17 Funds for 2024 and Beyond

Explore these long-term investments in small-cap, international stock, and bond funds.

Wow. That’s how you finish the year. Benign inflation and solid jobs growth set the table for the Federal Reserve to pivot from rising rates to possibly cutting rates in 2024. And investors were giddy in December 2023. Small caps rallied 10%, long bonds bounced 8%, and large caps surged 5%. We had enough for a solid year in just one month.

Wall Street takes the adage “Don’t fight the Fed” to heart. A favorable interest-rate environment sets the stage for a lot of good things for Wall Street: Stocks with dividends look more attractive, future earnings are discounted by a smaller number, and, of course, investors can leverage their portfolios more cheaply.

On the other hand, there’s some sobering news. Stocks and bonds don’t look as cheap as they did. Also, nothing lasts forever. Pimco now says that there is a 50% chance of a recession in 2024. Rate hikes from the past couple of years are still percolating through the economy, potentially leading to a slowdown. The Fed is currently forecasting three rate cuts in 2024.

While the interest-rate picture is encouraging, wars in Ukraine and Israel plus a general election in the United States could produce quite a bit of turbulence for the markets and economy.

But let’s start with a simple idea. The long-running bond drought and large-growth rally may have left your portfolio out of balance. In January, it’s probably a good idea to rebalance so that you don’t have any outsize risk. That’s easy in a 401(k) where you can choose your weightings, hit a button, and set up an annual rebalance without tax consequences. In taxable accounts, you can minimize your tax bill by using distributions and other new money to bolster the parts of the portfolio that have shrunk in relative terms. Conversely, you may be able to find some losses or at least shares with very low appreciation in areas you want to dial back.

Now, let’s get to the fund ideas that could be rewarding over the long term. Some of these are based on the macroeconomic picture, and others reflect time-tested ways to unearth attractive investments. As always, I view this information as a guide to make modest portfolio adjustments and source new ideas rather than suggest a big shift in your portfolio.

Small Caps

Morningstar equity analysts estimate a fair value for each stock they cover, and we roll up those figures to get a big picture of the market’s attractiveness. It’s not a perfect predictor, of course, but I find it to be a useful guide, and it is saying that small caps are cheaper than large caps. The year-end rally was stronger in small caps, but they still trade at a greater discount than large.

At year-end, the overall market was trading at a 1% discount to fair value after about two years of trading at a discount that got as large as 19%. Within the U.S. market, large caps are 2% overvalued, mid-caps are 5% undervalued, and small caps are 11% undervalued.

T. Rowe Price Integrated U.S. Small-Cap Growth Equity PRDSX, which has a Morningstar Medalist Rating of Gold, has been a real gem in the 17 years that Sudhir Nanda has been a manager. Nanda runs a patient and diffuse portfolio built from a mix of quantitative and fundamental analysis, hence the “Integrated” in the fund’s name. Returns have topped peers and the benchmark over the past five-, 10-, and 15-year periods. The fund also charges a respectable 0.80% in fees.

DFA US Micro Cap DFSCX is the antithesis of the giant growth stocks that have largely driven the market in recent years. DFA casts a wide net aimed at capturing positive attributes while minimizing trading costs. Micro-caps have a lower correlation with the mega-caps, and they regularly have their day in the sun before going back to being ignored.

Janus Henderson Small Cap Value JSCVX reopened to new investors in April 2023. I like to get in when a fund reopens because it tells me that I’m going against the crowd. Managers Justin Tugman and Craig Kempler are seasoned managers who can take full advantage of a sale in good small caps. We rate the fund Silver despite unimpressive recent returns because we think the disciplined approach will prove out.

Foreign Stocks

Foreign equities have been neglected, too. I don’t know when they will start to lead U.S. stocks, but historically these things run in roughly 10-year cycles.

I’m still a big fan of Dodge & Cox International Stock DODFX. I own it in my 401(k), so I’m putting in a little more with every paycheck. The firm has just outstanding value investors, and its managers and analysts know their companies very well. The fund charges just 62 basis points, and long-term results are excellent, though it occasionally hits a bump in the road.

Vanguard International High Dividend Yield VIHAX keeps it simple. It tilts toward foreign equities with healthy dividends, but it doesn’t tilt so much that it gets loaded down with junky stocks that might not be able to maintain their big payouts. The fund costs just 0.22% and paid out a yield of 4.40% over the past 12 months.

Fidelity Overseas FOSFX manager Vincent Montemaggiore continues to impress with his mix of value and growth lenses. He looks for companies with high barriers to entry, strong recurring revenue, and healthy balance sheets. Although Montemaggiore has run well ahead of benchmark and peers since taking the helm in 2012, the fund’s size is relatively modest by the standards of successful funds at Fidelity. It has just $8.9 billion in assets under management.

