ESG Fund Returns Recover, but Still Trail Conventional Peers by a Small Margin

The tech stocks that helped ESG funds and the utilities that hurt them in 2023.

Sustainable funds performed much better in 2023 compared with 2022, but results were mixed across asset classes. Large-blend equity funds held up better than traditional peers. Tech provided a boost. Below are some highlights from 2023 Sustainable Funds Landscape.

Sustainable Equity Funds Lagged in 2023 but Performed Well Over the Trailing Five Years

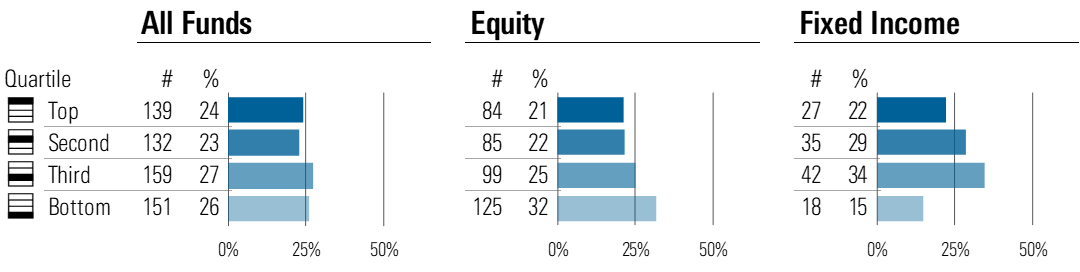

On the whole, sustainable funds lagged their conventional peers by a small margin, with 53% of sustainable funds landing in the bottom half of their respective categories.

Sustainable Funds 2023 Return Rank by Morningstar Category Quartile

Equity funds suffered the worst. Roughly one third of sustainable equity funds dropped to the bottom quartile relative to peers. Some of the macroeconomic pressures that contributed to their modest performance—such as high interest rates, inflation, and supply chain disruptions—continue to feature in market outlooks for 2024.

In fixed income, roughly one third of sustainable funds landed in the third quartile relative to peers. They did a better job than peers at avoiding the lowest returns, and only 15% landed in the bottom quartile.

Over the trailing three years, the distribution of sustainable funds across their respective categories looks similar to 2023.

However, in terms of trailing five-year returns, they held up better than conventional peers. Some 60% of sustainable funds landed in the top half of their respective categories during this time period. Strong performance during 2019 and 2020 contributed.

Sustainable Funds Three-and Five-Year Trailing Performance by Morningstar Category Quartile

On the other hand, over the trailing three-year and five-year periods, sustainable bond funds found themselves in the bottom half of their respective categories more often than not.

