Tech Stock Dividends Are Changing the Face of Dividend Growth Investing

With Alphabet, Meta, and Salesforce paying dividends, what does this mean for investors?

Big tech is again leading to disruption, this time in dividend investing.

Mega-sized stocks Alphabet GOOGL/GOOG, Meta Platforms META, and Salesforce CRM have announced their first-ever dividend payouts, joining a growing number of smaller tech stocks.

While the yields offered by most tech names are relatively small, their potential to grow dividend payouts along with earnings over time is attractive for many investors focused on dividend growth. This is changing the complexion of dividend growth strategies away from financials and other slower-growing companies. Tech stocks have increased from 2.3% of the Morningstar US Dividend Growth Index (made up of securities with a history of uninterrupted dividend growth and the capacity to sustain that growth) in 2003 to 18.0% at the end of 2023.

With market returns driven in recent years by big-tech names, and growth stocks more broadly, this dynamic is filtering into dividend growth investing. As big-tech stocks such as Meta and Alphabet issue dividends, income strategies now “have access and exposure to those names that have driven the market more recently,” says Matt Quinlan, lead portfolio manager for the $3.9 billion Franklin Equity Income fund FISEX and the $27.4 billion Franklin Rising Dividends fund FRDPX.

Tom Huber, portfolio manager for the $24.4 billion T. Rowe Price Dividend Growth fund PRDGX, thinks the trend still has more room to go. “There will be more and more opportunities for dividend growth investors to buy technology stocks,” he says.

For investors, there is one possible catch. While the trend means dividend growth strategies may capture more of the overall stock market gains, it could also lessen their appeal as portfolio diversifiers. “The inclusion of the big names [Meta, Alphabet] in any sort of dividend indexes or dividend growth indexes is very likely to increase their correlation with the broad market,” says David Harrell, editor of the Morningstar Dividend Investor newsletter.

Sector Breakdown of the Morningstar US Dividend Growth Index

Tech Stock Dividend Trends

For the most part, technology companies and growth stocks typically do not take the cash they generate and send it back to investors through dividends. Instead, that cash is reinvested in the business to fuel additional growth or returned to investors through share buybacks. Still, the announcement of dividends by key big-tech companies extends a longtime trend.

“You saw it first with semiconductors,” says Quinlan. Texas Instruments TXN issued its first dividend in 1985, Analog Devices ADI paid out in 2003, and Broadcom AVGO followed suit in 2010. “These companies have attractive financial models that generate tremendous cash flow,” he explains. “They can both invest in the business and reinvest to maintain those competitive positions, while also paying dividends.”

The Morningstar US Target Market Exposure Index, which measures the performance of the top 85% of the investable universe in the United States by market cap, has also seen a modest influx of dividend-paying tech stocks. In 2008, 22 stocks in the index were tech dividend payers. By 2015, that number had grown to 41. At the end of 2023, there were 47.

As of April 30, 2024, here are the 10 dividend-paying tech stocks with the largest weight in the Morningstar US Target Market Exposure Index:

- Microsoft MSFT

- Apple AAPL

- Nvidia NVDA

- Alphabet GOOGL/GOOG

- Meta Platforms META

- Broadcom AVGO

- Salesforce CRM

- Cisco Systems CSCO

- Accenture ACN

- Qualcomm QCOM

More Names, But Low Dividend Yields

Though more tech stocks are paying dividends, the yields are low. The Morningstar US Technology Index has the smallest forward dividend yield out of all the Morningstar sector indexes, at 0.72%. Excluding real estate, the two highest-yielding sectors are utilities, at 3.44%, and energy, at 3.10%.

Huber says the low yield is partly due to the mindsets of management teams at big tech companies. “It takes time for the companies to get to a point where they understand they are grown up, mature, and generating more cash than they need,” he explains. Dividends are a commitment, he notes. “Once you start, you certainly don’t want to cut, and ideally you grow.” Additionally, he says some firms worry that paying dividends will signal to investors that they do not expect strong growth to continue.

