Beware the Crypto Spot ETF Bubble

Crypto funds may be witnessing a resurgence, but few launches have true long-lasting impact.

The evolution of the cryptocurrency landscape has been a journey filled with everything from rags-to-riches wealth to alleged fraud.

Despite numerous challenges, the cryptocurrency market has seen numerous launches over the past decade and surpassed the milestone of $1 trillion in market capitalization in the second quarter of 2023.

Now comes the next major turning point for the crypto industry: The SEC is currently reviewing proposals for six crypto spot exchange-traded funds. They could potentially see approval by early 2024.

While opportunities for investors exist in the cryptocurrency space, we emphasize the need to navigate this dynamic and volatile market prudently.

Crypto Launches: A Bull Market Phenomenon

Cryptocurrency managed investment products come in various sizes and shapes, including physical crypto exchange-traded products, synthetic crypto ETPs, and inverse crypto ETPs.

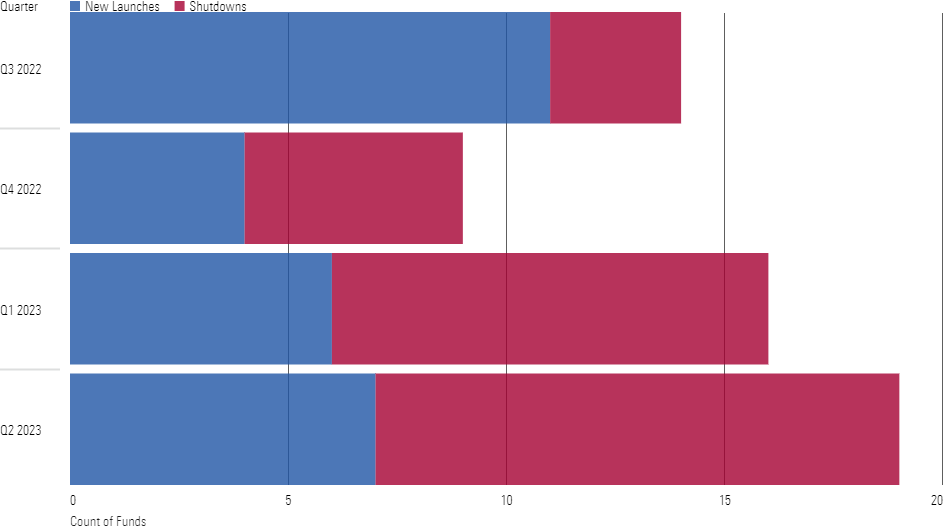

The chart below demonstrates recent launches and shutdowns of crypto ETPs. Over the past year, the number of funds liquidated has risen significantly. On average, the funds that were liquidated had an average life of less than one year and average assets of around $500,000 at shutdown.

Crypto ETP Launches Versus Shutdowns Over the Past 4 Quarters

BITX: The First Leveraged Crypto ETF

The latest product on the crypto scene is the leveraged crypto ETP: The launch of Volatility Shares’ 2x Bitcoin Strategy ETF BITX in late June 2023 marked the first ever leveraged crypto ETF to be approved by the SEC.

BITX seeks to provide daily investment results, before fees and expenses, which correspond to twice the performance of the S&P CME Bitcoin Futures Daily Roll Index for a single day. The fund does not invest directly in bitcoin—rather, it seeks to mimic the performance of bitcoin futures contracts daily.

Leveraged products are inherently risky, so on top of the risk associated with the overall crypto market, the performance of leveraged crypto ETFs is especially unpredictable.

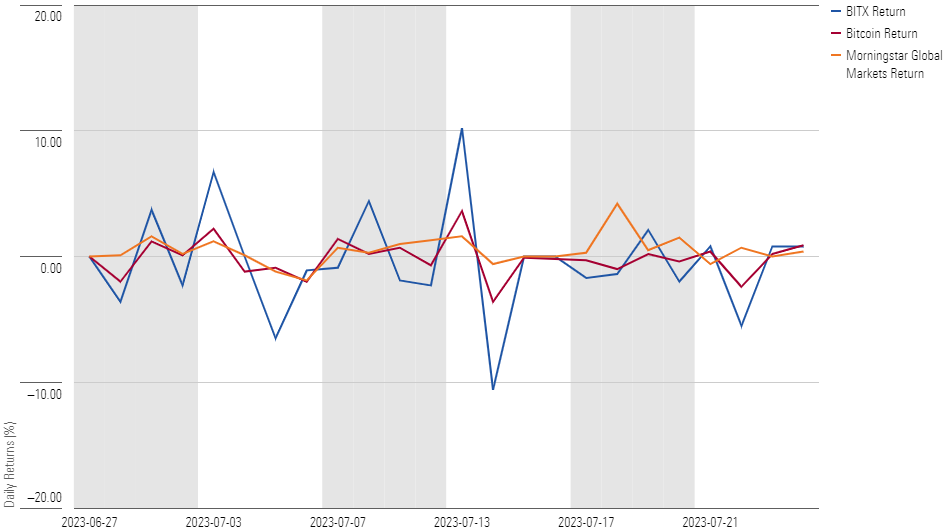

The chart below shows the daily returns of BITX since launch compared with the returns of bitcoin and the S&P 500. As is evident, the leveraged ETF’s daily returns have been highly volatile, with a standard deviation of 4.3% daily—nearly 3 times greater than bitcoin’s daily standard deviation of about 1.6%, and 4 times greater than the broader equity market’s daily standard deviation of around 1%.

