10 min read

Online Commerce Observer June 2024: Accelerated Growth Expected

Key Takeaways

The average online marketplace operator in our coverage is roughly twice as profitable as the average brick-and-mortar player, driven by strong square footage and headcount productivity.

We project that online marketplaces' advertising businesses (excluding Amazon) could account for roughly 31% of firms' market capitalization in 2028, up from an estimated 21% today. That’s driven largely by regulatory changes.

While Temu and Shein have enjoyed explosive recent growth, we believe that they generally compete for a different customer base than do the large marketplaces in our coverage.

On this page

A lot has changed in the retail landscape over the past four years, but one thing has not: the shift from brick-and-mortar retail toward online commerce. Consumers are still battling back from a challenging spell, with April savings rates of 3.6% representing about half their prepandemic level while revolving credit balances remained high, at over $1 trillion in the US. With those conditions, a turnaround is unlikely to show up in the data for a few quarters. Despite this, the long-term trajectory of online commerce appears clear to Morningstar. The net effect is strong sales growth prospects for players in our online commerce coverage, offering long-term investors substantial opportunities in names like wide-moat Allegro, narrow-moat Chewy, and wide-moat Etsy, each of which appear to be underappreciated.

The Morningstar Economic Moat Rating is a proprietary data point that refers to how likely a company is to keep competitors at bay for an extended period.

This article was adapted from the 2024 Online Commerce Observer report published by the Morningstar Equity Research team. Download the free 69-page report here.