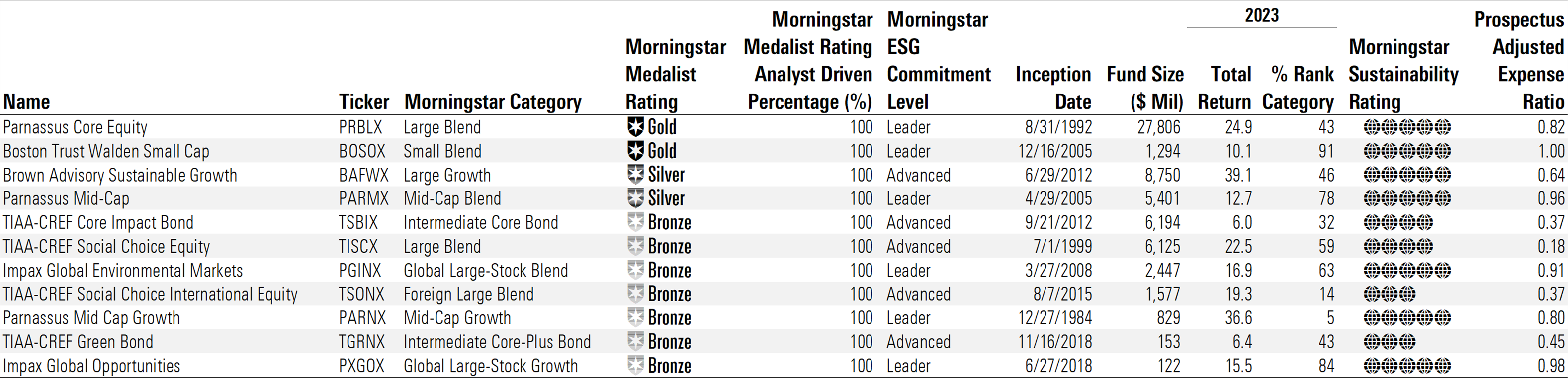

A Handful of Sustainable Funds Stack Up Well on Multiple Morningstar Metrics

Looking ahead, we can consult forward-looking ratings to identify those funds that Morningstar’s manager research team believes will outperform. More than 300 sustainable funds earn our higher ratings under the Morningstar Medalist Rating system. Of those, 11 are offered by asset managers that earn top marks on the Morningstar ESG Commitment Level. The ESG Commitment Level is a qualitative measure of the extent to which asset managers incorporate ESG considerations into their investment processes. The scale runs from best to worst as follows: Leader, Advanced, Basic, and Low.

Top Sustainable Gold, Silver, and Bronze Funds

Parnassus Core Equity PRBLX leads the pack in terms of assets and earns the highest merit under both ratings systems. Small but mighty, Boston Trust Walden Small Cap BOSOX also fares well under both assessments. In terms of sustainability performance, seven of the top 11 earn High Morningstar Sustainability Ratings, a sign that their portfolios are exposed to little ESG risk compared with peers.

