Stop Holiday Arguing, and Invest in These Cheap Stocks

We’ll review the top stocks, funds, and exchange-traded funds this week as well as updates you can make to your portfolio.

What You Missed

This week, we dive into winning stock funds; conversations about environmental, social, and governance investing; and portfolio lessons from 2022. We name the top 20 companies to invest in now and count down 2022′s best and worst new exchange-traded funds. John Rekenthaler talks Vanguard, and Tom Lauricella keeps us up to date on the markets.

Chart of the Week

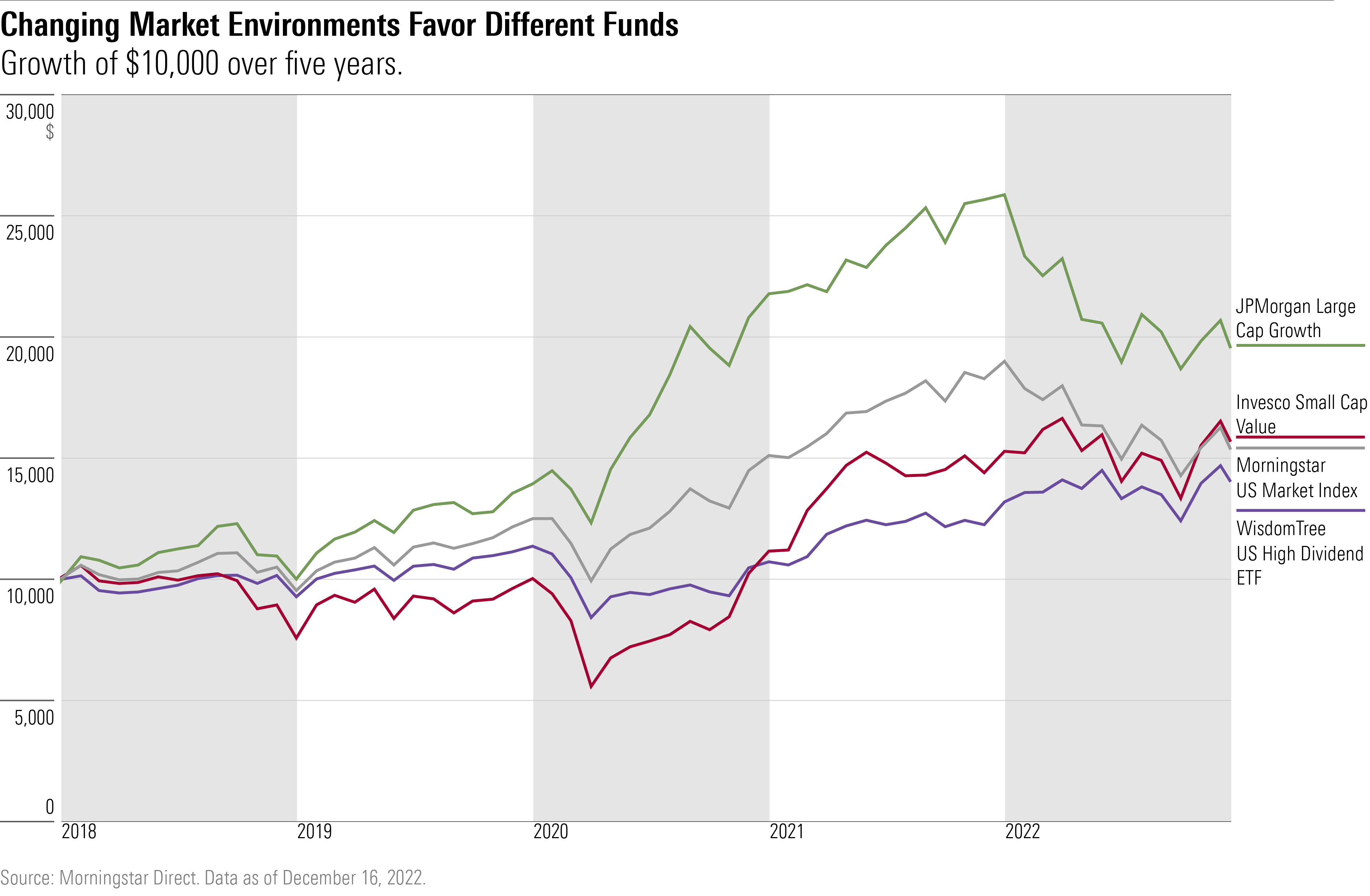

2022′s Best-Performing U.S. Stock Funds

These stock funds are the winners in recent years.

