14 Top-Performing Large-Blend Funds

S&P 500 funds, along with offerings from Fidelity and Vanguard, are among the group’s best performers.

Large-blend stock funds are among the most important building blocks for a diversified portfolio. Investors have increasingly turned to passively managed S&P 500 index funds when putting money to work in large-blend investments, but a few actively managed funds also land among the top performers.

This shift into index-tracking funds for core stock market exposure has paid off for investors. S&P 500 funds rank among the best performers in the large blend Morningstar Category over the last five years. But funds from JPMorgan, Columbia, and Natixis also have posted peer-beating returns.

While investors in large-blend funds saw significant losses in 2022, the category average came out ahead of the overall stock market. The Morningstar US Market Index lost 19.4%, while the average large-blend fund lost just 17.0%. Since the beginning of 2023, the overall stock market has gained 13.5% and the category average has gained 11.0%. Thanks to the gains posted in 2023, the category average gained 10.7% for the 12 months ended June 12, 2023, while the US Market Index rose 12.5%.

In 2023, funds at the top of the large blend category have gotten a substantial lift from Apple AAPL, Amazon.com AMZN, Microsoft MSFT, and Tesla TSLA. Apple, Amazon, Microsoft, Alphabet GOOGL, and Nvidia NVDA are the five largest stocks in the U.S. market, accounting for 78% of this year’s returns in the Morningstar US Market Index.

Large-Blend Funds vs. the U.S. Stock Market

What Are Large-Blend Stock Funds?

Holdings in large-blend funds and exchange-traded funds are fairly representative of the overall U.S. stock market in terms of size, growth rates, and price. Large-cap stocks are companies in the top 70% of the capitalization of the U.S. equity market. The blend style is assigned to portfolios where the stocks are a mix of value and growth names.

These portfolios tend to invest across a spectrum of industries. Owing to their broad exposure, their returns are often similar to those of the S&P 500 index. Given the cost advantage of investing in index funds, many investors opt for passively managed funds that simply track the S&P 500 as a way to add exposure to the large blends in their portfolios.

14 Top-Performing Large-Blend Stock Funds

To find the best-performing large-blend stock funds, we looked for those that have posted top returns across multiple time periods.

First, we screened for funds that ranked in the top 33% of the category over the trailing one-, three-, and five-year time frames using their lowest-cost share classes. Then we screened for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets.

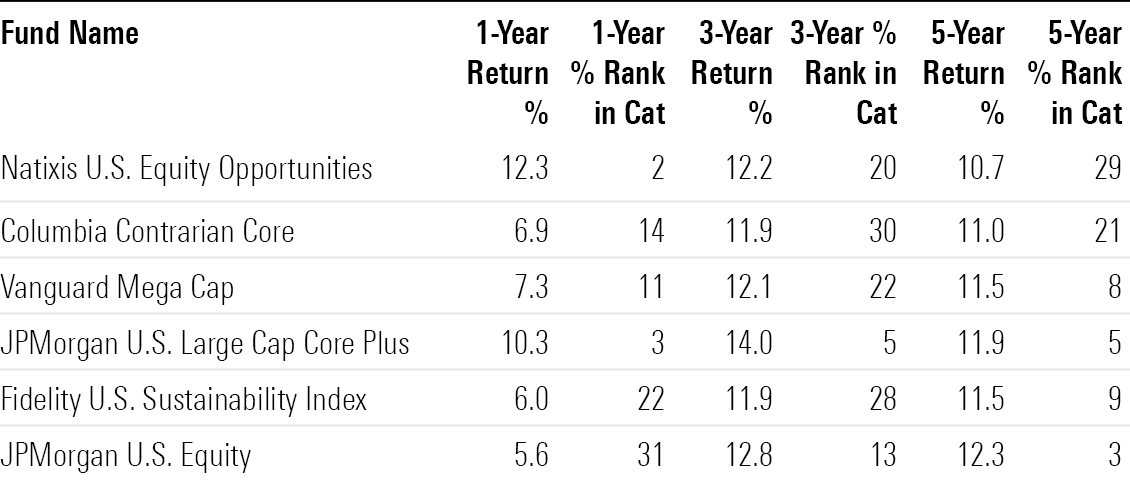

From this screen, we’ve highlighted the 14 funds with the best year-to-date performance. The group includes four active funds and 10 index-tracking funds, eight of which track the S&P 500. Because those S&P 500 funds have the same strategy, we’ve highlighted those funds in a separate table.