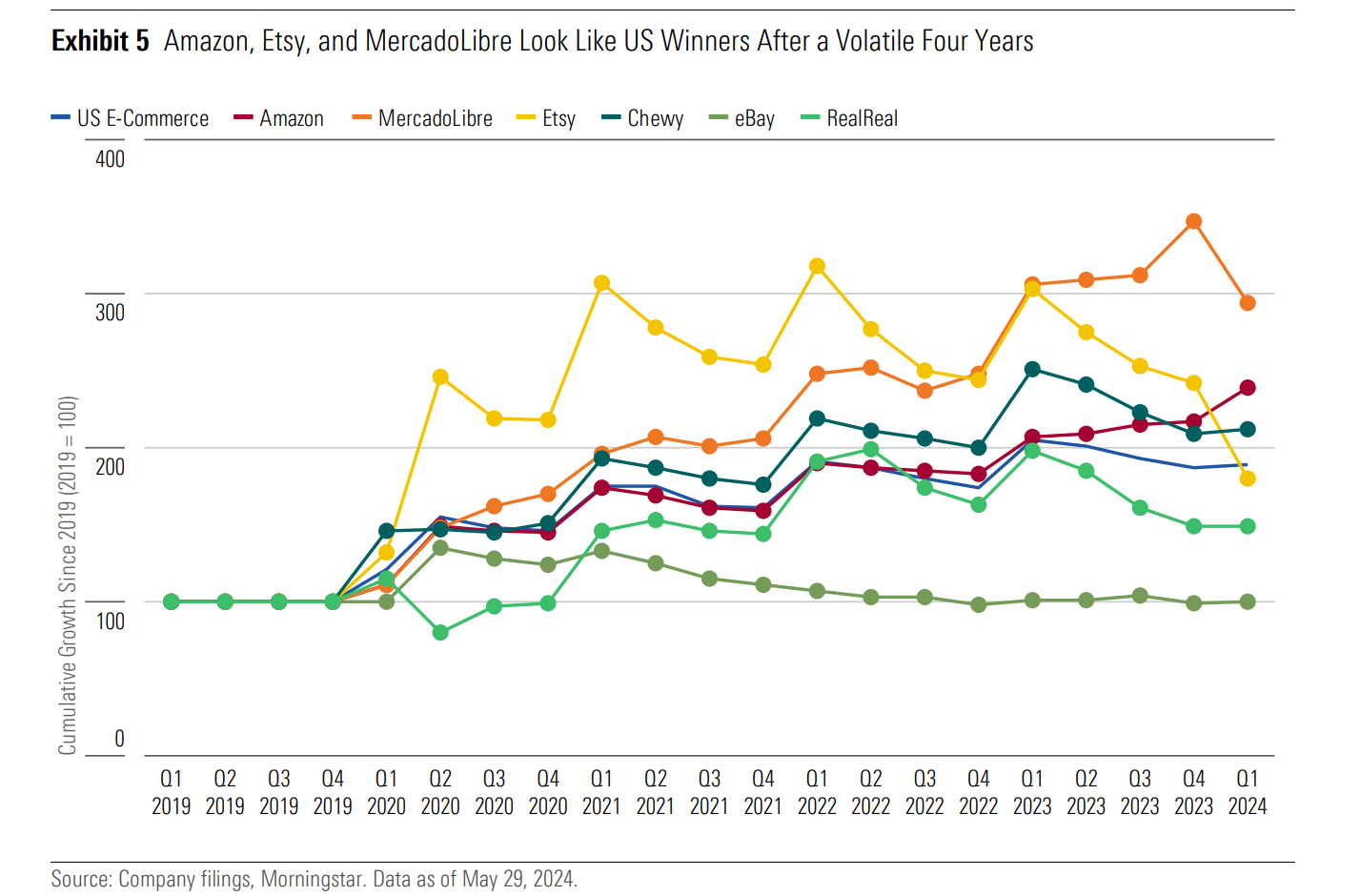

The Covid Years Drove a Slight Pull-Forward in Online Penetration in the US

Effects varied widely by company and industry, but across our US coverage, it is clear that wide-moat Amazon, wide-moat Etsy, and narrow-moat Chewy emerged as winners, while narrow-moat eBay and no-moat The RealReal have struggled. While we expect a qualified turnaround at the former, driven by a "focus category" strategy that privileges its competitively advantaged non-new, in-season inventory, we continue to view the operator as a distant third place in the US e-commerce landscape, falling comfortably behind both Amazon and wide-moat Walmart. In an industry that naturally lends itself to winner-take-all or at least winner-take-most dynamics, investors should be careful to funnel capital toward companies that dominate their niche and benefit from durable, self-reinforcing marketplace network effects.

Firms that have not yet consolidated market share and which operate without a proven economic model, like no-moat The RealReal, should be approached with an abundance of caution and carry substantial risk of economic value destruction. Business mix is also important—while we believe that eBay dominates in its core focus categories like collectibles, refurbished products, and even perhaps in certain luxury resale spaces, its business-to-consumer marketplace is meaningfully smaller and less competitive than that of wide-moat Amazon or even wide-moat Walmart, suggesting that market share losses within US e-commerce are likely on an ongoing basis.