Glossary Term of the Week

The debt-asset ratio looks at how much of a company’s assets are leveraged by debt. A lower ratio implies fewer assets are financed by debt.

The debt-asset ratio is often used by creditors to determine a company’s financial situation. This helps them determine if the company can repay the debt and how fast the debt can be repaid.

See Morningstar’s Investing Definitions and Financial Terms for the full definition.

What to Watch

Here are some key takeaways for investors after a tough year for most markets.

Articles We Love

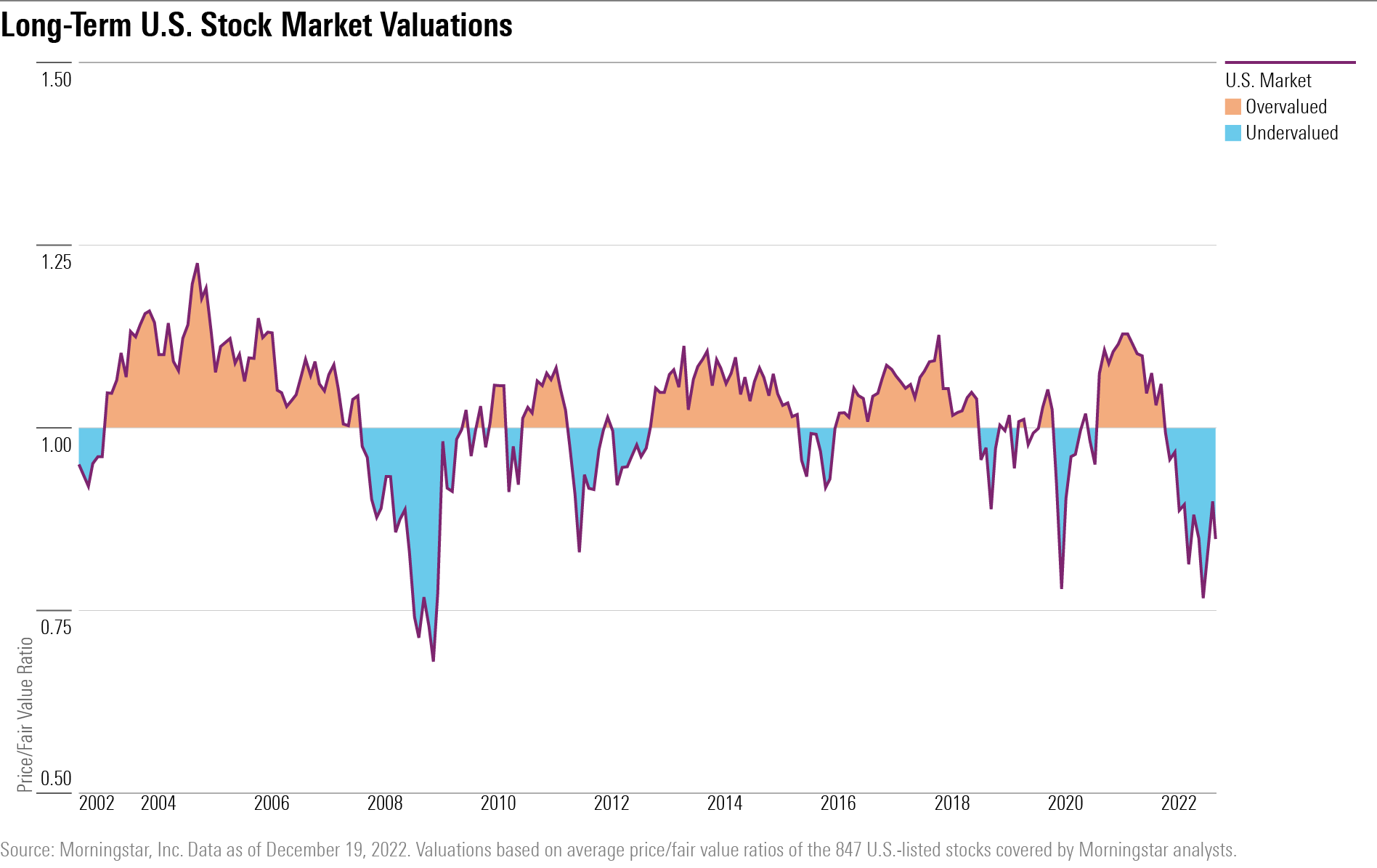

Where Are Stocks Looking Cheap or Expensive?

