6 Critical Lessons for Bond Investors

Everyone can learn something from Principal Street High Income Municipal’s tardiness.

It may seem like a paperwork snafu for the little-known Principal Street High Income Municipal GSTAX bond fund, but lessons from the late filing of its annual report could help you avoid heartache. Principal Street missed the deadline to file the fund’s annual report to shareholders several weeks ago, telling the SEC that the firm had difficulty valuing certain municipal bonds in its portfolio. That could cause problems for the fund were it to try to liquidate those positions quickly.

Bond market drama often comes from its sleepiest corners, like the municipal-bond market. Muni bonds usually fund local or state government agencies. Investors usually consider them safe bets because predictable taxes or fees for important civil services cover the bonds’ interest payments. Most municipal bonds carry high credit ratings from third-party agencies because they pay their interest and principal on time. But Principal Street High Income focuses on a different breed.

Lesson 1: A Rating Means More Than You Might Think

The Principal Street fund specializes in munis that fund private-sector projects with public benefits, such as waste recycling, senior housing, or healthcare facilities. Those bonds usually carry state or local governments’ names, but the finances of private businesses support them. Government agencies help issue the bonds and give them tax-free status but do not guarantee them. The projects and bond issues are often smaller than the average large municipal or corporate bond. That can increase the cost of getting third-party credit ratings, so many issuers don’t pay for them. Most high-yield muni funds hold big stakes in such nonrated bonds, whose generous yields are supposed to compensate for the lack of ratings. Extensive credit research is required to avoid the duds.

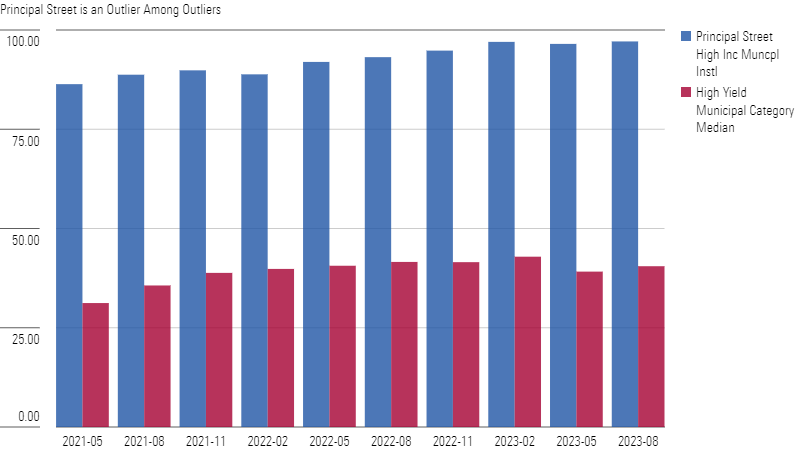

Principal Street High Income Municipal—Nonrated Bond Exposure

Even among its peers in the high-yield muni Morningstar Category, Principal Street flies very close to the sun. At the end of June 2023, 95.3% of the fund’s assets were in nonrated bonds, according to Principal Street data. (The chart above shows Morningstar data through August.) That is the highest in Morningstar’s database ever reported by any muni fund except for Heartland High-Yield Municipal Bond, which had pricing problems, lost 70% in a day, and liquidated in the early 2000s.

Lesson 2: Concentration Makes Risk Riskier

The most diversified high-yield muni portfolios hold more than 1,000 bonds, which minimizes the impact of a few problematic holdings. Principal Street’s portfolio has held 140 on average over the past three years, making it among the category’s least diversified. It doesn’t evenly distribute those assets, either. The fund’s top 20 holdings took up almost half of the portfolio in August 2023, a figure more common among concentrated equity funds. That ratio has been even higher: It was 62% in May 2020.

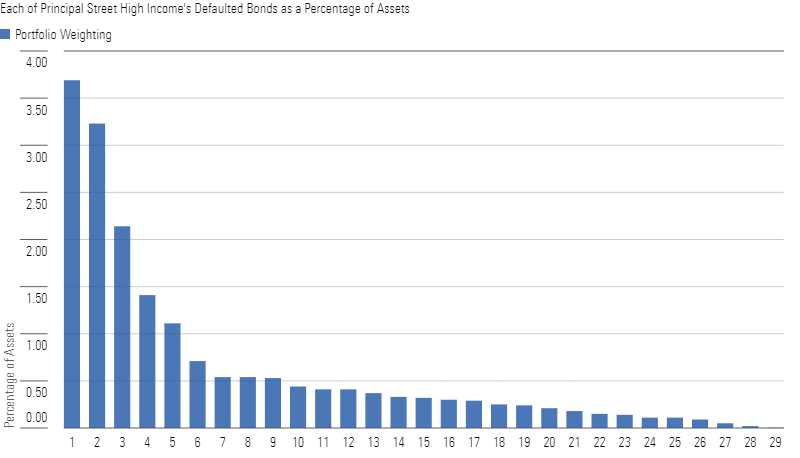

Principal Street’s concentration exacerbates its problem children’s behavior. The fund’s August 2023 annual report footnoted 29 bonds in default, more than 18% of the portfolio. That was up from 11.8% of assets across 25 defaulted bonds in February 2023. While funds sometimes buy defaulted bonds in hopes of a windfall if their issuers settle with bondholders, many of Principal Street’s troubled bonds appear to have defaulted after the fund bought them, and a handful are among its largest holdings.

