The Perils of Funds That Narrowly Target High-Yielding Stocks

Putting too much emphasis on dividend yield can harm the total return of your equity income investment.

A version of this article appeared in the July 2017 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

It’s easy to understand the allure of dividend-paying stocks. Dividend payments can help investors manage behavioral issues such as their reluctance to realize capital gains to meet income needs, and may give them the fortitude to weather market volatility.

In the United States, dividend payments are usually stable because management teams are reluctant to cut them, as this may signal a loss of confidence in their company's prospects. Research also has shown that dividend payments contribute about half of U.S. equities' long-term returns.[1]

Dividend payments offer investors many benefits, but focusing narrowly on dividend yield can increase risk. This is akin to buying bonds based strictly on yield. As always, it is important to focus on an investment’s prospective total return, and not solely its yield, as higher yields usually imply greater risk.

For example, the highest-yielding stocks could be under financial distress and thus may be more likely to cut their dividend payments than their lower-yielding counterparts. Many high-yielding stocks pay out a large share of their earnings as dividends, leaving a small buffer to cushion these payments if their business deteriorates.

A high dividend yield looks attractive at first blush, but it’s also important to remember that dividend yield is a ratio – the dividend payment (numerator) divided by the stock price (denominator). A company’s dividend yield increases when the dividend payment (numerator) is unchanged, but its stock price (denominator) decreases. Here, I will walk through a couple of examples of high-yielding funds that have narrowly targeted dividend yield and paid the price.

Be Wary of Backward-Looking Metrics

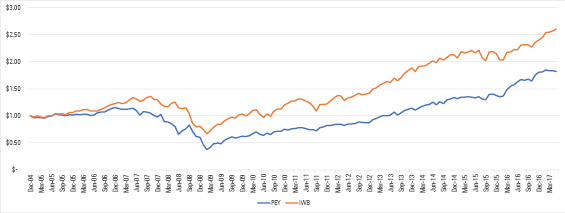

Exhibit 1. Growth of $1

- source: Morningstar Direct; analyst's calculations. Month-end returns from January 2005 through May 2017.

PEY attempts to mitigate risk by only selecting for those stocks that have raised their dividend payments for at least 10 consecutive years. But by relying on a backward-looking dividend sustainability metric and weighting its holdings by their yield, PEY has loaded up on some of the highest-yielding and riskiest stocks at the wrong time. For example, in the run-up to the financial crisis, bank stocks had amassed track records of increasing their dividend payments, so they passed PEY’s dividend sustainability screen. At the end of January 2008, PEY’s financial sector weighting measured 81% compared with the Russell 1000 Index’s 19% weighting. And by yield-weighting its holdings, PEY allocated the greatest proportion of its portfolio to the most distressed companies. As you can surmise, PEY suffered during the financial crisis. The fund cumulatively lost 71.4% from October 2007 through March 2009, compared with the Russell 1000 Index’s drawdown of 55.1%. PEY subsequently modified its methodology to cap sector weights at 25% in November 2013, but like its backward-looking dividend screen, hindsight is 20/20. Owing to these deficiencies in its index’s methodology, PEY carries a Morningstar Analyst Rating of Neutral.

There Will Be Blood

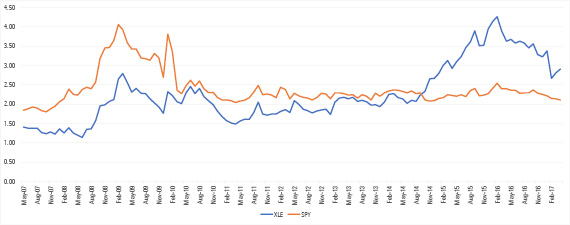

The recent malaise in the energy sector helps illustrate the perils of loading up on high-yielding stocks for the wrong reasons. Unlike the financial crisis, the negative effects of the decline in energy prices have not spilled over into other equity sectors. Exhibit 2 shows the indicated dividend yield of both

Exhibit 2. Indicated Dividend Yield

- source: Morningstar Direct.

