Crypto, REITs, Private Equity: Long-Term Investments or Short-Term Trends?

What to know before you dive in.

Investing trends are hard to ignore. Every swipe on your phone seems to boast a new (or reoccurring) investing opportunity that you must jump on—whether it’s a new crypto product or exposure to private equity.

The source may even provide valid-sounding reasons as to why the opportunity is a good idea. However, before you jump on the bandwagon, it’s worthwhile to consider if this opportunity is right for you, regardless of the overall benefits touted online.

Taking a step back before making the plunge can help you do two things in particular: make sure you’re not deceiving yourself and make sure your actions are in line with your financial goals.

Why Are Investors Drawn to New Investment Trends?

In our recent research, we asked individual investors about their knowledge of certain trending investments, whether they owned them, whether they were planning on changing their investment in each, and their motivations behind that decision. We focused on the following trends:

- business development companies, or BDCs

- commodities

- cryptocurrency

- private credit

- private equity

- REITs

- semiliquid interval funds

- separately managed accounts via direct indexing

- structured products

This is, of course, not an exhaustive or perfect list of all assets that could be considered “trending investments,” but it covers the main assets that we identified from conversations with industry leaders and reviews of industry research and content.

We found that most investors only had a basic understanding of these investing trends. For most of the assets, fewer than half of investors felt they could even pick out the correct definition from a list.

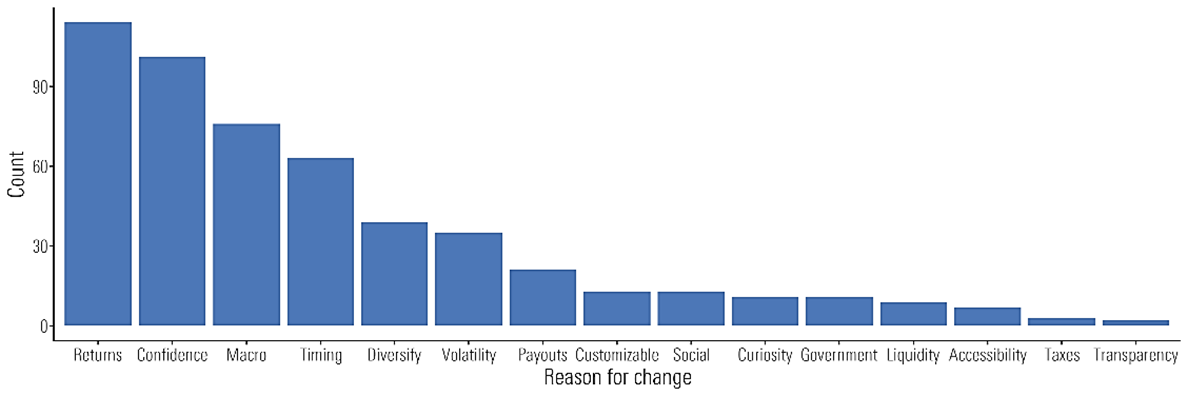

When we looked at people’s motivations for making changes to their future investments in each asset, the most common reasons people gave had to do with returns, their confidence in the long-term viability of the asset, macroeconomic factors they thought could affect the asset, and their desire to time the market.

Notice how most of these reasons are related to short-term thinking, trying to time the market, overemphasis on present-day returns, and overreaction to events—common mistakes investors have always made.

Motivation Counts

Furthermore, many of the benefits commonly attributed to these investing trends—things like diversification, tax efficiencies, or transparency of information—aren’t at the forefront of investors’ minds. In other words, when it comes to decisions about trending investments, it’s all too easy to fall into age-old investing pitfalls.

Follow These 3 Steps Before Jumping Into Investing Trends

To avoid making an impromptu investment decision, it’s helpful to have a set process you can use to slow down, combat cognitive biases, and think carefully through future investments.

