How to Find Stocks Poised to Outperform

Wide moats plus low valuations have been a winning combination.

This past year was a mixed picture for the stocks of companies that carry durable competitive advantages—otherwise known as the Morningstar Economic Moat Rating—but that ignores an important factor: valuation.

Once valuations (a measurement of whether stocks are over- or underpriced relative to their long-term values) are added to the mix, undervalued moat stocks not only held up better during 2022′s bear market, they’ve also shown a long track record of outperformance. In fact, Morningstar analysts say that investors are best served considering economic moats alongside valuation to get the best long-term returns.

This can be seen with the Morningstar Wide Moat Focus Index, a collection of only the lowest-priced companies with analyst-assessed competitive advantages expected to last more than 20 years into the future. The wide moat focus index has performed twice as well as the broad Morningstar US Market Index over the past 20 years.

“To find stocks that are most likely to outperform, the key is to combine high quality with attractive price,” says Morningstar equity strategist Allen Good. “Economic moat, in itself, won’t result in outperformance.”

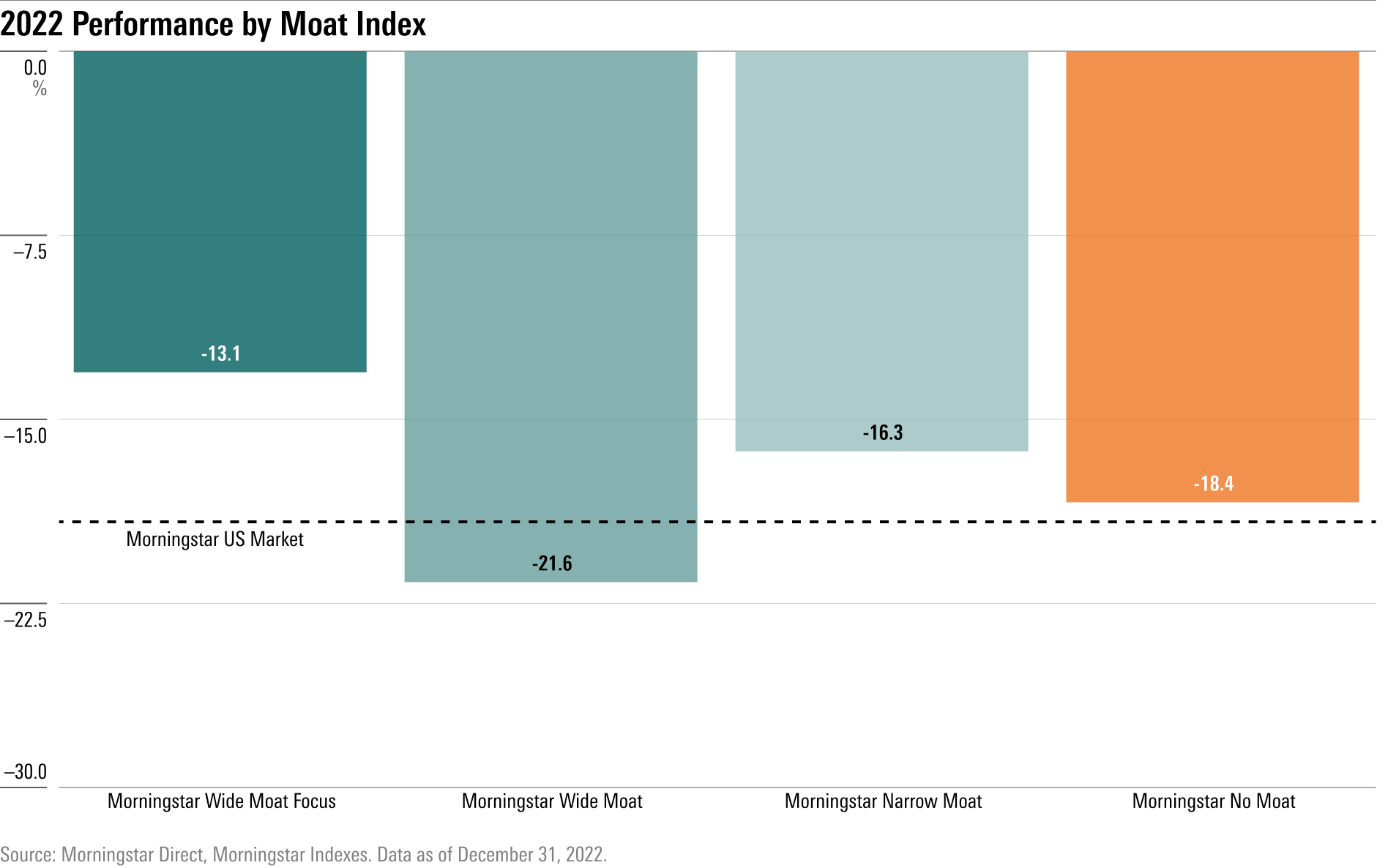

As a group, wide-moat stocks—both undervalued and overvalued—had a poor showing last year. The Morningstar Wide Moat Composite Index, which groups together all the stocks in the U.S. market with wide economic moat ratings regardless of their valuations, fell 21.6%. Meanwhile, the broad Morningstar US Market Index fell 19.4%.

Wide-moat stocks even performed worse than the stocks of companies without an economic moat of any kind. A key reason for the poor performance of wide-moat stocks in 2022 was that technology giants including Amazon.com AMZN, Microsoft MSFT, and Meta Platforms META, all of which earn Morningstar’s wide moat rating, had a terrible year in the face of rising interest rates and surging inflation.

Meanwhile, the Morningstar Wide Moat Focus Index fell just 13.1% in 2022. A loss to be sure, but a strong showing compared with the overall market.

