3 Stock Strategists and 3 Scenarios for the Stock Market in 2023

Are we in a new bull market, stuck in the bear market, or going sideways?

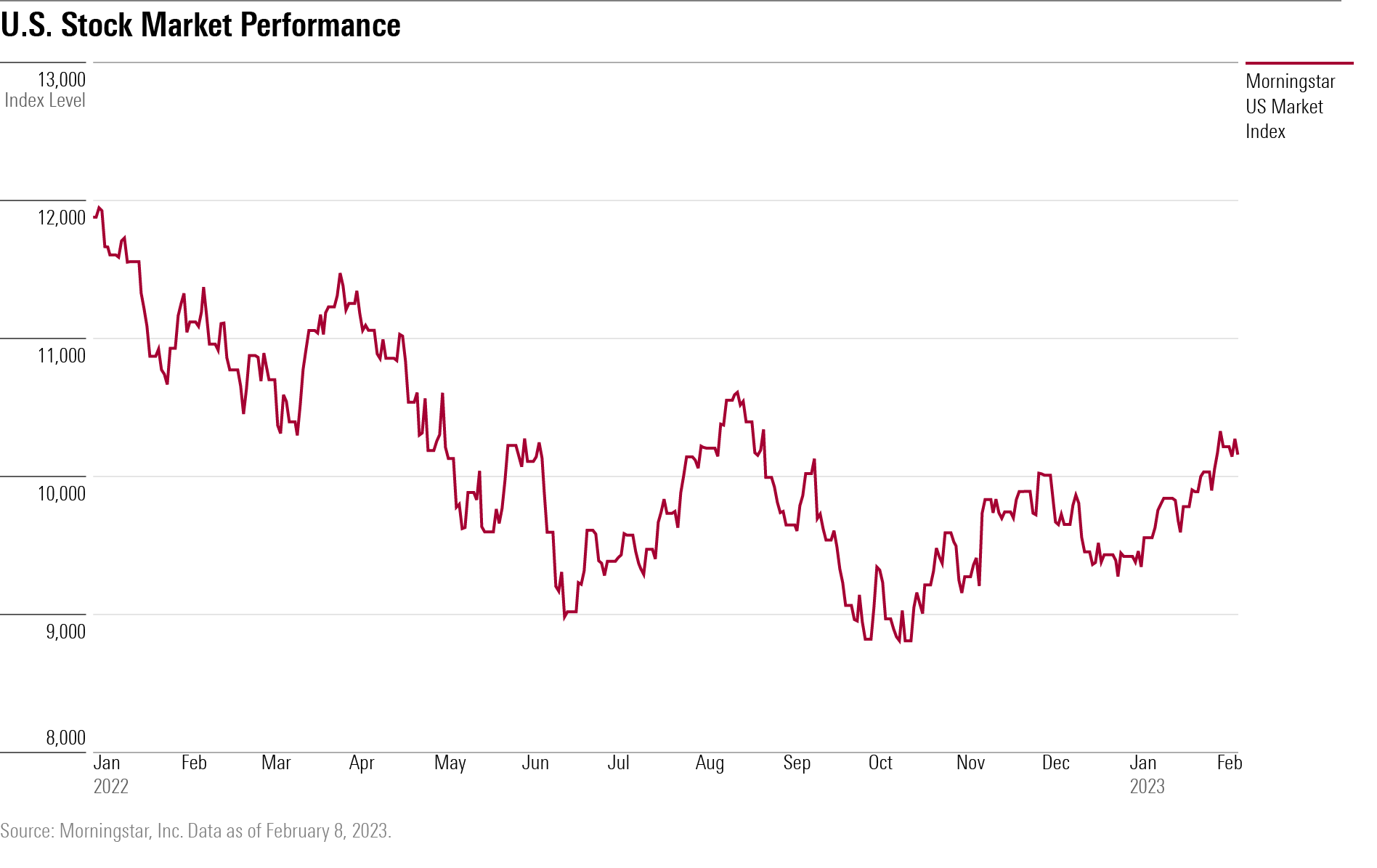

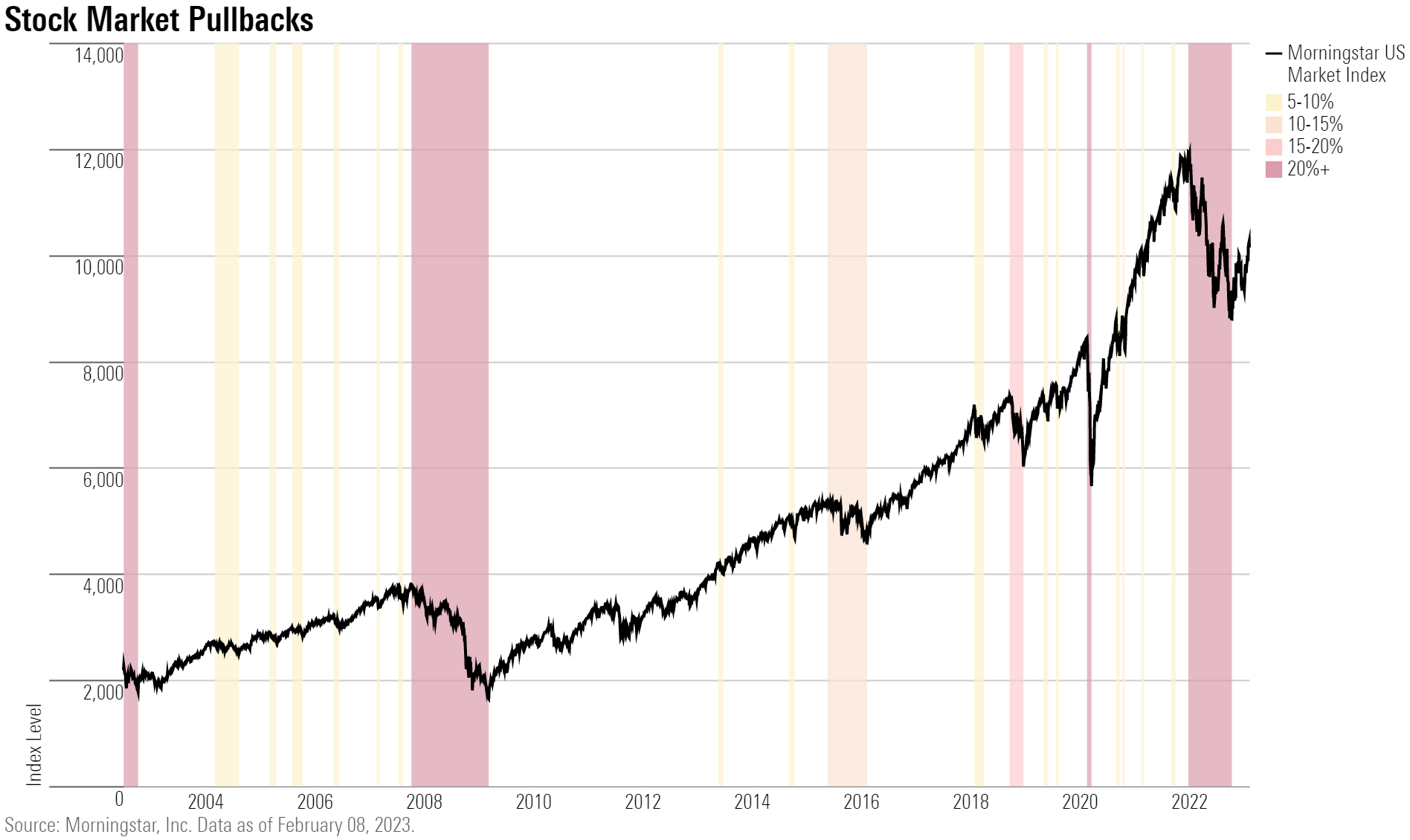

After a bruising 2022 in which major stock indexes posted their worst performances since 2008, stocks are off to a strong start this year.

The Morningstar US Market Index is up 7.84% so far in 2023, with 6.7% of that gain coming in January, which marked the best monthly start to the year in four years.

Whether the strong run is a harbinger of what’s to come or proves to be another bear-market rally is up for debate, with arguments on both sides. The major dividing lines: whether the U.S. economy can avoid recession; whether the Federal Reserve keeps rates higher for longer, pauses, or even eases; and the outlook for corporate earnings.

