Markets Brief: Stocks Are Starting to Look Cheap Again

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

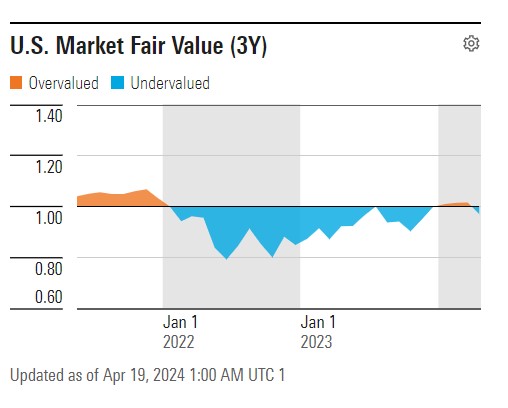

The Morningstar US Market Index ended the week 3.06% lower. Large technology companies led the decline, exemplified by the 14.5% fall in the price of Nvidia NVDA. Consequently, Morningstar equity analysts believe the US equity market is 2% undervalued. Although equities are undoubtedly more attractively priced now than they were a few weeks ago, the chart below shows that prices fluctuate widely around fair values. Because of this, the most recent changes in stock prices should not be seen as indicative of a need to adjust one’s portfolio.

US Market Fair Value

Looking more broadly at global capital markets, it seems most equity and bond markets offer investors normal returns. Investors can thus create diversified portfolios without sacrificing expected returns. More information about which global assets Morningstar’s Investment Management team currently favors can be found in the recently published quarterly convictions document.

Earnings Season: Will Tech Stocks Outperform?

Looking at FactSet, as we move deeper into the US corporate reporting season, analysts forecast a bifurcated outcome, with the largest technology companies delivering strong profit growth while the remainder of the market reports profit declines. Given how concentrated commonly used benchmark indexes are, the contributions of the technology companies will likely lead to overall profit growth. However, this concentration also creates vulnerability to disappointment among investors, which could lead to concern about the health of the US economy. Amid these competing narratives, one should focus on individual businesses’ fundamental characteristics and valuations. To help with this, Morningstar has a dedicated page on company earnings.

Why Invest In Bonds?

As expectations have continued to weaken for interest rate cuts, Treasury bonds have become more attractively priced as sources of both returns and portfolio diversification in the event of weaker-than-expected economic growth. However, when investing in bonds, you must know why you own them. Investors who fail to specify bonds’ role in a portfolio and don’t properly organize the remainder risk achieving none of their aims.

Beware of Harmful Market Narratives!

The week ahead will likely be an obstacle course for investors, with a slew of economic and company data coming out against a volatile macroeconomic backdrop. Most prominent is the latest economic growth data on Thursday and the latest inflation data on Friday. Stronger-than-expected outcomes would fuel speculation that interest rate cuts will be further delayed and cause further volatility in asset prices.

With so much news, every asset price movement will likely be attributed to a piece of data, creating a narrative among investors. Such narratives are harmful, as they fool us into believing we can successfully predict near-term market movements and encourage us to chase short-term trading profits rather than the rewards good businesses provide to their owners over the long term.

Highlights of This Week’s Market and Investing Events

- Monday, April 22: Earnings from Verizon Communications VZ

- Tuesday, April 23: April Purchasing Managers Index Composite, earnings from GE Aerospace GE, General Motors GM, Tesla TSLA

- Wednesday, April 24: March Durable Orders, earnings: AT&T T, Boeing BA, Ford Motor F, Meta Platforms META, ServiceNow NOW

- Thursday, April 25: Corporate Earnings: American Airlines AAL, PG&E PCG, Alphabet GOOGL, Microsoft MSFT, Snap SNAP

- Friday, April 26: - March PCE Deflator, earnings from Exxon Mobil XOM

Check out our full weekly calendar of economic reports and corporate earnings.

Stats for the Trading Week Ended April 19

- The Morningstar US Market Index fell 3.07%.

- The best-performing sectors were utilities, up 1.81%, and consumer defensive, up 1.24%.

- The worst-performing sector was technology, down 7.04%.

- Yields on 10-year US Treasury notes rose to 4.62% from 4.50%.

- West Texas Intermediate crude prices fell 3.89% to $83.22 per barrel.

