August Accelerates Mutual Fund Outflows

But passive equity and alternative strategies continue to draw interest.

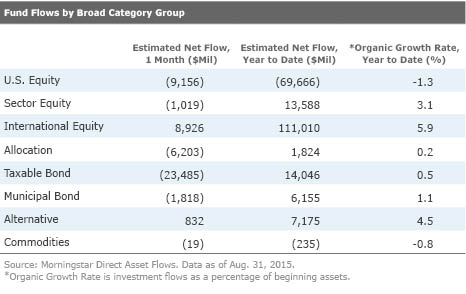

Outflows from open-end mutual funds accelerated in August, with a total of $31.9 billion moving out last month. Diversified domestic-stock funds have seen $69.7 billion in outflows for the year, including $9.2 billion in August. That is perhaps not surprising, given that every diversified domestic-equity Morningstar Category saw a loss of 4% or more last month.

However, flows haven't strictly followed returns: Taxable-bond funds saw outflows of $23.5 billion last month, more than twice those of domestic-stock funds--even though they have half the market share and didn't see as strong of a sell-off. Even municipal-bond funds saw outflows last month, though they were generally in the black.

International-equity funds, on the other hand, enjoyed net inflows of $8.9 billion in August--even though the average foreign large-blend fund was down more 7.1%. Investors also sought out alternative funds, which took in more than $800 million, not an insignificant sum considering that these funds still make up less than 1.5% of open-end fund assets.

Drilling Down

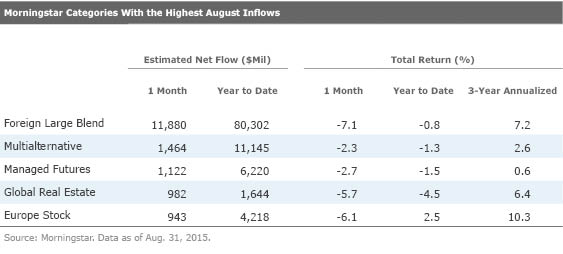

There was a distinct division among foreign fund flows. Core foreign large-blend offerings saw the most inflows in August of any Morningstar Category, $11.9 billion. Much of that owes to

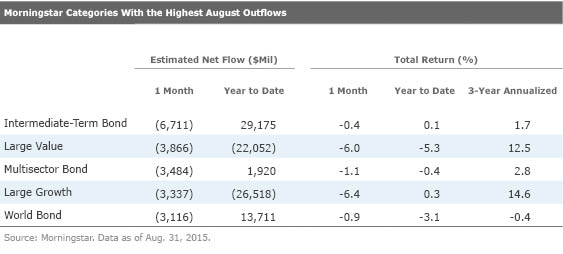

Diversified emerging-markets funds, however, were some of the least popular, with outflows of $1.5 billion last month, spurred by China's economic woes. China funds themselves saw more than $400 million in outflows, and Pacific/Asia ex-Japan funds saw $2.8 billion flow out. (Japan funds, on the other hand, drew assets.) The largest fund in the category, the $7 billion

Real estate, along with utilities and technology funds, saw outflows in August and for the year to date. Global real estate funds, however, have continued to receive strong inflows--it was the fourth most popular category in August--as have health-care and consumer cyclical specialty funds.

Intermediate-term bond funds, a basic core holding, lost more than any other category ($6.7 billion), with high-yield funds, multisector bond funds, and world-bond funds also seeing significant outflows--although all except high yield still have net inflows for the year to date. Short-, intermediate-, and long-term government bond funds bucked this trend, however, as investors retreated to Treasuries amid global economic uncertainty.

Passive Continues to Dominate

Underlying the numbers above is a persistent investor preference for passive investing. International funds, for example, are seeing inflows overall largely because of passive products such as Vanguard Total International Stock Index. This trend toward indexed core stock funds helps explain why large-blend U.S. equity funds (a group that includes such passive behemoths as

While domestic-stock funds continued to see outflows overall in August, that figure obscures the shift from active to passive. In fact, while actively managed U.S. stock funds saw outflows of $14.0 billion last month, their passively managed counterparts racked up net inflows of $4.8 billion in August--and that excludes exchange-traded funds, which have taken in $121.6 billion so far this year (including $3.1 billion last month) and now account for 14.5% of open-end and ETF assets combined.

This pattern remains evident in fund family flows: Vanguard and DFA are two of only three of the 10-largest families to see net inflows in August. J.P. Morgan, however, is the third; it continues to buck the trend and draw advisors to its actively managed offerings.

On the other hand, investors are leaving core fixed-income funds across the board, with significant net outflows overall from both active and passive intermediate-term bonds in August. Vanguard Total Bond Market II Index VTBIX--a version of

Investors wary of traditional equity and fixed-income markets are showing more confidence in active alternative funds (open-end passive alternatives have seen outflows); these promise to reduce correlation to the market or temper risk. It is also worth noting that $1.3 billion of new money went into risk-oriented strategic-beta ETFs in August, while their return-oriented counterparts saw outflows of $2.0 billion.

Putting Outflows in Perspective Persistent outflows raise a concern that shareholders who stick with a fund will suffer when a manager is forced to sell securities to meet redemptions. Some funds may be struggling, but fortunately most categories and funds lost fairly small percentages of their assets overall. Most of the categories in redemptions saw outflows totaling less than 2% of assets. However, diversified Pacific/Asia, China, and Pacific/Asia ex-Japan averaged outflows of 5% to 12% last month. The trend bears watching; excessive outflows (and inflows for the matter) can hinder performance, as explored in a recent Fund Spy.

/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)