How the Largest Stock Funds Did in the First Quarter

Fidelity Contrafund, Invesco QQQ lead the pack, while Vanguard Value Index lags.

Investors in the most widely held mutual funds and exchange-traded funds largely enjoyed gains in the first quarter of 2023 after posting steep losses in 2022, though the extent of returns varied considerably depending on the investment strategies.

Funds with heavier technology stock exposure and an overall growth-stock tilt fared significantly better than value stock or dividend-focused strategies.

But after the brutal 2022, for owners of the biggest mutual funds and ETFs, the first quarter still marked a welcome reprieve from the bear market.

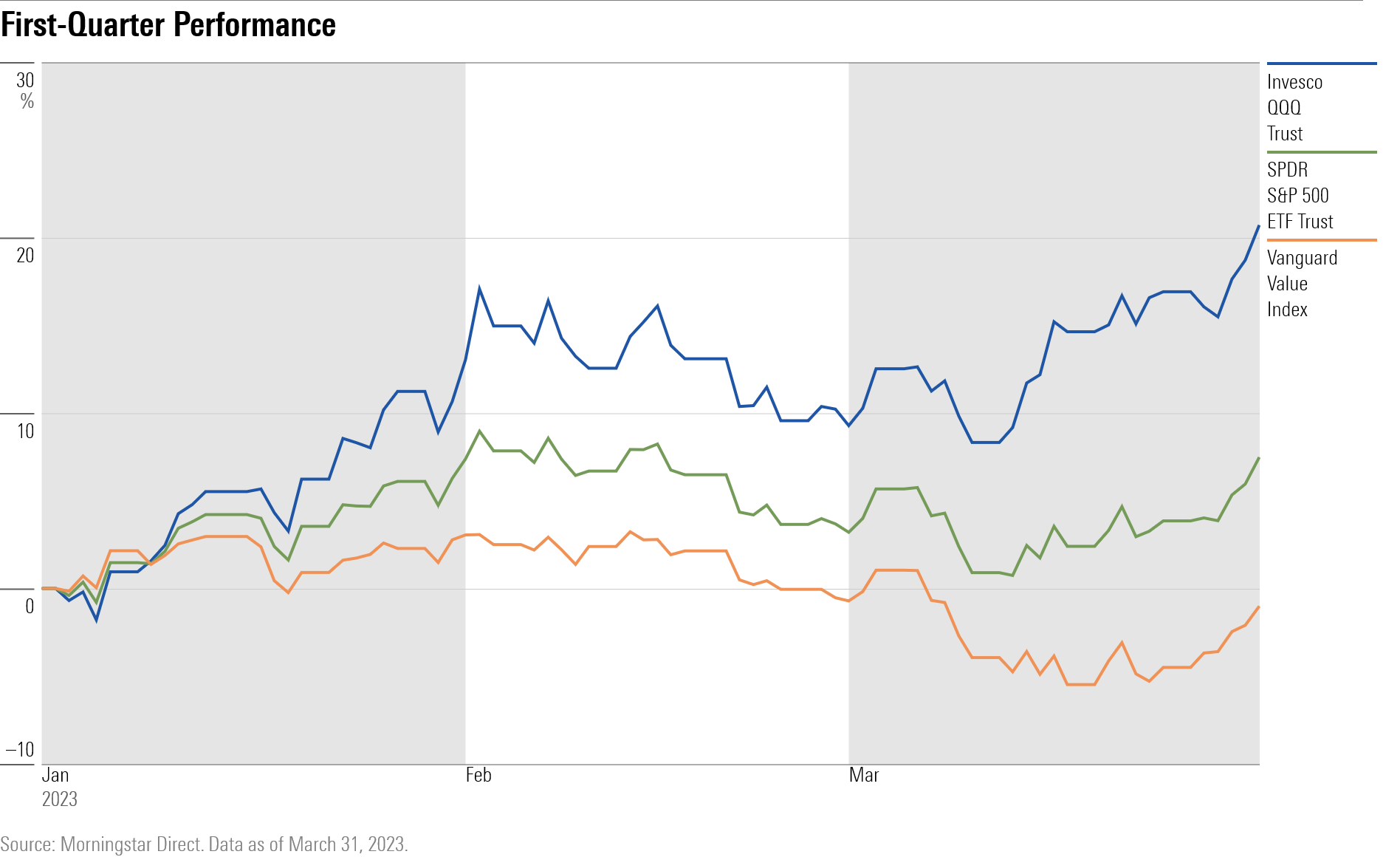

Q1 2023 Performance for Largest Stock Index Funds

Technology stocks rallied in the first quarter, with gains magnified in March as bond yields fell following the regional banking crisis and investors shifted into big technology names, viewing their solid balance sheets as safe havens.