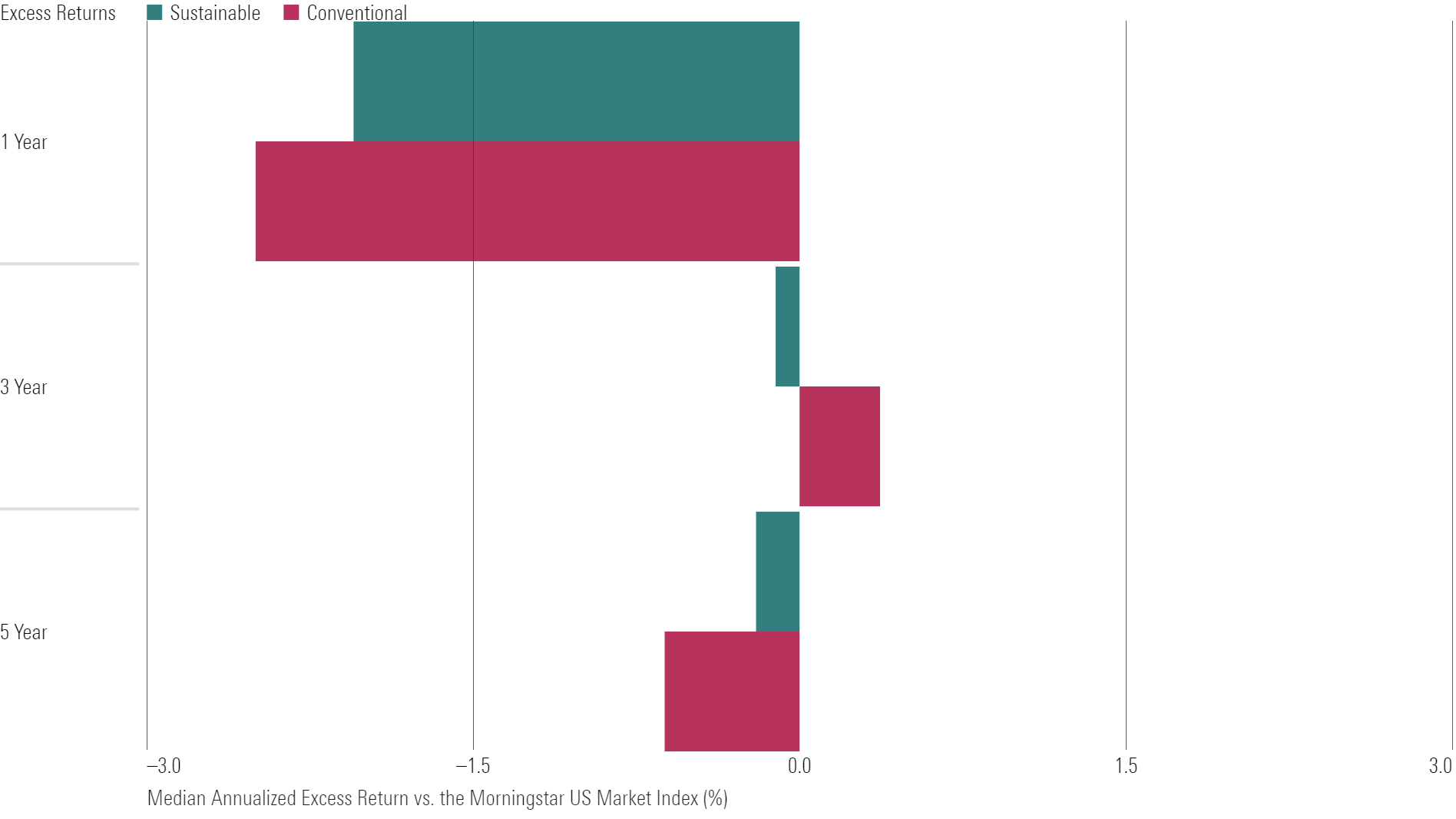

ESG Large-Blend Equity Funds Bounce Back From 2022′s Lows

In 2023, both sustainable large-blend equity funds and conventional peers lagged the Morningstar US Market Index, but the median shortfall was smaller for sustainable funds than for conventional peers. The top-performing sustainable large-blend equity fund was IQ Candriam U.S. Large Cap Equity ETF IQSU, which gained 32 percentage points during the year, nearly 6 percentage points better than the index.

Large-Blend Funds: Median Annualized Excess Return vs. the Morningstar US Market Index

In 2022, sustainable funds underperformed their conventional peers, in part because they didn’t participate as fully in the energy rally that followed Russia’s invasion of Ukraine. This is reflected in the trailing three-year comparison, where the median sustainable fund lagged the index by roughly 10 basis points and conventional funds outperformed.

