Tips for Expanding a Financial Advisory Without Compromising Client Service

Step one: Formalize the partnership. That’s what we recommended for this father-and-son advisory duo.

If you’d like your firm to be a future Practice Made Perfect subject, please drop me a line at sheryl.rowling@morningstar.com.

Advisors Rick and Jared Weinerman form a unique father-son partnership. I met Jared at a small dinner party where he and I were the only people not related to the other guests. Sitting across from each other, we struck up a conversation that turned out to be fortuitous. He was a young financial advisor at the beginning of his career. I was impressed by his enthusiasm and dedication to the profession.

As we talked, I became more intrigued and thought he could be a great subject for my second Practice Made Perfect article—a series in which I offer advice to a financial advisory struggling with a problem. (My first Practice Made Perfect is here.) Like most successful advisors, Rick and Jared are trying to figure out how to expand their practice without sacrificing the service their clients have come to expect. I have a few suggestions to help them.

Meet Advisors Rick and Jared Weinerman

Rick Weinerman began his financial career in 1978. He has been with the same company the entire time, even though the firm itself went through many transitions, beginning with Connecticut General, then Cigna, and finally Lincoln Financial Advisors/Sagemark Consulting. In the beginning, Rick focused on estate planning and insurance services. However, he found that he really wanted to focus on more-comprehensive financial planning. He moved his business away from commissioned sales to an assets-under-management model. Because life insurance could be an important part of a client’s overall plan, Rick believed his ability to provide that service was essential, so he kept that offering for clients. Based at Lincoln Financial Advisors/Sagemark Consulting in suburban Detroit, Rick continues to provide high-level services to his clients while working with Jared on joint clients and advising Jared on his own clients.

Rick has consistently received the highest company honors for his work. He has been regularly recognized as one of Lincoln Financial Advisors/Sagemark Consulting’s top 50 financial planning professionals. Rick has qualified for the prestigious Chairman’s Council, which represents the top 1% of financial planners affiliated with Lincoln Financial Advisors, and is a lifetime member of Lincoln’s Resource Group, an internal invitation-only nationwide network of the top financial planners within Lincoln Financial Advisors. He has been Financial Planner of the Year for the Lincoln Financial Advisors/Sagemark Consulting’s Michigan offices in 2019, 2018, and 2016. This internal award is given to Lincoln Financial Network planners each year and is based on sales, quality of service, and commitment to Lincoln’s principles, and is given by Lincoln senior managers. Rick is a frequent speaker at national meetings and has delivered the keynote address at several corporate meetings on charitable, estate, and insurance planning. He has written numerous estate planning and insurance articles for several national industry publications and has taught courses on estate and financial planning to CPAs and stockbrokers throughout the country.

Jared works out of the Chicago office of Lincoln Financial. He is working toward his CFP certification and holds Series 7 and 66 registrations. He is licensed to provide life and health insurance. He is a graduate from the University of Michigan and resides in downtown Chicago. In addition to his financial training, Jared is very knowledgeable in technology, process optimization, and business efficiencies. Jared believes in “working in and working on the business.”

In 2022, Jared was one of 14 participants chosen to attend Lincoln Financial’s Vice President’s Seminar. He is a participant in the “invite-only” High Net Worth Planning Meeting as one of 10 “up and comers.” Finally, as a member of the Legacy program, Jared takes part in The Resource Group, a study group at Lincoln for the top financial planners in the company.

Both Rick and Jared work within the Lincoln Financial network because of the company’s vast educational offerings, compliance support, and research capabilities. This affiliation does not affect Rick and Jared’s partnership nor does it commit them to using any in-house products. The team pays a small fixed annual fee to Lincoln as well as lease payments for their computers and office space.

Team Structure

Rick and Jared’s practice is within the professional offices of Lincoln Financial. As such, they share the benefits of a nationwide network of experienced professionals, attorneys, CPAs, MBAs, CFPs, CFAs, and so on. They also have access to Lincoln’s National Planning Institute, which assists with case design, education, and supporting materials. Thus, even though Rick and Jared are the two advisors in their firm, there is a strong emphasis on sharing resources among the Lincoln advisors. For example, if they have questions on product solutions, financial modeling, or complex retirement plans, they can reach out to other planners all across the country for support.

Within their practice, Rick’s focus is on his clients and providing Jared with on-the-job training. (“He soaks up information like a sponge!” Rick says). He works with Jared on joint clients and is transitioning his separate clients to be joint clients with Jared. Ultimately, Rick would like to retire (or at least semiretire) when Jared is ready to take over completely. Rick also has an experienced assistant who works with his clients as well as some joint clients. Jared’s primary responsibilities include financial plan preparation, back-office operations, staying up to date on the ever-changing product landscape, and financial modeling for investments.