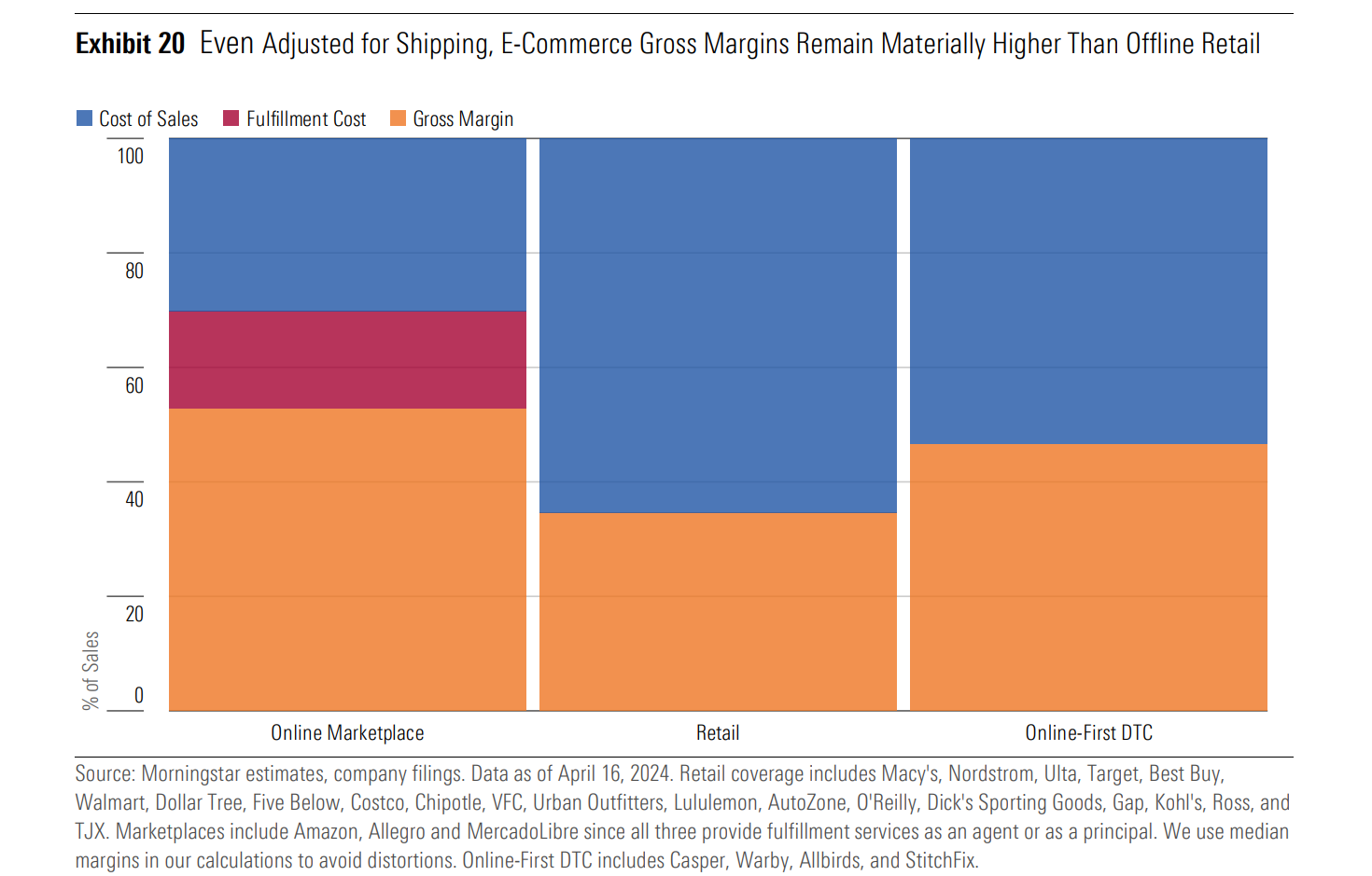

E-Commerce Gross Margins Remain Materially Higher Than Offline Retail, Driving Growth

We see that the dominant driver of operating margin outperformance is the chasm between e-commerce marketplace gross margins (53%) and offline retail (35%), even after adjusting for fulfillment services that typically get booked as operating expenses rather than cost of sales by marketplace operators.

This is an attractive structural feature of the third-party marketplace model--third-party sellers front working capital and bear the cost of goods sold for inventory they sell on e-commerce platforms, underpinning competitive economic models for these moaty service providers. For firms which exclusively sell third-party wares, like Etsy and eBay, gross margins clock in at a striking 70%. For those companies, the only meaningful cost of goods sold is web hosting services and payment processing, underpinning a business model with outstanding incremental operating margins and margin expansion prospects.

Taken together, despite capturing only a fraction of platform sales as revenue (the marketplace "take rate"), bearing incremental shipping costs that offline retailers do not, and having to deal with return volumes nearly three times higher than in the brick-and-mortar channel, marketplaces generate double the operating profitability of the median brick-and-mortar retailer in our coverage.

The online channel provides strong consumer value, with price competitiveness representing the primary driver of purchase behavior in most surveys we have seen (convenience typically comes second), and it is also clear that marketplace sellers can be quite profitable. We believe that this combination provides meaningful support for our strong US e-commerce growth forecasts. We hypothesize that, while gradual, retail sales will continue to shift toward the cheaper, cost advantaged online fulfillment channel over time, consistent with the patterns we have seen over the past couple of decades.