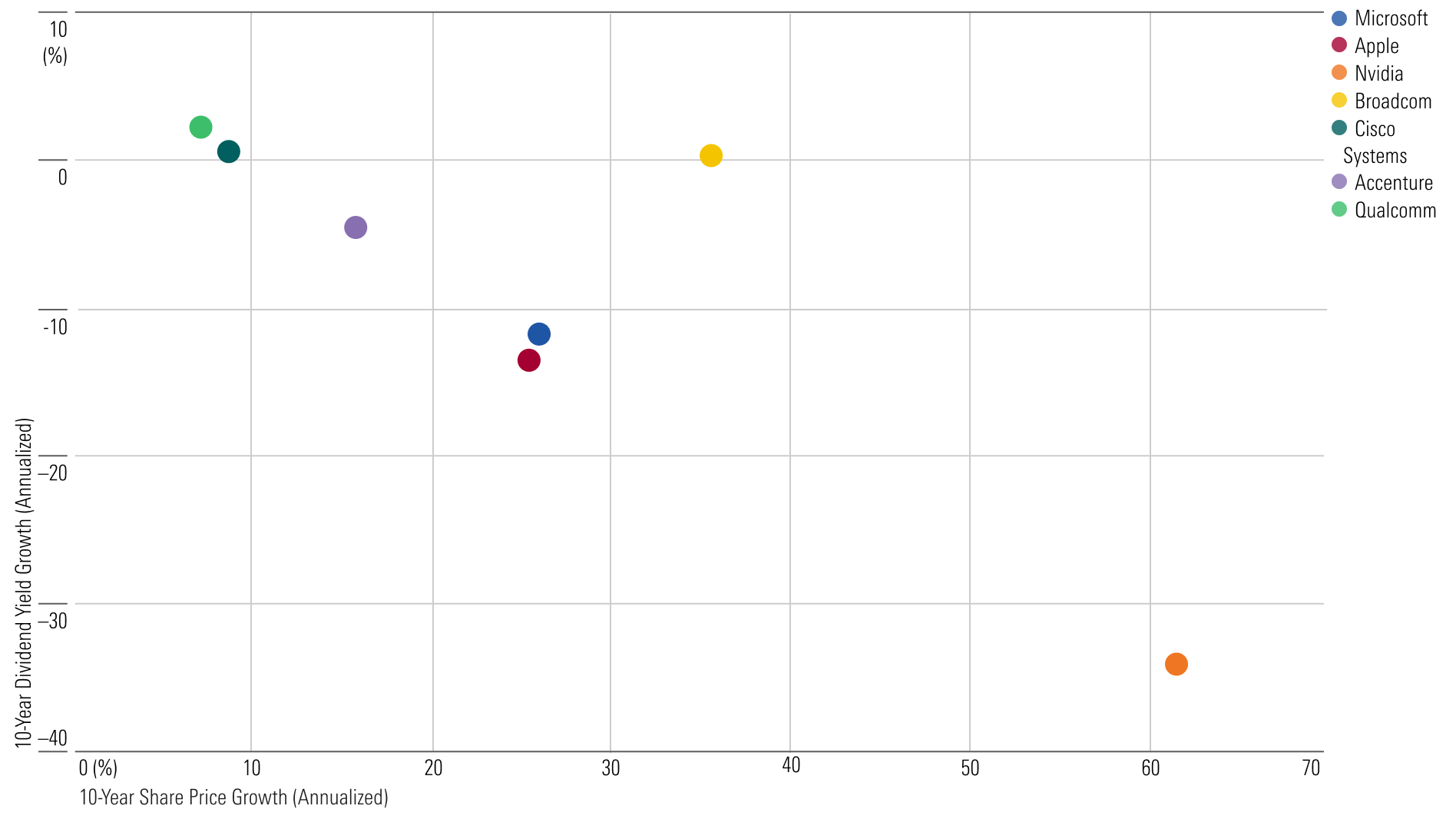

Within the Morningstar US Target Market Exposure Index, the average forward dividend yield is 1.14%. The highest-yielding stock is Cisco, at 3.42%, and the lowest-yielding is Nvidia, at just 0.02%. Furthermore, while all the stocks in the group have grown the dividend dollar amount paid out annually over the past 10 years, only Qualcomm, Cisco, and Broadcom have grown their yields. Accenture, Microsoft, Apple, and Nvidia have seen their yields fall significantly. Soaring share prices and modest dividend increases have driven them down over time, as a yield is a function of a stock’s price. Nvidia is the most extreme example, as its yield shrunk by 34.09% from 2013 to 2023 on an annualized basis while its share price surged 61.89%.