- Of the 704 US-listed companies covered by Morningstar, 216, or 31%, were up, three were unchanged, and 485, or 69%, were down.

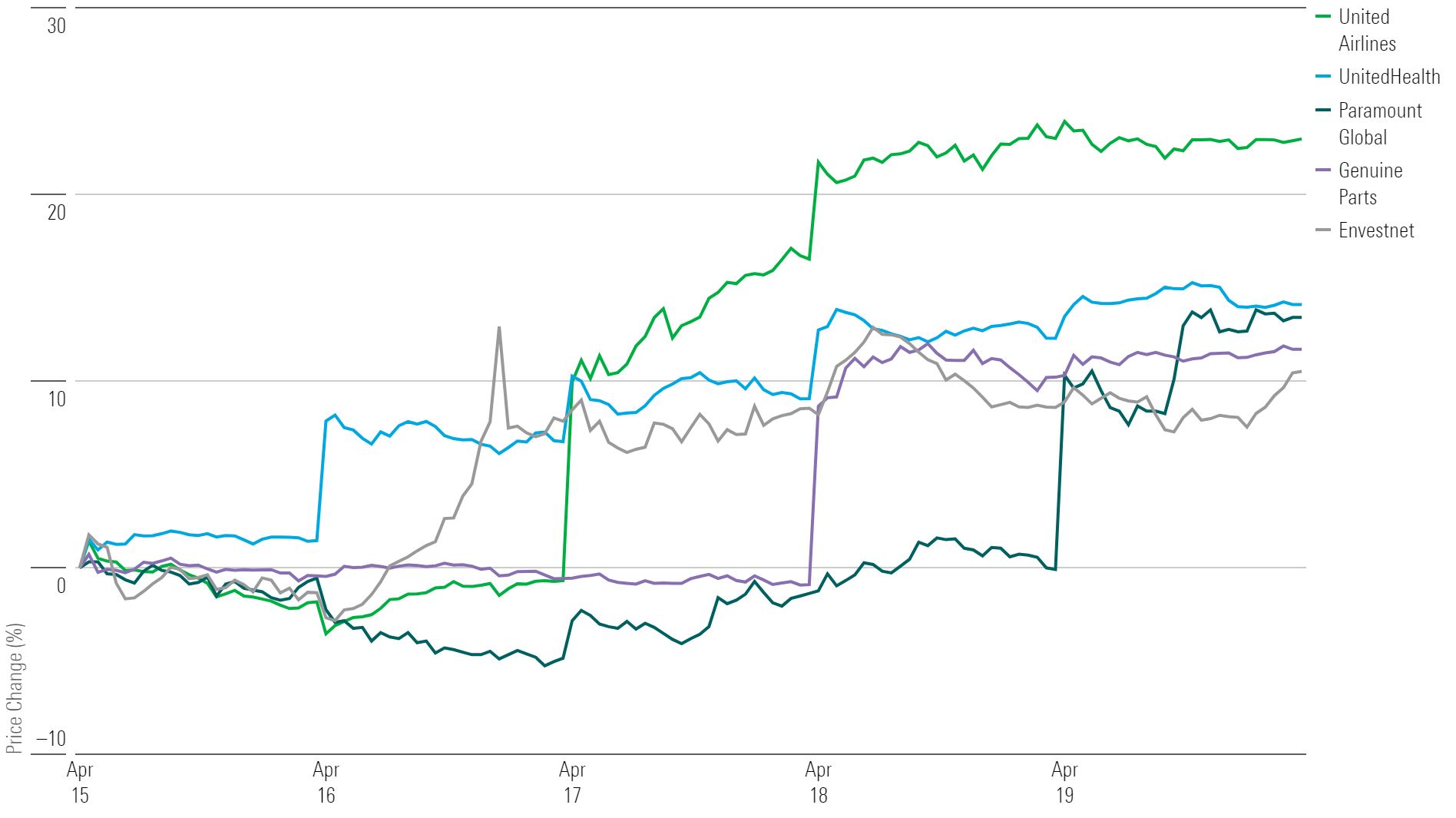

What Stocks Are Up?

United Airlines UAL, UnitedHealth Group UNH, Paramount Global PARA, Genuine Parts GPC, and Envestnet ENV.

