How to Use Alternatives in Your Portfolio

What you need to know about the advantages and risks of alternative investments.

Alternative investments can be broadly defined as anything that isn’t a stock or a bond. More specifically, these strategies promise something fundamentally different from mainstream asset classes. Morningstar defines these strategies based on their abilities to modify, diversify, or eliminate traditional market risks.

In this series on portfolio basics, I’ll explain some of the fundamentals of putting together sound portfolios. I’ll start with some of the most widely used types of investments and walk through what you need to know to use them effectively in a portfolio.

What Are Alternative Investments?

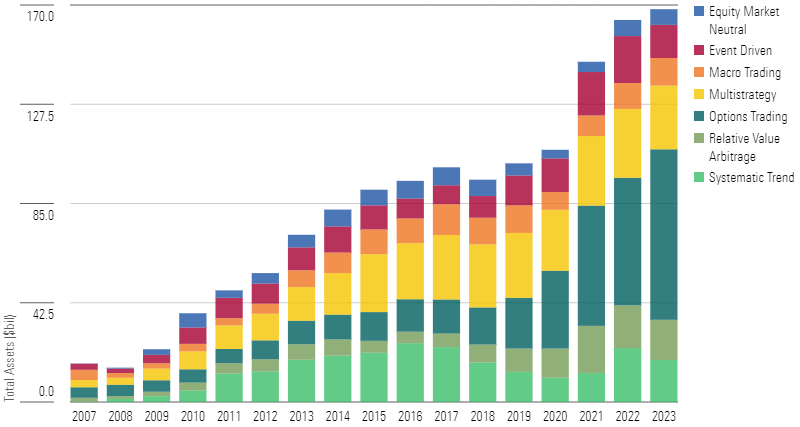

Alternative investments span a wide range of strategies but are generally intended to enhance returns and/or provide diversification value relative to more widely used asset classes, such as stocks and bonds. Alternative investment strategies have long been used by institutional investors and hedge funds but are also available to regular investors via mutual funds and exchange-traded funds (also known as liquid alternatives). As of Jan. 31, 2024, assets in U.S.-based alternatives funds totaled about $200 billion. That’s still relatively small, but assets have been growing rapidly over the past couple of decades.

Total Assets in Alternative Fund Categories

Investors seek out alternatives strategies for various reasons, such as protecting against downside risk, gaining exposure to untapped areas of the market, or enhancing returns. However, they’re more often used as hedge-fund-like strategies instead of a way to gain exposure to broad market performance.

Morningstar classifies alternatives funds in two broad buckets: portfolio diversifiers and opportunistic.[1]

Alternatives classified as diversifiers include the equity market-neutral, event-driven, options-trading, relative value arbitrage, and multistrategy categories. These combine various traditional market risk factors alongside nontraditional or alternative risk factors to offer a more diversified source of long-term returns. The most common strategies in this group—equity market-neutral, event-driven, and relative value arbitrage—typically have little to no sensitivity to moves in equities markets. In all three cases, they tend to trade securities both long and short against each other rather than trading against the overall market.

Strategies defined as opportunistic (macro trading and systematic trading) generally focus on absolute returns, meaning they aim for positive returns in all markets and focus more on capital preservation. Managers of these strategies move in and out of long and short positions as opportunities arise. Opportunistic funds tend to lose less in drawdowns but also come with more complexity. Sometimes these managers bet the market will continue moving in the same direction, sometimes they wager it won’t, and they often switch or hedge their bets. Market expectations can often get caught out of step, so they often use sophisticated risk-management systems to manage their myriad exposures.

What Are the Advantages and Risks of Investing in Alternative Investments?

Alternative investing has two potential benefits: diversification and the potential to perform better than the overall equity market over certain periods.

