Should You Invest in a Currency-Hedged International-Equity ETF?

Currency-hedged ETFs have recently delivered category-topping performance, but moving in and out of these products may not be a sustainable strategy for long-term investors.

In the United States, most international-equity funds do not hedge their foreign-currency exposure. This long exposure to foreign currencies contributed to the performance of these funds in the past decade, as the U.S. dollar weakened against major currencies. More recently, currency movements have reversed, starting with a sharp decline of the yen over the past three years, and the more recent gradual decline of the euro versus the U.S. dollar. This trend is now weighing on the returns of currency-unhedged international-equity funds.

Not surprisingly, these currency movements have prompted strong flows into currency-hedged exchange-traded funds over the past two years. These index funds, offered from providers such as iShares, Deutsche Bank, and WisdomTree, are among the few international-equity funds that hedge the effects of foreign exchange movements on the returns of their portfolio. For U.S.-based investors, this strategy seems to make plenty of sense in a rising-U.S.-dollar environment. What are the pros and cons of investing in these types of products?

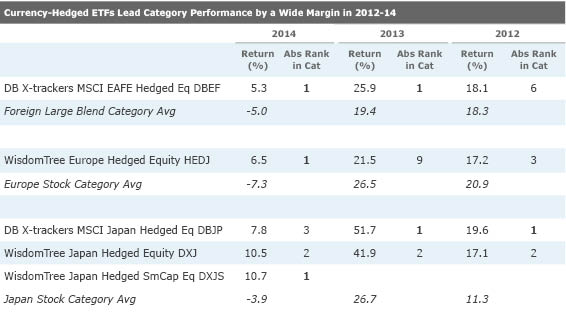

Reasons to Pursue a Currency-Hedged Strategy 1. At times, currency-hedged products can deliver category-topping performance. Because most international-equity funds do not hedge their foreign-currency exposure, currency-hedged funds will usually outperform during periods when developed-markets currencies are falling against the U.S. dollar. On average, foreign large-blend fund have large exposures in the euro (22%), the yen (15%), and the pound sterling (15%).

- source: Morningstar Direct

Thanks to the falling yen over the past three years, currency-hedged Japan equity funds have led performance in the Japan-stock Morningstar Category by a significant margin. Most notably, in 2013, DB X-trackers MSCI Japan Hedged DBJP returned 51.7%, crushing the category average of 26.7% (and the unhedged MSCI Japan Index’s return of 27.2%). A similar story played out in the European-stock category in 2014 (as the euro declined against the U.S. dollar), where

2. Hedging exposure to major currencies is fairly inexpensive. To illustrate this point, we compared the returns of a market-cap-weighted MSCI index denominated in local currency with its corresponding 100% Hedged to U.S. Dollar Index. These hedged indexes reflect the return that can be achieved by hedging the currency exposure of a market-cap-weighted index with one-month foreign-currency forward contracts, rebalanced monthly. Generally speaking, the execution costs related to these forward contracts are negligible, as these products are extremely liquid.

While forward contracts serve as a hedge, they also reflect the cost of hedging, which is the short-term interest-rate differential between two currencies. If short-term rates in a foreign currency are higher than they are in the U.S., the hedge will have a cost. But if the reverse is true, the hedge would result in a gain. It is this cost to hedge that drives the difference in performance between the returns of a 100% hedged index versus the returns of an index denominated in the local currency.

- source: MSCI

The MSCI EAFE Index is a market-cap-weighted index composed of large- and mid-cap stocks across 21 developed markets, excluding the U.S. and Canada. Over the past two years, the cost to hedge the MSCI EAFE’s foreign-currency exposure was 30 basis points a year, detracting from returns. But at times when short-term rates were lower in Japan, or Europe, than in the U.S., the hedge added to returns (represented by a negative number), which was observed over the past five and 10 years.

