Investors Bail on Large-Value Stock Funds

Record outflows in May come as investors reverse course from 2022 inflows and exit value index funds.

As investors have pulled money out of U.S. stock funds in 2023, one category has seen the brunt of the exodus: large-value funds.

While actively managed large-value funds have seen steady investor withdrawals for many years, in a shift, this year investors have also been pulling money out of index-tracking large-value funds. The outflows come as core value funds are once again lagging growth strategies after a short spell of outperformance in 2022.

May marked the category’s worst month of outflows ever, with $15.1 billion leaving large-value mutual funds and exchange-traded funds. In all, roughly $36.3 billion has exited the $1.5 trillion category this year—equal to about 2% of their assets at the end of 2022.

Last month, investors pulled more money from passive than active large-value funds. The largest passive fund—the $140.3 billion Vanguard Value Index VVIAX—shed $4.9 billion, equal to more than 3% of its assets. The largest active fund—the $87 billion Dodge & Cox Stock DODGX—registered $600 million in outflows.

“The outflows from value funds stand out, even among the overall U.S. equity fund outflows,” says Morningstar analyst Ryan Jackson.

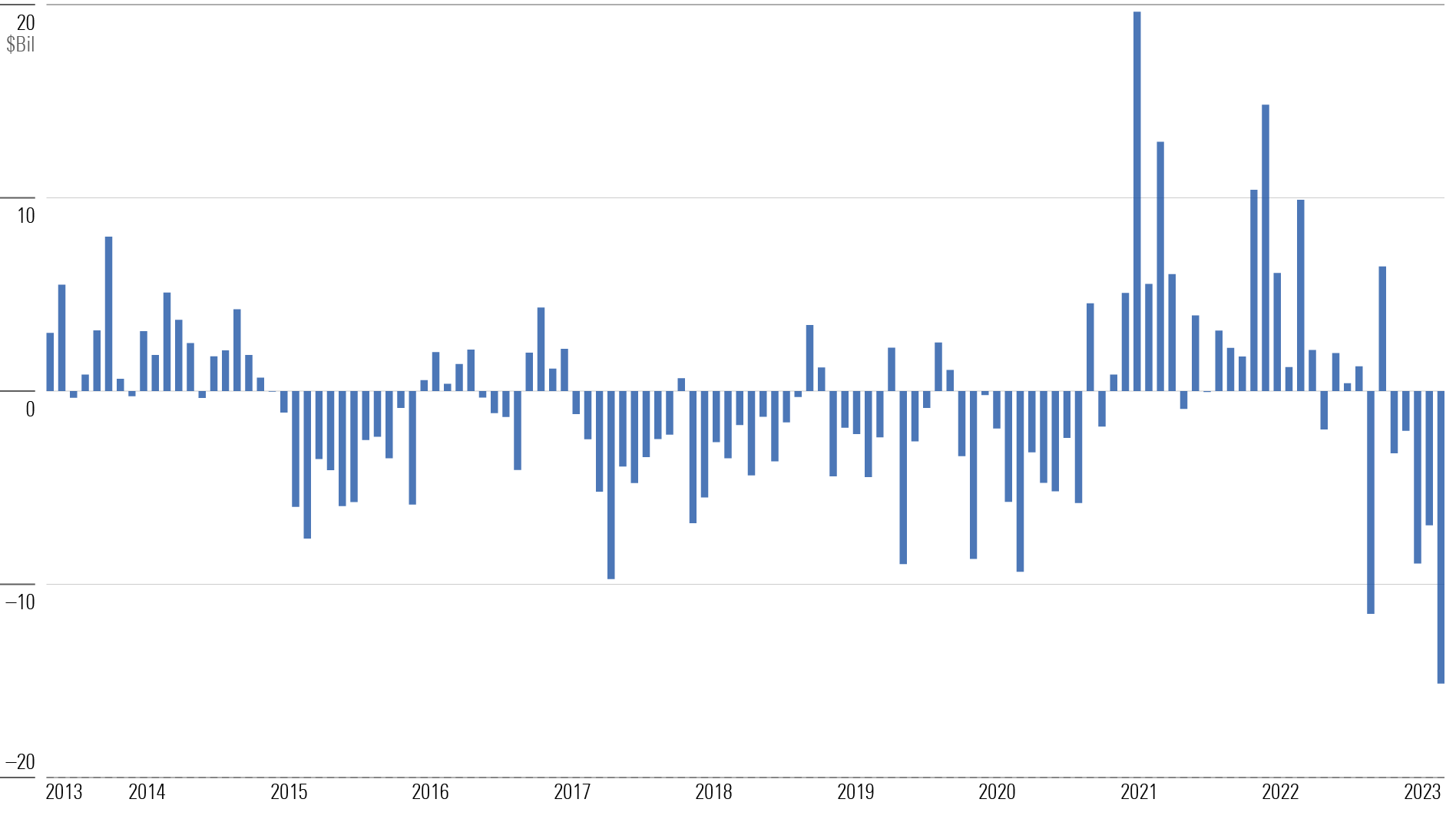

Large-Value Fund Asset Flows

Investors Reverse Course on Large-Value Equity Funds

These outflows signal a change from 2022, when investors poured $41.2 billion into large-value funds. It was the third-best calendar year on record for these funds, and most weathered the bear market much better than growth funds. That year, growth funds declined 30% on average, while large-value funds lost 5.9% on average.

Outflows from large-value funds account for almost half of the $77.5 billion that’s exited U.S. equity funds this year. In comparison, when U.S. equity funds lost more than $240 billion in 2020, the $5.1 trillion large-blend category accounted for 35% of the total outflow, while large-value funds accounted for 19%.

This year’s outflows coincide with a renewed spell of underperformance for value strategies. The average large-value fund rose 3.9% through June 15, while the average growth fund returned 23.5%.