SPY’s indicated dividend yield topped XLE’s for much of the past decade. In October 2014, the price of oil plummeted and XLE’s indicated yield eclipsed SPY’s. XLE’s dividend yield didn’t track higher because its dividend increased at a faster clip than SPY’s, but rather was owed to stock price declines across XLE’s holdings. XLE’s indicated dividend yield topping SPY’s coincided with the spot price of WTI crude falling to $80.53 per barrel in October 2014 from $107.95 per barrel in June 2014

. XLE traded at a high of $101.26 in June 2014. By the end of October 2014 it was trading at $85.69. Because the price of oil affects most energy companies’ revenues, XLE’s price fell by 15% during those months as the spot price of WTI crude tumbled by 25%. This offers an example of a fund’s dividend yield increasing as a result of falling prices rather than dividend payments increasing at a rate that outstrips share price appreciation. XLE’s indicated dividend yield peaked in February 2016 at 4.3% as the spot price of WTI crude bottomed out at $26.19 per barrel. The same month,

Whipsawed

DIV tracks an equally weighted 50-stock index that targets stocks with high dividend yields and low betas compared with the S&P 500. This fund starts with stocks that have betas of 0.85 or less, have paid dividends for at least two years, and whose current dividend payments that are at least 50% higher than the prior year’s payment. Next, it ranks the stocks in descending order by dividend yield, selects the top 50, and equally weights them. The fund limits sector weights to 25% and caps its MLP exposure at 20% of the portfolio. It reconstitutes annually and rebalances quarterly. Even with sector caps in place, this fund loads up on utilities, energy, consumer defensive, and real estate stocks. Because it equal weights its 50 holdings, it skews toward smaller stocks. This fund lands in the mid-cap value Morningstar Category, but its portfolio’s average market capitalization measures $6.0 billion, about half of the category’s average.

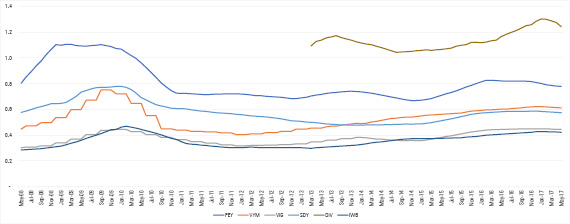

Although the fund looks for stocks that had increased their dividend yield, it doesn’t consider dividend sustainability. Since DIV’s March 2013 inception, its payout ratio, or the ratio of aggregate dividends paid relative to its holdings’ net income, has measured greater than 1.0 times nearly every month. A company that pays out a dividend greater than its reported earnings is at risk of cutting its payout. Such firms may be borrowing to meet their payment and could be neglecting reinvestment needs. So, while DIV’s average dividend yield of 7.4% looks attractive on the surface, the outlays of many of its holdings don’t seem sustainable considering the funds’ payout ratio is greater than 1. Exhibit 3 shows the rolling average 12-month dividend payout ratios for PEY, DIV, the Russell 1000 Index (as measured by

Exhibit 3. 12-Month Rolling Average Dividend Payout Ratio

- source: Morningstar Direct; analyst's calculations.

Per exhibit 3, PEY’s 12-month rolling average payout ratio jumped above 1.0 times earnings during the financial crisis. DIV’s 12-month rolling average dividend payout ratio hasn’t measured below 1.0x earnings since its inception. In contrast, each of the three Morningstar Medalist dividend-targeting funds highlighted have 12-month rolling average payout ratios that measure below 0.6 times earnings for most of the past decade.

Focus on Total Returns Investors can avoid stepping on land mines in the field of dividend-oriented ETFs by understanding how these funds target and weight dividend-paying stocks, and seek to reduce the risks of holding high-yielding companies. Most dividend-targeting funds use several approaches to reduce risk such as:

1. Screening for profitability. If a stock is more profitable, it should be able to maintain its dividend during a market drawdown or increase its dividend in the future. These metrics usually include return on invested capital, net margin, payout ratio, interest coverage, and cash flow-related measures.

2. Looking for a history of dividend payments. Many equity-income benchmarks screen holdings based on their historical dividend payments. These screens are, of course, backward-looking, but this step ensures that a firm has an established pattern of paying or growing its dividend—evidence of a commitment of returning cash to shareholders.

3. Market-capitalization weighting. Weighting stocks by their market capitalization tilts holdings toward larger, more stable firms. Alternatively, weighting stocks on the basis of their yield or equal-weighting, may tilt the portfolio toward higher-yielding, smaller, and riskier stocks that are more prone to cut their dividends.

4. Caps. Capping single-stock and/or sector weightings is a straightforward way to reduce risk. Unfortunately, many of these caps have been applied only with the benefit of hindsight—after the damage has been done.

None of these tactics is a silver bullet. No approach can avoid stocks that may cut their dividends altogether. That said, funds that effectively incorporate these approaches to risk reduction into their process may offer better investor outcomes.

[1] Roger Ibbotson & Peng Chen. 2003. "Long-run stock returns: Participating in the real economy." Financial Analysts Journal, Jan/Feb 2003. Vol. 59, No. 1, P. 88.

[2] Daily WTI crude spot prices available on the U.S. Energy Information Administration (EIA) website.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets,

or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RSZNI74R6FG7FDSWBUF6EWKDE4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)