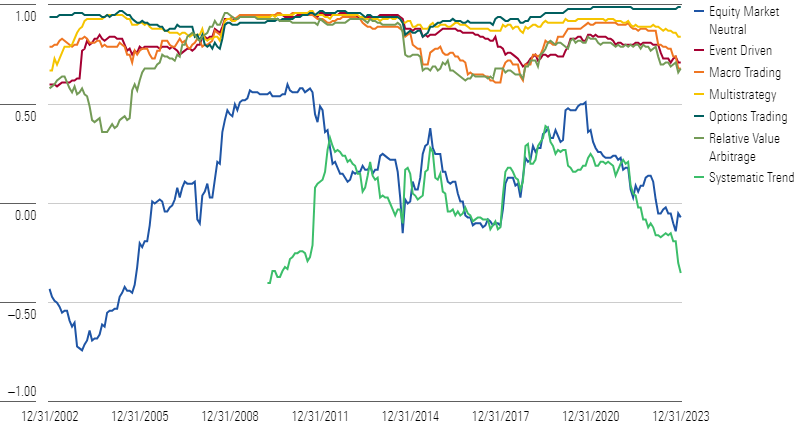

For portfolio diversification, funds following equity market-neutral and systematic-trend strategies are standouts. Both categories have consistently had rolling three-year correlations of 0.6 or less with the overall equity market, and correlations have actually trended down in recent years. The four other alternatives categories—multistrategy, event-driven, options trading, macro trading, and relative value arbitrage—have generally moved more in tandem with stocks.

Rolling Three-Year Correlations vs. Morningstar Market Index

It’s also helpful to consider the categories’ respective betas, which provide insight into alternatives’ degree of sensitivity to equity movements. In the past 10 years, all categories but options trading have had rolling three-year betas of 0.35 or less versus the Morningstar US Market Index.

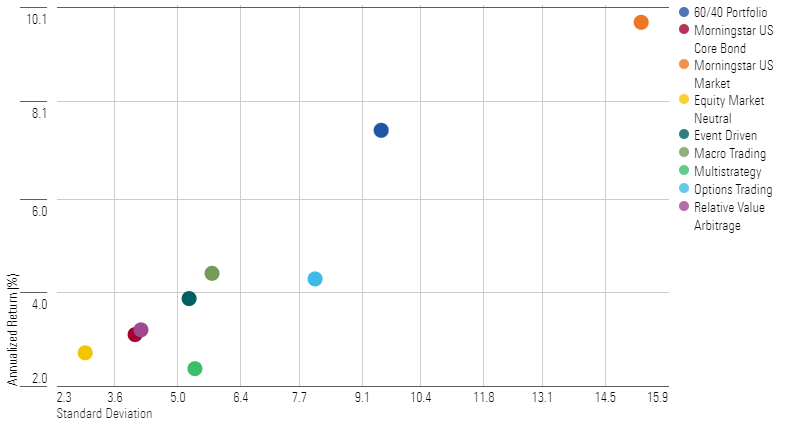

In terms of return generation, alternatives funds haven’t been standouts. As shown in the scatterplot below, most alternatives categories have generated lower returns than both stocks and a 60/40 portfolio that combines stocks and investment-grade bonds. Risk has been lower, as well, but generally not low enough to generate compelling risk-adjusted returns.