Bonds

The previous two years have been among the worst for the bond market. The rally in late December took a little of the pain away, but yields are still much higher than they had been. That sets up the market for pretty solid returns in the next few years. You’ll need to get over the ugly results of recent years and focus on the potential results that may be coming. I’ve chosen two aggressive options and two core bond funds.

Vanguard High-Yield Corporate VWEHX packs more credit risk than the bond market as a whole but less than most high-yield funds. That seems a comfortable spot to be as you get a nice yield, but a bit of a slowdown in the economy won’t sink the ship. Wellington’s Elizabeth Shortsleeve and Vanguard’s Michael Chang run the fund. Its tilt toward the higher-quality end of high yield leads it to lose less in credit selloffs, and the low fees mean you still enjoy a decent yield.

Gold-rated T. Rowe Price Floating Rate’s PRFRX 8.6% yield figures to be fleeting as bank loans adjust their yields based on changes in interest rates. But clearly, yields can come down a chunk and still be appealing. T. Rowe Price has built a strong team that is up to the task of doing the extensive research required to run a bank-loan fund well.

Dodge & Cox Income DODIX is a Gold-rated fund in the intermediate core-plus bond Morningstar Category. Its focus is mostly on investment-grade corporate bonds and mortgages. Results have been stellar as the firm’s deep team has managed the fund well through all kinds of environments.

Gold-rated Fidelity Investment Grade Bond FBNDX is in our intermediate core bond category as nearly all its portfolio is investment-grade. It will hold a little in below-investment-grade bonds and a lot in BBB rated debt, which is the bottom rung of the investment-grade ladder. Jeff Moore and Michael Plage have proved adept at issue selection and macro positioning.

Funds Whose Fees Have Fallen

Let’s look at some funds that have gotten more attractive over the year. Five Fidelity funds have enjoyed significant drops in fees. The first three come with an asterisk, though, as they have declining performance fees, which are based on the funds’ returns versus their benchmarks over a three-year period. That means the funds might rebound (good news) and performance fees will head north (bad news).

Fidelity Contrafund’s FCNTX fees fell 26 basis points to 0.55%, and that makes the Silver-rated fund look like a bargain. Bronze-rated Fidelity Magellan FMAGX got a 16-basis-point cut to 0.52%, and Silver-rated. Fidelity Blue Chip Growth FBGRX saw a 7-basis-point cut to 0.69%.

Two Silver-rated Fidelity bond funds also have lower fees. Fidelity Short-Term Bond FSHBX saw a 15-basis-point drop to 30 basis points. That’s a big cut. Fidelity Limited Term Municipal Income FSTFX saw a 7-basis-point cut to 0.29%. Yields are modest in shorter-term bond categories, so every basis point in fee cuts helps.

Bronze-rated T. Rowe Price Emerging Markets Stock PRMSX saw its expense ratio fall 6 basis points to 1.15%. That takes Eric Moffett’s fund to a little below the peer-group norm. Moffett is relatively new to the lead manager’s chair at this fund, but he boasts a strong record at prior assignments.

Vanguard Global Equity VHGEX is a Silver-rated fund whose expense ratio fell to 0.41% from 0.45%, taking it from cheap to super cheap. Vanguard’s actively managed funds are among the best bargains in investing. The fund is divvied up among advisors Baillie Gifford, Wellington, and Pzena. That trio and low fees make us bullish about this fund’s prospects.

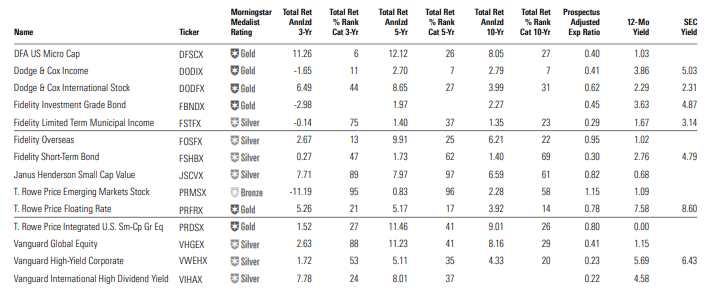

Picks for 2024 and Beyond

Conclusion

As you review and rebalance your portfolio, remember to focus on your goals on fund fundamentals rather than getting happy or mad about last year’s performance. Stick to your plan and good things will happen.

This article first appeared in the January 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

3 Great Funds for the New Year

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)