For the bull case, the bear case, and the case for a stock market that ends up flat by year-end, we took the pulse of three Wall Street strategists.

The Bullish Case for Stocks

Ed Yardeni, the president of Yardeni Research, a provider of global investment research and strategic analysis, sees the stock market rallying 10% to 15% from current levels.

“We believe that the rally since Oct. 12 is the real McCoy, the start of a new bull market instead of just a rally within a bear market,” Yardeni says.

Central to his optimistic outlook is the U.S. economy avoiding recession and instead making a “soft landing” in 2023. He forecasts zero to 1.5% in real—adjusted for inflation—gross domestic product growth. That would follow GDP growth of 2.1% in 2022, when GDP increased 3.2% in the third quarter and 2.9% in the fourth quarter, offsetting a weaker first half.

He acknowledges his sanguine outlook is a minority view but contends that for much of the past year different segments of the economy have been in a “rolling recession,” a dynamic that results in slow growth but keeps a full-blown recession at bay. Some evidence of the rolling recession: Housing and retailing are two industries that have experienced severe downturns without dragging down the rest of the economy. They benefited mightily during the coronavirus pandemic years but saw their fortunes change as the Federal Reserve began to raise rates. The auto industry has also struggled, never fully recovering from plant shutdowns and supply shortages during the pandemic, and now faced with consumers coping with higher finance rates.

Despite the tougher conditions confronting technology companies and their headline-grabbing layoffs, “Tech companies are not in danger of going out of business—they’re just improving margins,” by cutting staff levels that ballooned during the pandemic, says Yardeni.

Yardeni notes, too, that consumers continue to spend, particularly in the services sector. “Watching the consumer, it’s perverse to see all this pessimism,” he says.

