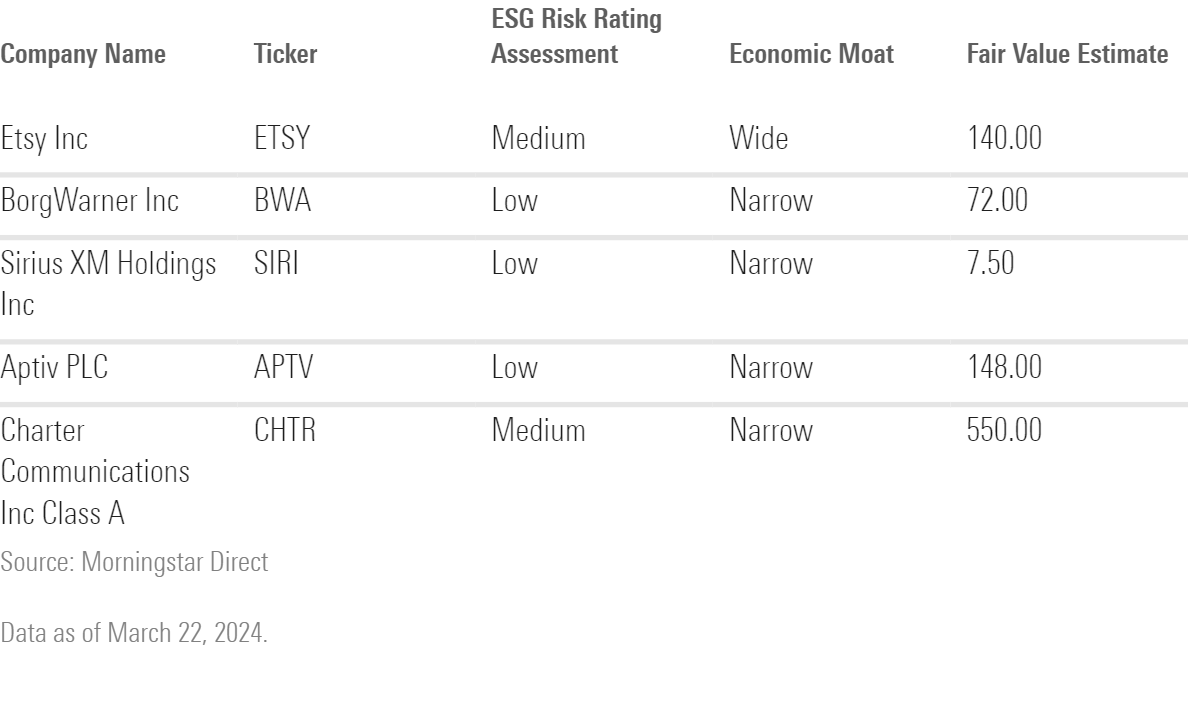

5 Cheap Sustainable Stocks With Moats

Etsy, BorgWarner, Sirius, Aptiv, and Charter Communications are trading more than 50% below fair value.

If you are looking to invest in high-quality undervalued sustainable stocks, Etsy ETSY, BorgWarner BWA, SiriusXM Holdings SIRI, Aptiv PLC APTV, and Charter Communications CHTR might be worth further research. These companies not only have low ESG risk scores, indicating that the companies are exposed to fewer environmental, social, and governance risks, but they are also trading at a price 50% lower than their fair values, according to Morningstar.

In addition, all five have been assigned a Morningstar Economic Moat Rating of wide or narrow by the analyst covering the stock, meaning that the company has a competitive advantage. Morningstar considers a company to have a wide moat if it expects a company’s competitive advantage to last more than 20 years. It deems a company to have a narrow moat if it believes the company can fend off rivals for 10 years. Undervalued stocks with moats have a long track record of outperformance.

Morningstar US Sustainability Index

We found these stocks in the Morningstar US Sustainability Index. So far this year, the index has returned approximately 12.5%, outperforming SPDR S&P 500 Trust SPY, which has returned approximately 10%. Over the past five years, the sustainable index has returned approximately 108%, and SPY approximately 84%.

The Morningstar index has 333 stock holdings. A third of assets resides in the top 10 holdings of the index, which includes companies like Microsoft MSFT, Nvidia NVDA, and Berkshire Hathaway BRK. B. The index tracks stocks with low ESG risk ratings. Approximately 90% of the stocks within this index have a narrow or wide moat rating. The below-mentioned five stocks had the lowest price/fair value ratio in the index, indicating that they currently trade at prices much lower than the fair values that Morningstar’s equity analysts have assigned them.

