6 Top-Performing TIPS Funds

Funds from iShares, Pimco, and Vanguard lead the inflation-protected bonds category

Investors look to funds focused on Treasury Inflation-Protected Securities to cushion portfolios against inflation. However, TIPS fund investors have learned the hard way over the last two years that rising interest rates can offset their benefits.

With bond yields resuming their push higher this year, TIPS funds that tend to hold more short-term bonds (less sensitive to changes in interest rates than longer-term ones) have provided the best performance.

To screen for the best-performing funds in this category, we looked for the ones that have posted the best returns over the last one-, three-, and five-year periods. Of the six we found, all but one are index-tracking funds.

- Eaton Vance Short Duration Inflation-Protected Income Fund EIRRX

- FlexShares iBoxx 3-Year Target Duration TIPS Index Fund TDTT

- iShares 0-5 Year TIPS Bond ETF STIP

- iShares Short-Term TIPS Bond Index Fund BKIPX

- Pimco 1-5 Year US TIPS Index Exchange-Traded Fund STPZ

- Vanguard Short-Term Inflation-Protected Securities Index Fund VTIP

What Are TIPS?

A TIPS bond offers portfolios a safeguard against inflation that conventional Treasury bonds do not by adjusting its principal (or the face value) to changes in the Consumer Price Index, a widely used measure of inflation. The value of a TIPS principal is raised when the CPI rises, resulting in increased coupon payments. TIPS bonds generally outperform traditional Treasury bonds when inflation rates are higher than expected. Conversely, they can underperform when inflation is lower than anticipated, as the base interest rate is adjusted downward to account for the inflation-adjusted principal.

TIPS Funds Performance

TIPS Funds vs. the US Core Bond Index

Have TIPS funds successfully protected investors from inflation? The last two years have provided a significant test, along with a window into how these funds work.

Inflation hit a four-decade high in 2022, when the CPI at its worst reading posted a 9.1% annual increase. That surge prompted the Federal Reserve to raise interest rates at its most aggressive pace ever. In response, the bond market saw its worst selloff in history; the Morningstar US Core Bond Index lost 13% that year. The average TIPS fund fared better but posted a significant loss regardless, dropping 9.5%.

By the final months of 2023, the inflation picture improved, which boosted investor confidence that things were under control. That made Treasury bonds look like a more appealing investment opportunity, and investors lost interest in TIPS, according to Eric Jacobson, director of manager research, US fixed-income strategies at Morningstar. With bond yields falling back sharply, TIPS fund returns of 3.83% were eclipsed by the Core Bond Index’s 5.31%.

Inflation has taken another turn for the worse to start 2024, leading to another rise in bond yields. This was seen in the return comparison between the average TIPS fund’s loss of 0.32% and the Core Bond Index’s average loss of 1.62%. According to Jacobson, the takeaway is that in environments like the past two years, shorter-duration TIPS investment tends to offer more effective inflation protection, due to its lower sensitivity to interest rate changes.

