How plan sponsors can help investors avoid the cost of naive diversification.

By Ray Sin and Samantha Lamas

Retirement

By Ray Sin and Samantha Lamas

Read Time: 2 Minutes

“Don’t put all your eggs in one basket” has particular significance when it comes to investing.

Investors are typically taught the importance of diversification and its power to reduce risk and enhance overall portfolio performance. Recent research [PDF] has even found that there may be benefits to even naive diversification. In all, recent work seems to support diversification in any sense or form.

But these findings may not incorporate a very important aspect of investing: the cost of fees. In our research, we found that suboptimal diversification can backfire.

We conducted an experiment to understand the impact of offering individuals multiple S&P 500 exchange-traded index funds that are essentially indistinguishable in terms of performance and holdings but charge vastly different fees. We found that many participants still invested in the more-expensive funds to some extent, even when nearly identical low-cost index funds were available. But when participants could choose only one ETF to allocate all their money to, significantly more of them chose the cheapest option.

Our research points to naive diversification as the culprit of this investing mistake.

The logical response to these findings—and most experimental research—is that, in the ”real world,” investors aren’t usually asked to choose between similar index funds. Our research suggests, however, that this situation may be much more common than imagined.

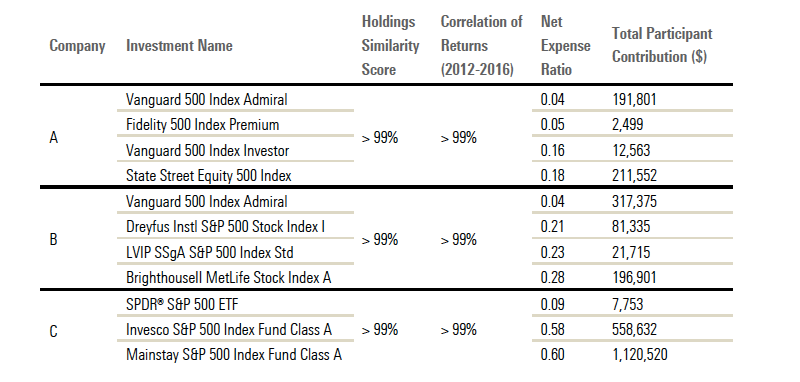

We examined a dataset of 2016 retirement plans and their lineups drawn from RightPond to identify plans that have two or more indistinguishable S&P 500 index funds with disparate costs—a choice environment that is identical to our experiment—and we found quite a few.

Here are a couple of examples:

Source: Morningstar Direct℠, RightPond, and Authors’ Analysis

Some plans even had as many as three similar funds with a wide range of expense ratios.

As the data shows, participants in these plans actually contributed a substantial amount of money to the most expensive options. While our data doesn’t show how individual plan participants allocated their money, the aggregate patterns suggest that they seem to be investing in a haphazard way and may be using techniques such as naive diversification.

Preventing the use of naive diversification may be close to impossible. Instead, plan sponsors can work with this tendency by curating plan lineups.

Although recent studies have pointed to some benefits of naive diversification, its effect on investors still depends on the choice environment. Our findings suggest that if a client is presented with similar index funds with wide fee dispersions, their tendency to naively diversify could be extremely expensive. In these situations, plan sponsors can help investors by curating their environment in a way that minimizes these costs.

We know most employees need help saving for retirement. Find out how our service can help your workforce reach their retirement goals.