Trailing 20-Year Risk and Return: Alternative Fund Categories and Other Assets

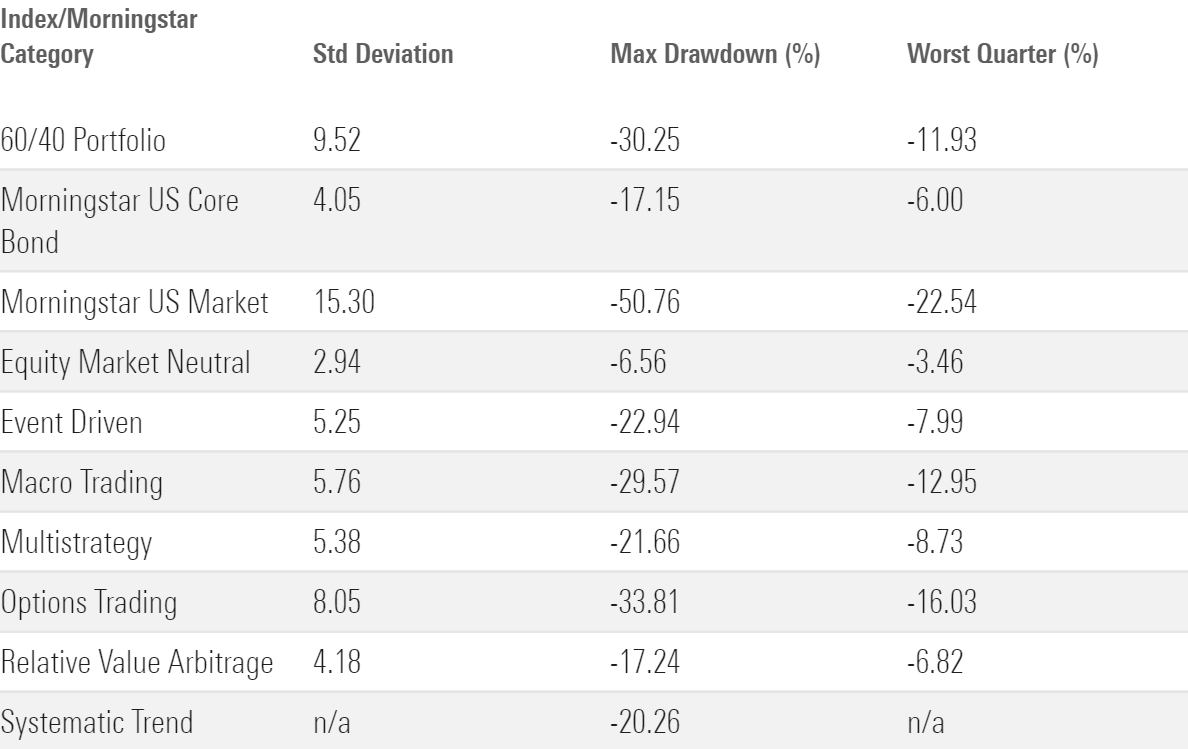

On the positive side, alternatives funds have generally courted less downside risk than the overall equity market, as shown in the table below.

Drawdown Stats for Alternatives Funds and Other Assets (Since 2004)

How to Invest in Alternatives

There are many alternatives strategies, such as hedge funds, that are only available to well-heeled investors. These vehicles are typically limited to accredited investors, who must meet at least one of several criteria, including a net worth greater than $1 million or income greater than $200,000 in each of the two most recent years and expected for the current year. For less affluent folks, mutual funds and ETFs are the best ways to access alternative investment strategies.