Long-Term Outperformance for Undervalued Wide-Moat Stocks

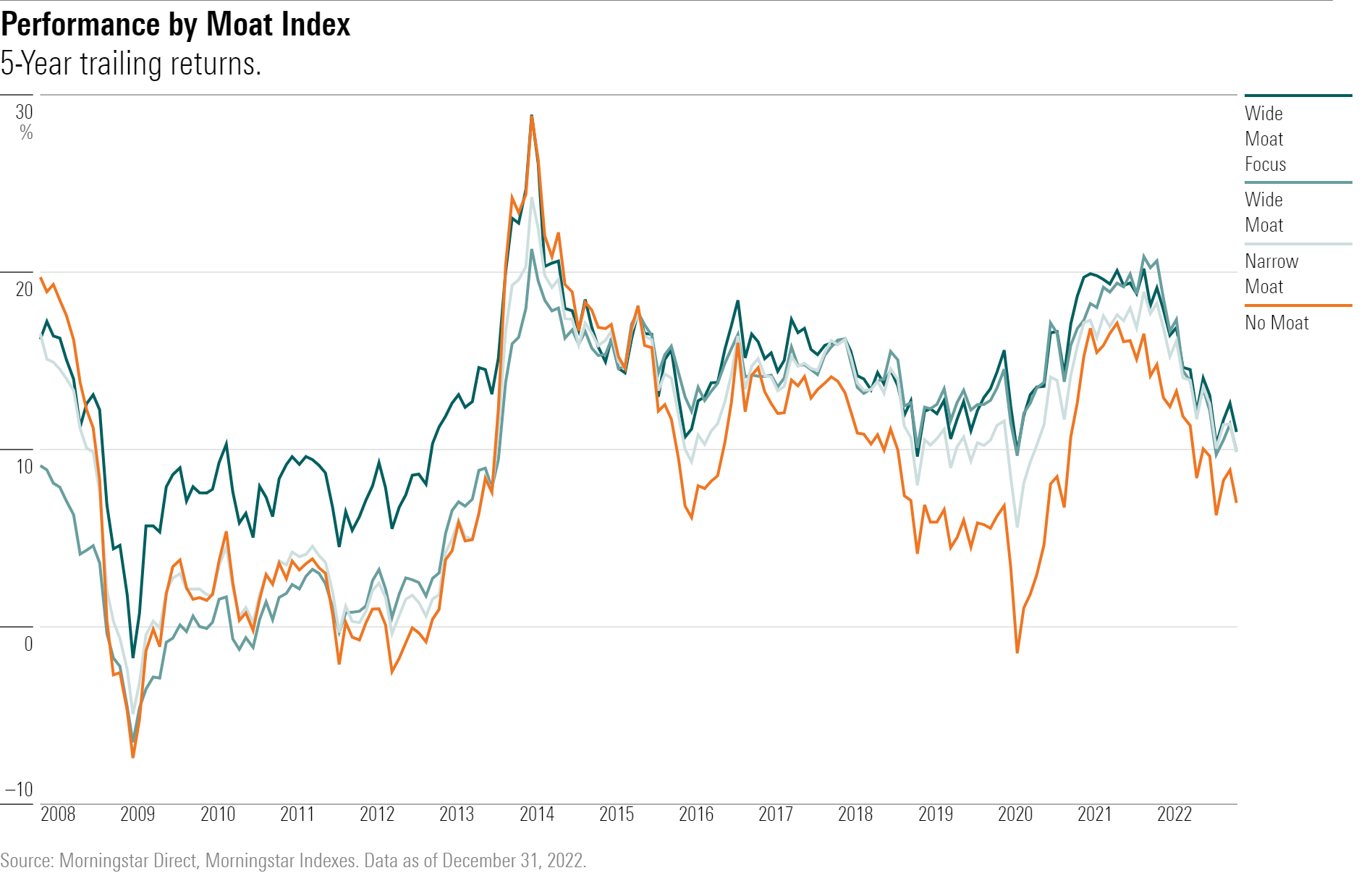

Last year wasn’t an isolated case for undervalued wide-moat stocks. “If you go all the way back to when the wide moat focus index launched, it has hugely outperformed the broader market,” says Andrew Lane, director of equity research for index strategies at Morningstar. The Morningstar Wide Moat Focus Index was first launched in 2007.

In the past decade, the wide moat focus index has risen 250.5%, ahead of the wide moat composite index, which gained 238.1%, through December 31. During the same period, no-moat stocks rose 167.2%, and the Morningstar US Market Index gained 215.4%.

“Investing at the intersection of quality and value has worked really well,” says Ioannis Pontikis, a senior equity analyst at Morningstar. “Not only over the past decade, but over the past 20 to 30 years.”

Over the past 20 years, the wide moat focus index has risen 1,166.9%, gaining twice as much as the Morningstar US Market Index, which rose 574.7% for the same period. Undervalued wide-moat stocks also outdid the overall group of wide-moat stocks by more than double: The wide moat composite index has risen 504.6% over the past 20 years.

To understand why undervalued economic moats have done so well over the long term, it’s worth looking under the hood at both the moat rating itself and the way that Morningstar analysts determine valuations.

The Importance of High-Quality Competitive Advantages

Long-lasting competitive advantages—represented by economic moats—play a big role in how a company generates excess returns on capital.

Economic moats reflect the degree to which a company has durable competitive advantages. A company with an economic moat can fend off competition and earn high returns on capital for many years to come. To determine whether a company has an economic moat, Morningstar analysts look at network effect, switching costs, intangible assets such as patents and brand identity, cost advantage, and efficient scale.