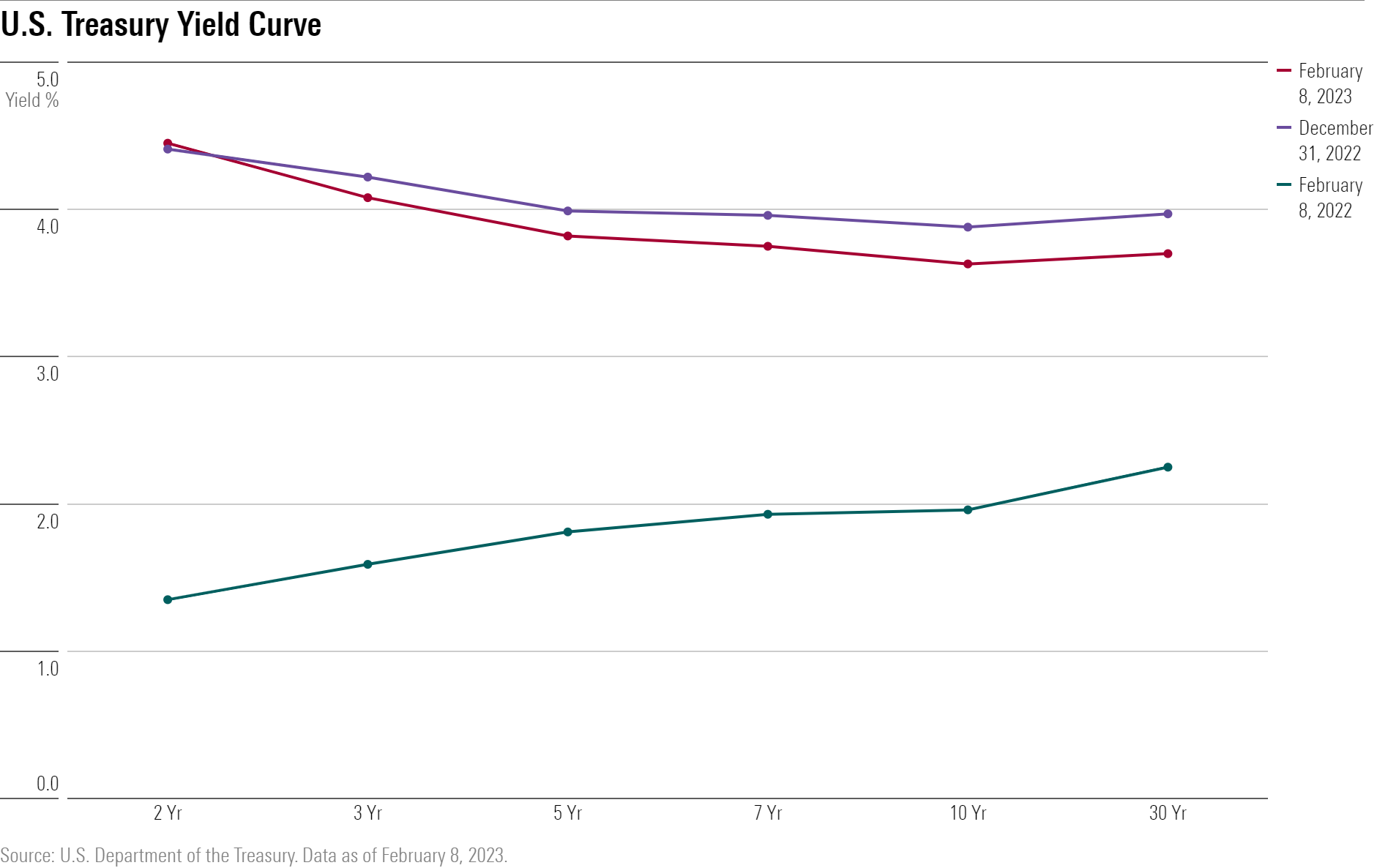

Yardeni says he isn’t concerned about one widely watched recession signal: the inverted Treasury yield curve. For much of the past year, short-term bond yields have been substantially above long-term yields as the Fed has hiked rates at the fastest pace in decades, indicating the potential for an economic slowdown.

The inverted yield curve has “historically predicted a process that led to recession,” as the Fed has essentially created a credit crunch in the economy. But this time around, “I don’t think we’re going to get a credit crunch even if the Fed raises rates by another 50 basis points,” says Yardeni.

The Fed has raised the federal-funds rate from zero at the start of 2022 to its current target of 4.5%-4.75%. Bond futures markets suggest the Fed is expected to raise interest rates another half a percentage point by May.

Another pair of positives for the market in Yardeni’s eyes is that the serious recessions predicted for the eurozone and China have yet to materialize, though their economies have slowed considerably. Domestic and global economies are showing resilience, he says.

Indeed, despite the serious headwinds of war and inflation, the eurozone economy expanded slightly in the fourth quarter, by 0.1%, as milder weather and government subsidies blunted the effect of high energy prices, according to Eurostat, the statistical office of the European Union.

The eurozone economy showed growth in every quarter in 2022 and grew at a 3.5% rate for the year. Importantly, too, eurozone inflation fell to 8.5% in January for the third straight month, down from a peak of 10.6% in October.

Meanwhile, China’s President Xi Jinping said in January that the world’s second-largest economy grew at a 4.4% pace in 2022, better than expected but below the government’s target of 5.5%.

Yardeni forecasts $225 in earnings per share on the S&P 500 this year, just above the mean estimate of $224 for this year, according to FactSet, and up 3% from the $219 per share the consensus sees for 2022. Yardeni recommends overweighting energy, financials, industrials, and materials in 2023, and maintaining market weights in information technology and healthcare.

The Go-Nowhere Stock Market

While investors often fixate on whether the stocks are in a bull market or a bear market, there’s also the possibility that the market will, over the course of the year, bounce back and forth and end up not far from where it started.

Candice Tse, global head of strategic advisory solutions at Goldman Sachs Asset Management, sees that outlook as a likely scenario as the economy avoids recession but earnings growth is flat.

“The Fed can still maneuver a soft landing,” Tse says. Based on that outlook but expecting zero percent growth in earnings from her $224 per share estimate for 2022, Tse sees the S&P 500 ending the year down roughly 3% from the current index level of 4,117. In the best case, the S&P 500 ends the year up 3%.

But, from here to there, “it’s going to be an interesting ride,” she notes.

