Blackstone Is the First Alternative Asset Manager to Hit $1 Trillion AUM. So Where Does It Go From Here?

7 charts on Blackstone’s ‘no-stone-unturned’ approach.

In July, Blackstone BX reported that it had surpassed $1 trillion in total assets under management during the second quarter of 2023, being the first alternative asset manager to cross that threshold.

A bit of background to start: “Alternative asset management” is an umbrella term for asset managers that specialize in private market investment strategies like private equity, private debt, or real assets, or in strategies that invest in publicly traded securities in a nontraditional manner, like hedge funds or funds of funds. (I am oversimplifying a bit—there is some overlap between these groups.)

There is a select fraternity of firms, including Blackstone, that operates in all five of these disciplines: private equity, private debt, real assets, hedge funds, and hedge funds of funds. Primarily, though, the alternative asset-management industry remains highly diffuse, consisting of many highly specialized managers with modest pools of investor capital.

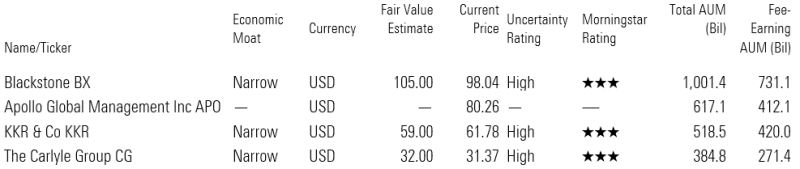

Along with other firms, Blackstone succeeded in riding the wave of demand for alternative products over recent decades. But how did it succeed in beating other private equity shops like KKR KKR, Apollo APO, and The Carlyle Group CG to the $1 trillion watershed?

Companies Mentioned

It boils down to two complementary advantages that Blackstone established early on in its history: reputation and scale.

Reputation and Pedigree

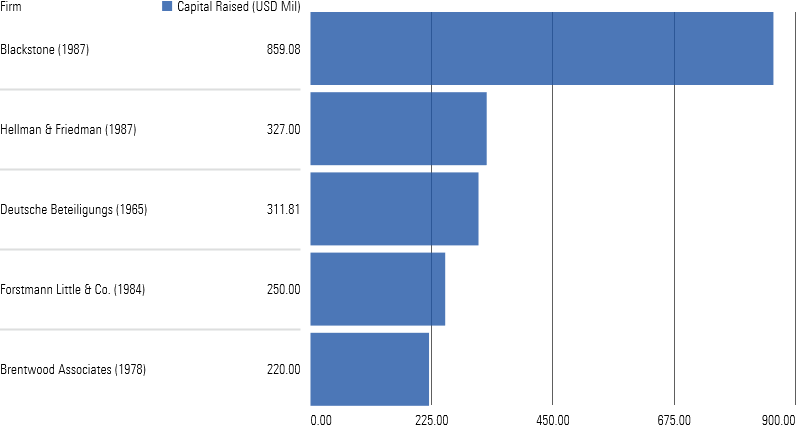

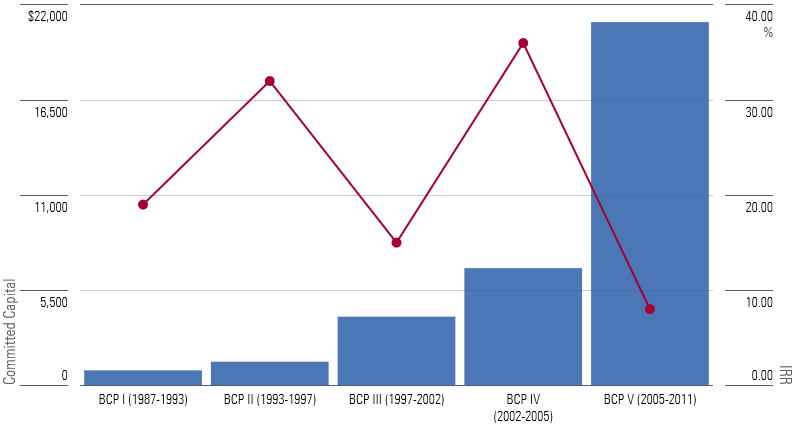

From the beginning, Blackstone’s founders, Stephen Schwarzman and Peter Peterson, proved adept at using reputation as a springboard. The pair leveraged relationships they’d previously forged as investment bankers to raise more than $800 million in 1987 for Blackstone’s flagship offering, Blackstone Capital Partners I, making it the most successful debut ever for a leveraged buyout fund.

Biggest Debut Buyout Funds by Committed Capital, 1965-87

Blackstone’s close ties with institutional clients have endured to this day. In fact, 87% of the firm’s assets under management comes from the institutional channel, compared with 80% for the industry at large, as of April 2023.