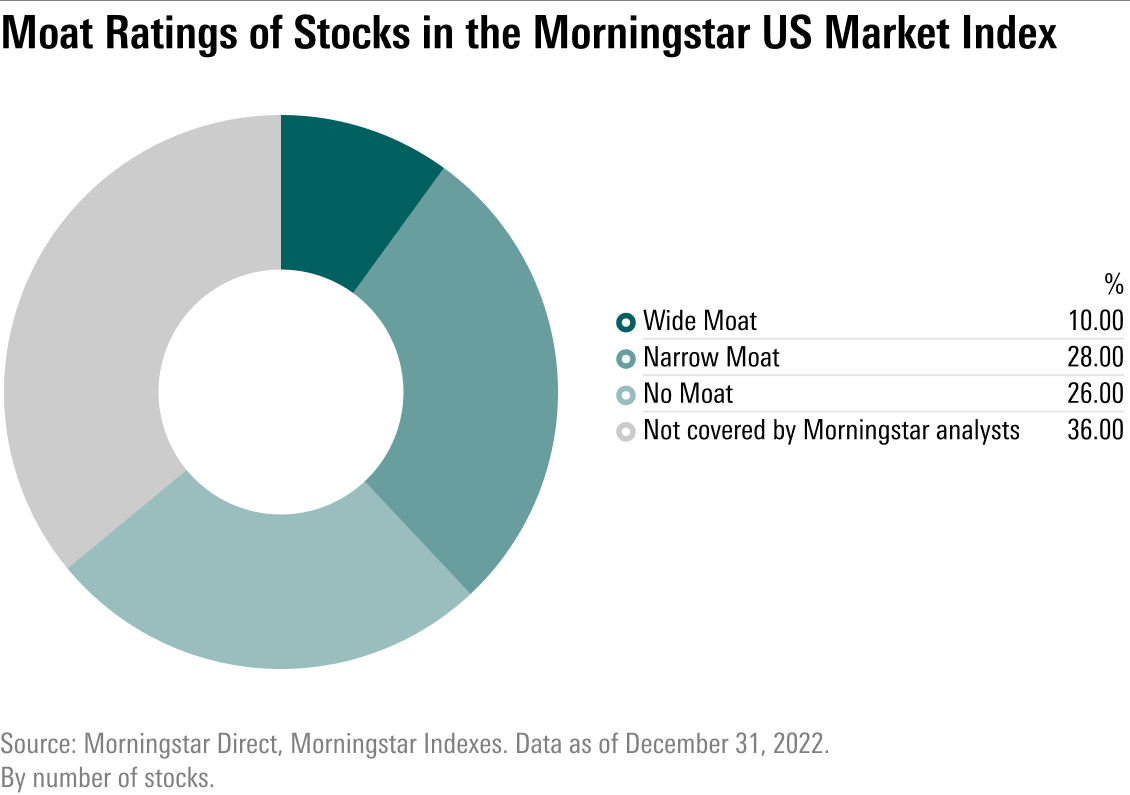

Morningstar analysts say that companies with a wide economic moat can maintain their competitive advantages for more than 20 years. Just 10%—or 149 companies—of the 1,496 companies in the Morningstar US Market Index earn the wide economic moat rating.

Twenty-eight percent of companies in the broader equity market have narrow economic moat ratings, meaning they can fend off their rivals for 10 to 20 years. The remaining 62% of stocks in the U.S. market index come from companies without any economic moat: Morningstar analysts either don’t cover them, or they think these firms have no competitive advantage or one that will quickly dissipate.

The Benefits of Economic Moats and Attractive Prices

Even though a company may be generating meaningful returns on invested capital, in large part because of its economic moat, those fundamental returns may not show up in the form of stock price growth. For a stock’s price to appreciate meaningfully, it generally has to start from an attractive valuation.

“If you buy at the top, it’ll be almost impossible to earn return on your investment as a stock investor—no matter how high-quality the company,” Good says.

But what a moat has historically meant for a stock is that when prices are moving higher, it has a better chance of outperforming over a long period of time.

