5 Undervalued Stocks That Crushed Earnings

Albemarle and Ionis Pharmaceuticals are among the names that are still cheap despite impressive Q4 earnings and revenue beats.

Amid an overall positive picture for earnings in the fourth quarter, a large swath of US companies have been beating estimates. Combining the results of the companies in the Morningstar US Market Index that have reported their earnings with analyst expectations for those that are still yet to publish, earnings are on track to increase 5.1% from the third quarter of 2023.

At the same time, almost half of the US-listed stocks covered by Morningstar that reported as of Feb. 26 managed to beat their FactSet consensus estimates by 5% or more. Even better for investors looking to put money to work, analysts believe a number of these stocks remain undervalued relative to their fair value estimates. To highlight these opportunities, we ran a screen for undervalued stocks that beat both earnings and revenue expectations for the fourth quarter of 2023.

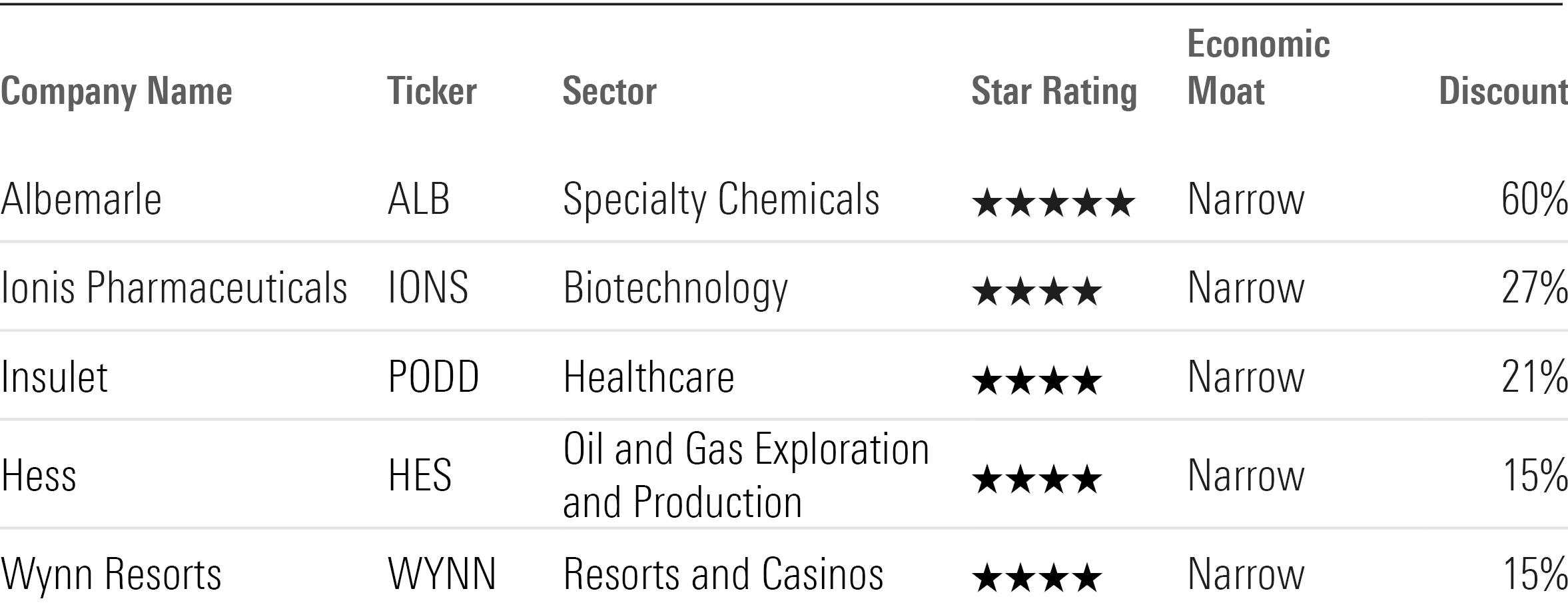

5 Undervalued Earnings Crushers

How Do Fourth-Quarter Earnings Stack Up?

As of the time of writing, 83% of the 704 US-listed stocks covered by Morningstar analysts have reported earnings for the most recent quarter. Of those, 47% beat the FactSet mean estimates for their earnings by 5% or more—a decline compared with the 52% that beat estimates by the same amount last quarter. About 16% missed their estimates by 5% or more—an uptick compared with the 13% seen in the third quarter of 2023.