Client Services

Rick and Jared will not accept a new client before creating a financial plan. The first step is the introductory meeting. In this meeting, Rick, Jared, or both gather client information, discuss client needs, and determine whether the client is a good fit and whether they can add value. If the determination is yes in these two areas, they quote a fee for financial planning. The fee is based on complexity and begins at $4,500. Once the financial plan is complete and has been presented to the client, the client engages the firm for implementation.

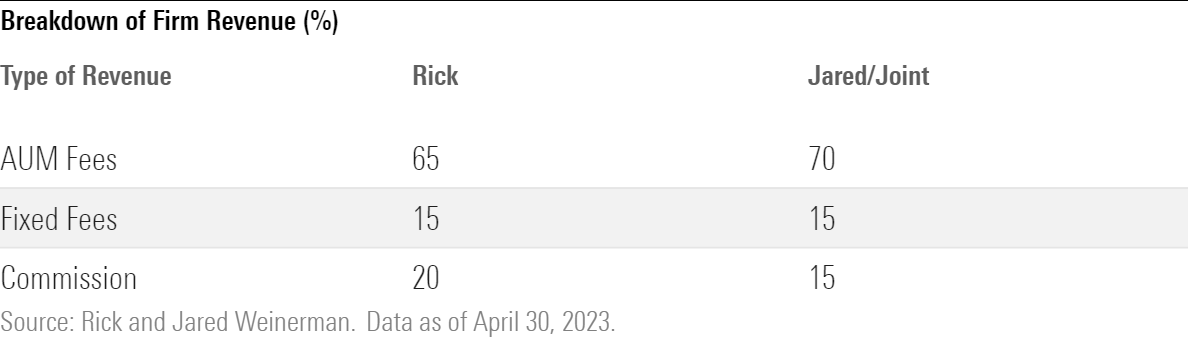

AUM and Fee Structure

Management fees begin at 1% and decline as portfolio size increases. Rick and Jared also manage outside accounts, fully integrated with each client’s overall investment portfolio.

Revenues from new and joint clients are typically split 50/50 between Rick and Jared. Revenues from remaining clients are split by various amounts based on circumstances.

AUM fees are debited directly from clients’ accounts in advance. The fees are split automatically by the custodian according to the submitted allocation between Rick and Jared.

Workload

At this point, Rick is working 45-50 hours per week (down from 70-75 hours per week before Jared joined his firm). Jared estimates his time at about 70 hours per week.

Rick’s workload has decreased due to Jared taking on some of the work as well as more efficiencies instituted by Jared. Jared continues to focus on clients and back-office responsibilities and improvements. He estimated that he could cut his workload by 15 hours a week if he had a qualified assistant.

Of Rick’s 40-45 hours per week, most are spent on rainmaking, client meetings, introducing Jared to clients, “putting out fires,” and training Jared.

Jared estimates he spends 40% of his time developing financial plans, proposals, and client service; another 40% on rainmaking and business planning; and the remaining 20% on administration and training.

Software

Rick and Jared use software to better ensure quality and consistency. This software includes:

- Envestnet (portfolio accounting, reporting, rebalancing)

- Firelight (outside accounts integration)

- eMoney (financial planning)

- Redtail (client relationship management)

- Morningstar (research and analysis)

- Riskalyze, BlackRock, and Envestnet (risk tolerance)

- Omnisource (reporting)

- Hearsay (social media)

- AdvicePay (billing and payment platform for fee-based financial planning)

- Broadridge Decision Optimizer (evaluation tool for merits of Reg BI rollover opportunity)

- Cannex (comparison tool for annuity solutions to satisfy Reg BI and DOL requirements)

- Finra Fund Analyzer (fee and expense comparison tool for investment research)

- DST Vision (performance reporting and statement aggregation platform)

- Advisors Asset Management (comprehensive analytic, portfolio strategy, educational, and technology tools.

- RegEd (central location for compliance training and accessing the compliance manual, outside business activity submissions, approvals, maintenance, and more.

Jared has brought a higher level of automation and efficiency to the practice, enabling more responsive client service and accurate record-keeping.

Client Service

The firm prides itself on excellent client service. All client responses are sent within 24 hours. This is a shared responsibility based on the particular questions and availability. Specific client communication is customized to each client’s preferences. Everyone receives emails, but meetings are broken into about 35% in person, 25% phone calls, and 40% Zoom. Some questions require a screenshare or visual walk-throughs, while others can be answered verbally and more easily via a quick phone exchange.