To that end, we created a three-step process inspired by our research. The process guides investors through recognizing their knowledge level regarding the investment topic in question, addressing their motivations and connecting those back to their financial goals, and then widening their perspectives:

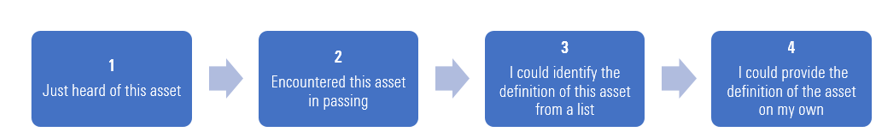

1. Level-set: Use the following scale to understand how knowledgeable you are about the investment topic. If you rate yourself as 3 or below, hold off on making any decisions until you more fully understand the investment. Regardless of where you are on the scale, consider visiting a few trusted sources for more information about the investment.

Knowledge Level

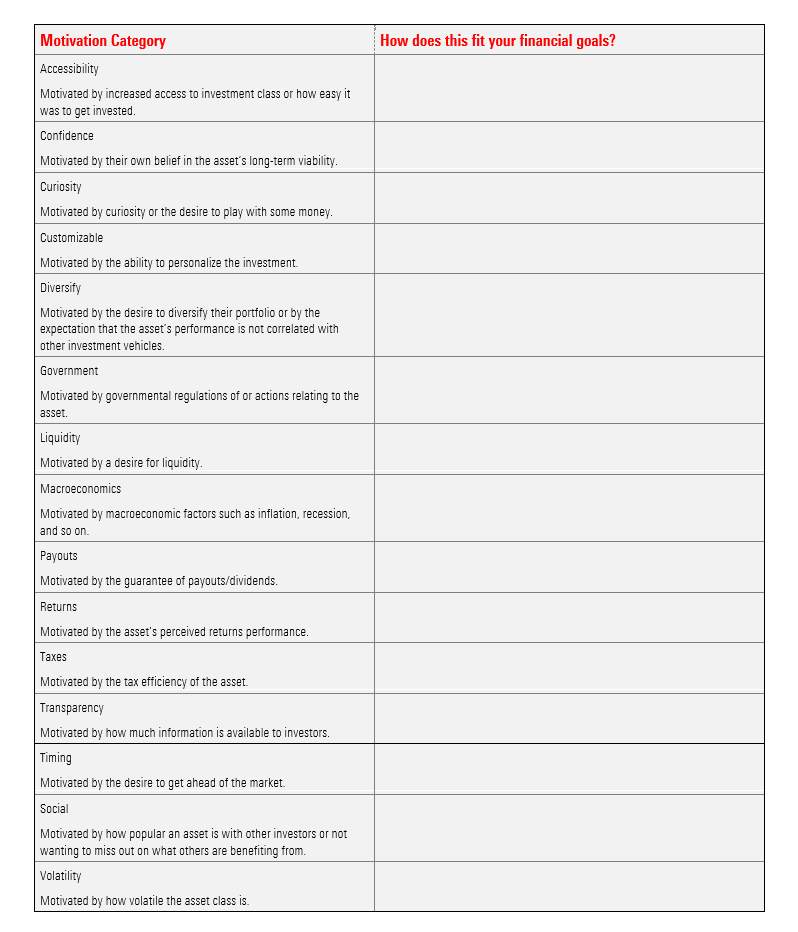

2. State your motivations and align with your investing goals: Take a moment to state your motivations for making this investment decision. Consider choosing from the following motivations we found in our research. Carefully consider what is driving you to make this change to your investments. Next, consider if this motivation aligns with your financial goals. Fill in the corresponding area in column two with your explanation of how this gets you closer to your long-term goals.

Motivation

3. Deliberately broaden your perspective: Because of the way our minds work, this is harder than it seems. Set aside an hour and intentionally search online for three resources that disagree with your investment decision. For example, if you are looking to buy a particular REIT, read three resources that claim this is a bad idea. Finding and considering perspectives different from your own will help you reduce confirmation bias and garner a more well-rounded view.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)