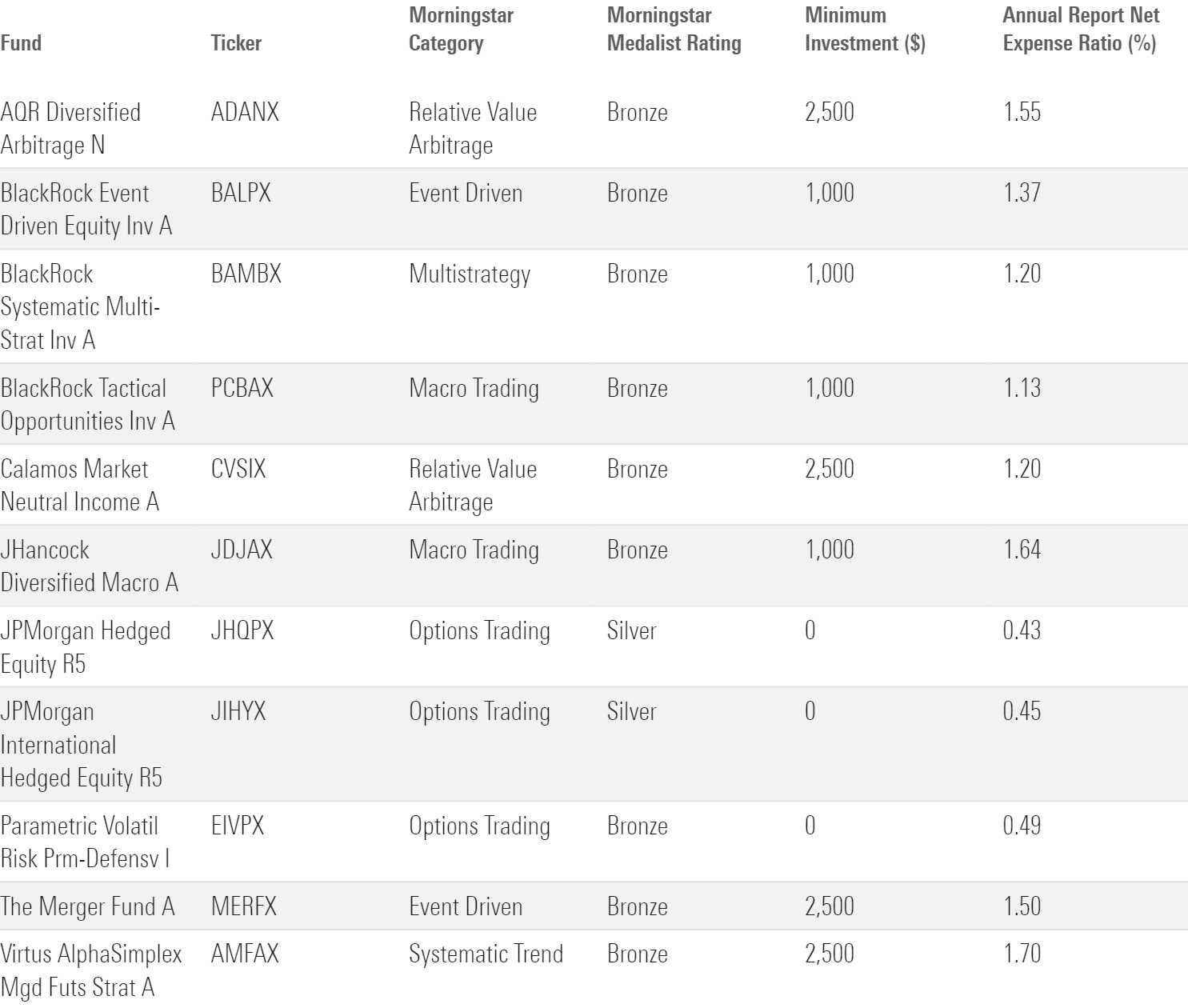

The table below shows a subset of alternatives funds with above-average Morningstar Medalist Ratings.

Highly Rated Alternatives Funds

Sharp-eyed readers will probably notice two things about the funds featured above. First, there are currently no alternatives funds with Medalist Ratings of Gold, illustrating the lack of high-conviction investment options in the space. Second, expense ratios are well above average, making alternative investments far pricier than more mainstream assets.

When Do Alternative Investments Perform Best?