Best-Performing Stocks of the Week

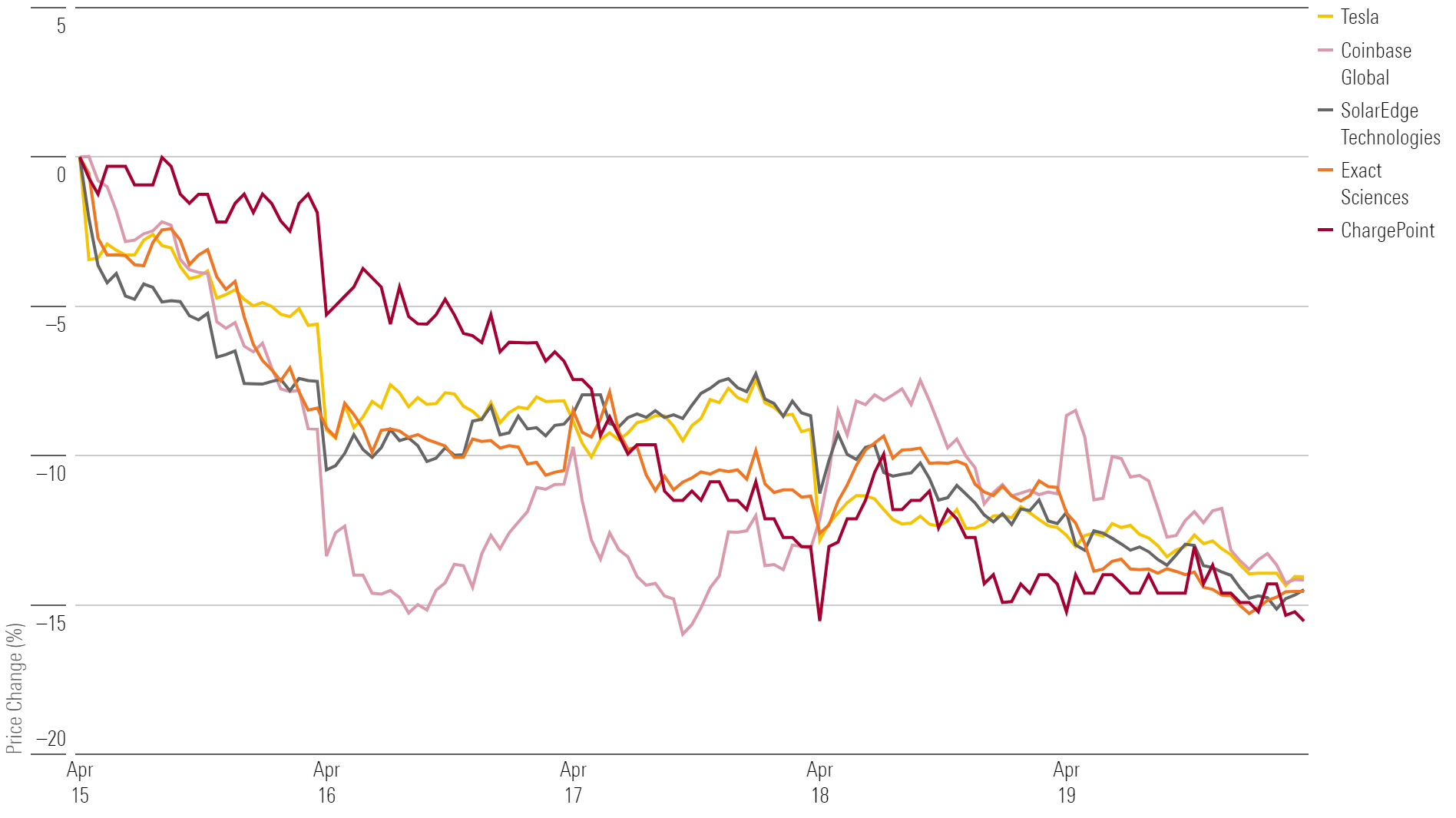

What Stocks Are Down?

ChargePoint CHPT, SolarEdge Technologies SEDG, Exact Sciences EXAS, Coinbase Global COIN, and Tesla TSLA.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)