Tips for Making a Great Firm Even Greater

Bishop & Co. is a lean and mean machine, but it still can get better.

Practice Made Perfect is my series that helps advisors improve their practices. In this edition, I look at a very small firm: Bishop & Company Investment Management located in Erie, Pennsylvania. Bishop & Co. is composed of Michael Bishop, CFA, and his wife, Maureen Bishop. Michael serves as the firm’s portfolio manager and financial advisor. Maureen, with a Bachelor of Science degree in finance, is the operations manager and controller. This lean and mean machine manages approximately $330 million, serving 194 clients with 460 accounts.

As with my past Practice Made Perfect analyses, I was concerned that I would not find any opportunities for improvement at Bishop & Co. After all, I only choose firms that are already well-run—ones where I would feel comfortable placing my investments. In the case of Bishop & Co., I found myself closer to realizing my fears than with any other subject. The Bishops do just about everything right, are happy with their practice and its structure, and are not motivated to grow significantly.

After digging into the details, however, I found some areas that could be improved. Although not huge, these tweaks will prove meaningful to the firm’s future and its clients.

And remember, if your practice might benefit from a Practice Made Perfect analysis, email me at sheryl.rowling@morningstar.com.

How Bishop & Co. Works

Michael emphasized to me more than once that he and Maureen like being a small firm and enjoy the freedom of not having employees. It avoids any potential issues that can arise from managing staff members. (For those firms with employees, I’m sure you can understand that feeling!) Beyond avoiding HR problems, the lack of employees keeps their profitability high and ensures that clients get direct attention from the key professional.

“I am honored when I frequently hear from our clients their gratitude for the personal care and attention Maureen and I provide,” Michael says. “I am amazed our two-person office continually meets and exceeds our clients’ expectations.”

The couple works from three locations: an office suite and two home offices. All locations have instant access to all programs and file sharing because all software is cloud-based.

Michael is a CFA charterholder, a designation that is highly regarded among financial professionals. The chartered financial analyst designation is globally recognized and certifies the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering accounting, economics, ethics, money management, and security analysis. The program is lengthy and arduous, and the pass rate on the three exams is only about 7%.

Bishop & Co. is a registered investment advisor, meaning Michael is committed to the fiduciary duty to always place the interests of firm’s clients first. There are no commissions or hidden kickbacks, and every piece of advice offered is based solely on what is best for the client.

The firm’s fee schedule is on the low side of average, ranging from 1% for the first $1 million in assets and dropping down to 0.5% on portfolios of over $5 million. For portfolios in excess of $10 million, the fee is negotiable. Bishop & Co. bills and collects fees quarterly in advance.

Technology

Bishop & Co.’s back-office software heavily relies on Morningstar tools. Especially in portfolio construction and communicating investment strategy to clients, Morningstar software has been the logical choice for the team. The firm’s software selections are as follows:

- Customer Relationship Management: Junxure, AdvisorEngine

- Portfolio Trading: Morningstar Total Rebalance Expert

- Portfolio Accounting: Morningstar Office

- Account Aggregation: Morningstar ByAllAccounts

- VOIP (Phone): Univerge Blue

- Financial Planning: RightCapital

- File Sharing: Microsoft 365

- Financial Accounting: QuickBooks

The Bishops say that their technology solutions “empower us to deliver outstanding service and business controls without the ongoing need to add to staff.”

To reduce clients’ tax exposure, Michael relies heavily on Morningstar Total Rebalance Expert. An early adopter of the technology, Michael looks to TRX to take advantage of timely, ongoing rebalancing in the most tax-efficient manner. TRX also identifies opportunities and calculates trades for tax-loss harvesting as well as capital gains distribution avoidance and, when appropriate, capital gains harvesting.

ByAllAccounts rounds out the firm’s portfolio-management software suite. The ability to integrate outside accounts, like 401(k)s, with the rest of the portfolio provides an important service to clients while increasing assets under management revenue.

Investment Strategy

As a CFA, Michael believes that long-term returns come from equities and not bonds and cash. He builds portfolios using low-cost index funds, using Morningstar analysis tools to construct the portfolios and Morningstar X-Ray, Snapshot, and stock-intersection reports to communicate the strategy to clients. Michael takes to heart the studies that show active management rarely outperforms indexes over time. Thus, he focuses on diversification, low fees, and tax management to provide value to clients.

“Our experience has been that goal-focused, planning-driven investors reach their goals. In contrast, performance-chasing, reactive investors do not,” Michael says.

Michael considers the client’s risk tolerance, return needs, and risk-taking capacity to determine an appropriate percentage of equities within the portfolio. He then selects the model that best achieves the client’s needs from three allocation structures: 40% equities for low-risk portfolios, 60% equities for midrange, and 80% equities for higher risk. He does not employ alternative investments because he believes they would result in insignificant benefit versus the increased volatility of each position.

Because the bond allocation is meant only as a volatility cushion to damp risk, Michael makes the bond selection very straightforward: He simply invests in a U.S. intermediate-term corporate bond index. As with alternatives, Michael sees no meaningful benefit to diversifying bond holdings.

