A Fixed-Income Fund’s Cautionary Tale

This aggressive mortgage fund’s losses can teach investors about the role of bonds in a portfolio.

At the start of 2022, lead manager Tom Miner and comanagers Garrett Smith and Brian Loo of Garrison Point Capital looked well positioned. Even if the risk-adjusted record of the fund they run for AlphaCentric Advisors was then subpar, its long-term absolute return—the kind you can take home—stood out.

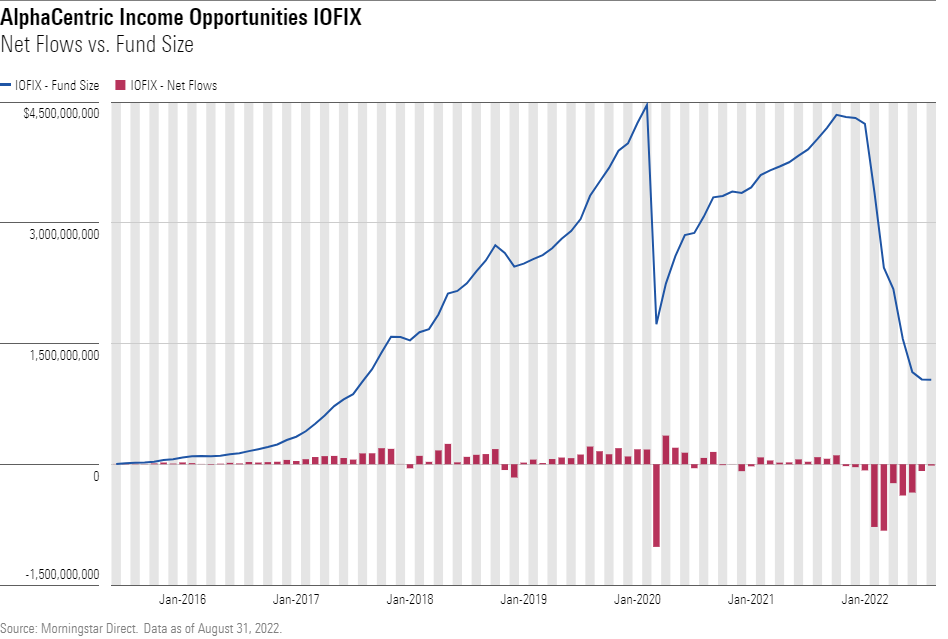

AlphaCentric Income Opportunities’ IOFIX 8% annualized gain since its mid-2015 debut ranked first out of 60 distinct multisector bond Morningstar Category peers over that period, and it was near the top of more than 1,200 taxable rivals. What’s more, in March 2020 alone, the fund had withstood a harrowing 38% loss and $1 billion of outflows. As 2022 began, its $4.3 billion asset base was finally close to what it had been prior to that meltdown.

Now, in a market roiled by war and surging inflation, the fund is once again on the brink. Its 18.5% drop for the year to date through Aug. 31 ranked last in its category and has been accompanied by nearly $2.8 billion in outflows. With bonds that are difficult to trade likely dominating its current $1 billion portfolio, another comeback will be difficult, though not impossible.

No matter AlphaCentric Income Opportunities’ fate, it offers a cautionary tale about the role of bonds in a portfolio. This Fund Spy will tell that tale. Along the way, we will see why the risks the fund courted and the corners it cut laid the seeds for its rise and fall. In the end, the lesson here is simple. Investors who chase performance in an increasingly complicated and obscure fixed-income market should beware lest years of returns evaporate in a matter of months—or less.

AlphaCentric Income Opportunities' Rise in Context

Prior to surviving its March 2020 near-death experience, AlphaCentric Income Opportunities had been a consistent highflier. It had finished in its category’s top quartile each calendar year of its existence, twice placing in the top 1% (2017, 2018).

The context for that outperformance was the financial crisis' aftermath. Historically, investing in securities composed of baskets of mortgages had been largely confined to those guaranteed either explicitly or implicitly by the U.S. government—so called agency mortgage-backed securities. This had been a low-risk endeavor, and it also, as a consequence, yielded modest returns.

Always in search of ways to increase returns while (purportedly) keeping risk in check, investment banks as early as the 1980s began engineering various products. One of the most popular involved pooling together residential mortgages that did not meet the strict lending standards of government-sponsored entities like the Federal National Mortgage Association (aka Fannie Mae). Not all of these loans were subprime, or made to households with below-average credit, but some were.

To entice investors to buy these nonagency residential mortgage-backed securities, or RMBS, their originators, working with independent ratings firms like S&P Global, divided them into credit-quality slices, or tranches, and priced them based on their cash flows and expected losses. The debacle of 2008 unfolded largely because investors underestimated the extent to which even the higher-rated nonagency RMBS tranches were exposed to a continued housing downturn.