Top-Performing Large-Blend Funds

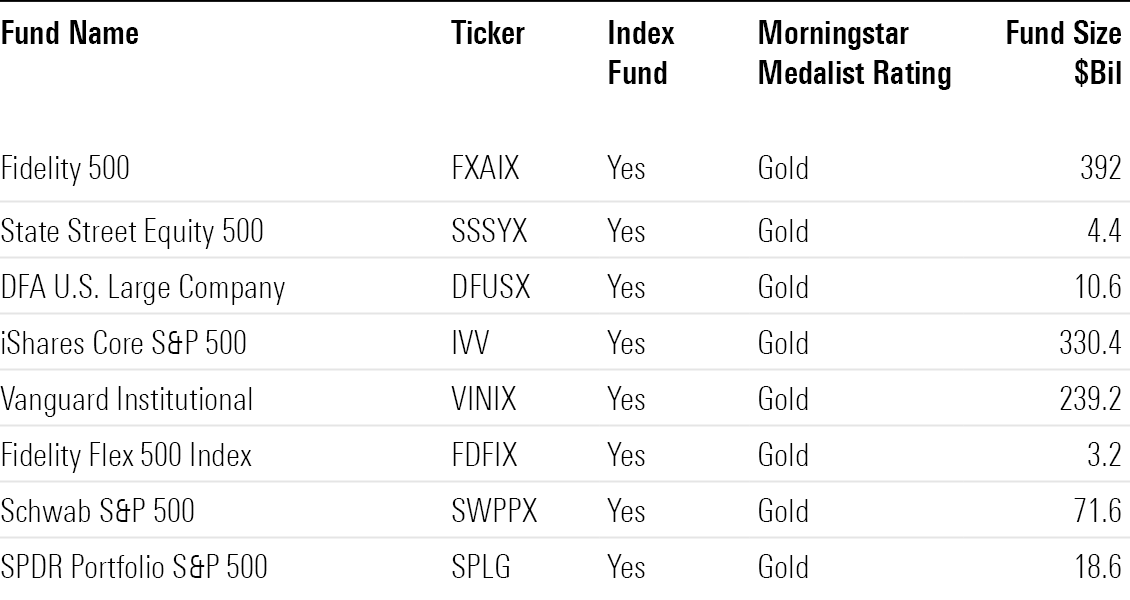

Large-Blend Stock Funds That Track the S&P 500

These are the top-performing large-value funds that track the S&P 500 index, which on average has gained 12.4% in 2023 so far.

Top-Performing S&P 500 Tracking Large-Blend Funds

Top-Performing Large Blend Funds

Natixis U.S. Equity Opportunities

- Ticker: NESYX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

“Harris Associates seeks undervalued stocks with an open mind. Analysts scrutinize firms’ management teams and paths to value creation. They sensibly tailor their valuation models, using (among other tools) sum-of-the-parts analyses, merger-and-acquisition activity, and prospective cash flows to assess companies’ worth.

“In August 2021, with the Harris sleeve leaning more toward value stocks, Morningstar moved this strategy to the large-blend category. That should be a better fit, but the managers’ autonomy means there’s no guarantee the strategy will stay there. Even so, the strategy’s long-term record against its prospectus benchmark, the S&P 500, is competitive. The A shares’ 11.4% annualized return from March 2014 through April 2023 edged the index’s 11.3%.

“The portfolio usually has a moderate average market cap. It was $110 billion in March versus the index’s $146 billion. Not owning Apple but mixing in a few smaller companies has kept that number relatively low. The strategy also often has a few non-U.S. holdings. In March, that included the U.K.’s Willis Towers Watson WTW (a Harris pick) and Yum China YUMC (from Loomis, Sayles & Company).”

—Tony Thomas, associate director

Columbia Contrarian Core

- Ticker: CCCRX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 3 stars

“The portfolio often shines in downturns, such as in the pandemic-induced decline of early 2020 and in the year through November 2022. After the quick downturn in late 2018, Pope took advantage of discounts on stocks such as Lam Research LRCX, which went on to power outperformance over 89% of peers in 2019. Conversely, the strategy tends to lag in frothier markets, such as the first three quarters of 2018, most of 2020, and all of 2021.

“The strategy’s 33.0% return in 2019 beat the benchmark’s 31.4% as 2018′s fourth-quarter selloff increased market pessimism, which broadened Pope’s opportunity set. The strategy also fared well in the 2020 pandemic selloff, as Pope quickly moved out of affected firms like Aramark ARMK and SLB SLB. While painful, the fund’s 32.5% loss when large-cap stocks sold off from Feb. 20 to March 23 was less than the benchmark’s 34.6%. And in the trailing year through November, its 8.9% decline was better than the index’s 10.7% loss.”