Besides adding value through diversification, low fees, and tax management, Michael thinks the biggest benefit he provides clients is preventing them from making emotional mistakes that will hurt in the long run.

Client Communications and Reporting

Perhaps one of the most intriguing aspects of Bishop & Co. is that the firm does not produce quarterly performance reports for clients. Says Michael, “Our value is not trying to beat the market; our value is in helping clients reach their goals.”

I have long thought that there is a disconnect in the industry. Advisors claim that their value is in helping clients achieve goals and not trying to beat the market. Yet advisors typically report on how the portfolio is performing on a quarterly basis, relative to an index. For a profession that claims its value should not be measured by performance versus benchmarks, it is contradictory to provide quarterly reports that focus solely on that.

Bishop & Co. has long advocated for being judged by long-term performance and their clients’ ability to reach long-term goals. Instead of sending frequent performance updates, they keep clients abreast of market and economic events with the ultimate goal of helping clients remain faithful to their strategy and avoid making emotional decisions.

When meeting with clients, Michael compares the value of their portfolio to the “running principal” (initial investment plus additions less withdrawals) and highlights times when they may have allowed fear to derail from the plan. Per Michael, “When clients see this long-term, multiyear review, it solidifies their trust in our approach and results.”

The Challenge: Finding Ways to Improve

So, with all of these things being done right, why did Bishop & Co. come to me in the first place? They were not concerned with increasing revenue or bringing on a lot more clients. They did not want to add employees. They were only concerned with being able to maximize efficiency while doing the best possible job for their clients. How could I possibly make any recommendations that would allow them to increase efficiency and provide better service to clients? Fortunately, I tend to look at practices deeply. I uncovered a few areas that the Bishops could do differently to achieve these goals.

Efficiency and the Two-Person Team: Too Efficient?

The structure where Michael handles the portfolio and client-facing duties while Maureen handles all of the administration and back-office responsibilities is quite the formula for efficient operations. By having all of their software in the cloud and a phone system that reaches them anywhere, the Bishops have no problem splitting their time between the office, their home, and their vacation home. “We utilize VOIP phone systems that enable our phones to ring wherever we are,” Michael says.

But being available anywhere anytime and having only two employees in the entire firm means there is no time for the principals to fully unplug. Although this issue is not really a problem for the Bishops, it is still something to be addressed. According to Michael, because they do not try to time the market or select individual securities, there is no need for daily transactions. “It’s not a big deal to occasionally answer a phone call or email when on vacation. And if there is a need to jump into action on any transactions, we are still able to do so.”

What happens if there is a disability or worse for one or both of them? To me, this situation begs for the addition of another professional employee—someone who could hold down the fort in case of emergency and even provide the Bishops with the ability to take a real vacation. However, there is another alternative to hiring an employee. Michael told me that they are in the process of finalizing a continuity and succession plan with another like-minded firm.

This is a big deal! Because whether clients communicate this with the firm or not, I bet that many of them worry about what would happen to their portfolios should something happen to the principals. Because Michael and Maureen are comfortable that this other firm would not try to poach their clients (nor would the other firm likely succeed at that, based on the personal relationships and trust the Bishops have built with their clients), I suggested that they actually test the emergency plan. One way to do this would be to do a dry run on a randomly selected date. The test should be invisible to clients except in the case of a client needing something immediately on the day of the test. Once done behind the scenes, the Bishops should let clients know about the backup plan. Publicizing it will give clients greater peace of mind.

Reinforcing Value

My suggestion for cementing client relationships is to make clients more aware of the great service they are receiving. The Bishops return emails and phone calls the same day; they consistently provide solid, tax-efficient portfolio management; and they communicate with regular newsletters and meetings. Unfortunately, clients sometimes need more frequent and tangible reminders of an advisor’s value. I believe that clients would be reinforced in their decision to stay with Bishop & Co. if they are also regularly reminded of the value added by the firm.

Because the value is not placed on performing better than the market, the reminders should focus on how long-term returns are helping clients to reach their goals. The reports that Michael shares with clients showing long-term results over invested dollars is an excellent means of doing that. But he could show more by summarizing how the firm keeps costs low and how tax dollars are saved. For the low costs, I would suggest a periodic summary to clients of what the total internal costs are of their portfolios versus typical costs. For example, Bishop & Co.’s average weighted cost of its exchange-traded funds and mutual funds is only 10 basis points. If the average fund costs 1%, then the firm is saving their clients nearly 1 percentage point every year compounded. It would be a good idea to put this into concrete numbers for clients to see. For example, the client with a $1 million portfolio will have an average fund cost of just $1,000 per year versus the industry average cost of $10,000 per year. If the savings are compounded at a rate of 5%, this additional $9,000 per year will be worth over $61,000 in five years.

