Ratings Changes for March Reflect the Importance of Strong Lead Managers

Here are some ratings highlights from March.

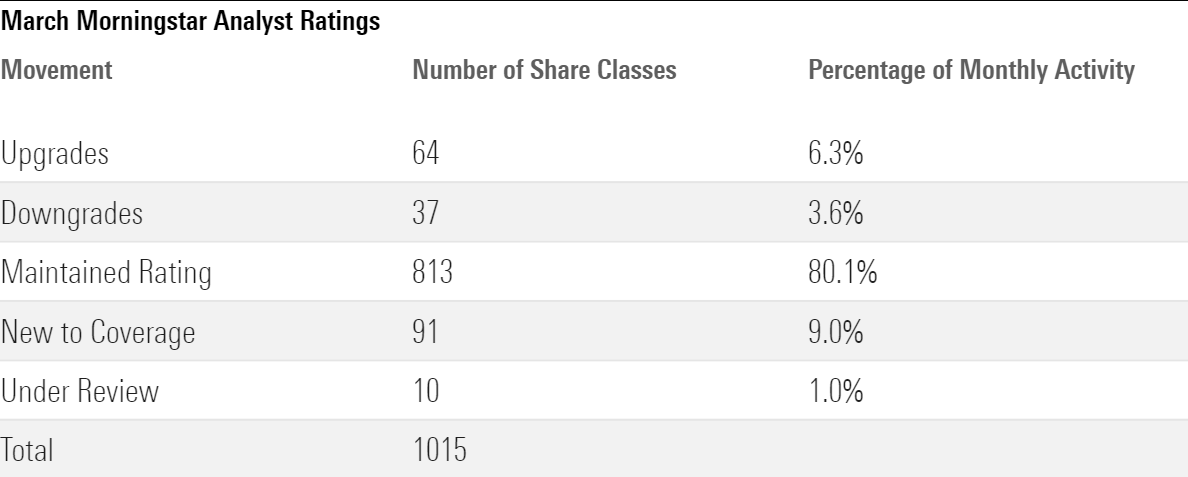

Morningstar updated the Morningstar Analyst Ratings for 1,015 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios in March 2022. Of these, 813 maintained their prior rating, 37 were downgraded, 64 were upgraded, 10 were placed Under Review owing to material changes such as manager departures, and 91 were new to coverage.

Looking through share classes and vehicles to underlying strategies, Morningstar issued 222 Analyst Ratings during March. Of these, seven were new to coverage and the remainder had at least one investment vehicle that had been previously covered by a Morningstar analyst.

Below are some of the highlights of the downgrades, upgrades, and strategies new to coverage.

Downgrades:

The upcoming retirement of John Hancock Income’s JSTIX longest-tenured manager, Dan Janis, dropped the strategy’s Morningstar Analyst Rating to Neutral from Bronze for all share classes. Janis’ departure may not affect day-to-day operations, but his experience overseeing this wide-ranging strategy will be missed. As lead manager, Janis played a hands-on role in the fund’s currency-trading program. Kisoo Park, who comanages this strategy and also has traded currencies in his career, will now oversee that sleeve from Hong Kong. U.S.-based managers Tom Goggins and Chris Chapman, who joined the strategy in 2009 and 2017, respectively, will ensure some continuity. While the team’s dedicated analysts and strategists still support the management trio, Janis’ departure leaves a noticeable void.

The departure of Metropolitan West Unconstrained Bond Fund’s MWCRX lead manager dropped its Analyst Rating to Silver from Gold. Tad Rivelle, TCW’s longtime fixed-income CIO and one of the strategy’s four generalist portfolio managers, retired from the firm at year-end 2021. While the remaining three generalists and supporting sector teams are impressive, the potential for further change among TCW’s senior ranks remains elevated through the end of 2022, when CEO David Lippman's contract expires. There’s still a lot to like, though. Management uses a time-tested approach of putting credit risk front and center, with nonagency residential mortgages, asset-backed securities, and corporate bonds figuring prominently. Finally, the supporting cadre of specialists, analysts, and traders remains among the strongest in the industry, adding to its appeal.

Upgrades:

Nuveen’s environmental, social, and governance target-risk series is a solid choice for those seeking sustainable-themed investments. Its straightforward allocation process utilizes sound ESG ETFs, supporting an upgraded Analyst Rating of Bronze, up from Neutral. Managers John Cunniff and Steve Sedmak focus on broad diversification and steady allocations using seven of Nuveen’s low cost-ESG ETFs (five equity and two fixed-income) as the building blocks. The series earns an Advanced Morningstar ESG Commitment Level, a qualitative assessment reflecting ESG integration in the investment process. The ETFs are run by MSCI with minimal tracking error relative to their non-ESG parent index. The ETFs exclude firms involved in fossil fuels, gambling, and tobacco, and use a carbon emissions criterion to tilt toward sustainable-themed companies, targeting the top 50% of rated companies. The team added Nuveen ESG High Yield Corporate Bond ETF NUHY in early 2020’s market turmoil, which bolstered returns in the ensuing rebound and improved the bond portfolio’s diversification.

Increased confidence in Fidelity Advisor Diversified Stock’s FDESX veteran manager and surrounding resources boosted its Analyst Rating to Bronze for most of its share classes, though the priciest shares remain rated Neutral. Dan Kelley has ample, relevant industry experience. He previously (2012-18) led large-growth fund Fidelity Trend FTRNX, which beat its peers but lagged its benchmark on his watch. Kelley then adopted his investment approach to this style-flexible strategy in 2018 after joining as a comanager one year prior. He diversifies the portfolio across three kinds of companies he distinguishes by their quality, growth profile, and valuation. While the approach is sensible, it benefits from the support and insights of Fidelity’s large equity research department. The strategy’s results under Kelley have been impressive next to rival stock-pickers.

New to Coverage:

The Neuberger Berman Sustainable Tax Efficient model portfolio series debuted with Neutral Analyst Ratings as it seemingly lacks an allocation advantage relative to peers. Erik Knutzen is the solo portfolio manager with broad discretion, but he lacks a large, seasoned crew to assist. That said, the managers of the series’ underlying holdings tend to be experienced and successful at their ESG-leaning mandates. On top of a small team, the construction process also raises questions. The strategic asset-allocation targets are typical but imprecise, and the tactical allocation plan lacks discipline and definition. Passive strategies hold about 40% of assets, while 60% of assets are actively managed funds, predominantly from Neuberger Berman. Because of the tax-aware goal, Neutral-rated Neuberger Berman Municipal Impact NMIIX plays a big role here, currently holding 50% of the conservative model’s assets.

/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)