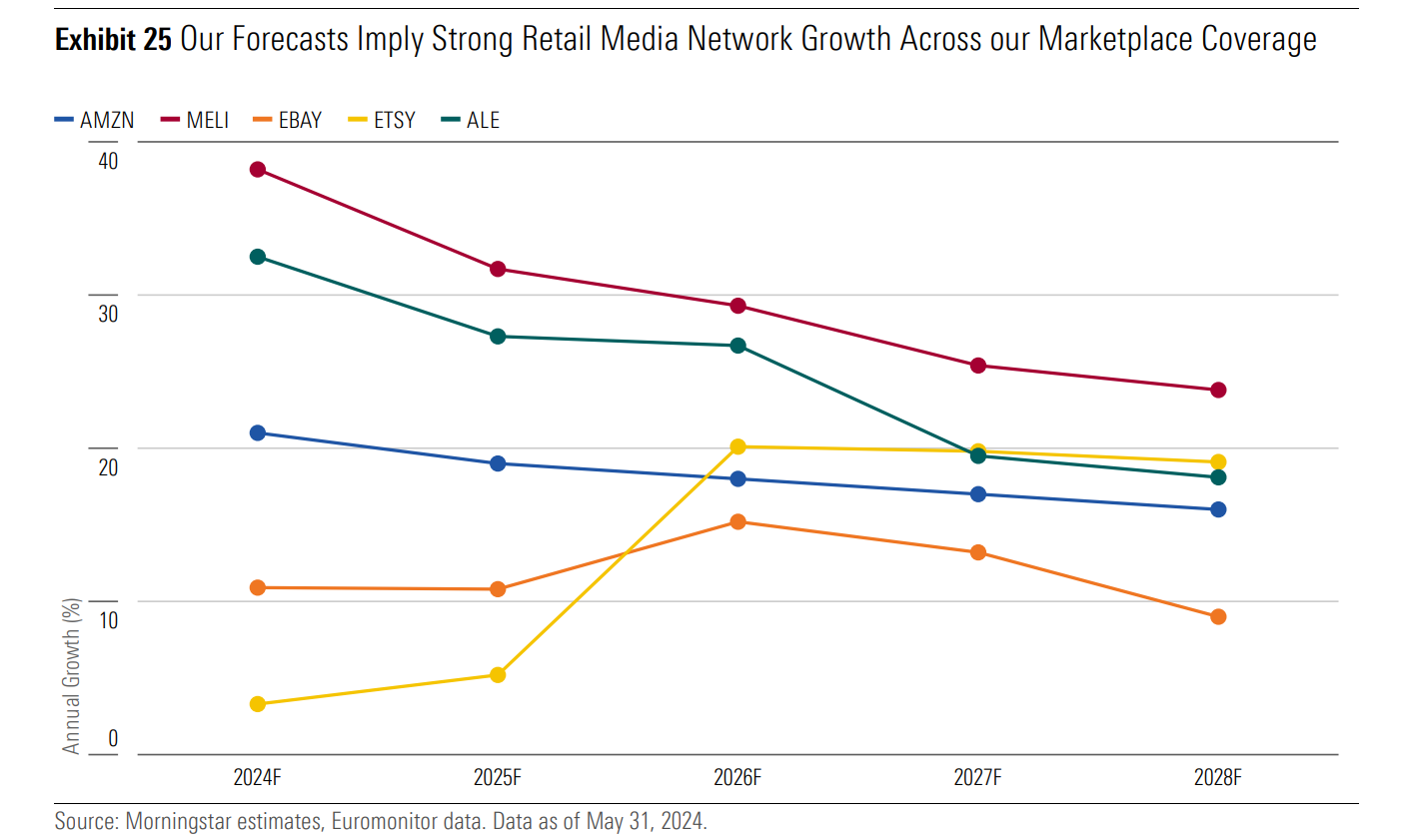

Privacy Changes in Advertising to Drive Profit Windfall for Online Marketplaces

Accelerating growth in retail media networks represents the key near-term opportunity for our online marketplace coverage. As we see it, privacy changes upstream look set to drive a surge in performance marketing budgets funneled toward those platforms. Against this backdrop, it is no coincidence that MercadoLibre and eBay have launched first-party advertising platforms over the past few years, while Amazon, Etsy, and Allegro have doubled down on existing efforts. Importantly, that advertising revenue arrives at robust incremental margins—MercadoLibre suggests that its retail media network runs at a "high 70s [to] low 80s" EBIT margin, while Meta and Google reported advertising margins of 47% and 37% in 2023, respectively. It is likely that those margins could be even higher for the big technology players if it were not for aggressive research and development investment in core social media and search platforms.

As we see it, the sheer scale of projected growth in retail media spending cements it as the most important dynamic to monitor in the industry and one that looks likely to further strengthen already durable moats across our coverage. To this effect, we expect MercadoLibre, eBay, and Etsy to boast advertising businesses north of $1 billion in annual revenue by 2028, representing compound annual growth of 30%, 12%, and 13%, respectively. Allegro's $632 million clocks in a shade behind in dollar terms, but its 25% forecast annual growth over the period aligns directionally with its peers. Amazon is set to remain the global pacesetter, with $47 billion in 2023 advertising revenue across its commerce, streaming video, and alternative media properties representing a striking 41.1% of the global market, and our projections see the firm approach $110 billion in advertising sales by 2028, suggesting that even the market leader's growth narrative has plenty of running room. Notably, with Amazon's advertising revenue clocking in north of 9% of third-party gross merchandise volume, by our estimates, and continuing to grow healthily, we foresee no near-term glass ceiling for other players. We conservatively estimate that advertising businesses could comprise 31% of market capitalization for the online marketplace players in our coverage by 2028 (excluding Amazon), up from an estimated 21% today.

Outsize Fulfillment Cost and Tighter Seller Margins Challenge Temu and Shein's Models