7 charts on valuations as the stock market heads into 2023.

Over the course of 2022, stocks have undergone a significant valuation reset thanks to the bear market.

At the start of the year, Morningstar analysts saw many of the stocks they cover as overvalued. But after a more than 20% decline in the broad market for the year to date, analysts think valuations have swung too far in the opposite direction, even after cutting back on their growth assumptions.

At the Holiday Table, Don’t Fight About Politics, Religion—or ESG

In fact, don’t fight at all. Expert tips for keeping the peace during the holidays.

The holiday season is upon us, the buffet tables are groaning with roasts and pies, and the alcohol is guaranteed to be flowing. So it’s no surprise that a fight around the table is a fixture of holiday celebrations.

Usually, it’s about politics and religion, which is one reason we’re advised to steer clear of these subjects. But one topic raising hackles lately is environmental, social, and governance concerns, a key element of sustainable investing. This year, it’s also been condemned by conservative Republicans in some states as “woke capitalism,” or companies espousing social and environmental causes. There are also concerns about “greenwashing,” in which fund managers and companies are accused of misleading customers by exaggerating the sustainability attributes of their products.

Many of the political attacks are ill-founded, but looking at how we deal with this conflict is instructive in helping address other conflicts that might arise at the holiday table.

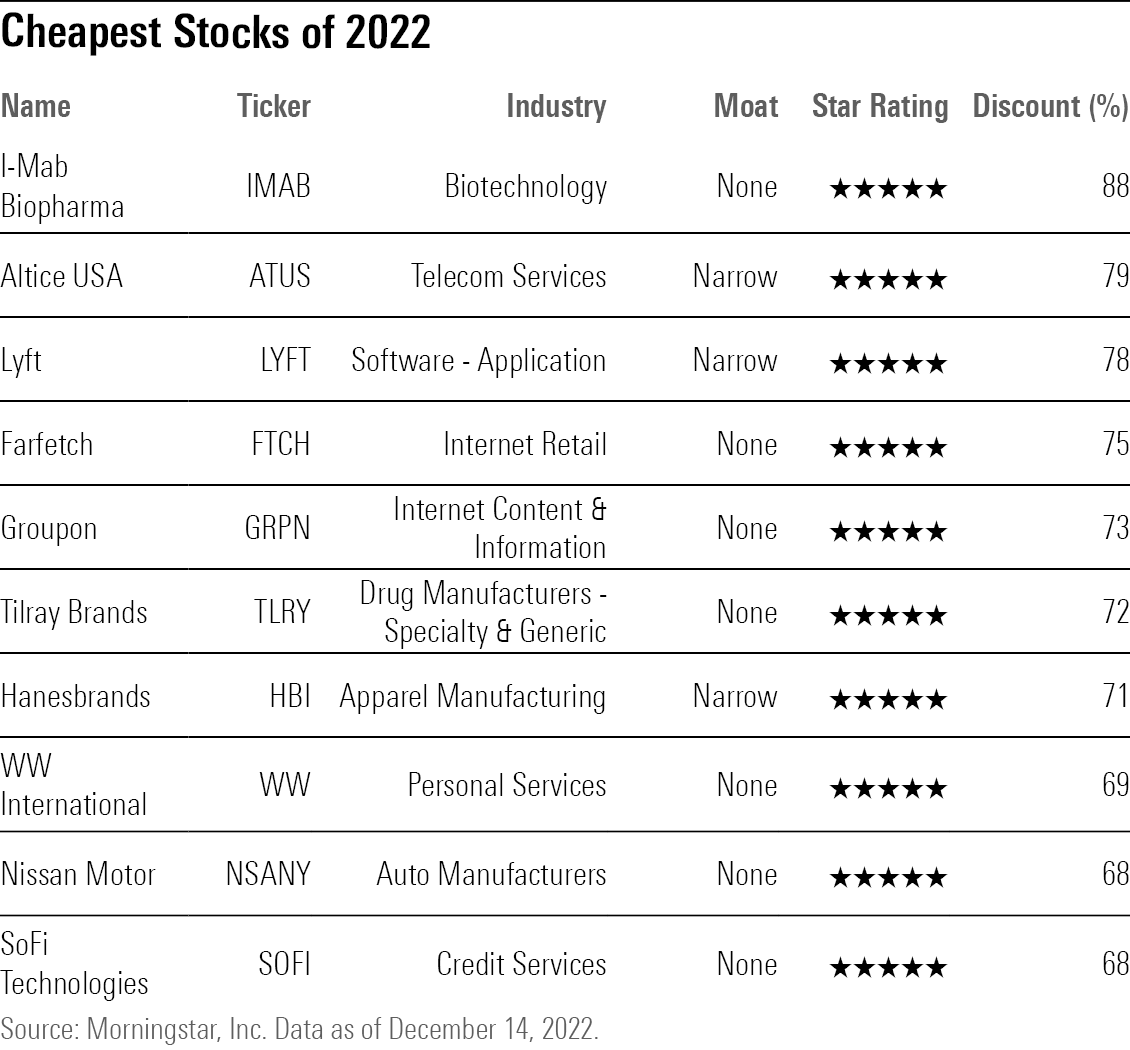

10 of the Cheapest Stocks of 2022