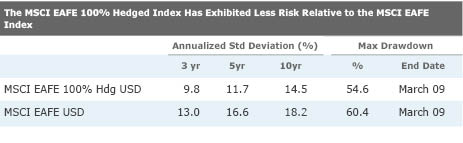

3. Hedging can reduce volatility. For a U.S.-based investor, a currency-hedged strategy can reduce the volatility of an international-equity portfolio. This may be partly attributable to the fact that the U.S. dollar is considered a safe haven currency and tends to rise when risk aversion is high. In other words, when volatility spikes in global markets, the performance of an unhedged international-equity fund can be negatively affected by both falling international-equity markets, as well as a rising U.S. dollar. During the 2008 global financial crisis, the unhedged MSCI EAFE Index had a maximum drawdown of 60.4%, whereas the hedged version declined by 54.6%.

- source: MSCI

Reasons to Not Pursue a Hedged Strategy 1. Knowing when to move in and out of a currency-hedged strategy requires an ability to forecast currency movements, which is not easy. Over the past few years, central banks in the U.S., Japan, and Europe have been fairly transparent about their monetary policies and their goals, so it hasn't been that difficult to predict the performance of the yen and euro against the U.S. dollar. However, central banks can suddenly change their mind—in January 2015, the Swiss National Bank surprised global markets when it decided to drop its exchange-rate cap, which sent the Swiss franc soaring.

2. There are also tax issues to consider. Moving in and out of hedged and unhedged strategies can result in capital gains. In addition, currency-hedged funds must distribute gains on derivative contracts (which includes currency forwards) to fundholders, which are taxed at a combination of long-term and short-term capital gains rates (60% long term and 40% short term). For the two largest currency-hedged ETFs, WisdomTree Japan Hedged Equity and WisdomTree Europe Hedged Equity, capital gains accounted for 8.5% and 2.0% of net asset value, respectively, in 2014.

3. Over the long term, the difference in returns from hedged and unhedged international developed equity strategies is not that significant. While it has been observed that the value of a currency can deviate from its fundamental value over the short term, over the long term, a nation's interest rate, inflation, growth, and current account balances generally drive currency values. This is consistent with the theory of purchasing power parity, which suggests that real exchange rates mean revert over long horizons. In the table below, the return gap between the hedged and the unhedged MSCI Index narrows as the observed time period expands. This suggests that for long-term investors, it is probably isn't necessary to pursue a currency-hedged international-equity strategy.

- source: MSCI

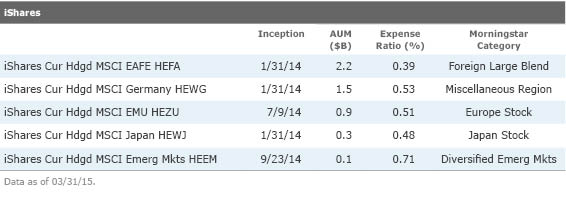

A Look at Currency-Hedged International-Equity Funds Options Below, we highlight both passively managed and actively managed international-equity funds that hedge their foreign-currency exposures. The ETF options carry expense ratios that are significantly lower than that of their category median.

Most of the funds below use currency forwards to hedge their foreign-currency exposures. While the use of these derivatives does introduce counter-party risk, this risk is limited, as the contracts cover only the movement of the foreign currency and not the entire value of the fund.

ETF Options iShares (Parent Rating: Netural) IShares launched five currency-hedged ETFs in 2014. These funds each hold an existing iShares ETF, along with currency-forward contracts to hedge the foreign-currency exposure back to the U.S. dollar. Through this structure, the iShares currency-hedged ETFs seek to track the MSCI 100% Hedged to U.S. Dollar Index.

- source: Morningstar Direct

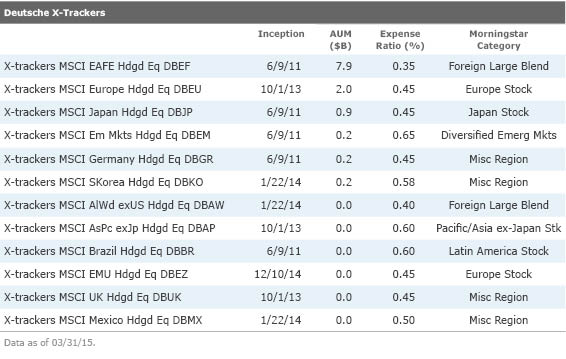

Deutsche X-trackers (Parent Rating: Neutral) Deutsche X-tracker currency-hedged ETFs also track MSCI 100% Hedged indexes. However, unlike the iShares suite, these funds hold the individual index constituents (whereas the iShares funds hold an iShares ETF which in turn holds index constituents). But aside from this structural difference, the Deutsche X-tracker funds are similar to the iShares funds in that they hedge by using one-month currency forwards, which reset monthly.