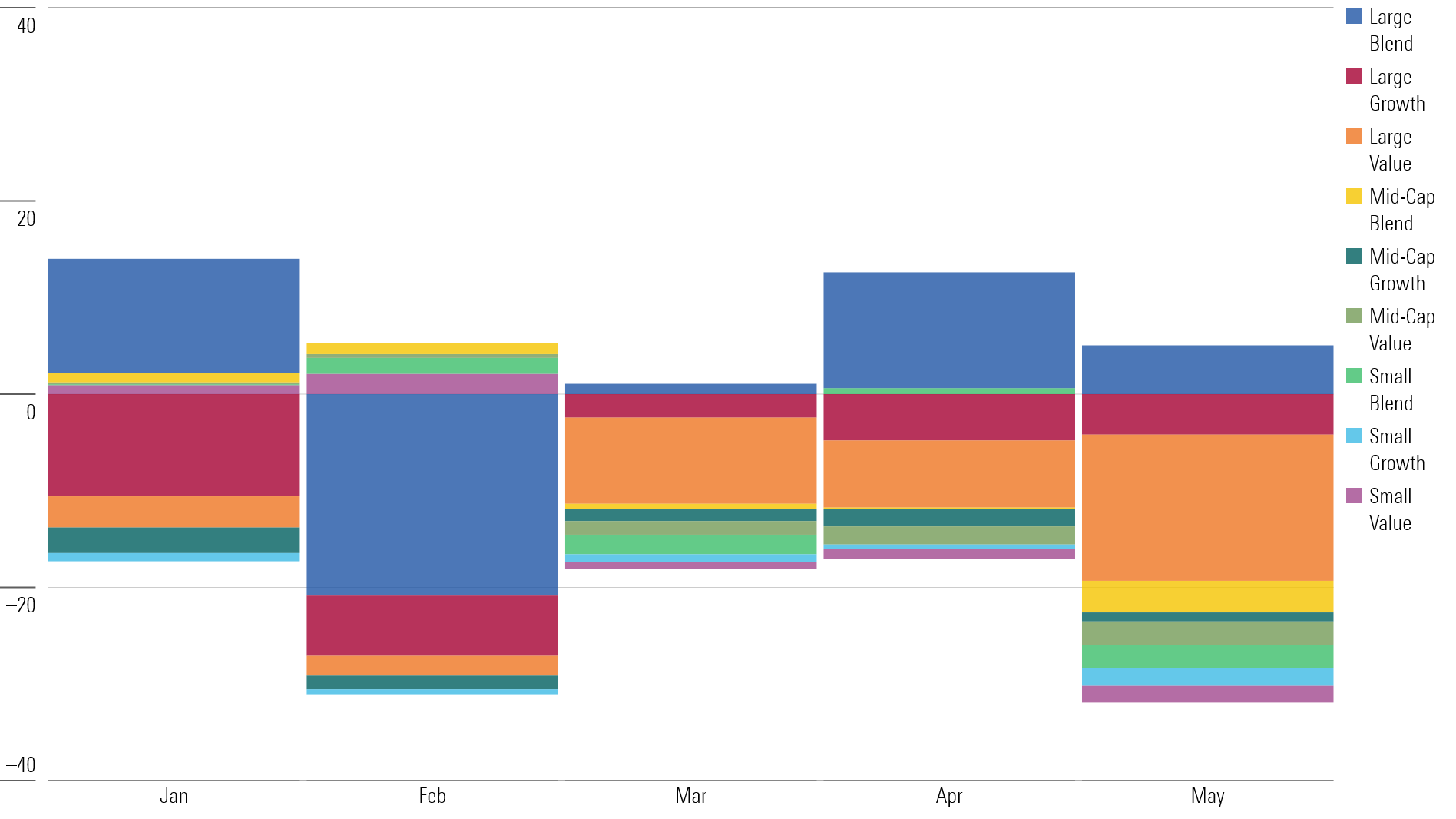

U.S. Equity Fund Flows

Large-Value Index Funds Lead Outflows

Perhaps the biggest change with large-value outflows in 2023 is the retreat from index-tracking strategies. In the first five months of the year, passive large-value funds experienced $20.7 billion of outflows, while active funds lost $15.6 billion. In contrast, most of the money heading into large-value funds over the past two years was directed toward passive funds.

For example, Vanguard Value Index gathered $13.6 billion in 2022 and $16.7 billion in 2021. In addition, investors sought dividend-focused funds, which generally land in the value category. They poured $15.5 billion into the $48.3 billion Schwab U.S. Dividend Equity ETF SCHD last year.

At the same time, investors were pulling money from active large-value funds, which experienced $36.0 billion of outflows last year while passive funds collected $77.2 billion.