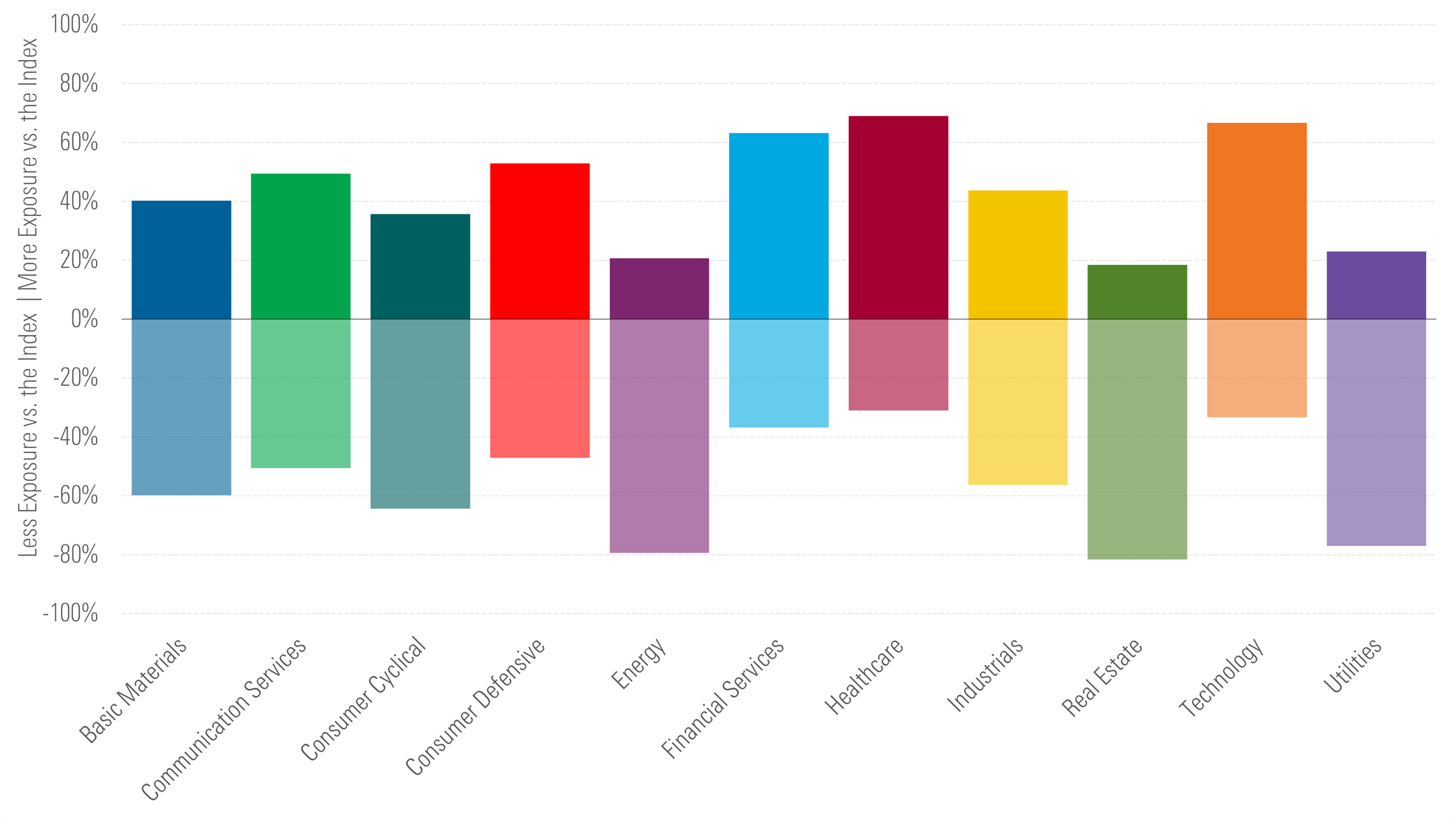

A Look Inside Portfolios: Tech Stocks Helped

In 2023, the median sustainable large-blend equity fund outperformed conventional peers but lagged the Morningstar US Market Index. To understand what drove sustainable funds’ performance in 2023, we compared the sector profiles for nearly 90 sustainable large-blend equity funds with that of the Morningstar US Market Index.

Sustainable Funds Sector Exposure vs. the Morningstar US Market Index Going Into 2023