Tse puts the probability of a recession at 25% compared with the Wall Street consensus of 65%. Should a recession occur, that would change her outlook, she says, and stocks could slide more than 20%.

The Fed is likely to continue to raise its fed-funds rate by an additional 0.25% at each of its March and May meetings to a level of 5%-5.25% before pausing. “We’re not anticipating a quick pivot,” she explains.

The risks to her outlook: the ongoing Russian war against Ukraine, escalating tensions between the U.S. and China, stalled action on lifting the U.S. budget debt limits, and inflation staying “higher for longer.”

“There will be a lot of volatility,” says Tse. “But volatility also brings opportunity.”

While financial conditions of the last decade or more favored U.S. equities and growth over value, especially large technology companies, today’s environment of decelerating growth, rising rates, and narrowing profit margins puts the spotlight on non-U.S. equities, as well as U.S. fixed-income assets, U.S. dividend-paying stocks, and alternatives.

In particular, Tse sees Europe as increasingly attractive.

“We are warming up to Europe,” she says, noting a spate of positive developments that include “energy green shoots” stemming from milder-than-expected winter weather which has lowered demand and pricing. “Recession risk has significantly diminished in Europe.”

Europe will also be a big beneficiary of China’s reopening as the Asia-Pacific region accounts for 21% of revenue at European companies. A weaker dollar will also have a positive impact.

Tse also sees valuations working in favor of European stocks. While they typically trade at a discount to U.S. equities, the 28% gap that currently exists is significant, she says.

The Bearish Case for Stocks

The stock market will get worse before it gets better, says Keith Parker, head of U.S. equity strategy research at UBS. The UBS view is that there will be a recession beginning in the second quarter that lasts through the end of the year. “In that scenario, equities have lower to go from here through midyear.”

Parker sees the possibility of a 10%-15% decline from current levels.

He’s concerned that investors are misreading market dynamics and notes the “significant disconnect” between investor enthusiasm for stocks and the underlying economic data. And that has led to a mispricing of risk for U.S. equities.

According to Parker, the surge in the market has been driven by easing financial conditions as the 10-year Treasury yield has fallen to 3.4%, nearly a full percentage point lower than the October high. In addition, the inflation rate has fallen “more and quicker” than anticipated. Employment data has been strong, suggesting the consumer can remain resilient, leading to fewer worries about consumer spending. China’s reopening and Europe’s ability to sidestep a recession have “removed the worst-case scenario and helped buoy markets,” says Parker.

What investors are ignoring, he says, is the huge drop-off and deterioration in key economic data, including a sharp decline in the ISM Services Purchasing Managers Index in December to 49.6 compared with 56.5 in November and below-market forecasts of 55. It marked the first contraction in the services sector since May 2020 amid COVID-19 lockdowns.

Parker also notes that retail sales were negative in December and posted the biggest monthly decline of the year during the key holiday shopping season.

“This typically happens ahead of recessions, and yet the market isn’t pricing in recession,” he says. “The setup is essentially a race between easing inflation and financial conditions, versus the coming hit to growth and earnings. History shows that earnings growth continues to deteriorate into market troughs before financial conditions ease materially.”

At current levels, the market is trading at more than 18 times 2023 earnings estimates and nearly 17 times forward 2024 earnings, even as earnings estimates are being lowered and downgrades are increasing. At market bottoms in the recessions of 2002, 2018, and 2020, the multiple fell to 14.5 times earnings.

Parker expects cuts to earnings to be meaningful. Fading sales growth, margin compression, labor cost growth, and weaker productivity will lead to lower earnings.

His estimate on S&P 500 earnings is $198 in 2023, an 11% decline from his 2022 estimate of $223. For 2024, he sees a rebound to $215, an 8.6% gain but still below the consensus view of $249 per share.

“The sooner a recession is priced, the sooner equities recover,” he says.

UBS, he says, expects the Fed to ease in the second half as payroll growth deteriorates and inflation softens.

In this environment, Parker favors quality growth companies in communication services and technology, and defensive sectors such as healthcare and (to a minor extent) consumer staples. He suggests underweighting materials, industrials, and financials.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AURS6DE625BH5LIGZZMZSHOUGY.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-24-2024/t_02e621614b3b42078e17000bf20c9bf2_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)