Principal Street High Income Municipal—Defaulted Bonds

Lesson 3: Higher Yield Is a Signal

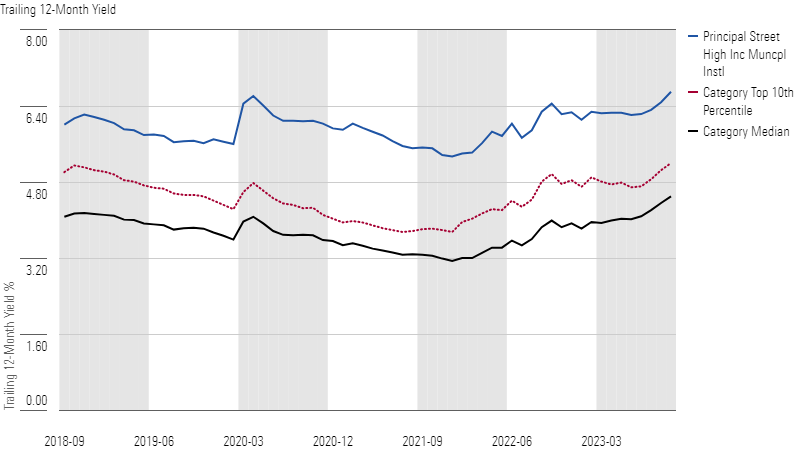

Risky nonrated, private-project munis must pay higher rates than run-of-the-mill municipals with low historical default rates to attract investors. Higher yields are a reliable risk indicator. The high-yield muni Morningstar Category’s typical fund had a 12-month trailing yield of 4.5% at the end of October 2023, which was much higher than the norm for higher-quality intermediate or long-term national municipal-bond portfolios. Yet, Principal Street High Income Muni’s yield was even higher, 6.7%. In fact, the fund’s yield has been the category’s highest every month since Morningstar began calculating it in 2018. A yield that high, relative to a fund’s peers, is almost always a warning sign.

Principal Street High Income Muni Yield vs. Category

Lesson 4: Ownership Loves Company

Principal Street’s bonds also have a small audience. Not many other asset managers who submit portfolios to Morningstar hold them. Principal Street is the only fundowner of about 19.6% of the bonds in its portfolio, according to Morningstar’s data. Nearly 58% of its assets are in bonds held by only two other firms. That could make it difficult for the fund to find investors willing to buy its bonds without a big discount if it had to sell them in a pinch.