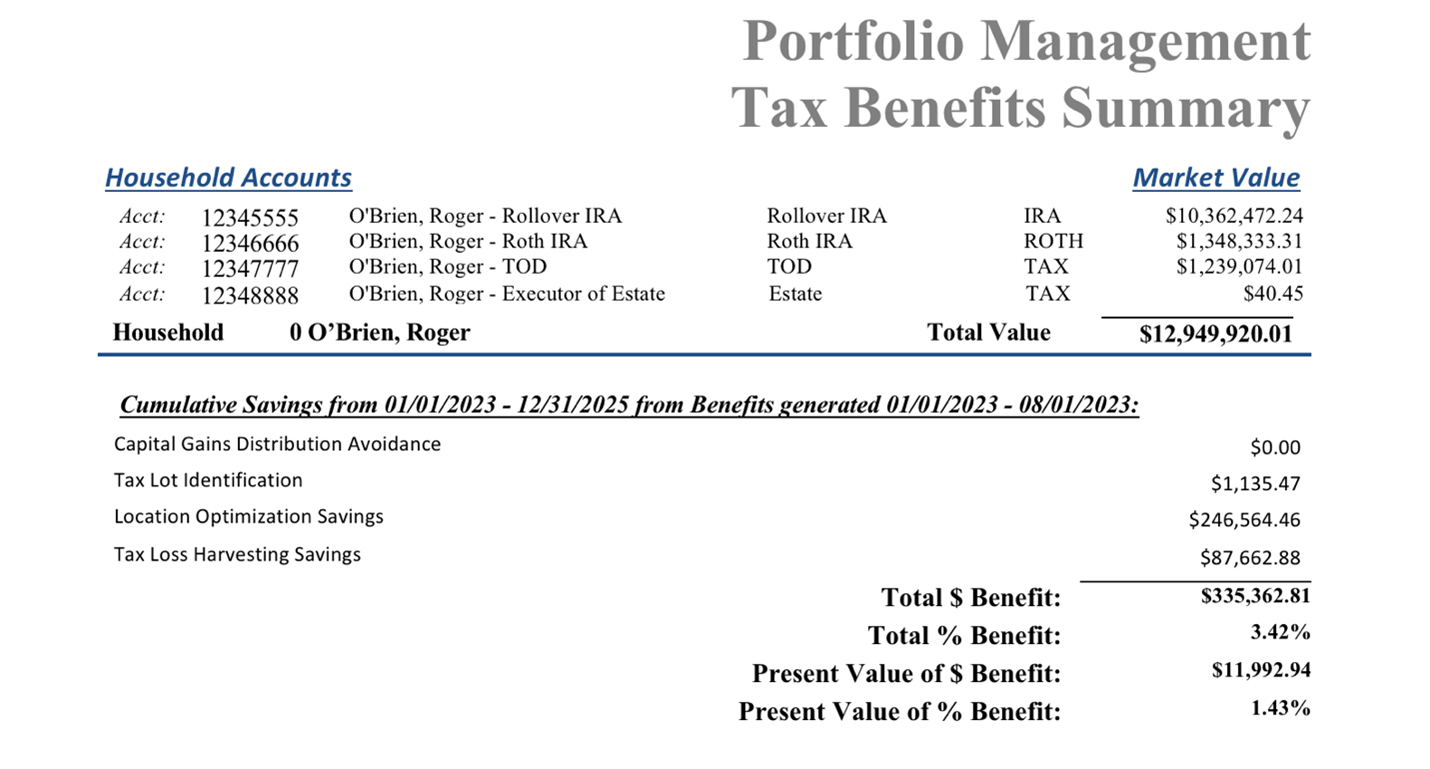

As far as tax savings, TRX can provide a summary tax benefit report for each client showing the value of tax benefits generated, including those generated from capital gains distribution avoidance, tax-loss harvesting, tax lot identification, and location optimization.

Portfolio Management Tax Benefits Summary

Finally, I recommend sending out a periodic service summary to each client. The basis for these summaries can be easily obtained by reviewing Junxure. The service summary should work as a reminder of all the value-added services provided such as mortgage refinancing advice, college funding advice, advice on determining whether to lease or buy a car, and so on.

Providing clients with summaries of cost savings, tax savings, and value-added services, as well as long-term portfolio growth, will go a long way toward keeping client loyalty high.

Fee Schedule

One final suggestion for Bishop & Co. is to consider raising fees charged on portfolios of over $1 million. According to Advisory HQ, average financial advisor fees for portfolios in excess of $1 million range from about 0.9% for portfolios of $2 million down to 0.84% for portfolios of $5 million, and to 0.59% for portfolios of $30 million. Bishop & Co.’s fees are well below these amounts.

Factors when considering the appropriateness of fees go beyond whether the owners think they are making enough money. Consideration should be given to the extent of service enhancements over time, inflation, market rates, client demand (raising fees limits new growth while adding revenue), additional years of experience, additional compliance burdens, rising insurance and other costs, and market complexity.

Conclusion

Bishop & Co. is doing everything right. They are managing investments well for their clients and are prompt in responding to clients’ needs. They live the lifestyle they want and enjoy solid relationships with their clients. By publicizing more of the value that they add, incorporating a layer of protection through succession and contingency backup, and possibly increasing fees, the firm can continue to have the lifestyle practice that they like, without compromising the needs of their clients.

If you have a practice that might benefit from a Practice Made Perfect analysis, please get in touch at sheryl.rowling@morningstar.com. I’d welcome the challenge!

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)