10-Year Share Price Growth vs. 10-Year Dividend Yield Growth

Dividend Growth vs. Dividend Income Strategies

Dividend strategies typically fall into one of three categories: income, growth, or a blend.

Dividend income strategies are generally focused on high-yielding companies, Quinlan says, whereas dividend growth strategies focus on companies that can “significantly and consistently increase their dividend over time.”

The Franklin Rising Dividends fund, a dividend growth fund, holds 22% of its portfolio in tech stocks, with names like Microsoft, Roper Technologies ROP, Accenture, Texas Instruments, and Analog Devices in its top 10 holdings. “All of those would be examples of businesses that we like that have attractive growth in terms of their ability to grow the business and have innovative new products to drive capital appreciation over time,” says Quinlan. Additionally, he believes that “their dividend payments, in terms of the per share amounts, will continue to go up.” The T. Rowe Price Dividend Growth fund also holds 22% in tech stocks, with Microsoft and Apple holding the top two spots in the portfolio.

Looking at income strategies, tech stocks are not as widely held. The Morningstar Dividend Yield Focus Index, which tracks stocks with attractive dividend yields and strong financial quality, is 8% tech stocks. This is less than half the amount of the Dividend Growth Index. The average yield on stocks within the dividend yield focus index is 3.98%, higher than the yield on any single tech stock in the Total Market Exposure Index.

Key Metrics for the Big-Tech Dividend Payers

Microsoft MSFT

- Forward Dividend Yield: 0.73%

- Annual Dividend: $3.00

- Morningstar Rating: 3 Stars

- Capital Allocation Rating: Exemplary

“Microsoft’s capital deployment strategy centers around re-investing in the business, paying dividends, buying back shares, and making generally small tuck-in acquisitions,” says senior equity analyst Dan Romanoff. “We expect the share count to continue to decline over time and see dividends growing generally in line with earnings.”

Read Romanoff’s full take on Microsoft here.

Apple AAPL

- Forward Dividend Yield: 0.55%

- Annual Dividend: $1.00

- Morningstar Rating: 3 Stars

- Capital Allocation Rating: Exemplary

“On top of strong investments, Apple boasts a robust balance sheet and uses it to reward shareholders,” says equity analyst William Kerwin. “Apple’s cash generation is fantastic, and we like its goal of becoming net cash-neutral, which should help avoid the opportunity cost of holding masses of cash. We also like the firm’s dividend and buyback program, a combination that routinely sends all of Apple’s free cash flow back to shareholders.”

The rest of Kerwin’s outlook on Apple can be found here.

Nvidia NVDA

- Forward Dividend Yield: 0.02%

- Annual Dividend: $0.16

- Morningstar Rating: 3 Stars

- Capital Allocation Rating: Exemplary

“Nvidia is in outstanding financial health. As of January 2024, the company held $26.0 billion in cash and investments, compared with $9.7 billion in short-term and long-term debt,” says equity strategist Brian Collelo. “Nvidia’s dividend of $0.16 annually is very reasonable relative to its financial health and forward prospects, and the firm also returns excess cash to shareholders via stock buybacks.”

Colello has more about Nvidia’s stock here.