“Economic moat adds an element of quality to a company: Cash flow is expected to compound at a higher rate for a longer period of time, risk of bankruptcy is lower, and R&D investment is more productive” for companies with a moat, says Good. “But it’s the combination of quality and valuation which ultimately impacts the long-term stock price.”

The companies in the Morningstar Wide Moat Focus Index have the inherent high quality that comes along with an economic moat, “but for whatever reason—be it short-term bad news or some perceived negative feature about the company—the market isn’t fully appreciating that high quality today,” Good says.

High Quality, Stable Prices

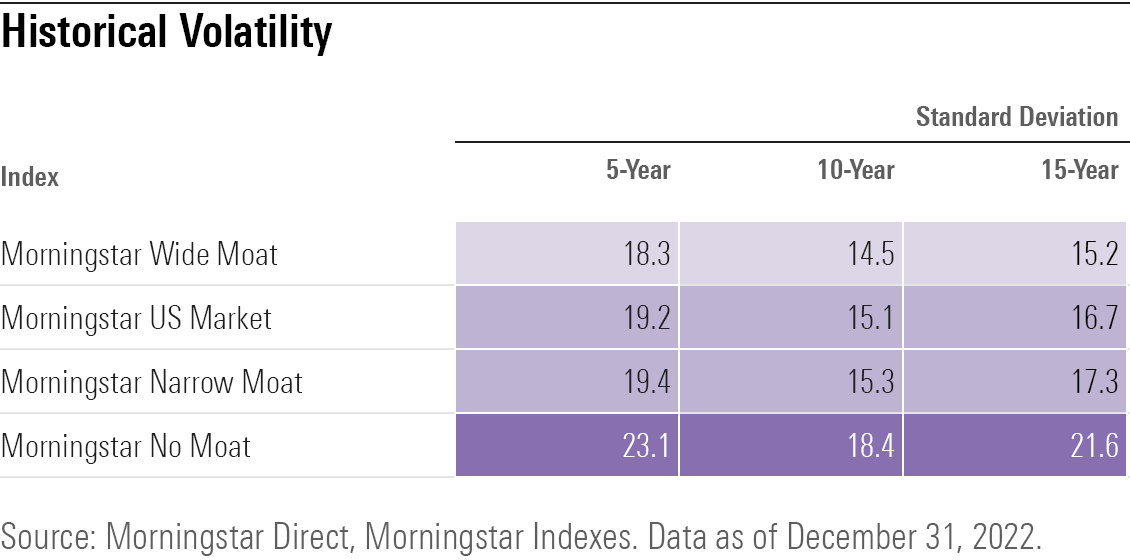

Stocks with economic moats have also tended to have smaller price swings than their no-moat counterparts. As measured by standard deviation—a common barometer for volatility—over the past five, 10, and 15 years, wide-moat stocks have come with lower volatility than narrow-moat stocks and the broader equity market. No-moat stocks have shown the highest volatility as a group.

That lower volatility could be seen during the past year’s bear market. But it also means investors may get somewhat smaller returns in roaring bull markets. “Stocks of companies with economic moats have tended to outperform in downcycles and underperform in the upcycle,” Good says. However, “their strong showing during downcycles ultimately results in long-term outperformance.”

Which Stocks Have Led the Wide Moat Focus Index?

