5 Small-Growth Stock Picks From Neuberger Berman’s Genesis Fund

The managers of this top-performing fund highlight their favorite holdings.

Finding long-term winners among small-growth stocks is tricky. With highly focused businesses, it’s easy for hot names to flame out.

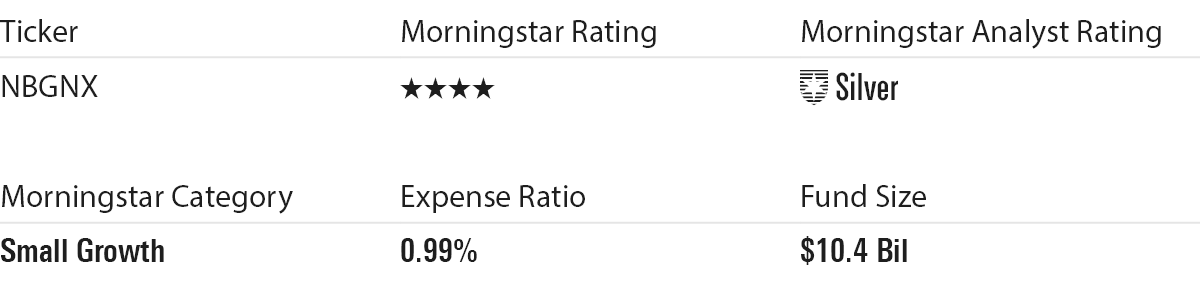

For the managers of Neuberger Berman’s top-performing $10.4 billion Genesis fund NBGNX, that means emphasizing stocks from companies that not only are growing fast but also have solid finances and strong competitive edges. “We’re looking for high-quality businesses,” says Greg Spiegel, one of Genesis’ four portfolio managers.

Among the stocks that these managers say reflect this approach:

A Strong Strategy for Down Markets

Neuberger Berman Genesis Fund Key Stats

Neuberger Berman Genesis has been in the top 20% of the small-growth fund category for the past five years, with an average annual return of 9.1%. For the last three years, the fund has ranked in the 30th percentile, while for the past decade, it’s placed in the 35% percentile.

“This strategy has often looked its best amid market declines,” writes Morningstar analyst Paul Ruppe. “During the global equity market selloff that began in late 2021, its focus on profitable, high-quality companies whose shares trade at modest multiples of their earnings has once again helped it curb losses.” The fund lost just shy of 20% in 2022. While a meaningful loss, it was still far better than the 27.8% average decline for small growth funds.

Downside protection often comes at the expense of returns when markets move higher. But Genesis has also kept up with its small-growth peers during market rallies according to Morningstar’s upside capture ratio, which measures a strategy’s performance in up markets relative to an index. While the average small growth fund has captured 77% of its target benchmark’s performance, Genesis has captured 79%.

Genesis’ Growth Stock Strategy

Behind these returns is a 12-person team that includes four portfolio managers and five analysts. Along with Spiegel, the fund is run by Robert D’Alelio, Brett Reiner, and Judy Vale. (Vale is stepping down from day-to-day management duties in January 2024.)

Spiegel says the team looks for companies “with sustainable and ample free cash flow, [that] have very strong balance sheets, and [which] tend to generate very high returns on assets.” Their process of identifying these stocks takes 10 years of financial history into consideration.

“We want to see how the business performed in different economic environments—a good economy, a tougher economy,” says Spiegel. That includes assessing a company’s cash-generating capabilities in a downturn to see whether margins hold up under pressure, as well as what happens to the balance sheet. In addition, “we really want to look at the quality of the earnings. We want to understand how they’re generating cash flow, and almost equally important is how they’re going to spend it.”

To understand whether the management of a company is committed to maintaining these attractive attributes, Reiner says the team turns to corporate proxy information that spells out executive short- and long-term compensation. “As the old saying goes, ‘Show me the incentive, and I’ll show you the behavior,’” he explains.

With an expectation of holding stocks in the portfolio of anywhere from seven to 10 years, that also means seeking out companies with the competitive advantages needed to defend their market positions. The result is a portfolio of about 110 stocks, with a top 10 usually populated only with names the fund has held for several years. “We want to live with them,” says Reiner.

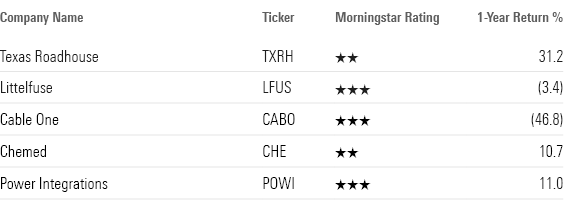

We asked Spiegel and Reiner to talk through the team’s investment theses for five of these stocks. There are two that have done well in the past year, one that has struggled, and two more of their choosing.