Short-Term vs. Long-Term TIPS Funds

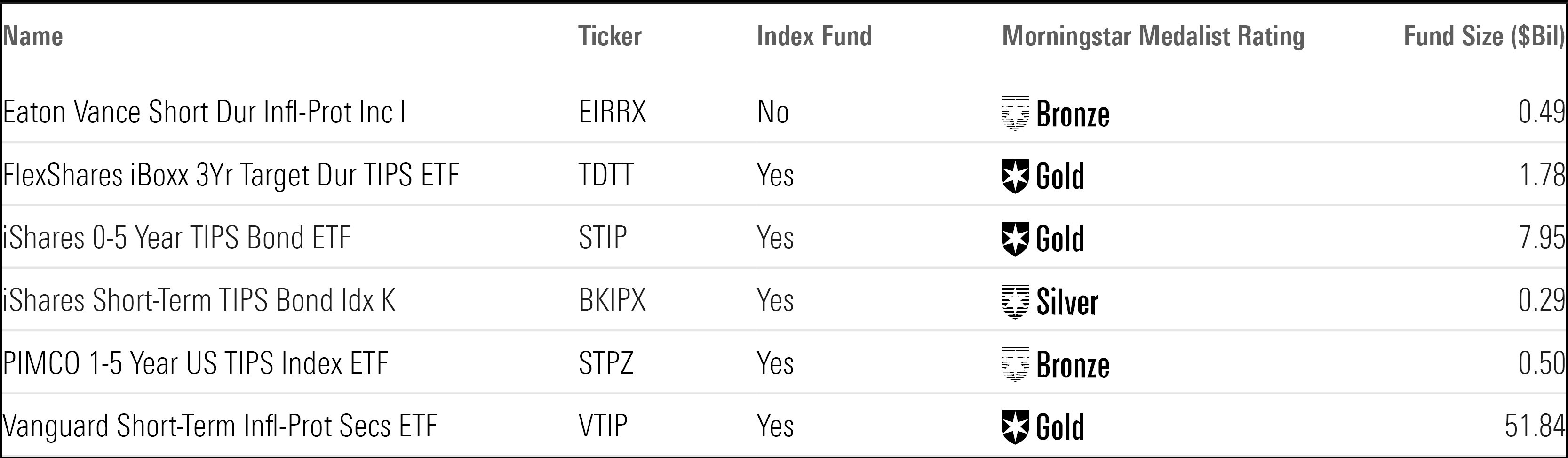

6 Top-Performing TIPS Funds

To identify the best TIPS bond funds, we first eliminated funds with less than $100 million in assets and those without at least a Bronze Medalist Rating. Next, we chose funds that ranked in the top 33% of their categories over the past one-, three-, and five-year periods. We then highlighted the six funds with the highest year-to-date performance.

Five of the selections are passive funds. TIPS bonds constitute a specialized area where fees play a crucial role in the differentiation of funds, making the lower expense ratio of passively managed funds more appealing. Eaton Vance Short Duration Inflation-Protected Income Fund was the exception, with an active investing approach.

The screen was based on the lowest-cost share class for each fund, but some share classes may not be directly accessible to individual investors outside of retirement plans. Individual share classes may have higher fees. For more detailed information on the funds’ performance, refer to the table at the end of this article.

Top-Performing TIPS Funds

Eaton Vance Short Duration Inflation-Protected Income Fund

- Ticker: EIRRX

- Morningstar Rating: 5 Stars

- Morningstar Medalist Rating: Bronze

“Compared with other funds in the Inflation-Protected Bond Morningstar Category, this fund consistently takes on higher credit risk and lower interest-rate sensitivity over the past few years. Opening the analysis to additional factors, the portfolio has displayed biases over time, whether towards or away from certain fixed-income instruments. Relative to the average strategy in the category, the managers have been significantly overweight corporate debt in recent years. In the latest month, the strategy has relatively overweighted corporate bonds compared with its peers. Additionally, there’s been a bias away from debt with 20- to 30-year maturities over the past few years. Similarly, the strategy has recently had less exposure to debt with 20- to 30-year maturities than peers. Finally, during the past few years, the fund leaned away from AA-rated bonds. In recent months, the strategy also had less exposure to AA-rated bonds than its peers.”

- Morningstar Manager Research

FlexShares iBoxx 3-Year Target Duration TIPS Index Fund

- Ticker: TDTT

- Morningstar Rating: 4 Stars

- Morningstar Medalist Rating: Gold

“Compared with other funds in the Inflation-Protected Bond Morningstar Category, this fund consistently took on lower credit risk over the past few years. Opening the analysis to additional factors, the portfolio has displayed biases over time, whether towards or away from certain fixed-income instruments. Relative to the category average, the managers have been underweight AA-rated bonds in recent years. In the latest month, the strategy has also relatively underweighted AA-rated bonds compared with Morningstar Category peers. Additionally, the managers have exhibited a notable sector bias towards government bonds over the past few years. Compared with category peers, the strategy had more exposure to government bonds in the most recent month. Finally, during the past few years, the fund leaned meaningfully away from debt with 20- to 30-year maturities. In recent months, the strategy also had less exposure to debt with 20- to 30-year maturities than its peers.”

—Morningstar Manager Research

iShares 0-5 Year TIPS Bond ETF

- Ticker: STIP

- Morningstar Rating: 5 Stars

- Morningstar Medalist Rating: Gold

“The investment seeks to track the investment results of the ICE US Treasury 0-5 Year Inflation Linked Bond Index. The index measures the performance of TIPS with a remaining maturity of five years or fewer. The fund will invest at least 80% of its assets in the component securities of the underlying index, and the fund will invest at least 90% of its assets in U.S. Treasury securities that BFA believes will help the fund track the underlying index.”

—Morningstar Manager Research

iShares Short-Term TIPS Bond Index Fund

- Ticker: BKIPX

- Morningstar Rating: 4 Stars

- Morningstar Medalist Rating: Silver

“This strategy offers exposure to the short end of the curve, which correlates more closely with inflation than portfolios that include longer-term TIPS portfolios. Interest-rate changes may overshadow the inflation-protection benefits of longer-term TIPS given their higher duration than this fund.