5 Cheap Sustainable Stocks

5 Cheap Sustainable Stocks

1) Etsy ETSY

Fair Value: $140

Morningstar Rating: 4 stars

Price as of March 22, 2024: $67.82

Etsy is trading at a 51% discount.

Etsy is a top-10 e-commerce marketplace operator in the US and the UK, with sizable operations in Germany, France, Australia, and Canada. The firm dominates an interesting niche, connecting buyers and sellers through its online market to exchange vintage and craft goods.

“We view Etsy’s competitive strategy as sound, with the firm’s playbook designed to improve buyer consideration and frequency through brand marketing, improvements in search efficacy, platform trust, and reliability. The craft marketplace operator has retained a sizable chunk of the customer cohorts it acquired during a pandemic-induced volumetric surge, seeing its active user base grow 101% between 2019 and 2023, which, in tandem with a consequential increase in average spending per buyer—up 22% over that period—has resulted in a marketplace that’s 2.4 times larger than its prepandemic iteration,” writes Sean Dunlop, Morningstar senior equity analyst, in a report.

2) BorgWarner BWA

Fair Value: $72

Morningstar Rating: 5 stars

Price as of March 22, 2024: $33.20

BorgWarner is trading at a 54% discount.

BorgWarner is a Tier I auto-parts supplier with three operating segments: An air management group, a drivetrain and battery systems group, and an e-propulsion segment.

“BorgWarner is well positioned to capitalize on industry trends arising from global clean air regulations, consumers’ demand for fuel economy, and the popularity of sport utility and crossover vehicles around the world. The company benefits from its ability to continuously innovate, a global manufacturing footprint, highly integrated long-term customer ties, high customer switching costs, and moderate pricing power from new technologies,” writes Richard Hilgert, Morningstar senior equity analyst, in a report.

3) Sirius XM Holdings SIRI

Fair Value: $7.50

Morningstar Rating: 5 stars

Price as of March 22, 2024: $3.88

This stock is trading at a 48% discount.

Sirius XM Holdings consists of two businesses: SiriusXM and Pandora. SiriusXM transmits music, talk shows, sports, and news via its satellite radio network, primarily to consumers who pay a subscription fee, often tied to a vehicle. Pandora, acquired in February 2019, is a streaming music platform that offers an ad-supported radio option and a paid on-demand service.

“We assign Sirius XM an Exemplary Capital Allocation Rating, driven primarily by the likelihood that the company adds value through its shareholder distribution policies while also considering the shape of its balance sheet and investments. Sirius XM’s balance sheet is sound, as the company had $216 million of cash and equivalents and $9.2 billion of debt at the end of 2023. This places the net debt/adjusted EBITDA ratio at 3.3 times, a reasonable level within its target range of low 3′s and typical for a firm affiliated with Liberty Media and John Malone,” writes Matthew Dolgin, senior equity analyst at Morningstar, in a report.

4) Aptiv PLC APTV

Fair Value: $148

Morningstar Rating: 5 stars

Price as of March 22, 2024: $78.72

This stock is trading at a 46% discount.

Aptiv is an automotive supplier. Its signal and power solutions segment supplies components and systems that make up a vehicle’s electrical system, including wiring assemblies and harnesses, connectors, electrical centers, and hybrid electrical systems.

“In our opinion, Aptiv’s ability to regularly innovate and commercialize new technologies bolsters sales growth, margin, and return on investment. A global manufacturing presence enables Aptiv to serve customers around the world, capitalizing on the economies of scale inherent in automakers’ plans to use more common vehicle platforms,” writes Richard Hilgert, Morningstar senior equity analyst, in a report.

5. Charter Communications CHTR

Fair Value: $550

Morningstar Rating: 5 stars

Price as of March 22, 24: $290

This stock is trading at a 46% discount.

Charter owns cable TV networks. It is the product of the 2016 merger of three cable companies: Legacy Charter, Time Warner Cable, and Bright House Networks. The firm now holds networks capable of providing television, internet access, and phone services to roughly 56 million US homes and businesses, around 40% of the country.

“Charter’s cable networks have provided a significant competitive advantage versus its primary competitors—phone companies like AT&T T—as high-quality internet access has become a staple utility. We estimate the firm now claims about 70% of the internet access market across the territories it serves, up about 7 percentage points over the past five years. Charter has been able to upgrade its network to meet consumer demand for faster speeds at modest incremental cost, while the phone companies have ignored their networks across big chunks of the country,” writes Morningstar director Michael Hodel in a recent report.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)