4 Undervalued Stocks That Just Raised Dividends

Mosaic and First Energy are among the cheap stocks with notable dividend increases in March.

Dividend stocks have lagged the broader market over the last year, but that poor performance is providing opportunities for long-term investors to find undervalued dividend payers. That includes those that have been raising their payouts.

Dividend investing comes in various forms. Investors can look for stocks that offer the highest yield, names with a history of stable dividend payouts and strong finances, or companies that are raising dividends. For this article, we screened for stocks that have increased their quarterly dividends, which can be a sign of a company’s confidence in its future finances.

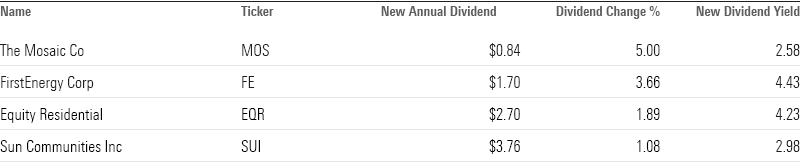

In all, there were four undervalued companies with dividend increases during March:

Dividend Stock Performance

How We Screened for Undervalued Stocks Raising Dividends

We combined this screen with one for stocks that are trading below their Morningstar fair value estimates, meaning they have attractive prices for long-term investors. These stocks offer the potential to benefit from both increased dividend yields and the possibility that their investment values will grow.

We started with the full list of US-based companies covered by Morningstar analysts and looked for names that pay investors a quarterly dividend. We then tracked changes from previous payouts in dividends declared during February. From there we filtered for companies that saw dividend increases. After that, we picked companies considered undervalued by Morningstar analysts, meaning they are rated 4 or 5 stars.

Undervalued Stocks With Dividend Increases

Here’s a deeper dive into these stocks and their outlooks from Morningstar’s equity analysts.

Mosaic MOS

- Morningstar Rating: 4 stars

- Fair Value Estimate: $40.00

- Price/Fair Value Ratio: 0.81

- Morningstar Economic Moat Rating: None

- Forward Dividend Yield: 2.58%

“Mosaic is a leading producer of potash and phosphate fertilizers. Mosaic’s US phosphate rock mines and Canadian potash assets provide the company with a stable input base for its products. Over the long run, Mosaic should benefit from growing global demand for fertilizer.”

Find Seth Goldstein’s complete coverage of Mosaic here.

FirstEnergy FE

- Morningstar Rating: 4 stars

- Fair Value Estimate: $43.00

- Price/Fair Value Ratio: 0.89

- Morningstar Economic Moat Rating: Narrow

- Forward Dividend Yield: 4.43%

“FirstEnergy’s regulated utilities are focused on accelerating investments that should result in solid earnings growth. The company expects to invest $26 billion through 2028, a 44% increase from the previous five-year capital investment plan, supporting our expectations for the company to achieve the midpoint of management’s 6%-8% annual earnings growth target.”

Find Andrew Bischof’s commentary on First Energy here.

Equity Residential EQR

- Morningstar Rating: 4 stars

- Fair Value Estimate: $79.00

- Price/Fair Value Ratio: 0.81

- Morningstar Economic Moat Rating: None

- Forward Dividend Yield: 4.23%

“Equity Residential has repositioned its portfolio over the past decade to focus on owning and operating high-quality multifamily buildings in urban, coastal markets with demographics that allow the company to maintain high occupancies and drive strong rent growth.”

Kevin Brown’s coverage of Equity Residential is available here.

Sun Communities SUI

- Morningstar Rating: 4 stars

- Fair Value Estimate: $172.00

- Price/Fair Value Ratio: 0.73

- Morningstar Economic Moat Rating: None

- Forward Dividend Yield: 2.98%

“Sun Communities is a residential REIT that focuses on owning manufactured housing, residential vehicle communities, and marinas. The company has grown significantly over the past decade after spending $11.8 billion since 2010 to build a portfolio of 667 properties from just 136 at the end of 2010.”

Find research here for Sun Communities from Kevin Brown.

Dividend Stock Investing: More Ideas to Consider

- Use the Morningstar Investor Screener tool to find the best dividend stocks according to your specific criteria. You can search for stocks based on their dividend yields, valuation measures like price/earnings ratios, and more.

- Use Morningstar Investor to build a watchlist of the best dividend stocks and easily follow those stocks’ valuations, ratings, and dividend yields.

- Watch our dividend stock video series, hosted by David Harrell, for ideas to consider.

- When it comes to buying stocks, it’s more than just dividends. Read here how valuations and competitive advantages—known as economic moats—matter when it comes to a stock’s potential for outperformance.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)