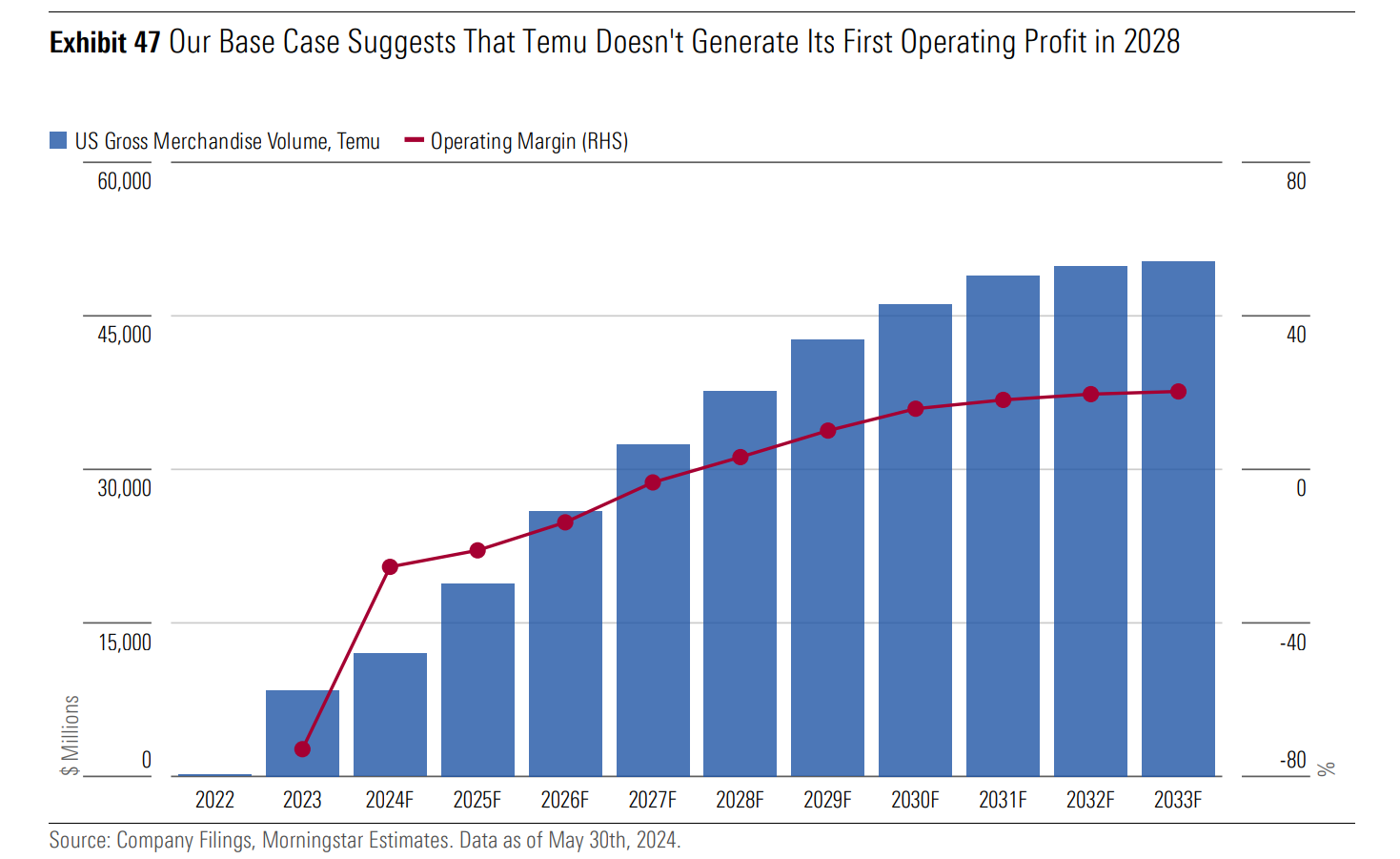

Lower seller margins and high fulfillment costs mean that Temu (a narrow-moat PDD Holdings subsidiary) and Shein are likely to remain small players in the US e-commerce market, though we envision them enjoying better success in Asia Pacific, the Middle East, and, to a lesser extent, in Europe. We believe that this view contrasts with market expectations, although with PDD Holdings' recent strategic pivot away from the US, consensus may quickly come around to our perspective.

To be clear, we believe that the drop-shipping model can succeed across borders, with our estimates contemplating that Temu achieves low-20% operating margins in the long term, albeit with fulfillment costs that are multiples higher than integrated markets like Amazon, MercadoLibre, and Allegro as a percentage of gross merchandise volume. We envision the platform’s success as most likely to come at the expense of other international marketplace players and dollar stores, rather than the moaty marketplace players in our online commerce coverage.

While it is undeniable that Temu has made meaningful ripples in the competitive landscape, sending cost-per-click advertising prices soaring and inciting Amazon to lower its referral rate on low-value apparel, we expect that the PDD Holdings subsidiary will remain a niche competitor in the US. Our thesis rests on structurally higher fulfillment costs and looming challenges in attracting domestic sellers onto the Temu platform, given the firm's focus on everyday low prices and the lower unit margins that those beget.

