How the SEC Can Make Relationship Summaries Useful for Investors

Focused enforcement and small changes to the Instructions could go a long way toward empowering investors.

Customer Relationship Summaries, also known as Form CRS, are a key accompaniment to the SEC's Regulation Best Interest, or Reg BI, which governs the standard of conduct for broker/dealers. As of last year, broker/dealers, Registered Investment Advisors, and dually registered firms must provide each client, or prospective client, with the firm's Form CRS. The Form is intended to be a short and practical document that highlights important information regarding the services provided by the firm in a readily understandable format. The goal of Form CRS is ultimately to equip retail investors with the right information so they are empowered to make informed decisions about where, and with whom, to entrust their savings.

Unfortunately, after reviewing Form CRS from 100 firms, Morningstar has found that only a few firms have gone beyond the minimum requirements given by the SEC. As such, to fix this deficiency, we believe the SEC should take two important steps to reinforce the requirements of Form CRS.

The SEC Should Do a Better Job With Enforcement, Raising the Bar for These CRS Disclosures

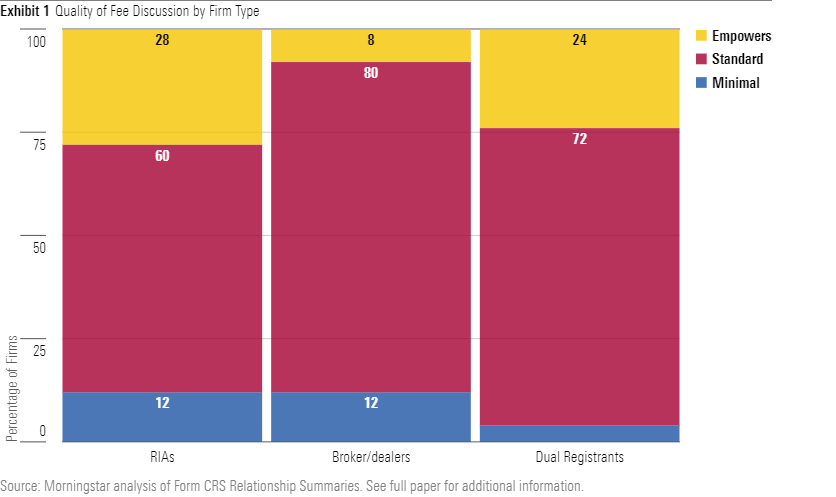

Our analysis found that there is considerable inconsistency in the quality of one firm's Form CRS from another, which places many investors at a disadvantage. This inconsistency tells us that firms are simply not following the Instructions to Form CRS. The SEC should use its enforcement authority to make it clear to firms that the Instructions are directives, not merely suggestions.

For example, the SEC has asked firms to disclose incentives created by four named products, and in the--unlikely--event that there were no conflicts in those categories, to instead disclose at least one other material conflict that could affect their investors. Despite those directives, Morningstar found that only 16% of firms described their conflicts in a way that empowered investors to understand how such conflicts of interest could affect the advice given and received.

We also found that, despite the SEC’s specific instructions:

- 24% of firms did not explicitly state the connection between the services or products an investor selects and the compensation their financial professionals receive based on the selection.

- 8% of firms did not state the structure of the fees, whether asset- or commission-based, that an investor would pay.

- 71% of firms did not quantify the fees, or provide a meaningful discussion of fees, within their Form CRS.

The SEC Should Remove the Flexibility It Has Given to Firms by Taking a More Prescriptive Approach

In the case of Form CRS, flexibility has not promoted innovation and competition. As indicated in our analysis and as the above examples show, flexibility is causing--and could continue to worsen--the race to the bottom in the quality of information provided by firms to investors.

The SEC gave firms too much flexibility when it asked them to make certain disclosures without giving explicit instructions on the breadth and scope of such disclosures. Without specific instructions, firms have been doing the bare minimum. As a result, firms can be--and currently often are--technically compliant with Form CRS without satisfying the goal and purpose of the Form or Reg BI.

Based on our review and analysis on Form CRS, Morningstar believes the SEC should make the following changes to its Rule and Instructions:

- The SEC should ask firms to provide an example of a material conflict at the beginning of its discussion of conflicts, instead of burying that request in the middle. The Instructions should include a definition of what the SEC is looking for when it uses the term "material conflict," and it should explicitly ask for information not only on what the conflict is, but more importantly, what steps are being taken to manage the conflict. A definition and clear directives would highlight the importance of empowering investors in this area.

- Another term the SEC should define is "principal fees and costs." Instead of leaving it up to firms to decide what fee information to share, the SEC's definition should include the minimum and maximum fees for each service and an estimate of how much an investor will pay based on the services and products chosen. As only 29% of firms quantified fees within their Form CRS, many investors are likely left wondering whether they are paying a fair price for a product or service.

- The SEC allows firms to reference other documents in their Form CRS. It should be stated in the Instructions that these "layered disclosures" must be used only if the referenced information is concise and readily understandable. Currently, firms are referencing long and complicated documents, undermining the efficacy and purpose of Form CRS.

Concluding Thoughts

Our analysis of the Form CRS produced by broker/dealers, RIAs, and dual registrants showed gaps in the description of costs, the explanation of conflicts of interest, and the level of detail surrounding compensation. As the SEC enforces Form CRS regulation, it should ensure that firms are providing comprehensive, accurate information on these topics in an understandable way. Morningstar believes that the key step the SEC should take to ensure that firms fulfill the goals of Form CRS--and ultimately, Reg BI--is to amend the Instructions, leaving no room for firms to do anything less than provide the required information to empower investors.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZNKQPGMG5RFE5GPV47XGWXDLMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/W33JXIXP5RG7LMJEHRPL74K7AQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)