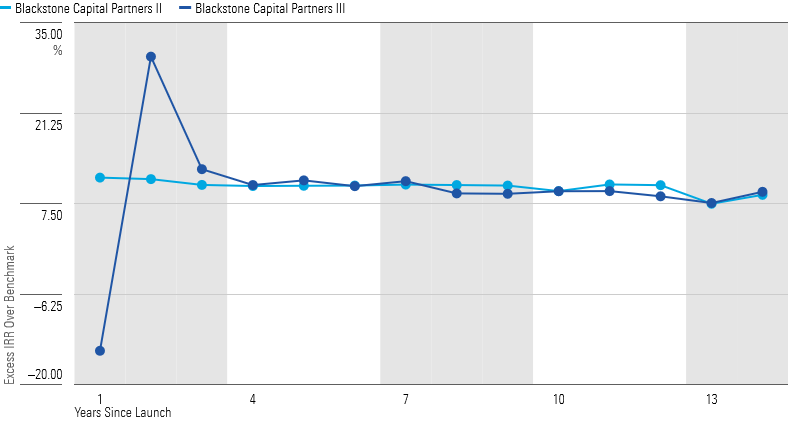

Beyond reputation, the firm also boasts a seasoned team and deep bench. The heads of private equity, real estate, and credit have all been with the firm for more than 10 years. But Blackstone has also taken care to groom the next generation of leaders. Indeed, its investment committee consists of more than 50 senior professionals, and that committee must approve every deal over $100 million. Blackstone also has benefited from strong investment performance, starting with its first two leveraged buyout funds—Blackstone Capital Partners I and II—which posted internal rates of return of 19.0% and 38.4%, respectively, over the life of each vintage. What’s more, some of the firm’s largest buyout strategies, like Blackstone Capital Partners II and Blackstone Capital Partners III, have outperformed relevant benchmarks over time.

Blackstone's Capital Partners II and III Consistently Oupterformed Benchmarks

(Although those numbers are impressive, it’s important not to rely too much on IRR when evaluating a manager’s performance. For starters, when returns are positive, IRR calculations often overstate an investor’s realized results. The calculation assumes that an investor can reinvest cash proceeds at the IRR over the entire investment period, which rarely holds in practice.)

Scale

Blackstone parlayed this initial success into launches of other lines of business, like real estate. From its founding in 1994, Blackstone Real Estate Partners I posted an IRR of 40.0% over its life. The firm went on to launch a private credit business in 1999 and expand internationally, bringing the firm’s number of strategies up to eight by the millennium.

Having established these franchises and after racking up still bigger gains (notably Blackstone Capital Partners IV fund’s 36% annual IRR), Blackstone raised even more prodigious sums to its buyout funds in the years that followed, as shown below.

Committed Capital and IRRs of Blackstone's First Five Buyout Funds

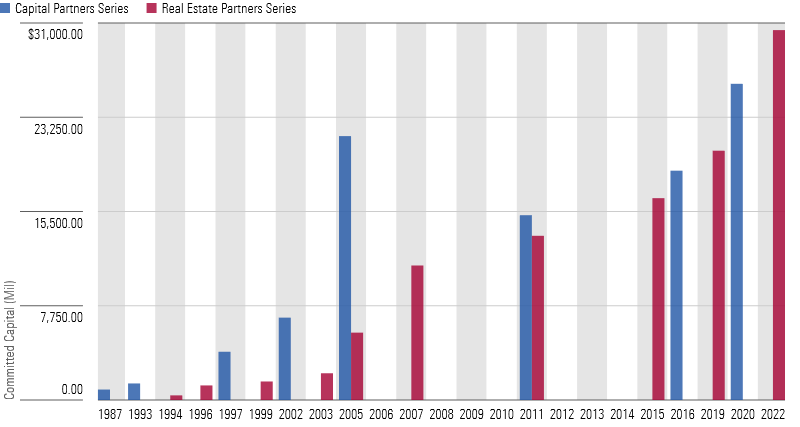

The firm also continued to rake in vast heaps of capital in its Real Estate Partners suite, easily matching its fundraising success in private equity.

Blackstone's Capital Raises in Real Estate Began to Match Private Equity in Mid-2000s

As it has grown, Blackstone has avoided dabbling in areas that it doesn’t believe it has a competitive advantage in, like venture capital—arguably the most speculative form of private investing. This enabled it to preserve its reputational edge even as it has expanded into new product lines.

Where Does Blackstone Stand Today?

Despite the remarkable expansion of private markets over the last two decades, scale can be as easy to shed as it was difficult to attain. In the same quarter that Blackstone announced it had reached $1 trillion in AUM, it also telegraphed that it had experienced $5.4 billion in net outflows, its first quarter of outflows since 2018. While a drop in the bucket relative to Blackstone’s size, the outflows nod to the looming question of whether Blackstone can fend off increasingly stiff competition in the future.