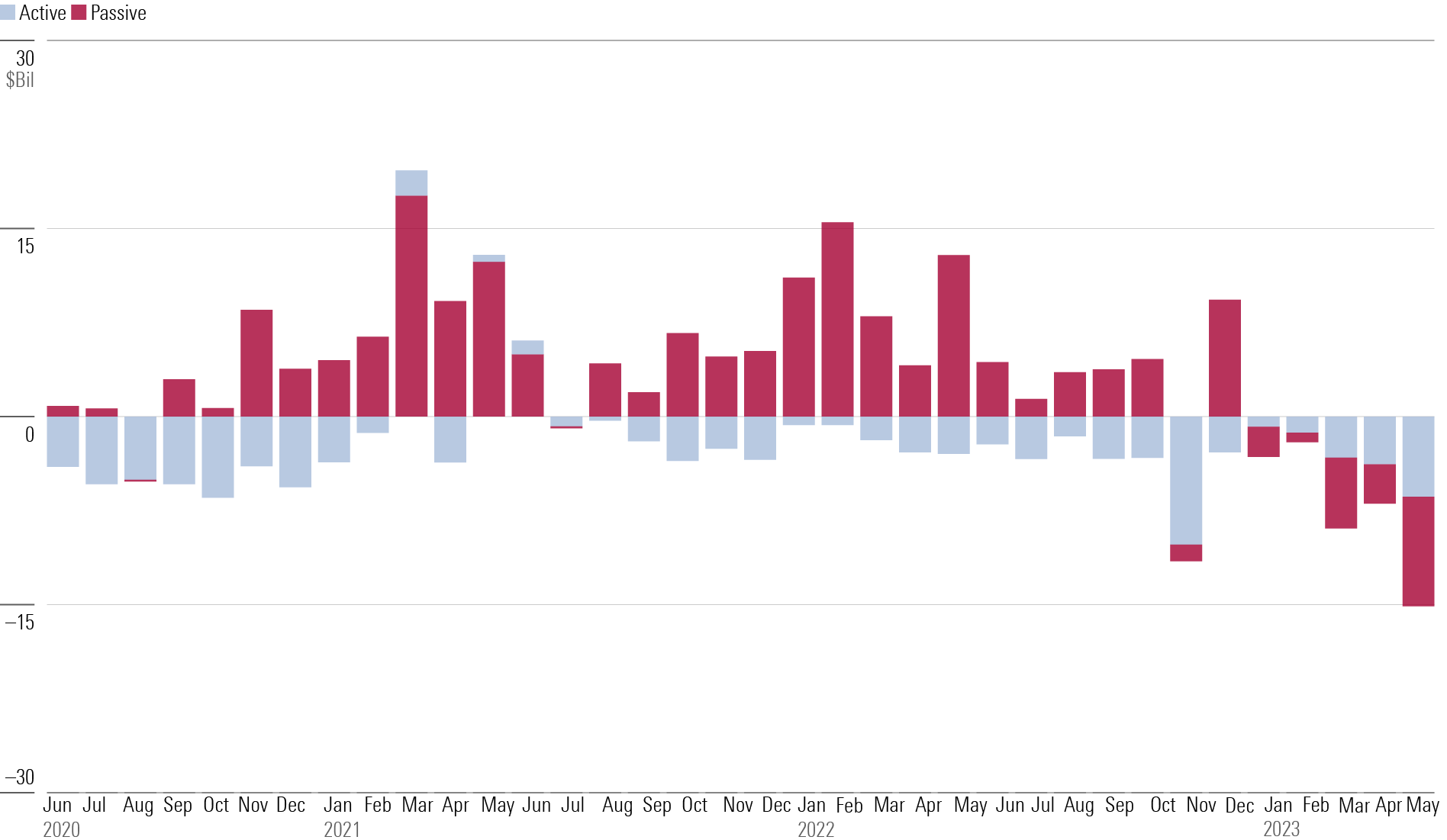

Active vs. Passive Large-Value Fund Flows

Among the 10 large-value funds with the greatest outflows this year, seven are index funds. Vanguard Value Index lost $2.3 billion, and iShares Russell 1000 Value ETF IWD has seen a $5.2 billion exit, causing it to shrink by more than 10%.

Dividend funds have also seen investors tend to switch from adding money to pulling it. “A number of dividend funds and dividend-stock ETFs—a hit in 2022 because they performed so well—have weighed on passive large-value flows in 2023,” says Jackson. “Investors have pulled about $4 billion from them after adding over $50 billion last year,” he explains.

This year, investors have yanked $2 billion from iShares Core High Dividend ETF HDV (equal to more than 15% of its assets) and $1.5 billion from iShares Core Dividend Growth ETF DGRO.

Among active large-value funds, only Dodge & Cox Stock has seen more than $1 billion of outflows this year. However, that amounts to less than 2% of the $87 billion fund.