One silver lining of the bear market is that half the stocks followed by Morningstar analysts are now undervalued.

There’s one good thing about a bear market: For investors looking to put money to work, stocks end up cheaper than they were before it started.

Valuations for the U.S. market did a flip-flop from the start of the year, with Morningstar analysts now viewing the market as 11% undervalued, compared with 6% overvalued during its peak on Jan 3.

As of Dec. 14, 421 of the 846, or about 50%, of the U.S.-listed stocks covered by Morningstar analysts are undervalued—having a Morningstar Rating of 4 or 5 stars. About 305 of them are considered 20% undervalued or more. At the start of the year, only 221 stocks were considered undervalued, and 126 were 20% undervalued or more.

The world’s largest fund company, revisited.

At $6.5 trillion, Vanguard is by far the world’s biggest fund manager. BlackRock BLK is larger overall, thanks to its institutional accounts, but Vanguard dominates the mutual fund and exchange-traded fund business. In that field, the company boasts a 17% global market share, with no rival reaching even 10%. At home, Vanguard’s lead is stronger yet, as the firm manages a whopping 27% of U.S. fund assets.

Such influence demands scrutiny. Twelve months ago, in “Has Vanguard Lost Its Way?”, I wondered if the company was heading in the wrong direction. That article raised three concerns: 1) Vanguard’s decline in customer service; 2) the aggressiveness with which Vanguard was marketing its Personal Advisor Services program; and 3) its announcement that it would be running private-equity funds. Today, I update those thoughts.