“There are two managers listed on the fund: Karen Uyehara and James Mauro. Experience on the team is abundant, with 14 years of average portfolio management experience. Together, they manage 114 strategies, with solid long-term prospects. The strategies average a Silver asset-weighted Morningstar Medalist Rating, indicating a position to deliver positive alpha relative to the category median in aggregate.”

—Mo’ath Almahasneh and Morningstar Manager Research

PIMCO 1-5 Year US TIPS Index Exchange-Traded Fund

- Ticker: STPZ

- Morningstar Rating: 4 Stars

- Morningstar Medalist Rating: Bronze

“The fund tracks the ICE BofA 1-5 Year U.S. Inflation-Linked Treasury Index, which includes TIPS between one to five years until maturity. The fund weights qualifying bonds by their market value, which promotes low turnover and mitigates transaction costs. This is a sound approach because the TIPS market is liquid and does a good job of pricing these bonds.

“Market-value-weighting is a sound approach. It is cost-effective, promotes low turnover, and the market does a decent job pricing these bonds given the homogeneous nature of the US TIPS market.

“This strategy offers exposure to the short end of the curve, which correlates more closely with inflation than portfolios that include longer-term TIPS. Interest-rate changes may overshadow the inflation-protection benefits of longer-term TIPS given their higher duration than this fund.”

—Mo’ath Almahasneh

Vanguard Short-Term Inflation-Protected Securities Index Fund

- Ticker: VTIP

- Morningstar Rating: 5 Stars

- Morningstar Medalist Rating: Gold

“The fund tracks the Bloomberg US Treasury Inflation-Protected Securities 0-5 Year Index, which includes TIPS with less than five years until maturity. The index weights qualifying bonds by their market value, which promotes low turnover and mitigates transaction costs. This is a sound approach because the TIPS market is liquid and does a good job of pricing these bonds.

“This strategy offers exposure to the short end of the curve, which correlates more closely with inflation than portfolios that include longer-term TIPS portfolios. Interest-rate changes may overshadow the inflation-protection benefits of longer-term TIPS given their higher duration than this fund.”

—Mo’ath Almahasneh

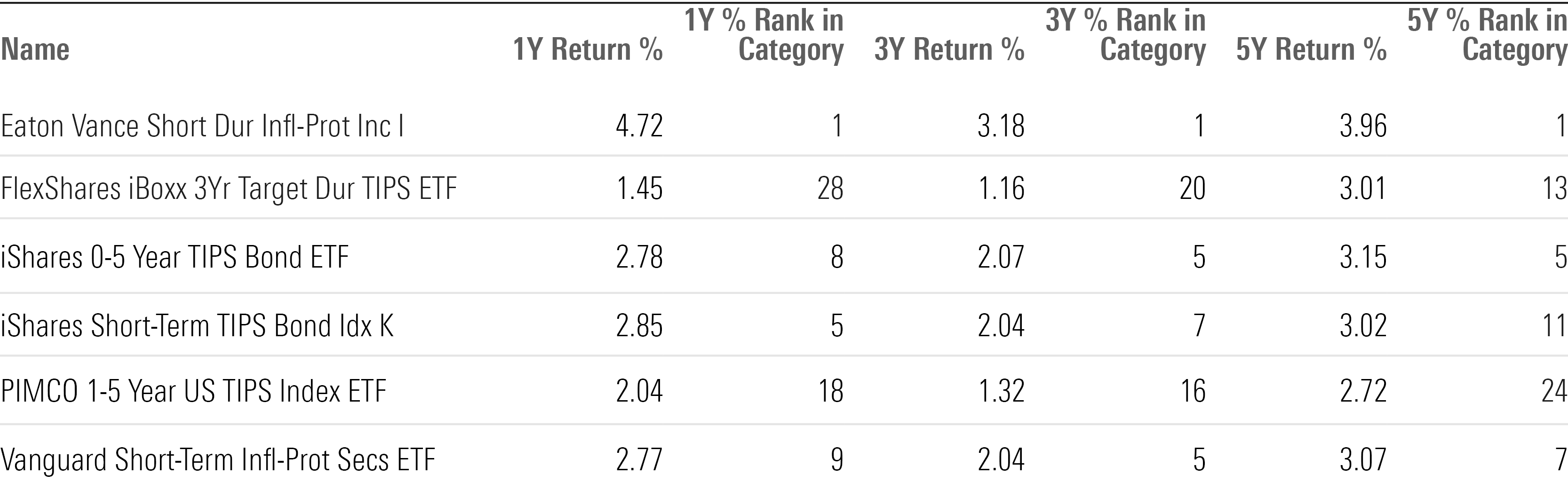

Long-Term Returns of Top-Performing TIPS Funds

TIPS Performance Table

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)