5 Stocks from Neuberger Berman Genesis Fund

Two stocks that have been recent winners for Neuberger Berman Genesis:

Texas Roadhouse

Genesis first added shares of this casual dining restaurant chain to its portfolio in 2013. “For many years, [Texas Roadhouse has shown] consistent same-store sales growth and good profit growth,” says Reiner.

Reiner says Texas Roadhouse, which operates 709 restaurants in 49 states and ten countries, distinguishes itself from other chains in part by the incentives it gives store managers. “The store manager doesn’t just get a salary, but also a percentage of the restaurant profits. So it’s aligned with company-wide incentives and shareholder incentives,” Reiner says.

A second factor is the company’s focus on being a consumer value proposition and avoiding raising prices unless it’s absolutely needed to cover costs. “Almost all of the total shareholder return or the income growth comes from sales growth, even though they could have grown margins over time at a much quicker rate [by raising prices]. They always put it back on the plate and into the consumer’s pocket, while you go to some restaurants and say, ‘That steak used to be bigger!’”

Littelfuse

The fund’s 12th-largest holding at the end of June was this Chicago-based maker of fuses, sensors, and circuit protectors. Its markets include industrial clients and auto electronics.

“The beauty here is that the thing they’re selling represents a very small cost of the overall bill of goods, but has a huge cost of failure,” said Spiegel. “You could have a circuit that either doesn’t work in an automobile or could blow up, and which costs something like 25 cents. This has created a barrier around their business and enabled them to have very sticky long-term customers.”

Littelfuse has posted organic growth in mid-single-digit percentages, deploying excess cash flow to acquire other companies in and around their core products. In addition, the company has been buying back stocks and paying out a dividend. Genesis first bought Littelfuse in 2012.

A stock that hasn’t worked:

Cable One

Genesis first bought broadband provider Cable One, which primarily services smaller rural communities, in 2017. “The company has enjoyed a strong competitive position in the markets in which they operate,” says Spiegel. “They’ve invested heavily in their network, offering amongst the most robust service in terms of capacity and bandwidth availability. And so growth tends to be driven by a combination of expanding footprint as well as getting customers up to higher tiers of speed and capacity.” Historically, “Cable One has been able to drive high-single-digit percentage organic growth and generate operating leverage, and that’s translated to mid-teens earnings growth,” he says.

However, Cable One shares have been cut nearly in half over the past 12 months. The primary concern about the stock is the potential for increased competition from wireless companies offering a 5G or a fixed-wireless option in some of the company’s markets, Spiegel says. Thus far, he says that fear has not turned into subscriber losses, but the concerns have still put a lid on the entire industry’s stock price potential.

Still, Spiegel says that “the fundamentals of the business are pretty good … In terms of the company’s actual performance, they’ve been delivering. You would peg the stock’s underperformance more on the overhang for the overall industry.”

Two more stocks from Neuberger Berman Genesis:

Chemed

Cincinnati-based Chemed has a split focus between two highly differentiated businesses: hospice care and plumbing. “The similarity between the two is rooted in what we look for in terms of our investment philosophy,” says Reiner. “In both cases … they’re the largest player in what I would consider boring franchises. But with boring comes consistency, particularly when you scale continuously over time.”

Vitas Healthcare operates in 14 states, providing at-home end-of-life care. That includes Florida, where Reiner says they’re the dominant player. Meanwhile, a high percentage of Vitas’ competitors are nonprofits, “and these players tend to be very inefficient and not terribly business-oriented.” At the same time, hospice is generally covered by Medicare. While it’s risky on the pricing side, government support acts “as an umbrella” for hospice providers.

Chemed’s other business is plumbing specialists Roto-Rooter. “They are, again, a scale player in a very fragmented industry” that is able to use technology to bring in customers that traditional plumbing companies can’t, Reiner says. “They gain share every year, and it’s a recession-resistant business,” he says.

Power Integrations

Recently the sixth-largest holding in the fund, Power Integrations is an analog semiconductor manufacturer that is the leading provider of power conversion chips. “It’s a pretty niche area in power conversion, and power conversion is all they do,” says Spiegel.

Their products “are used in basically anything and everything you can think of that has a power supply,” Spiegel explains. This includes appliances, industrial equipment, and increasingly autos.

“They have brought innovation over time, they have a very strong balance sheet, and during downturns, they invest in research and development and take market share from competitors that are pulling back,” Spiegel says.

In a story similar to Littelfuse’s, Power Integrations’ chips cost relatively little compared with the overall cost of the products they are put to work with. “That creates a natural barrier” to competition, Spiegel says. “If they are selling something that is a very low cost to the ultimate good and it works, there is no reason to switch it out” for a competitor’s product.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AURS6DE625BH5LIGZZMZSHOUGY.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-24-2024/t_02e621614b3b42078e17000bf20c9bf2_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)