- source: Morningstar Direct

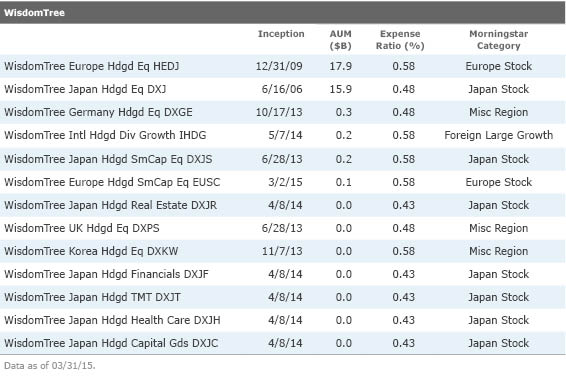

WisdomTree (Parent Rating: N/A) WisdomTree's flagship currency-hedged products, WisdomTree Japan Hedged Equity and WisdomTree Europe Hedged Equity ETFs, track (WisdomTree-designed) indexes that tilt toward exporters and dividend payers. This is different from the ETFs from Deutsche Bank and iShares, both of which track market-cap-weighted MSCI indexes. WisdomTree incorporates a dividend focus in DXJ's and HEDJ's indexes in an effort to tilt toward companies with better fundamentals. And by focusing on exporters, these indexes will tilt toward companies that may benefit from a weakening local currency. However, these tilts do not necessarily lead to outperformance. In 2012 and 2013, the market-cap-weighted Deutsche X-trackers MSCI Japan Hedged outperformed WisdomTree Japan Hedged Equity by a significant margin.

- source: Morningstar Direct

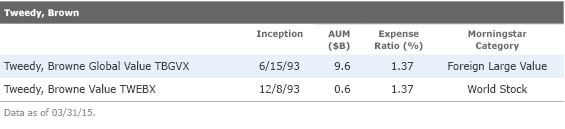

Actively Managed Options Tweedy, Browne (Parent Rating: Positive) Tweedy, Browne Global Value is the stalwart currency-hedged international-equity fund. This actively managed fund with a Morningstar Analyst Rating of Silver has a 20-plus year track record of generating higher returns with less volatility relative to category peers. Comanagers William Browne, John Spears, Bob Wyckoff, and Thomas Shrager focus on high-quality names with strong franchises and tend to hold positions for years, which results in a low-turnover portfolio. To mitigate volatility, the managers will hold cash when they can't find attractively priced stocks. Hedging the portfolio's foreign-currency exposure and generally avoiding emerging markets further reduces volatility. These four managers also run Silver-rated Tweedy, Browne Value, which employs a similar process and a currency hedge. The main difference between the Global Value and the Value funds is that the former has 9% allocation in U.S. stocks, whereas the latter has a 43% allocation.

- source: Morningstar Direct

Vanguard (Parent Rating: Positive) In December 2013, Vanguard launched Vanguard Global Minimum Volatility, an actively managed, global equity fund that combines a minimum volatility strategy with a currency hedge. Minimum volatility portfolios attempt to exhibit less price fluctuation over time when compared with their underlying market. The fund's managers, James Troyer, James Stetler, and Michael Roach, use quantitative models which incorporate historical volatility and correlations to create a minimum volatility portfolio of around 200 securities. The models have constraints to maintain country and sector diversification, and ensure liquidity. While these quant screens drive security selection and portfolio construction, the managers do have the discretion to tweak the portfolio to limit unnecessary turnover and adapt to the market environment. This fund has a mid-cap blend orientation. About 50% of the portfolio is in U.S. equities, with the remainder in foreign equities. Most of its foreign-currency exposure is hedged back to the U.S. dollar.

- source: Morningstar Direct

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)