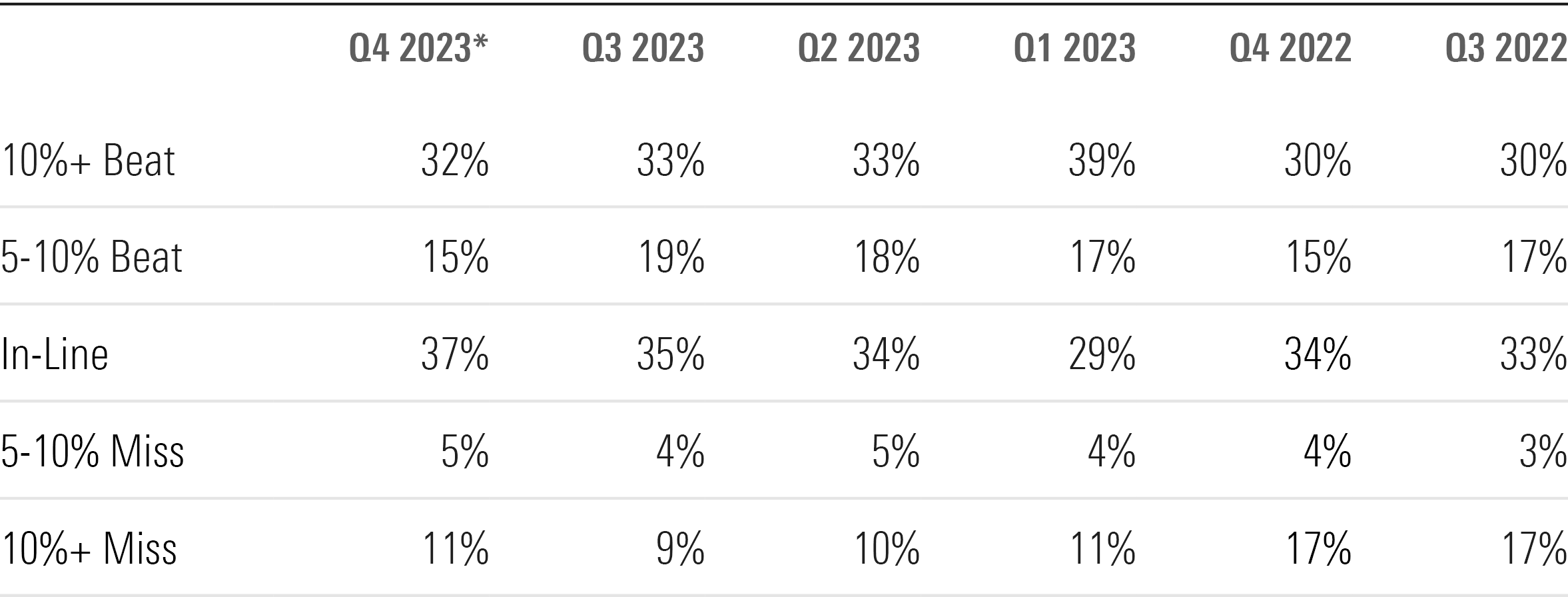

Quarterly Results for US-Listed Stocks Covered by Morningstar

Digging deeper, fewer companies beat their estimates by 10% or more—32%, versus 33% in the third quarter. About 15% surpassed expectations by 5%-10%, a decline from the 19% that did so in the third quarter.

The quantity of earnings misses was higher across the board, with 5% of companies reporting earnings 5%-10% below FactSet estimates, compared with 4% in the third quarter. An additional 11% reported earnings 10% or more below estimates—up from 9% in the third quarter.

How We Did Our Stock Screen

While Morningstar analysts pay close attention to earnings, their focus is on long-term results and valuations. One quarter doesn’t usually lead to a change in the long-term assumptions behind the assessment of a stock’s fair value estimate unless new material information affects those assumptions. For example, new data on a drug could raise the probability of its approval, or pricing gains on a key product line could affect an analyst’s long-term thinking. Still, looking at quarterly earnings against the valuation backdrop can help long-term investors identify opportunities.

We screened for stocks that beat their earnings expectations by 10% or more but remain undervalued. In addition, to keep the focus on companies with truly strong results that did not use accounting gimmicks or one-time factors, we screened for revenue beats of 5% or more. We then filtered for stocks that are rated 4 or 5 stars and have been awarded economic moats.