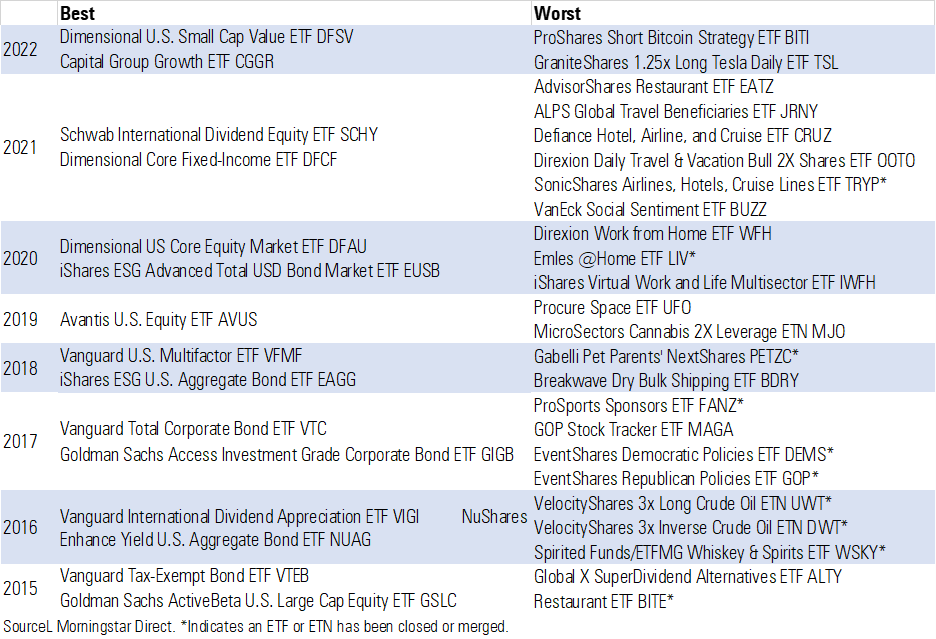

The Best and Worst New ETFs of 2022

As the ETF menu continues to grow, we weigh in on this year’s best and worst new launches.

As of Dec. 14, 391 exchange-traded funds were launched in 2022, on pace to fall just short of last year’s record of 438 debuts. There are now 3,145 ETFs available to investors. There have been 4,649 ETFs brought to market since the first one debuted in 1993. This means about 32% of them have since closed. In 2022, 125 of these ETFs shuttered their doors.

Stocks, Funds, and Exchange-Traded Funds

The Outlook for Healthcare in the COVID Era

Eddie Yoon runs Fidelity Select Health Care FSPHX, one of the best healthcare funds around. Healthcare is a big part of the economy, and in the coronavirus pandemic era, it has been largely responsible for getting the economy moving again.

Given that influence, director of manager research Russ Kinnel thought it would be interesting to hear from Yoon about the state of healthcare in America.

Morningstar U.S. equity strategist Robby Greengold and Russ talked with Yoon on Sept. 26, 2022. What follows are excerpts from that chat. Because things are always changing in the investment world, his views may have since changed and certainly will change more the further we get from that date.

20 Best Healthcare Companies to Invest In

The strongest long-term opportunities for healthcare companies primarily fall in three industries: drug manufacturing, medical devices, and diagnostics and research.

And all 20 of the best healthcare companies to invest in have intangible assets that provide a wide moat against competitors. This intangible-asset advantage is often derived from either patents or proprietary technology.

Patents are temporary government licenses that exclude competition from copying an invention. For example, in pharmaceutical companies, patents are necessary owing to the ease with which some drugs can be replicated. Similarly, patents are vital in the medical-devices industry to protect companies’ product designs.

Crypto’s Crash Reinforces Old Lessons for Fund Investors

When cryptocurrencies cratered in 2022, they left their mark on some mutual funds that invested directly or indirectly in digital coins, trading platforms, or banks with crypto clients.

But the extent of the crypto damage depends on how eagerly the funds jumped on the decentralized finance bandwagon, according to our analysis.

We looked at some of the biggest crypto investors among funds covered by Morningstar analysts to understand the impact. We found a big difference between funds whose crypto stakes were measured and built as part of established investment philosophies and diversified portfolios—and those that seemed to throw caution and prudence to the wind.

Missed Us?

Catch up with Tom Lauricella, Morningstar’s chief markets editor, on LinkedIn to read Morningstar’s markets and investing newsletter, Morningstar’s In the Markets, with the week’s highlights from Morningstar.com. Check out his most recent edition, “Where to Invest in Bonds in 2023.”

In this week’s newsletter:

- Where to Invest in Bonds in 2023

- 5 Charts on Big Tech Stocks’ Collapse

- Why the Fed May ‘Yo-Yo’ With Interest Rates

- The Fed and Markets Have Different Outlooks. Which One Will be Right?

Call it a reality check.

As we noted in our last newsletter, last week was likely to be a big week for news in the markets, the last big week of the year. And it didn’t disappoint.

Well, on one level it did.

The stock market seemed surprised after Federal Reserve Chair Jerome Powell talked tough on inflation Wednesday afternoon, leading to three straight down-days in the market.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A5UY22L42ZASPAW6OW75IQHR2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SRXFRUTTFZGPPK6U6Y5EG4WGMY.png)