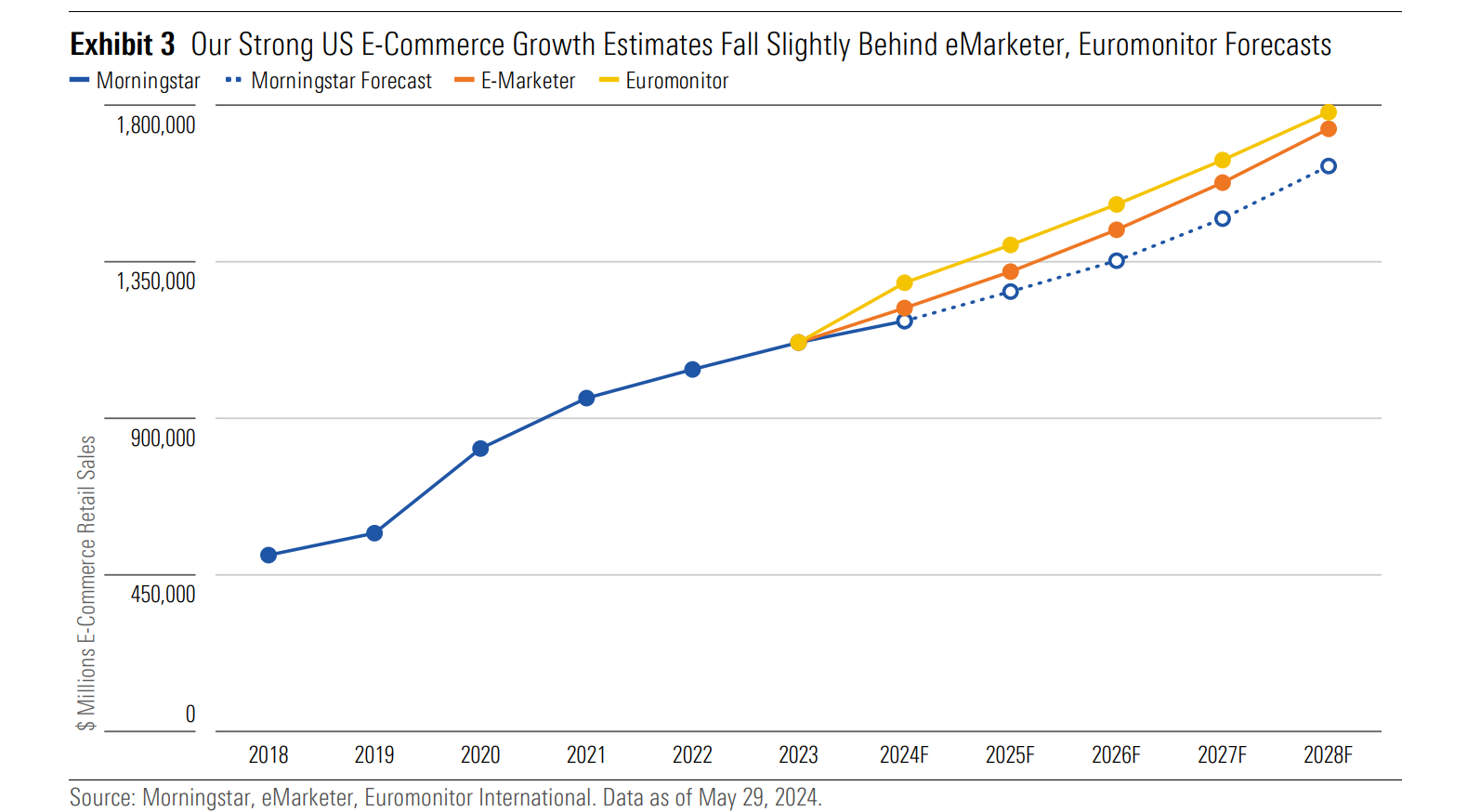

Growth in the Forecast for Fulfillment-Integrated Players

The largest online marketplace operators in our coverage should see their take rates increase by 2.4 points cumulatively over the next five years, on average, as they expand their reach further into auxiliary services like advertising, financial services, and fulfillment services. This widening ecosystem reach looks set to strengthen moats in the industry despite competitive pressure from international drop-shipping marketplaces like Temu and Shein. However, we expect growth in the US to slow to just 7.8% annually between 2023-28, reflective of a challenging macroeconomic environment that has consumers tightening their belts and shifting spending away from the discretionary categories toward which e-commerce has historically over-indexed. Despite current macroeconomic pressure, we forecast relatively strong growth for fulfillment-integrated marketplace players that compete well on value.

For more robust commentary and insights from the Morningstar Equity Research team, download the full 2024 Online Commerce Observer report.

Morningstar analysts use Morningstar data in combination with Morningstar Direct to draw the conclusions and projections found within this report. Morningstar Direct is a comprehensive platform that helps asset and wealth managers build their assets and manage their portfolios by supporting market research, product creation, positioning, marketing, and distribution strategies.