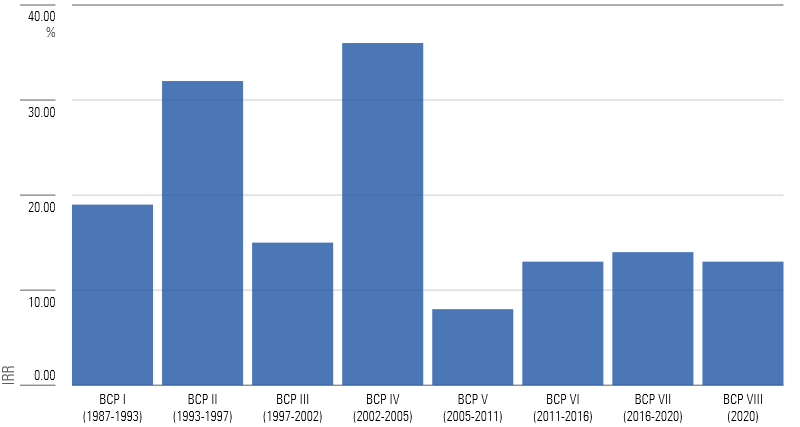

The question is a critical one, as performance is not as unimpeachable as it once was—at least in private equity. Recently, the IRRs Blackstone has reported could be more fairly characterized as singles and doubles than home runs.

Blackstone Hasn't Delivered a Cumulative IRR Over 14% in Any Vintage of Its Capital Partners Suite Launched After 2002

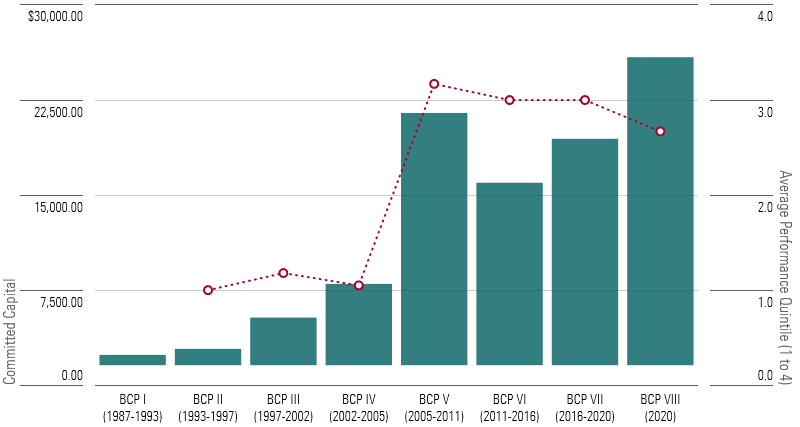

Since Blackstone Capital Partners IV’s windfall capital raise of $21.7 billion, Blackstone’s Capital Partners private equity vintages have continued to enrich their investors, but relative to the ever-intensifying competition, results look fairly pedestrian.

As Vintages Have Gotten Bigger, Blackstone's Peer-Relative Performance Advantage Has Waned

In fairness to Blackstone, the firm is also bowing to some near-term operational headwinds. There’s evidence that rising rates are pestering its strategies on several fronts. Stress tends to bubble up in the most liquid vehicles first, and the firm has sustained meaningful withdrawals from its quarterly liquidity vehicles, including Blackstone Real Estate Income Trust BREIT and Blackstone Private Credit Fund BCRED. Blackstone also took the unusual step of gating redemptions to the funds, among the first of its peer group to do so. These elevated redemptions contributed to Blackstone’s net outflows over the past several quarters.

Still, we have maintained our Morningstar Economic Moat Rating of narrow for Blackstone’s stock. Blackstone’s moat rating takes into account the full sweep of Blackstone’s business lines—private equity, private real estate, private credit, and hedge funds. It examines the sources of Blackstone’s competitive edge across these businesses, gauging whether the firm can effectively deploy these advantages to fend off its competitors and deliver superior returns on invested capital.

Despite the challenging operating environment, in the medium term, our equity research team believes that interest in alternatives will continue to grow as alternative asset managers unlock new client segments that they haven’t previously had access to, such as 401(k) plans, or that have been a secondary priority to this point.

Of course, the allure of this business proposition has not gone unnoticed. Traditional asset-management firms like BlackRock BLK, T. Rowe Price TROW, and Franklin Resources BEN have also moved into the space in recent years, pressured by the growth of low-cost passive products in the public markets, which have pressured both their fees and margins. Institutions are beginning to prune the roster of alternative managers they work with, which could eventually cause the industry to contract. Even though the asset-management industry in general is conducive to moats, the threat of increasing competition on both these fronts in the longer term limits Blackstone’s moat to narrow for now.

These trends are still in their infancy, though, and alts require time and experience to get right. There are some strides that Blackstone can take today to forestall the competition, including lowering fees and divulging more of what makes the firm tick.

If it doesn’t, the looming wave of traditional asset managers looking to enter the space at scale and the currents of industry consolidation will shape that outcome for it. Eventually, the “wild West” of alternative asset management will be tamed, whether Blackstone opts to try to beat the herd or join it.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)