Of the 704 US-listed stocks covered by Morningstar analysts, only five companies met our criteria. We’ve highlighted what our analysts had to say about their earnings below.

5 Undervalued Stocks That Beat Earnings Estimates

Albemarle

- Earnings Per Share: Gain of $1.85 versus the consensus estimate of $0.98

- Revenue: $2.4 billion versus the consensus estimate of $2.3 billion

- Morningstar Rating: 5 stars

- Discount to Fair Value Estimate: 60%

“Albemarle’s fourth-quarter earnings confirmed our view that the company is focusing on free cash flow generation over lithium volume growth amid the decline in lithium prices. As the company cuts operating expenses, this should support profits amid lower lithium prices. As Albemarle plans to cut capital expenditures and optimize working capital, this should support higher cash flow generation in 2024. Management’s market commentary also confirms our view that growing demand and slowing supply will lead to prices rising in 2024. Having updated our model to incorporate fourth-quarter results, we maintain our $300 per share fair value estimate. Our narrow moat rating is also unchanged.

“We view current lithium prices as at cyclically low levels. Prices are below the marginal cost of production. In response, higher-cost existing production has shut down, while new projects have been delayed by all major producers, including Albemarle.

“As electric vehicle sales grow and more utility-scale batteries are built, we forecast lithium demand will grow 10% to 1.1 million metric tons by the end of 2024. As total supply growth slows, we expect the market will move into a supply deficit, leading to prices rising, particularly in the second half of the year.”

—Seth Goldstein, equities strategist

Ionis Pharmaceuticals

- Earnings Per Share: Loss of $0.06 versus the consensus estimate of $0.82

- Revenue: $325 million versus the consensus estimate of $174 million

- Morningstar Rating: 4 stars

- Discount to Fair Value Estimate: 27%

“Ionis reported fourth-quarter results that were ahead of our expectations, due to the timing of milestone and collaboration revenue payments, with 2024 guidance slightly below our estimates. We’re maintaining our $62 fair value estimate as the firm’s commercial portfolio expands. Revenue increased 34% in 2023, which helped reduce operating losses despite more investment in leading programs approaching the market. Royalties from partner Biogen BIIB for spinal muscular atrophy drug Spinraza were roughly flat at $240 million in 2023, as Spinraza is retaining share despite strong competition from Roche’s Evrysdi.

“Ionis and AstraZeneca’s AZN polyneuropathy drug Wainua is launching in the US, and we expect this once-monthly, self-administered injection to help it gain some market share from Alnylam’s ALNY Amvuttra, although we continue to see first-to-market Alnylam maintaining a lead. Ionis also expects Wainua data in the larger cardiomyopathy indication in 2025, if the firm takes an early look at data, or in 2026 if the trial runs to completion. Amvuttra’s similar trial should produce data in mid-2024 that could influence Ionis’ decision. With two additional Ionis pipeline drugs poised to reach the market by 2025, we think the portfolio is growing nicely and continuing to support the firm’s narrow moat.

“Recent positive top-line phase 3 readouts bode well for the firm’s progression to independently launching two drugs in 2024 and 2025, and we expect sales of these drugs combined to eventually generate roughly half of our $4.7 billion 2032 total revenue forecast. We expect olezarsen to launch in late 2024 in the US in familial chylomicronemia syndrome, a rare lipid disorder, making it the first independent launch for Ionis. Donidalorsen’s success in a phase 3 trial for another rare disorder, hereditary angioedema, indicates that this drug could be administered every one or two months, versus a less convenient vial and syringe for the standard of care.”

—Karen Andersen, strategist

Insulet

- Earnings Per Share: Gain of $1.44 versus consensus estimate of $0.65

- Revenue: $509 million versus consensus estimate of $461 million

- Morningstar Rating: 4 stars

- Discount to Fair Value Estimate: 21%

“Insulet saw another strong quarter that wrapped up an entire year of impressive growth on the top and bottom lines. Though we haven’t shifted our assumptions, we might modestly raise our fair value estimate to account for cash flows realized since our last update. Our projections for 2024 remain on the high end of management’s outlook, but we see little to alter our thinking, especially considering the introductions lined up for the year, including integration with Dexcom’s G7 continuous glucose monitor, Omnipod integration with Apple’s AAPL iPhones, and further investment in the salesforce to leverage Omnipod’s long-standing strength in pediatric care.