For years following the financial crisis, many bond-fund managers were cautious about investing substantially in nonagency RMBS, especially lower-rated issues, including those created after 2008 and their many spinoffs.[1] The Garrison Point team saw this caution as an opportunity to swoop in on unloved securities and devoted AlphaCentric Income Opportunities to subprime nonagency RMBS.

But that’s not all. Within lower-quality nonagency RMBS, AlphaCentric Income Opportunities preferred “odd lots.” Like a standard carton of 12 eggs, bonds tend to trade in “round lots” that at par cost $1 million each (1,000 bonds at a face value of $1,000 each). But just as a grocer would discount the price per egg of a carton containing only seven eggs to get a customer to purchase it, dealers holding odd bond lots regularly discount their per-bond price to move them. AlphaCentric Income Opportunities liked these kinds of discounts and often bought them.

The bonds that sparked AlphaCentric Income Opportunities’ interest also turned out not to be widely held. Indeed, the percentage of securities in its portfolio that it alone owned, according to Morningstar’s extensive database of public funds, typically exceeded 50%—and exceeded 75% in March 2022.

Alongside its proclivity to buy subprime, odd-lot nonagency RMBS issues, this feature of unique ownership made many of AlphaCentric Income Opportunities' holdings illiquid, or difficult to sell. Widely held bonds can more easily flow from seller to buyer without lowering the price much.

That’s because if a fund already owns them, the due diligence has already been done to the fund's satisfaction. In contrast, if no one else owns a bond and you need to sell it, the potential buyer must take time to evaluate the security or first may be turned away by its novelty if nothing else. Hastening the sale of such bonds often requires offering them at a discount big enough to nudge the buyer to look past that novelty and any uncertainties.

Cutting Corners

As one of the most aggressive mortgage funds that Morningstar tracks, AlphaCentric Income Opportunities soared past its competition when credit markets boomed from mid-2015 to 2019. In retrospect, though, even in those years, the pressure to perform seems to have led to cutting corners.

In its first few months, when it was relatively small, the prices of AlphaCentric Income Opportunities’ odd-lot bonds were marked up to the higher prices of round-lot bonds immediately after purchase. That overstated its net asset value, or fund share price, by more than 7%. At least, that’s according to an SEC case settled on June 3, 2022.

That wasn’t the SEC’s only charge. It also found that from January 2017 into February 2019, the fund’s team submitted bids to broker/dealers offering to purchase bonds it already owned at prices higher than those used by the third-party pricing vendor. In some cases, the fund held the entire bond and couldn’t buy more. This caused the pricing vendor to raise its marks to match those bids, in turn again artificially increasing the fund’s NAV.

As a result of these two charges, the SEC censured the fund's advisor, AlphaCentric, and fined it $300,000. It did the same to subadvisor Garrison Point, imposing a steeper $3.5 million penalty.

AlphaCentric’s Fall

Those SEC charges also presaged AlphaCentric Income Opportunities’ recent troubles. They showed just how little trading activity there is in many of its securities and how their prices, when they do adjust, do so not incrementally but in dramatic fashion. The same dynamics that helped in past rallies have hurt in this year’s selloff.

Between poor performance and massive outflows, the fund’s asset base is down more than 75% this year. Difficulties multiplied in the days immediately following Russia’s Feb. 24 invasion of Ukraine, when investors redeemed more than $1 billion of the fund’s assets. That would have inclined the Garrison Point team to sell the fund’s most liquid holdings first. At the start of 2022, its cash, exchanged-traded holdings, and equity positions provided a roughly $300 million buffer that could be sold quickly. By the end of March, that buffer was gone, and the managers had drawn on the fund’s line of credit to meet redemptions.[2] Albeit modest, the fund was then 1.15% leveraged as it had some debt outstanding.

Junked Up

At the time of this writing, AlphaCentric Income Opportunities' full June 2022 portfolio was not yet available. All indications are, however, that it would reflect further decline. Investors continued to redeem fund shares in mass, triggering more selling and drawing down the line of credit, thereby increasing leverage to around 6%, according to the fund's second-quarter fact sheet. To be sure, that's modest compared with strategies that intentionally borrow through cheap, efficient means like futures contracts to increase return potential. Yet here the leverage has grown because of outflows from an increasingly less liquid portfolio, and those lines of credit must be paid for (and paid back).

Of greatest concern is the possibility of a liquidity spiral. The portfolio has been “junked up” from selling its most liquid, highest quality securities to meet redemptions. Hawking the leftovers may require the managers to accept prices much lower than what they think each security is worth. These markdowns can in turn exacerbate losses and lead to even more outflows and reliance on the line of credit, adding further leverage. That vortex could eventually lead the fund to shut down.