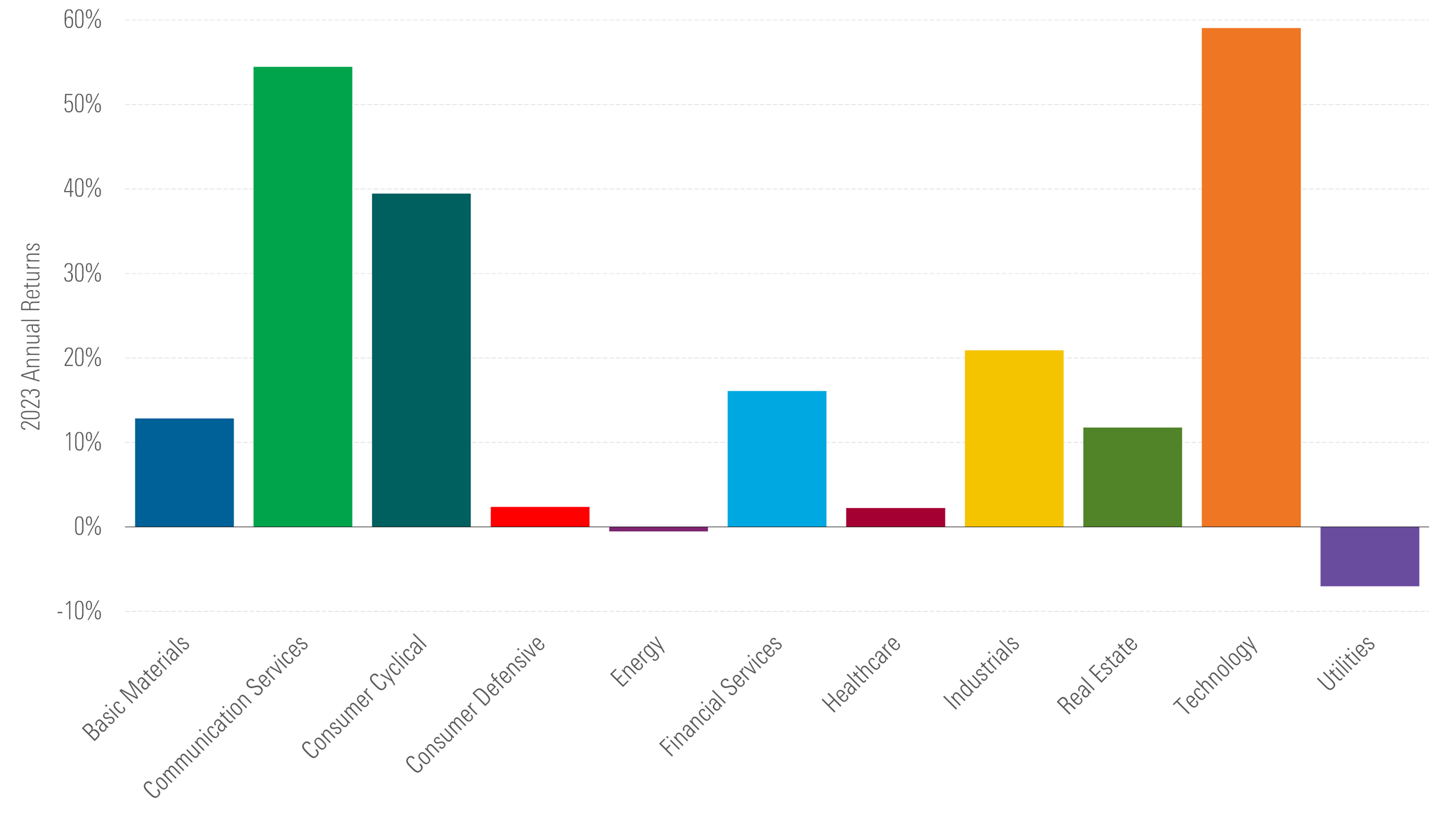

Equity Sector Annual Returns in 2023

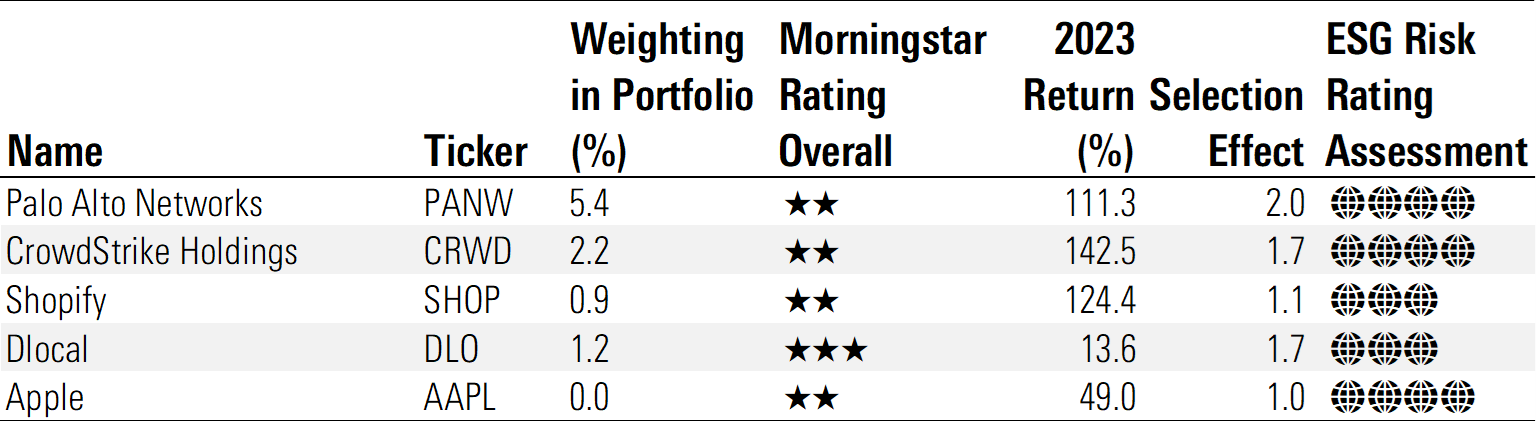

One Fund’s Top Tech Picks

Entering into 2023, two thirds of the universe held a relative overweighting to technology, which trounced all other sectors with its 59% gain in 2023. Eventide Large Cap Focus ETLAX maintained a 40% allocation to technology, nearly 26 percentage points higher than the benchmark. Because the sector bested all others in 2023, this helped the fund’s returns. Additionally, stock picks such as Palo Alto Networks PANW, CrowdStrike CRWD, Shopify SHOP, and Dlocal DLO contributed significantly to the fund’s success. Each of these carries Low or Medium levels of ESG risk compared with peers.

Eventide Large Cap Focus: Top 5 Technology Bets Going Into 2023

Because of the firm’s values-based approach, Apple AAPL did not make the cut into the portfolio. In this case, the exemption of Apple helped, as the fund reallocated its capital to other higher-performing technology names.

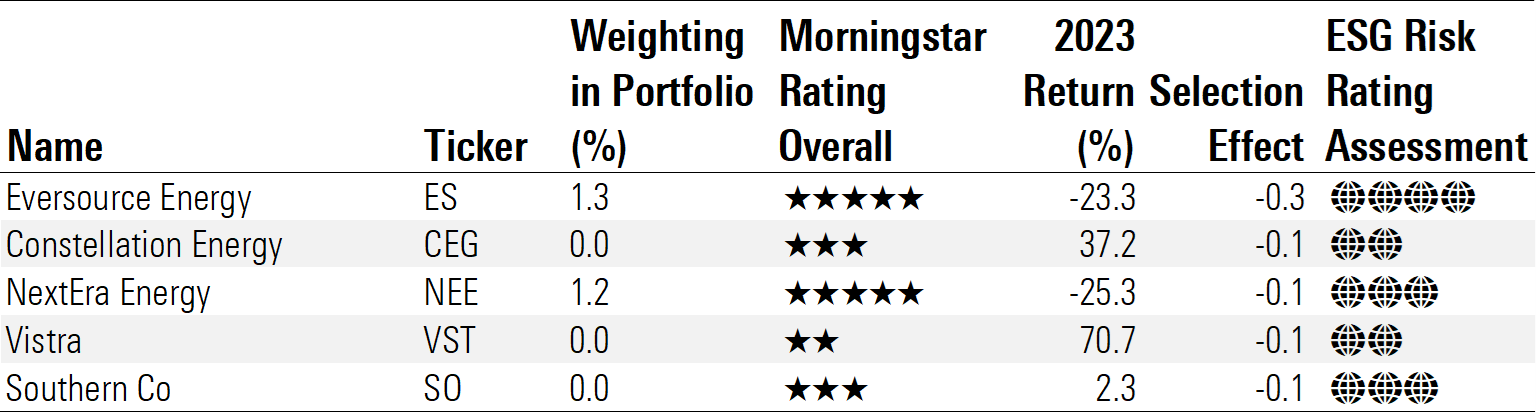

How Utilities Hurt an iShares Fund

On the other hand, nearly one fourth of the group maintained an overweighting to utilities stocks, compared with the market index. Since the sector lost 7% in 2023, funds with a relative overweighting were punished. IShares ESG MSCI USA Min Vol Factor ETF ESMV entered 2023 with a roughly 5-percentage-point overweighting in utilities. Because this sector was the worst performer in 2023, the additional exposure hurt the fund’s performance relative to the benchmark.

iShares ESG MSCI USA Min Vol Factor ETF: Main Utilities Detractors Going Into 2023

Stock picks within the utilities sector hurt, too. Compared with the benchmark, the fund held higher allocations to Eversource Energy ES and NextEra Energy NEE, each of which lost more than 20% during the year and ate on the fund’s returns.

On the flip side, Constellation Energy CEG and Vistra VST gained 37% and 71%, respectively. Both companies court High levels of ESG risk and were excluded from the portfolio, so the fund missed out on their wins.

For more on flows, assets, performance, and sustainability characteristics, download the full report here.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IJKB5DGDNJFLPP6SBNF27R3UEA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)