“Insulet defied the usual pattern related to new product launches—four consecutive quarters of significantly higher growth followed by noticeable moderation in the fifth. Quarterly revenue rose 37% in constant currency against the prior-year period, which itself had seen 20% year-over-year growth thanks to the first full quarter of Omnipod 5 sales. As management said, the most recent quarter happened to benefit from a buildup of inventory in the distribution channel as well as extra stocking by pharma distributors in anticipation of Insulet’s switch to a new enterprise software system this year. However, even after adjusting for those one-time factors, quarterly revenue still rose a stellar 28%.

“Further, Insulet’s new patient mix has returned to its typical 80% from multiple daily injections and 20% from competitive pump users, underscoring our view that the Omnipod is the ‘gateway’ pump to this kind of therapy. It helps that the pay-as-you-go model through the pharmacy means new users don’t have to commit to the more expensive pumps from Medtronic MDT and Tandem TNDM to try out the technology.”

—Debbie Wang, senior equity analyst

Hess

- Earnings Per Share: Gain of $1.63 versus the consensus estimate of $1.36

- Revenue: $3.0 billion versus the consensus estimate of $2.8 billion

- Morningstar Rating: 4 stars

- Discount to Fair Value Estimate: 15%

“Our fair value estimate for Hess is unchanged at $176 due to the pending merger with Chevron CVX. We also maintain our narrow moat rating. We still believe that this offers great value to shareholders, representing a significant premium to our premerger valuation of $118. There remains a risk—namely, the Federal Trade Commission investigation, which may end up postponing the close of the deal. At this point, we see little likelihood that the deal will not eventually close, given the limited risks to competition. The crown jewel, Guyana, is a non-operated minority stake. Hess’ Bakken operations would elevate Chevron to a top producer in the basin, but we don’t see a change in the competitive environment in the basin as a result of the deal, so we don’t think the investigation will force any changes. Despite the announced investigation, there has been no change to management’s estimated first half of 2024 close.

“Reported production was 418 thousand barrels of oil equivalent per day, up 5.8% from the third quarter, driven almost entirely by increased crude production in Guyana. The primary reason for this is the Payara expansion ramping during the period. Management has also stated that it reached initial capacity during January, so there is unlikely to be a similar growth in volumes from Guyana until the next expansion, Yellowtail, begins in the first half of 2025. Bakken production showed marginal sequential growth, with operations being stable and few surprises occurring during the period.”

—Stephen Ellis, energy and utilities strategist

Wynn Resorts

- Earnings Per Share: Gain of $1.91 versus the consensus estimate of $1.15

- Revenue: $1.8 billion versus the consensus estimate of $1.7 billion

- Morningstar Rating: 4 stars

- Discount to Fair Value Estimate: 15%

“Fourth-quarter Vegas sales rose 19% to $697 million, topping our $647 million estimate, as the company’s high-end offering saw a strong benefit from the Formula One race in November. Adjusted EBITDAR rose 24% to $271 million, edging our $268 million forecast, leading to a 38.9% margin (versus 37.5% last year). Looking to 2024, the event calendar should aid continued strong visitation in the region, offering the opportunity for yield improvement, given the firm’s already strong occupancy of 90% in 2023. In particular, the city hosts the Super Bowl this month, and Wynn expects its hotel revenue will see a similar boost to that experienced in November from Formula One. Further, Wynn believes its group business will see yearly room night growth throughout the year. As a result, we plan to increase our 4% 2024 sales growth estimate to 5%-6%.

“Results in Macao were strong, with sales of $910.6 million above our $853 million estimate. In 2024, we expect Wynn to see further sales growth roughly in line with the overall industry, increasing at a low 20% rate as China’s outbound travel continues to recover. Wynn’s Macao segment profitability also improved, with adjusted EBITDA of $296.9 million comfortably beating our $247 million forecast, resulting in a 32.6% margin (up 140 basis points versus 2019). We have increased confidence that the company can hold this margin level for the foreseeable future, as it benefits from an increasing mass and nongaming mix, which should offset any promotional competition.”

—Dan Wasiolek, senior equity analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-20-2024/t_dc0763464c0a4191b876af1624b96f43_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IPKX4IWSDBD3VJC2Y34W6STFL4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)