10 Funds That Buy Like Buffett in 2024

These mutual funds hold the same stocks as Warren Buffett’s Berkshire Hathaway.

Tens of thousands of investors will gather in Omaha this week for Berkshire Hathaway’s BRK.B annual shareholder meeting, the first since the November 2023 death of chairman Warren Buffett’s longtime business partner Charlie Munger. That means it’s time for our annual list of mutual funds whose portfolios have holdings in common with the Oracle of Omaha’s. These “Funds That Buy Like Buffett” have a high percentage of stocks in common with Berkshire’s investment portfolio, as listed in Buffett’s annual letter to shareholders and Berkshire’s annual report.

Buffett’s shareholder letter used to list Berkshire’s 15 largest stock holdings by market value, but this year the annual report just lists the five largest holdings as of Dec. 31, 2023: American Express AXP, Apple AAPL, Bank of America BAC, Chevron CVX, Coca-Cola KO. Occidental Petroleum OXY is also a major stock holding and a favorite of Buffett’s, though it is included in a different section (equity investments) because Berkshire owns more than 20% of the company’s shares.

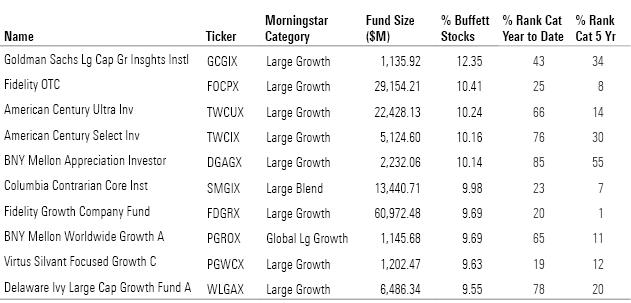

The table below shows the open-end mutual funds with the largest combined weightings in those six “Buffett stocks,” as of their most recent portfolio. We excluded funds without at least $1 billion in assets or a five-year track record, those not covered by Morningstar analysts, and sector funds such as technology and financial services funds.

With those constraints, the following table shows the 10 funds with the most Buffett-like taste in stocks. We show each fund’s Morningstar Category, size, percentage in the six Buffett stocks, and percentile rank in its category for the year to date and for the trailing five years through April 24, 2024. Nine of the 10 funds have beaten their category median over the past five years, illustrating the value of holding the type of high-quality growth stocks that Buffett favors. (For reference, the six Buffett stocks make up just over 8% of the S&P 500, though few actively managed funds hold all six.)

Diversified Funds That Own The Same Stocks as Warren Buffett

American Century Ultra TWCUX and American Century Select TWCIX occupied the top two spots on this list in each of the past two years, and this year they’re third and fourth. Veteran portfolio managers Keith Lee and Michael Li run both; their Buffett-like approach to picking growth stocks focuses on companies with histories of high profits, and competitive advantages to help them maintain those profits over time. These funds’ presence atop this list is attributable to one stock: Apple. That Buffett favorite is the largest holding in both funds, taking up around 10% of each one’s assets. Both funds have put up pretty good performance numbers in recent years, though each earns a Morningstar Medalist Rating of Neutral for the investor shares, owing to portfolio constraints that make it hard to stand out in the crowded large-growth space.

Just above the two American Century funds is the $29 billion Fidelity OTC FOCPX, which was third last year. Manager Chris Lin is a Fidelity veteran who used to run technology sector funds. His approach to finding growth stocks is Buffett-like only in the very broadest sense: Lin focuses on finding competitively advantaged firms that have pricing power but don’t require a lot of capital investment. He, like Buffett and many of the other managers on this list, is a big fan of Apple, which took up just over 10% of the fund’s Feb. 29, 2024, portfolio. The prominence of Apple among this year’s “Buffett stocks” illustrates how much that company and other tech giants like Microsoft and Amazon.com AMZN (Lin’s largest and third-largest holdings, respectively), now influence the US stock market and indexes.

Another holdover from last year’s list is BNY Mellon Appreciation DGAGX, formerly known as Dreyfus Appreciation. A team at subadvisor Fayez Sarofim manages this fund as well as BNY Mellon Worldwide Growth PGROX, which uses a global version of the same approach. The strategy looks for dominant companies in attractive industries, preferably with low debt and high returns on capital. The managers’ patient, long-term approach has led to some lean years in the past, but both funds put up great numbers from 2019 through 2022 before struggling last year. As of March 31, 2024, most of these funds’ weighting in “Buffett stocks” came from Apple and Chevron, which were among the top 11 holdings in both funds, though each also had a smaller position in Coca-Cola.

Finally, the largest fund on this year’s list is Fidelity Growth Company FDGRX. Manager Steve Wymer runs more than $60 billion in the mutual fund and another $40 billion in other vehicles following the same strategy. Wymer has led the fund to exceptional results over the past 25 years with an aggressive growth strategy. He often likes to own smaller, lesser-known growth stocks, but because of the fund’s size he has had to keep a big part of the portfolio in mega-cap growth names. The second-largest holding as of Feb. 29, 2024, was Buffett favorite Apple, with just over 9% of assets. Wymer also had a smaller position in Coca-Cola.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YGF5R6YDPJESJOU7XABKHHIP3Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)