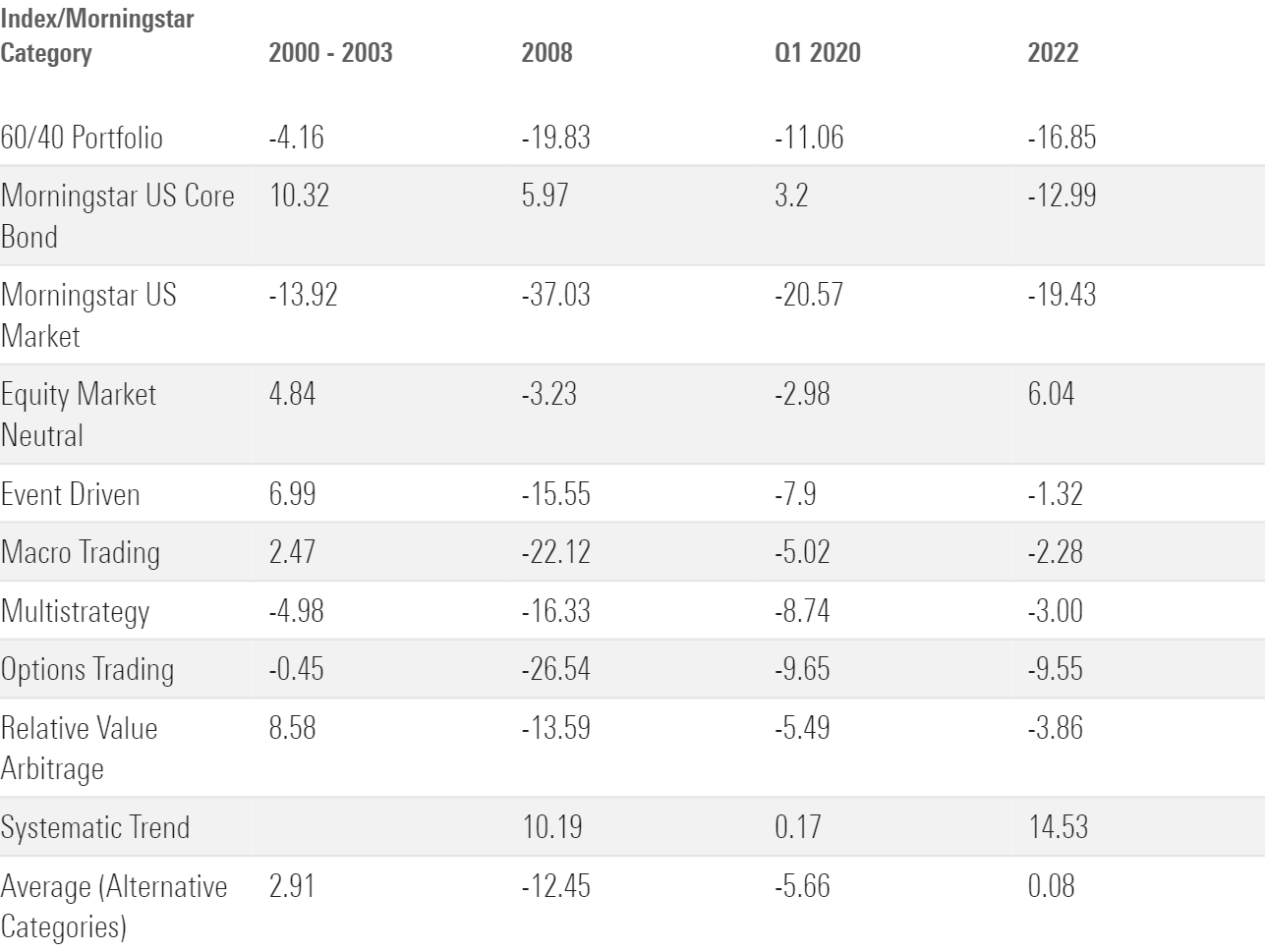

Theoretically, alternative investments should excel during periods of market disruption or dislocation. Overall, alternatives funds have performed reasonably well in that role. They generated modestly positive returns during the tech stock correction in the early 2000s and the 2022 bear market for both stocks and bonds. In 2008 and the first quarter of 2020, however, they held up better than a plain-vanilla balanced portfolio made up of U.S. stocks and investment-grade bonds but still suffered losses.

Annualized Returns During the Best Times for Alternatives Funds

How Long Should I Hold My Alternative Investments?

Morningstar’s Role in Portfolio framework recommends holding alternatives funds for at least 10 years. We came up with this guideline partly by looking at the historical frequency of losses over various rolling time periods ranging from one year to 10 years. We also considered the maximum time to recovery, or how long it usually takes to recover after a drawdown.

How Much of My Portfolio Should Be in Alternative Investments?

While institutional investors and endowment funds often invest much bigger chunks of their portfolios in alternatives, I’d argue that most individual investors should keep their alternatives exposure limited (which Morningstar defines as 15% of assets or less). But given alternatives’ complex strategies, often hefty expense ratios, and lackluster long-term performance, most investors are probably better off allocating significantly less than that to alternatives or even skipping them altogether.

Morningstar senior analyst Karen Zaya contributed to this article.

[1] Morningstar also includes the digital assets (aka cryptocurrency) category as part of the alternatives category group, but I’ve excluded them from this discussion because I consider them more akin to commodities.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)