—Drew Carter, analyst

Vanguard Mega Cap

- Ticker: MGC

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“Despite narrowly targeting mega-cap stocks, the fund is better diversified than its average peer in the large-blend category. The top 10 holdings make up 30% of the portfolio, which is 20 percentage points lower than the category average.

“The fund’s narrow focus on the biggest companies can affect its performance when smaller companies rally. During the first quarter of 2021, when smaller firms outperformed, the fund lagged both the category index and category average, which have greater exposure to smaller stocks.

“For the year to date through March 2023, the ETF share class outperformed the category average by 2.74 percentage points, driven mainly by the rebound of tech stocks. Names like Apple and Meta Platforms META bolstered the portfolio.

“The portfolio’s slight quality tilt can provide a performance edge in volatile markets. During the abrupt pandemic-driven drawdown, the fund held up better than its average peer by 1 percentage point. The fund’s heavier stakes in tech and healthcare stocks buoyed its performance.”

—Mo’ath Almahasneh, associate analyst

JPMorgan U.S. Large Cap Core Plus

- Ticker: JCPRX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

“The strategy looks sensible and is designed to fully exploit the analyst recommendations by taking long positions in top-ranked companies while shorting stocks disliked by the analysts. Classic fundamental bottom-up research should give the fund an informational advantage. The portfolio is quite diversified, holding 250-350 stocks in total, with modest deviations from the category index in the long leg, which has become more focused over the 12 months ending December 2022.

“Thanks to effective stock selection, the vehicles have been able to generate a positive alpha versus the Russell 1000 Morningstar Category Index. Stock picking was exceptionally strong during the pandemic period, both in the long leg of the portfolio and in the 30/30 extension. In 2020, the security selection within semiconductors and hardware proved to be very effective, but the team’s stock picks also added value within financials. On the stock level, the overweight positions in PayPal Holdings PYPL, Amazon, and Morgan Stanley boosted returns. In 2021, positions in semiconductors, banks, and energy drove performance. Diamondback Energy FANG and Alphabet were key contributors that year. The macro-influenced 2022 proved more challenging for the strategy. Positive sector allocation largely compensated for weaker stock selection results.”

—Jeffrey Schumacher, associate director

Fidelity U.S. Sustainability

- Ticker: FITLX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“The fund tracks the MSCI USA ESG Leaders Index, which targets large- and mid-cap U.S. firms with strong ESG characteristics. After screening out firms involved in controversial businesses, the index ranks companies relative to their sector peers using MSCI’s ESG metrics.

“While it inherited much of this outperformance from the broad portfolio of its parent index, the fund’s ESG tilts were also rewarded since its inception through March 2023. Its tech overweighting and energy underweighting worked well in the growth-favored market of the past few years. The fund also piled into major winners such as Tesla and Alphabet, which led the market rallies in 2020 and late 2021. However, the same allocations detracted from its performance in 2022 as market trends reversed.

“Many industry giants, which often receive large weights in broad-market ESG-agnostic indexes, do not rank high enough in MSCI’s ESG metrics and are consequently excluded. Noticeably absent from this portfolio are major market leaders such as Apple, Amazon, and Berkshire Hathaway BRK.B.”

—Lan Anh Tran, analyst

JPMorgan U.S. Equity

- Ticker: JUSRX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“Stock selection, as opposed to sector or industry allocation, has been the key driver of the fund’s excess returns. Top picks over manager Scott Davis’ tenure include industrial real estate investment trust Prologis PLD, UnitedHealth Group UNH, and Tesla.

“This portfolio finds a balance between differentiation and careful risk management. The U.S. mutual fund held 52 stocks in September 2022, significantly less than the 140-180 it previously had under three independently managed sleeves. However, Davis’ desire to let stock selection drive results leads to only moderate sector bets relative to its S&P 500 benchmark. Davis also considers factor exposure when building the portfolio. For instance, he increased the portfolio’s stake in financial companies toward the end of 2020 to bolster its exposure to cheaper, more cyclical stocks and help offset its lack of exposure to the energy sector.

“The strategy’s edge versus its benchmark is slim, but it has handily outpaced most peers. As of November, it landed in the top decile of large-cap blend category rivals over the trailing three-, five-, and 10-year periods. It has been a touch more volatile, but not enough to spoil its advantage. Its Sharpe ratio, a measure of risk-adjusted return, has tended to exceed that of its average rival.”

—Adam Sabban, senior analyst

Long-Term Results of Top-Performing Large-Blend Funds

Long-Term Results of Top-Performing S&P 500-Tracking Large-Blend Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KVRQ726W7RFHLPM2IY7EGD7SQU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)