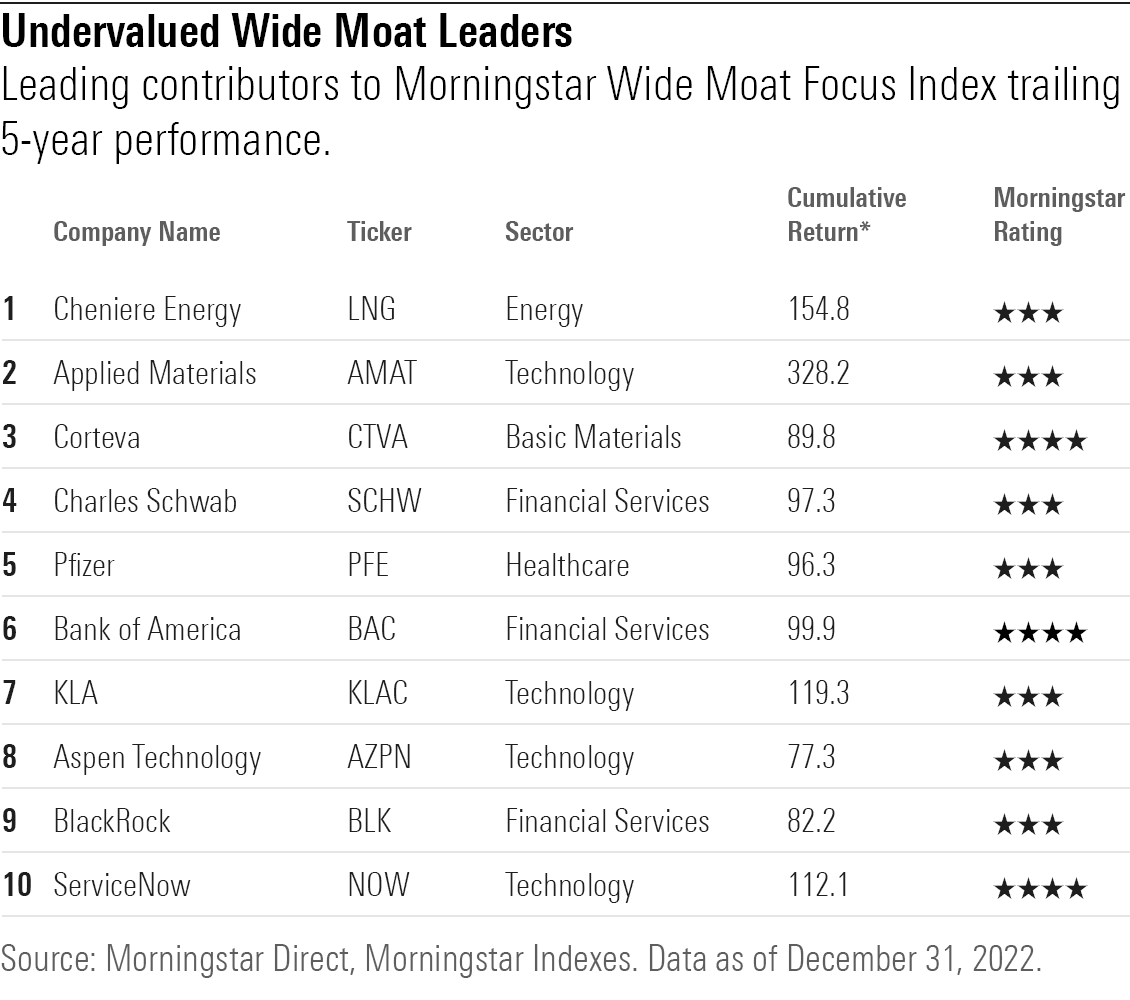

Top contributors to the Morningstar Wide Moat Focus Index’s outperformance come from a variety of market sectors, including energy, basic materials, financial services, healthcare, and technology.

Over the past five years, the liquefied natural gas company Cheniere Energy LNG is up 154.8%, and semiconductor equipment supplier Applied Materials AMAT, which gained 328.2%, led returns for the index. These two stocks were also the top two contributors over the trailing 10-year period, each gaining over 300%.

The undervalued wide-moat stocks’ leadership list is markedly different from the broader equity market’s leading stocks. Over the past five years, leaders to the Morningstar US Market Index have included technology giants and healthcare companies, among them Apple AAPL, Microsoft, and UnitedHealth UNH.

Correction: Jan. 23, 2023: A previous version of this article included incorrect percentages for the number of narrow- and no-moat stocks in the Morningstar US Market Index: 28% have narrow moats, 62% have no moat.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)