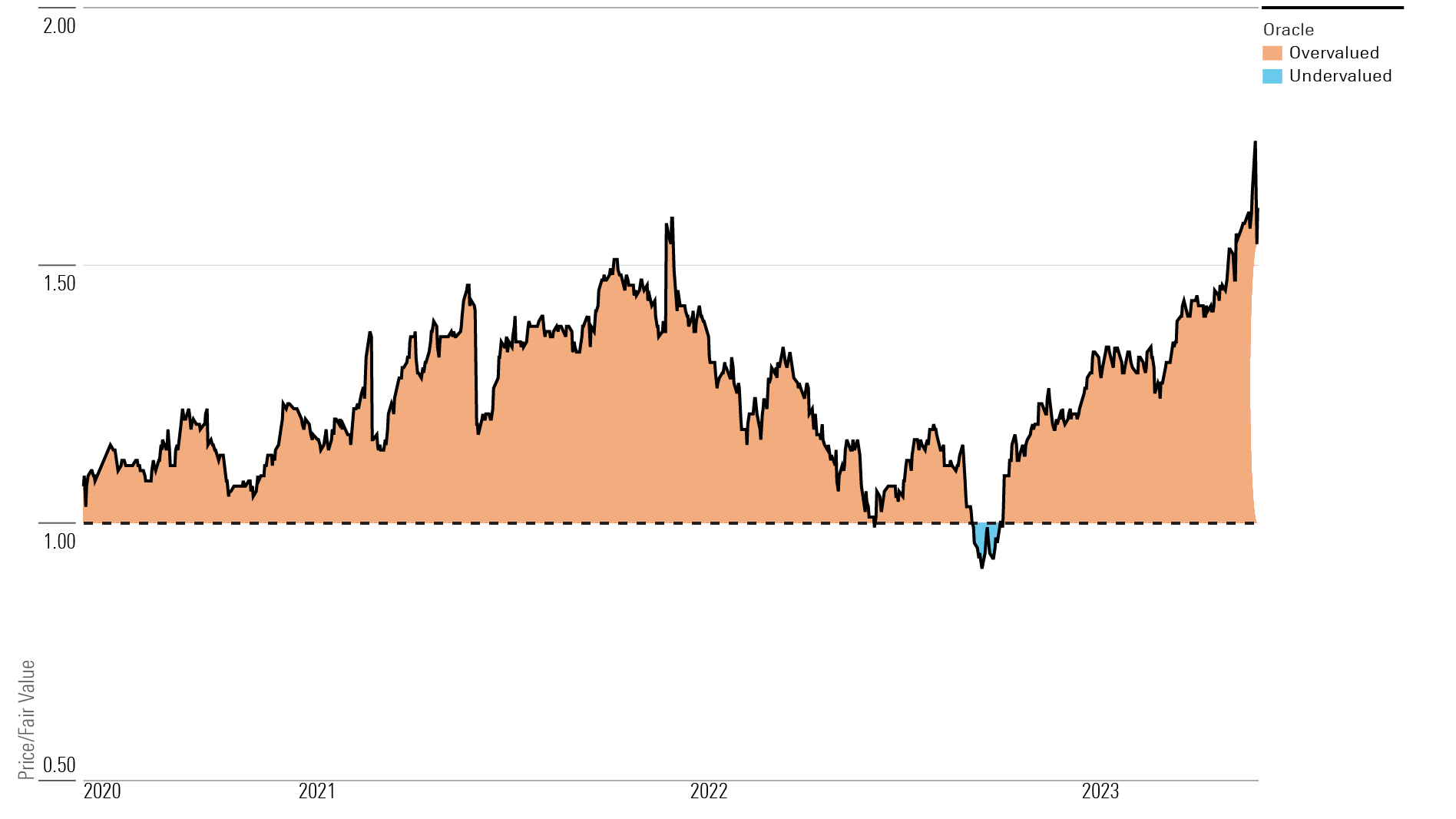

Even with this concern in mind, we are raising our fair value estimate to $76 from $67 per share after accounting for the time value of money as we roll our model ahead. However, with shares up by more than 80% over the trailing 12 months, we still strongly believe they are significantly overvalued, in 1-star territory.

Oracle Shows Strong Cloud Infrastructure Gains

The highlight of the quarter was the acceleration of cloud infrastructure growth, which rose 77% year over year. Notably, consumption of Gen 2 cloud infrastructure is now seven times larger than in 2020. We think these metrics are strong, but the health of this newer business over the next few years is not our primary concern. Ultimately we look to the long term, where we think the potential of Oracle’s cloud infrastructure business is capped. We believe the larger cloud infrastructure competitors have ample first-mover advantages, and that more general workloads will be harder to compete for. Our bearishness extends from the income statement to the balance sheet. Oracle closed out the year with $86 billion in long-term debt. With portions of this massive debt needing to be refinanced in the coming years with more expensive debt, we bake in this risk in our overall moderate credit risk rating.

Altogether we reiterate that our $76 fair value estimate implies significant overexuberance from the market. We are baking in a five-year revenue compound annual growth rate of 8% over the next five years and ample operating margin expansion of 7 points over the same period. We think our estimates are grounded in reality, as growing a top line of $50 billion at an 8% five-year compound annual growth rate is still an incredible feat, given the limits of the market’s size (even with a growing market implied).

