Sustainable Funds Universe Continues to Expand

The third quarter saw more funds reach viability, and more choice in emerging-markets equity and fixed income.

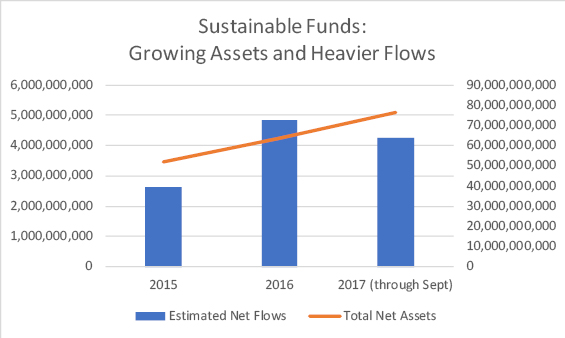

The universe of sustainable funds in the United States continued to grow in the third quarter, with five new fund launches and positive estimated net flows that keep the group on track for a record year of attracting new assets.

I define this universe as funds that, by prospectus, state that they incorporate environmental, social, and governance criteria into their investment process or indicate that they pursue a sustainability-related theme or seek measurable sustainable impact alongside financial return.

This definition excludes funds that only use values-based exclusionary screening that is not related to sustainability issues. In other words, if a fund only excludes so-called "sin stocks," it would not be included. If a fund excludes companies based on a set of religious values but these are not related to ESG criteria, it would not be included. That leaves about 200 open-end funds and exchange-traded funds in the U.S.

- source: Morningstar

The group grew by nine in the third quarter. Four of those are existing international funds from RBC that added ESG criteria to their prospectuses, something seen with increasing frequency recently. Of note in that group is RBC Emerging Markets Equity REEAX, which has a Morningstar Rating of 5 stars, a Morningstar Sustainability Rating of 5 globes, below-average Morningstar Risk relative to the diversified emerging-markets Morningstar Category, and low fees.

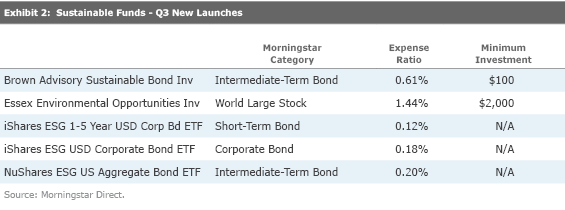

The other five additions are new launches, and four of them are bond funds. The lone equity fund is Essex Environmental Opportunities EEOFX, which is based on an institutional separate-account strategy that has been in place since 2009. The strategy focuses on sustainability themes like renewable energy, clean-water technologies, smart city infrastructure, and new transportation.

The bond funds include three ETFs and an actively managed open-end fund, Brown Advisory Sustainable Bond BASBX. Like the Essex fund, this one is based on an institutional separate-account strategy, which was launched in 2014. It provides intermediate-bond exposure using ESG research to assess issuers and then evaluates bonds' use of proceeds for positive environmental or social impact.

Most notable among the new bond ETFs is NuShares ESG US Aggregate Bond ETF NUBD, which is the first passive ESG fixed-income ETF to provide broad intermediate-bond exposure. It is based on the Bloomberg Barclays U.S. Aggregate Bond Index but eliminates issuers enmeshed in ESG-related controversies or selling controversial products. Corporate issuers must have an MSCI ESG Research rating of BBB or higher (on a scale ranging from CCC to AAA), and issuers in sectors with high levels of fossil fuel reserve ownership are excluded. This ETF joins seven NuShares equity ESG ETFs launched in the past year that can be used as building blocks for a diversified ESG portfolio. Although the NuShares ETFs still have tiny asset bases, they have a strong sponsor in Nuveen, whose parent, TIAA, has years of experience in sustainable investing, so I would expect the ETFs to grow to scale before long.

Speaking of TIAA and bond funds,

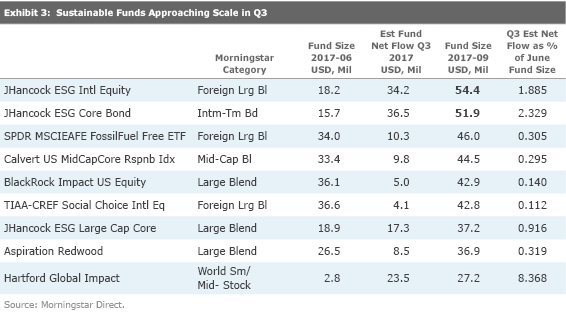

Because many sustainable funds are younger, with 90 of them still lacking three-year records, many also remain small, with asset bases less than the $50 million or so that is often the minimum for inclusion on brokerage platforms. Two John Hancock funds, subadvised by longtime sustainable investment managers, reached that asset threshold in the third quarter, and several others gained assets at a rate that suggests they will relatively soon, as the accompanying exhibit shows. JHancock ESG International Equity JTQAX, subadvised by Boston Common Asset Management, and JHancock ESG Core Bond JBOAX, subadvised by Breckinridge Capital Advisors, both had third-quarter estimated net flows that doubled their assets at the beginning of the quarter.

With continued new launches and flows remaining on pace for a record year, sustainable funds continued to gain traction in the third quarter, typically the slowest quarter for fund flows. There are more viable choices than ever for those interested in sustainable investing, and having more fixed-income and emerging-markets equity choices helps investors who want to build out their sustainable portfolios beyond core U.S. and developed-markets equity.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HRIVHHHVD5EKFATQH4SHWN44ZQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KCFABA6O6ZCQLGMQW2TLYFEREE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)