Email newsletters are sent periodically throughout the year. Rick and Jared send letters to keep clients informed about market performance, investment tips, tax law changes, and other timely economic information.

Marketing

Marketing is done separately by Rick and Jared. Rick relies primarily on his professional circle and clients, while Jared attends professional networking events in Chicago and hosts educational seminars for his fellow University of Michigan alumni throughout the country. They both align efforts through centers of influence in the Detroit and Chicago. Rick has focused on high-net-worth families and business owners. Jared has added HENRYs (“High Earners Not Rich Yet”), a younger demographic, as well as medical professionals and physicians.

Investing

The firm uses risk assessments to build appropriate models for each client. The models range from conservative to aggressive. with portfolio allocations that scale in 10-percentage-point increments from 0% stocks/100% bonds to 100% stocks/0% bonds. Most portfolios fall in this allocation structure. About 5%-10% of portfolios use customized holdings, which are accommodations for clients with legacy holdings who don’t want to realize gains, or those who insist on owning specific holdings. Finally, the firm can supplement models with alternative investments or fixed-income solutions.

The investment vehicles used to implement the models are based on each client’s preferences and needs. Typically, active management is found in qualified accounts (with no current tax implications from trading) and passive investments are more common in nonqualified accounts. When building portfolios, the firm considers sensitivity across risk, fees, existing holdings, diversification needs, liquidity, time horizon, and so on. Options are numerous because the firm has access to a bountiful library of third-party managers, separately managed accounts, and active and passive mutual funds and exchange-traded funds. With the resources of Lincoln Financial, clients get the benefit of vetted experts to build portfolios (along with their ongoing active management, rebalancing, discretionary trades, and so on). This is ultimately good for clients: numerous choices for flexibility and personalization.

Other Firm Info

As a successful, experienced professional, Rick earns a comfortable living while feeling the satisfaction of providing his clients with a financial sense of security. With his education, attention to detail, and mentoring from his father, Jared has been successfully building his share of the business. Clients continue to benefit from the firm’s combination of vast experience and state-of-the-art service.

The firm has all safeguards in place, including encryption and systems security, strict compliance procedures, a succession plan, and a continuity plan.

How Should Rick and Jared Take the Next Step?

Rick and Jared have built a firm that reflects how much they truly care about their clients. The fact that they accept only clients they think they can help is unique when many advisors focus solely on increasing revenues. Once they accept a client, no investing is done until a comprehensive financial plan has been completed. Should the client engage them to implement the plan, Rick and Jared create a customized portfolio, always choosing investments in the client’s best interest.

This firm does right by its clients. But, behind the scenes, are there ways Rick and Jared can increase growth without cutting quality or service? And can this be done without adding work hours to Rick and Jared? The goal is to allow Rick more flexibility and provide Jared with the ability to focus more of his time on clients.

My recommendations:

1) Promote Their Partnership

Rick and Jared are doing quite well with their evolving practice. However, one big disconnect is the lack of a public-facing joint entity. Although the two work as a team, they do not have a joint online presence. If they are truly a team—and they are—Rick and Jared need to present themselves as such both to current and future clients. This ensures that Rick’s clients know he has a partner who is up on all the current technology and that he has a successor in place. Jared’s clients will know that his partner has vast experience as well as a long-standing reputation for excellence.

Thus, their business partnership needs to have a name, an internet presence, and collateral marketing material. The integrated online identity will draw in prospects from the internet, as opposed to their limited current sources, which are centers of influences and personal connections.

As a result of our conversations, Rick and Jared have a name for their firm—Impact Financial Planning—and are in the process of developing a new website that provides video links and interactive content (that can also track metrics for open rates, clicks, and so on). They are also considering a marketing email package along with a service that provides white-labeled monthly articles on tax and estate-planning topics. A longer-term goal is a type of video marketing, something more interactive than just a long quarterly letter at reporting time.

2) Save on Taxes

The current “partnership” has been treated as two separate sole proprietorships for tax purposes. Thus, Rick and Jared have been reporting net income on their individual Schedule Cs. What does this mean? It means that they each have been paying federal and state taxes directly. And because federal rules limit the deduction for state (income) and local (property) taxes to $10,000 (the “SALT” limitation), Rick and Jared have been losing most, if not all, of the federal tax benefit from deducting their state income taxes paid.