Daily Returns of BITX Versus Bitcoin and Equity Market

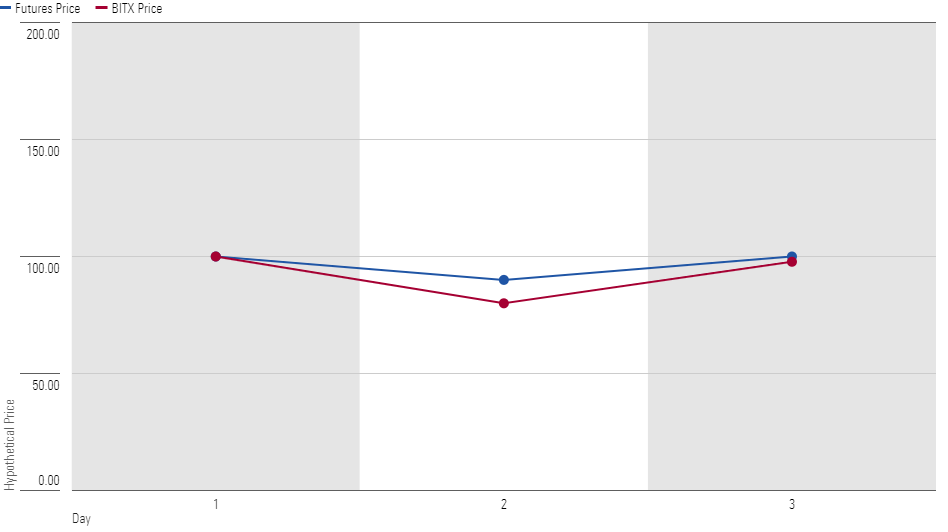

One salient feature of leveraged products is their downward returns bias, which arises from the compounding effect of leveraged returns.

As these financial instruments aim to magnify the daily performance of the underlying asset, fluctuations over time can lead to underperformance compared with the asset’s cumulative return. The compounding effect can cause the leveraged product to lose value even when the underlying asset returns to its initial level.

For instance, suppose Bitcoin Futures (the underlying security for BITX) and BITX are both currently trading at $100. If the futures fall by 10% in a day, BITX itself can be expected to fall by 20% on that day. This brings the price of the futures contract to $90 and the price of BITX to $80. If, on the subsequent day, Bitcoin Futures rises by 11.1%, the price of the future goes back to the original price of $100.

However, BITX rises by 22.2%, bringing its price to $97.76—still short of the original price of $100 by 2.24%. This negative performance bias can compound significantly over time, as explained in the below visual. The phenomenon is more pronounced in volatile markets, making leveraged products better suited for short-term trading.

Downward Bias of Leveraged Products

As of July 17, the fund has assets under management to the tune of $22.5 million. Much like other digital assets funds, it too has a high expense ratio: 1.85%.

Are Spot-Price-Based Crypto ETFs Coming to the U.S.?

Europe’s first-ever spot-price-based crypto ETF launched this week on the Euronext Amsterdam Exchange, and it may not be long before the United States follows suit.

United Kingdom-based Jacobi Asset Management is behind Europe’s first Bitcoin ETF (trading under the ticker BCOIN, which is not yet under Morningstar coverage), which will expose investors to actual shares, unlike previous crypto products.

In the U.S., though the SEC had previously been rigorous in rejecting proposals for crypto spot ETFs (citing concerns about the lack of regulation), it has recently begun accepting applications. There are currently six pending applications from several leading fund houses, including BlackRock, Fidelity, VanEck, WisdomTree, and Bitwise.

While the formal approval process may take some time to complete, it’s clear that change is coming.

This sequence of events has brought around renewed optimism in the crypto market, pushing bitcoin and related investment vehicles higher. Still, traders in the perpetual futures market tied to bitcoin remain risk-averse, unwilling to take on high leverage.

Similar products have also launched in other countries, including Canada, Brazil, and the United Arab Emirates, but they received limited investor attention. The average assets under management of a few of the earliest and largest Canadian crypto spot ETFs have changed over time, and it shows the same pattern: Optimism when products are launched followed by a period of dull growth and poor performance.

Is Crypto the New Gold?

Many investors and influencers have compared crypto and gold, drawing parallels between the emergence of gold investing in the 1970s and the modern rise of crypto. In the 1970s, gold was a largely unregulated asset, and the launch of gold products and ETFs in subsequent years helped its adoption as a reliable alternative asset by conventional investors.

The hypothesis is that crypto should be thought of as a commodity and that, much like gold, the launch of mainstream crypto products will help with the mainstream adoption of crypto, too.

However, gold does provide an established hedge against both equity and inflation. The chart below shows that, during any major equity market correction, gold has risen to the challenge and been an effective hedge.

Gold Has Served as a Good Hedge Against All Major Equity Drawdowns

Crypto, on the other hand, has shown no such benefits. We believe that cryptocurrencies should not be identified as an asset class or as a commodity—it has no fundamental features that resemble either.

What’s Next for Crypto Investors?

Data suggests that the optimistic turn of events in the cryptocurrency market has had almost no significant impact on investor outcomes.

Coinbase, the second-largest crypto exchange, once touted crypto as the future of finance by championing “a global, open alternative to every financial service.”

But more recently, it has claimed that crypto is “not like stocks.” In a document submitted to the SEC, Coinbase argued that buying crypto is akin to “the sale of a condo in a new development. Or an American Girl Doll, or a Beanie Baby, or a baseball card.” This goes miles to show that there is absolutely no certainty in terms of what really is in store for crypto investors.

Crypto investors are still right to be concerned with the challenges of the space, especially the volatility and the regulatory uncertainty around it. Though the forthcoming launch of a U.S.-based spot bitcoin ETF is an important milestone, it remains to be seen whether such products will survive beyond their initial hype.

As such, it is important that investors take a long-term perspective and are prudent about market conditions.

We believe retail investors should wait to see whether these products can garner enough traction to see the light of day—let alone see convincing performance.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)