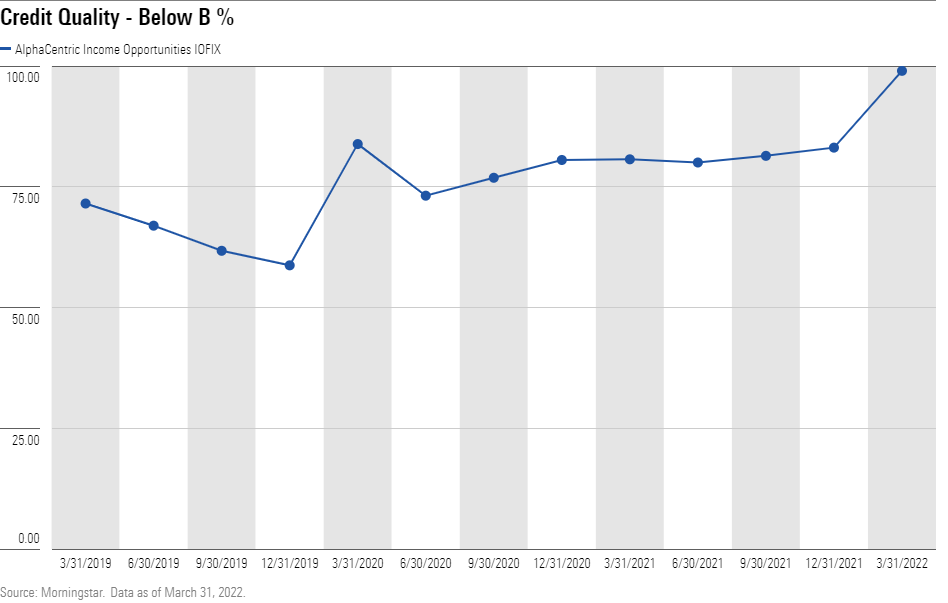

To say nothing of what the June portfolio might reveal, the fund’s ownership of highly speculative and likely difficult-to-trade bonds in March showed its precarious position then. Its stake in bonds with a below B rating had jumped from an already lofty 83% at year-end 2021 to 99%, highest among all 1,929 distinct U.S. fixed-income funds in Morningstar’s database. Only four of those 1,929 had more than 50% in below B rated bonds.

Another Comeback?

As bad as it looks, the fate of AlphaCentric Income Opportunities' still $1 billion portfolio isn’t sealed. Outflows have moderated recently. Would-be buyers with robust modeling capabilities may be able to complete the underwriting process quickly, even for securities with limited or no other owners. At the very least, there is demand—at a price—for the thinly traded securities that AlphaCentric Income Opportunities has had to jettison thus far.

There is also widespread consensus among asset managers that the U.S. housing market is in strong shape. If true, it’s unlikely that the fundamentals of AlphaCentric Income Opportunities’ holdings will deteriorate. And if markets stabilize, there’s a chance both asset prices and the fund’s fortunes rebound once more.

Caveat Emptor

Whatever happens, AlphaCentric Income Opportunities’ rise and fall is yet another example of a bond fund that flew too close to the sun and got burned. Fixed-income securities remain an essential building block for investor portfolios. But with interest rates until very recently plumbing their historic depths, the primary role of bonds has been to serve as ballast relative to their more volatile stock counterparts. In an era of elevated rates with potential to fall, bonds may serve as the engine powering portfolios.

For now, though, investors would do well to be cautious and consult financial advisors and third parties like Morningstar with the expertise to untangle bond funds’ latent risks. Even for those with some knowledge, the ever-widening dispersion of bond sectors, subsectors, and security types makes headline allocations on mutual fund fact sheets increasingly less useful. The performance of two offerings with similar overall exposures may diverge dramatically because of underlying differences. Moreover, fixed-income portfolio statistics like yield, credit quality, and duration (a measure of interest-rate sensitivity) are best understood not in isolation but in their intersections and potential for offsetting or multiplying risk.

For those with data and the eyes to see, AlphaCentric Income Opportunities' singular focus on the nonagency RMBS market’s most dicey corners made its ill-advised profile apparent beforehand. It didn’t take a blowup in March 2020 or this year, not to mention the SEC charges, to know this fund should be avoided.

Endnotes

[1] The nonagency RMBS market is one of the most fragmented within fixed income. A broad division can be drawn between legacy securities—those issued prior to 2008 and found at the heart of the financial crisis—and so-called 2.0 securities, issued after 2008. Nested within each division are multiple (and growing) subdivisions, and across the full spectrum there are further delineations by tranche and credit rating. The result is a disparate market where both risk and opportunity lurk. It serves as a natural playground for savvy active bond managers as well as their imprudent counterparts, but even among the professionals, few possess the skills and tools to thoroughly track and analyze the whole nonagency RMBS market. Thus, most focus either on legacy or 2.0 securities or just one or two subsectors within them.

[2] According to AlphaCentric Income Opportunities' March 31, 2022 annual report, the fund's line of credit was drawn on Jan. 26, 2022, and remained outstanding through the reporting period. However, in a meeting with Morningstar on Aug. 2, 2022, two of the fund's portfolio managers said the line of credit wasn't drawn until after Feb. 24, when the outflows began in earnest.

/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)