Furthermore, while our margin expansion does not imply a return to past levels of 40%, our 34% terminal operating margin reflects solid profitability in the face of a more competitive environment than what Oracle operated in a decade ago, and we believe increased competition is here to stay.

Oracle Stock Price

Fair Value Estimate for Oracle Stock

With its 1-star rating, we believe Oracle stock is significantly overvalued compared with our fair value estimate of $76 per share, which implies a fiscal 2024 enterprise value/sales ratio of 5 times, an adjusted price/earnings ratio of 15 times, and a free cash flow yield of 5%. We expect Oracle’s total revenue to grow at an 8% compounded annual rate over the next five years. We see the cloud services and license support segments organically driving growth, but offset by hardware and services declining as a result of customers transitioning to the cloud.

In terms of profitability, gross margins in cloud services and license support would remain vulnerable in the short term as more companies switch to Oracle software as a service, or SaaS, which is cheaper than on-premises software. Oracle does not mind this byproduct, given its expectations that SaaS customers will increase their spending with the firm threefold. However, this decreasing gross margin in cloud services and license support should be partially offset by an increase in gross margin in Oracle’s hardware business as it sheds more commodity hardware, as well as a decreasing mix of lower-margin services revenue. Altogether, we forecast that gross margins will increase to 75% in fiscal 2028 from 73% in fiscal 2023. Overall we expect the shifting mix to the cloud should drive operating leverage such that operating margins expand to 34% in fiscal 2028 from 27% in fiscal 2023.

Read more about Oracle’s fair value estimate.

Oracle Price Fair Value

Economic Moat Rating

We assign Oracle a narrow moat rating based on the switching costs permeating its business. Although it’s an industry-leading software provider, the company is encountering headwinds as it transitions to the cloud. In turn, we foresee less certainty about its ability to retain customers and generate excess returns on capital in the long run, which prevents us from assigning the firm a wide moat.

Oracle is by and large known for its relational database, Oracle Database. While Oracle offers both on-premises database licenses and its autonomous database via infrastructure as a service, or IaaS, we believe both forms carry significant switching costs. Enterprises rely on data more than ever, both internally and through their products. As a result, how that data is stored and accessed becomes critical. Changing the storage and access methods creates numerous headaches that aren’t dissimilar to the switching costs we see in enterprise software, such as the learning curve when using new databases or the monetary- and time-related costs associated with “rewiring” how a company’s data. One can imagine the disaster that would occur if salary data was accidentally stored in database cells where employees’ emails should be put because of a faulty migration to a competing database.

Apart from its database, Oracle offers a robust array of enterprise software, such as its platforms for supply chain management, human capital management, and enterprise resource planning, or ERP. We think all of Oracle’s major software offerings exhibit switching costs. The most obvious is the direct time and expense required when implementing a new software package for a customer while maintaining an existing platform. There are indirect costs along those same lines—mainly lost productivity as customers move up a learning curve on the new system, along with the distractions for users.

Lastly, and perhaps most importantly, there is the operational risk, including loss of data during a changeover, project execution, and potential operational disruption. The more critical the function and the more touch points a software vendor has, the higher the switching costs will be.

We certainly think Oracle has its fair share of intangible assets, such as its database’s ability to partition data to improve load balancing. However, we do not view these as a moat source, as we think the company’s switching costs are far more influential when generating excess returns than its technological edge alone.

Read more about Oracle’s moat rating.

Risk and Uncertainty

We assign Oracle a Morningstar Uncertainty Rating of Medium. We do not foresee any material environmental, social, or governance issues on the horizon.

In our view, the greatest risk for Oracle stems from the shift to cloud computing and whether the firm can effectively transition its client workloads from on-premises software into its cloud. This transition affects every aspect of Oracle’s business—most directly, eliminating the need for any customer to buy its hardware to run on-premises databases. But more importantly, if customers move to a competing cloud provider, they block themselves from the ability to use Oracle’s cloud-native software, Fusion, and the change to competing ERP software could instill a change in databases. We believe Oracle is at risk of this transition, and that the risk is exposed from all sides.

Read more about Oracle’s risk and uncertainty.

ORCL Stock Bulls Say

- Oracle’s relational database should be able to post strong growth as customers continue to depend on its quality features such as data partitioning, which brings incomparable load-balancing efficiency.

- Oracle’s autonomous database and IaaS were built with ease of use in mind, which could bring a significant base of first-time users to the company, strengthening top-line results.

- Oracle’s stake in TikTok and cloud services to its U.S. operations should add a significant boost to the firm’s top line and attract more “general-use” cloud customers.

ORCL Stock Bears Say

- Oracle could suffer below-average growth as customers are prompted to change databases and software providers in their transition to the cloud.

- Oracle’s cloud business could struggle to win business as alternative SaaS and database systems leave little incentive to select Oracle IaaS.

- COVID-19 could accelerate Oracle customers’ digital transformation efforts, causing the firm to lose customers at a faster pace than expected.

This article was compiled by Muskaan Hemrajani.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f497c984-8e67-4c32-8c6c-210934e57017.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f497c984-8e67-4c32-8c6c-210934e57017.jpg)