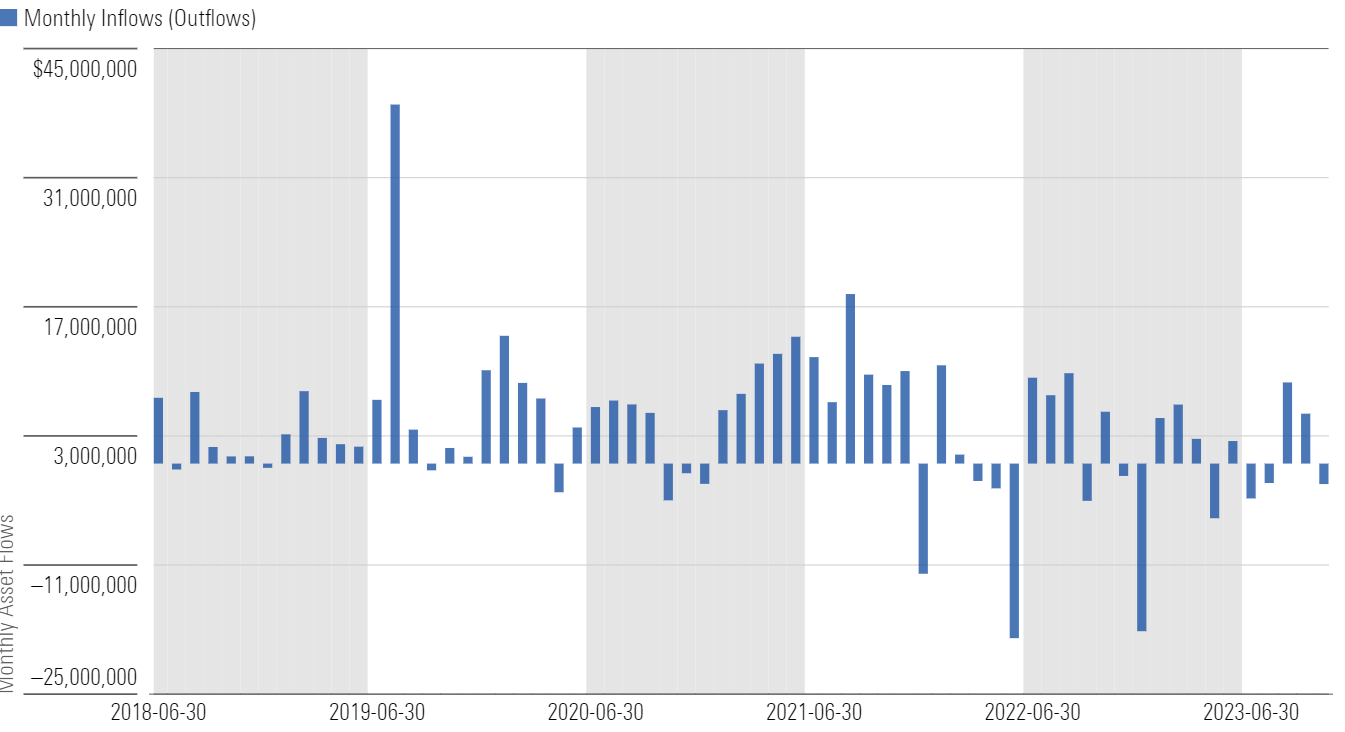

Principal Street hasn’t faced such a stiff test, yet. Its worst stretch of redemptions was 7.5% over three months in 2022. Still, more serious outflows could pressure it to unload bonds and cause trouble.

Principal Street High Income Municipal Asset Flows

Lesson 5: Bond Pricing Is as Much Art as Science

High-yield muni valuation challenges are common, but they’ve become more of a problem at this portfolio. Relatively few managers hold or trade small, unrated issues; they’re off most investors’ radars. So, the pricing services on which most managers rely may use external factors, such as recent trades for similar issues, to estimate bond prices. In some cases, though, a service may not have enough information, leaving the manager to conjure a “fair-value” price with the best information available. Such holdings show up in annual reports as Level 3 securities.

That could be what caused the Principal Street fund’s valuation complications. It’s unusual for funds to report more than a small Level 3 allocation. A year ago Principal Street had 3.4% in Level 3s; that climbed to 5.3% by February 2023 and more than doubled to 12.2% in its August 2023 annual report.

Large Level 3 stakes alone don’t mean problems, but they can when combined with other challenges. There have been examples of Level 3 numbers spiking before big trouble. For example, Third Avenue Focused Credit’s Level 3 holdings’ dollar value dropped between late 2014 and early 2015, but outflows and a shrinking asset base drove them to 20% by October 2015; the fund halted redemptions that December and eventually parsed out what was left to investors.

Lesson 6: Outflows Can Expose Lurking Risks

The ultimate concern here is any event that would make it hard for Principal Street to sell its bonds near their marked prices. That’s what happened in the early 2000s when big outflows forced Heartland’s muni funds to dump bonds in a hurry. SEC allegations of bond-pricing malfeasance contributed to a 70% single-day drop in Heartland’s high-yield muni fund and its eventual closure. No one accused Third Avenue Focused Credit of wrongdoing, but it lost 30% in 2015.

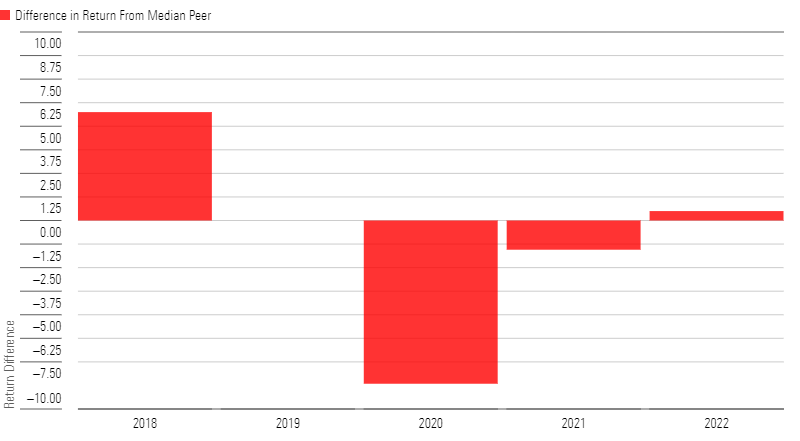

Principal Street Hasn’t Gone Unscathed

Principal Street’s fund may well avoid a similar fate, but the fund has already felt the pain of some of its risks. The 2020 pandemic-driven selloff still weighs on its longer-term record. Its institutional shares trailed its distinct category peers’ median by more than 8.6 percentage points that year. Another liquidly challenged market could cause similar pain. Even under the best of circumstances, though, serious outflows could be a bigger problem.

Principal Street High Income Municipal Annual Returns vs. Category Median

Fire-sale events like those of Heartland and Third Avenue have been few and far between, but they demonstrate how important it is to make sure you can live with the risks your fund takes.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)