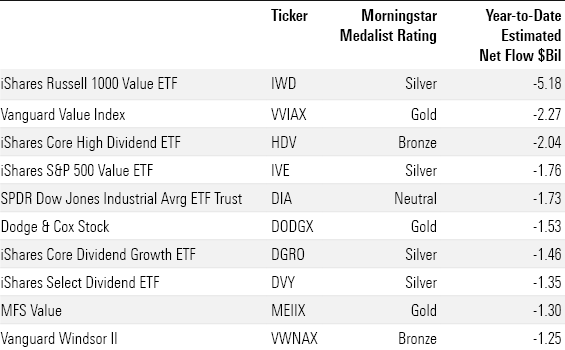

Large-Value Funds With the Largest Outflows in the Year to Date

Widespread Outflows in May

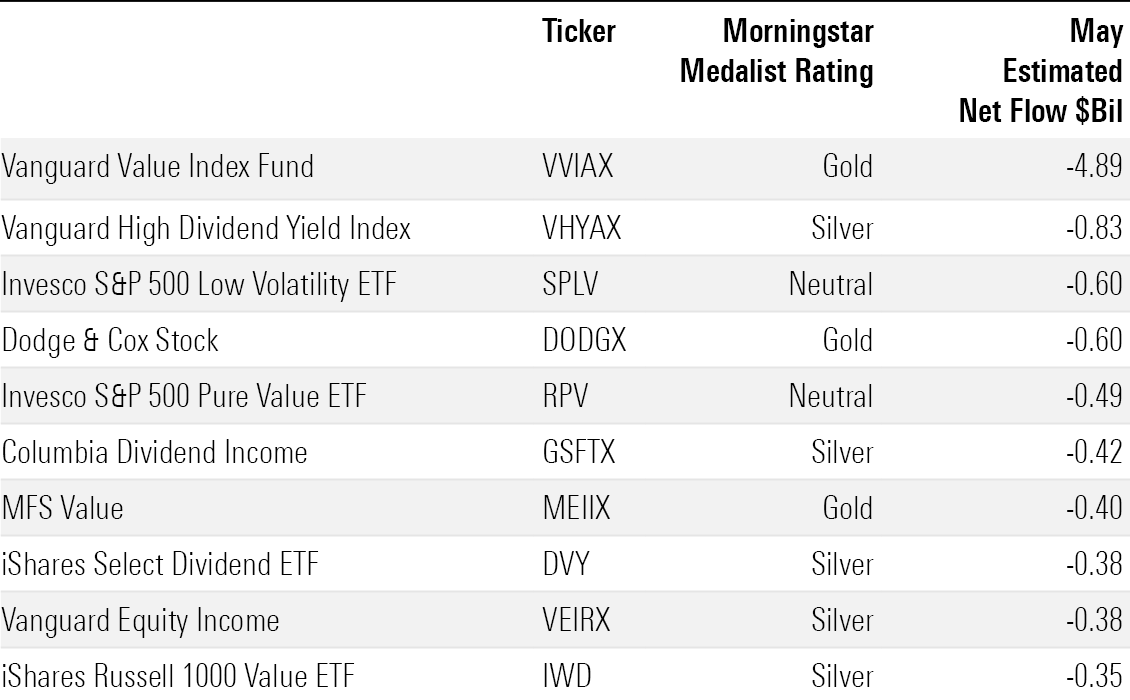

While the trend has been building, May saw it hit new heights as large-value funds experienced their worst month of outflows ever. Only 98 of the 408 funds with available data saw inflows.

Along with dividend funds, investors pulled money out of Invesco S&P 500 Low Volatility ETF SPLV. In May, $600 million left the fund; last year it gathered $2.5 billion.

Large Value Funds With Largest Outflows in May

Recently, as a small number of technology companies have led the U.S. stock market higher, value funds have greatly underperformed growth funds. But investors aren’t fleeing value funds for growth funds. Investors have pulled $26.1 billion from large-growth funds in 2023, but some passive funds are still seeing inflows, including the $13 billion Invesco NASDAQ 100 ETF QQQM and the $14.4 billion Fidelity Large Cap Growth Index FSPGX.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XRD4IQ2J6JG6HCMEDAJSI4ONUY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)