The solution is to report their income on a partnership tax return, using the SALT workaround rules. Internal Revenue Code Section 761 states, in part, that “the term ‘partnership’ includes a syndicate, group, pool, joint venture, or other unincorporated organization through or by means of which any business, financial operation, or venture is carried on, and which is not … a corporation or a trust or estate.” Further guidance states that the venture must be operated for joint profit and not simply a sharing of expenses. Because Rick’s and Jared’s business clearly meets this definition, the entity should file as a partnership, allocating net income according to their agreement on separate Forms K-1 of the partnership tax return Form 1065.

This creates a huge opportunity to take advantage of the SALT workaround rules. Essentially, if elected, the partnership can pay state taxes on behalf of the partners. This allows that:

- State income taxes can be deducted “above the line” against each partner’s K-1 income.

- State taxes paid by the partnership are credited against each partner’s individual state tax liability.

This will save Rick and Jared a material amount of tax dollars. For example, let’s say that a partner in a partnership has allocated income of $500,000. If the state income tax rate is 5%, without the SALT workaround, the $25,000 of state income taxes related to that income would not result in any federal tax savings (assuming property taxes are at least $10,000). Applying the SALT workaround, the partnership would pay the $25,000 state tax, reducing the partner’s federal taxable income by $25,000. At a federal tax rate of 35%, this workaround would save the partner $8,750. Even if tax preparation fees (which are deductible to the partnership) are slightly higher, it’s still a big win.

There are tax deposit requirements and state-specific details to comply with, so Rick and Jared should work with a qualified CPA.

Owing to the timing requirements of the election and deposits, I discussed this strategy with Rick and Jared right away. They were thrilled with the recommendation and are in the process of implementing this with their tax advisors.

3) Consider Hiring Needs

Although Rick and Jared do not seem to be in desperate need of hiring another assistant, they should consider it nonetheless. In my previous Practice Made Perfect study, I explained the benefits of “prehiring,” or hiring before the need arises. By prehiring, the firm should always be adequately staffed, allowing for the full provision of client services with flexibility for vacations and sick time.

At this point, Rick’s assistant has some additional capacity, which should be used. However, because of the firm’s anticipated growth, it also makes sense for Jared to hire someone in Chicago. A qualified assistant can help add bandwidth, freeing up Jared and Rick to focus on what they need to do (Jared providing client service and continuing his learning curve; Rick transitioning clients and training Jared). Because the firm has adequate profitability, this new hire should be a real help.

As in the prior Practice Made Perfect, the key to making the most of staff is effective delegation. Even though it’s quicker and easier to handle tasks personally, delegation is essential to growth. Time spent on delegation now will turn into saved time in the long run. Before jumping on a task, Rick and Jared should first ask themselves if it actually needs to be done. If the answer is “yes,” must it be done by them?

Hiring and delegating are duties required of responsible advisors, like Rick and Jared.

4) Consider Conforming Fee Structure

The firm currently collects fees quarterly, in advance. About 15% of clients—primarily legacy clients—pay fees in arrears. Most firms collect fees in advance, which is advantageous for several reasons:

- Three months of revenue is accelerated.

- The firm will not have to attempt to collect fees from a client that terminates prior to quarter-end.

- It is standard market practice and meets legal requirements.

Because new clients are billed in advance, the percentage of clients billed in arrears will continue to decrease as new clients are added. Rick and Jared might want to consider moving their “arrears” clients to “in advance,” telling them that the firm seeks conformity among clients. An immediate shift would result in a doubled-up fee for one quarter, so a gradual change might be more palatable to clients. This could be done by collecting an additional month of fees each quarter for three quarters.

Bottom Line

Rick and Jared already do right by their clients. By incorporating a handful of changes, they can add capacity for more clients, focus more on what they want to do, and make some extra money—while continuing to provide excellent client service. My bottom-line recommendations are these:

- Operate, market, and report as a partnership.

- Develop an internet presence.

- Take advantage of the SALT workaround.

- Hire in advance of need.

- Delegate effectively.

- Bill in advance for all clients.

Would you like your firm to be considered for the next Practice Made Perfect analysis? We are looking for other high-quality firms in need of advice to get to the next level! Please email me at Sheryl.Rowling@Morningstar.com.

Disclosure

Rick and Jared Weinerman are a registered representatives of Lincoln Financial Advisors Corp. Securities offered through Lincoln Financial Advisors Corp., a broker/dealer (member SIPC). Investment advisory services offered through Sagemark Consulting, a division of Lincoln Financial Advisors, a registered investment advisor. Insurance offered through Lincoln affiliates and other fine companies. Lincoln Financial Network is the marketing name for Lincoln Financial Securities Corporation and Lincoln Financial Advisors Corp., affiliates of Lincoln Financial Group. Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)