Alphabet GOOGL/GOOG

- Forward Dividend Yield: 0.47%

- Annual Dividend: $0.80

- Morningstar Rating: 3 Stars

- Capital Allocation Rating: Exemplary

“Alphabet delivered strong results during the first quarter, with revenue growth accelerating and restructuring efforts driving margin expansion, says director of equity research Michael Hodel. “The firm also instituted a dividend, which will total about $10 billion annually at the initial rate, and authorized an additional $70 billion of share repurchases. While growth likely won’t maintain this quarter’s pace throughout this year, Alphabet’s results position it to exceed our expectations for the year.”

Take a deeper dive into Hodel’s outlook for Alphabet.

Meta Platforms META

- Forward Dividend Yield: 0.42%

- Annual Dividend: $2.00

- Morningstar Rating: 2 Stars

- Capital Allocation Rating: Exemplary

“In an industry where continuing investments are required to compete and maintain market leadership, we believe Meta is well-positioned in terms of access to capital,” says Hodel. “Meta declared a quarterly $0.50 per share dividend in the first quarter of 2024. The firm will likely also use a portion of its cash to repurchase shares and remain active on the acquisitions front, although limited by continuing Federal Trade Commission antitrust oversight.”

Investors can find more of Hodel’s take on Meta Platforms here.

Broadcom AVGO

- Forward Dividend Yield: 1.58%

- Annual Dividend: $21.00

- Morningstar Rating: 2 Stars

- Capital Allocation Rating: Exemplary

“We anticipate Broadcom focusing on strong cash generation,” says Kerwin. “Over the short term, we expect the firm to focus on paying down debt taken out to acquire VMware. Over the long term, we expect the focus to be on growing its dividend and bolting on more acquisitions. Broadcom has committed to its dividend policy—50% of the prior year’s free cash flow—after closing the acquisition.”

Kerwin has more about Broadcom’s stock here.

Salesforce CRM

- Forward Dividend Yield: 0.57%

- Annual Dividend: $1.60

- Morningstar Rating: 3 Stars

- Capital Allocation Rating: Standard

“Salesforce dramatically changed its capital allocation strategy beginning in August 2022 when it began a formal share repurchase program, with $18 billion in repurchase authorization remaining as of February 2024,” says Romanoff. “In February 2024, the company instituted a quarterly dividend. We expect a balanced approach between buybacks, dividends, and internal investments for product innovation.”

Read Romanoff’s full take on Salesforce here.

Cisco Systems CSCO

- Forward Dividend Yield: 3.33%

- Annual Dividend: $1.60

- Morningstar Rating: 3 Stars

- Capital Allocation Rating: Exemplary

“In our view, Cisco’s shareholder return policies are superb,” says Kerwin. “The firm has a resolute balance sheet and generates immense cash flow. It dedicates well over half of this cash flow to its dividend and repurchases, which we view favorably. Cisco’s dividend yield and total shareholder return, including buybacks, should be attractive to long-term investors.”

Take a deeper dive into Kerwin’s outlook for Cisco.

Accenture ACN

- Forward Dividend Yield: 1.65%

- Annual Dividend: $5.16

- Morningstar Rating: 3 Stars

- Capital Allocation Rating: Exemplary

“We think Accenture’s shareholder distributions are mixed, as dividends and share repurchases are not diverting R&D efforts, but Accenture has repurchased shares at times when we’ve believed the stock to be significantly overvalued,” says equity analyst Julie Bhusal Sharma. “The company has consistently increased its dividend year after year, although the dividend payout has fluctuated over the last 10 years in the 35%-45% range. Share buybacks have been a mainstay at Accenture, with the firm buying back $1.5 billion-$2 billion in shares in each of the last 10 years.”

Investors can find more of Sharma’s take on Accenture here.

Qualcomm QCOM

- Forward Dividend Yield: 1.88%

- Annual Dividend: $3.40

- Morningstar Rating: 2 Stars

- Capital Allocation Rating: Standard

“We believe the firm has exhibited a sound strategy for returning cash to shareholders, as it intends to distribute much of its free cash flow,” says Colello. “The company has consistently bought back shares in recent years. Qualcomm also pays out a solid quarterly dividend.”

The rest of Colello’s outlook on Qualcomm can be found here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K4RTVRPKCVFQBMRNMXPUOHFNLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)