Value-focused funds were also hurt by their greater exposure to the financial stocks, which were hurt by ripples from the woes facing some regional banks.

This pushed growth funds, which tend to invest more in technology stocks, way ahead of value funds for the quarter.

“It was a difficult quarter for value stocks,” says Morningstar analyst Ryan Jackson. “They held up better than growth in 2022 because they are not as sensitive to interest rates, but that swung the other direction more recently as interest-rate hikes decelerated.”

The $100.8 billion Vanguard Value Index VIVAX was the only fund out of the 10 largest index funds—and 10 largest active funds—with negative returns for the quarter. The Vanguard Value Index strategy lost 1%, while the $81.6 billion Vanguard Growth Index VIGRX gained 17%. It was the Vanguard Value Index’s worst quarter relative to Vanguard Growth Index ever.

The tech-heavy $172.6 billion Invesco QQQ Trust QQQ gained 20.7%, its best quarter since March 2020, when investors flocked to tech stocks as a safe haven at the start of the pandemic.

Invesco QQQ outperformed not just value funds by a wide margin but also even typical growth funds.

Jackson notes that the QQQ also benefited by not owning financial stocks. “So it didn’t feel the pain of the SVB collapse as acutely as many of its competitors.” he says.

Meanwhile, funds that track the widely followed S&P 500 index, including the $374.8 billion SPDR 500 ETF Trust SPY and $380.9 billion Fidelity 500 Index FXAIX, gained 7.5%.

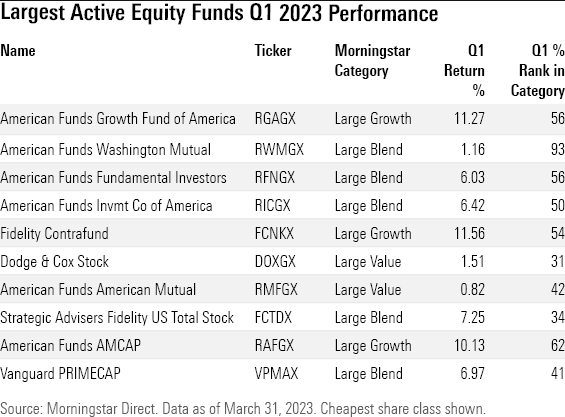

Q1 2023 Performance for Largest Active Stock Funds

Among the largest active funds, the $98 billion Fidelity Contrafund FCNKX performed the best in the first quarter, gaining 11.6%. The fund gained 11.6%, right in line with the average large-growth fund’s 11.6% gain in the quarter.

In the large-value category, the $91.1 billion Dodge & Cox Stock DODGX lagged the broader market and growth funds but outperformed more than two thirds of other funds in the Morningstar Category with a 1.5% gain.

The $151.2 billion American Funds Washington Mutual RWMGX lagged in the large-blend category. It posted a gain of only 1.2%, while the average large-blend fund advanced 5.7% in the quarter.

“It is a little more value-leaning than the index and probably most peers, so as growth bounced back this first quarter, it most likely lagged due to that,” says senior analyst Stephen Welch.

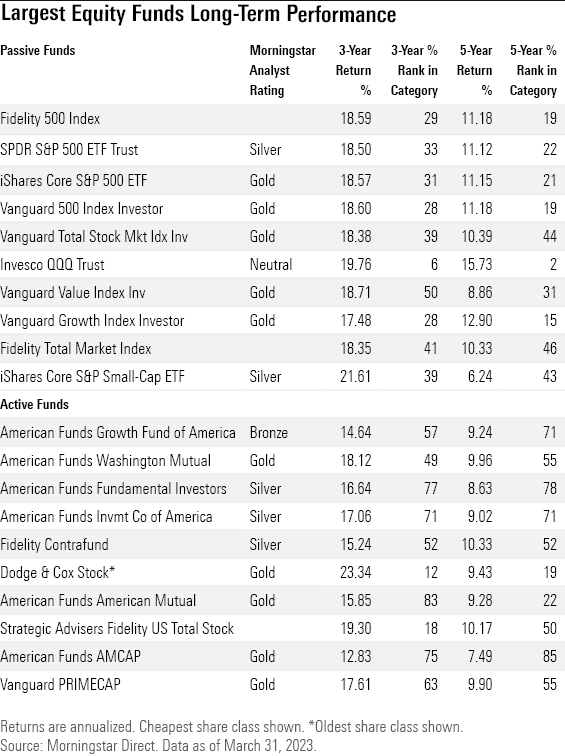

Note: The Largest Equity Funds Long-Term Perforrnance table was updated to show longer-term results for all funds.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XRD4IQ2J6JG6HCMEDAJSI4ONUY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)