US Fund Flows: Inflows Come to a Screeching Halt

Equity funds posted the largest outflows in April.

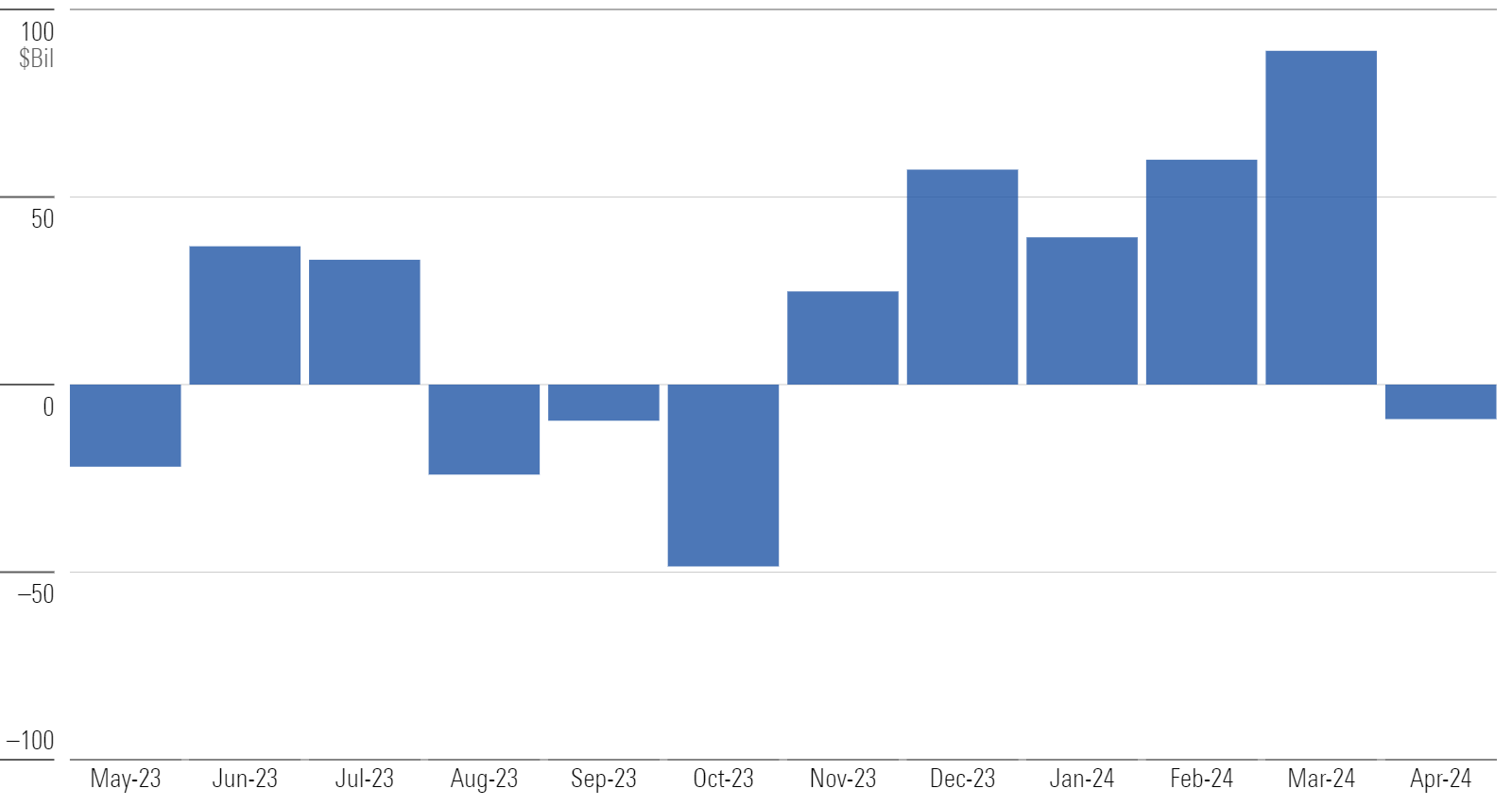

After building momentum through 2024′s first quarter, plummeting equity markets and rising long-term interest rates dampened fund flows in April. Long-term US funds shed about $9 billion—their first month with net outflows since October 2023, when similar market conditions prevailed.

Long-Term US Fund Flows

Market Volatility Mutes Enthusiasm for US Equity Funds

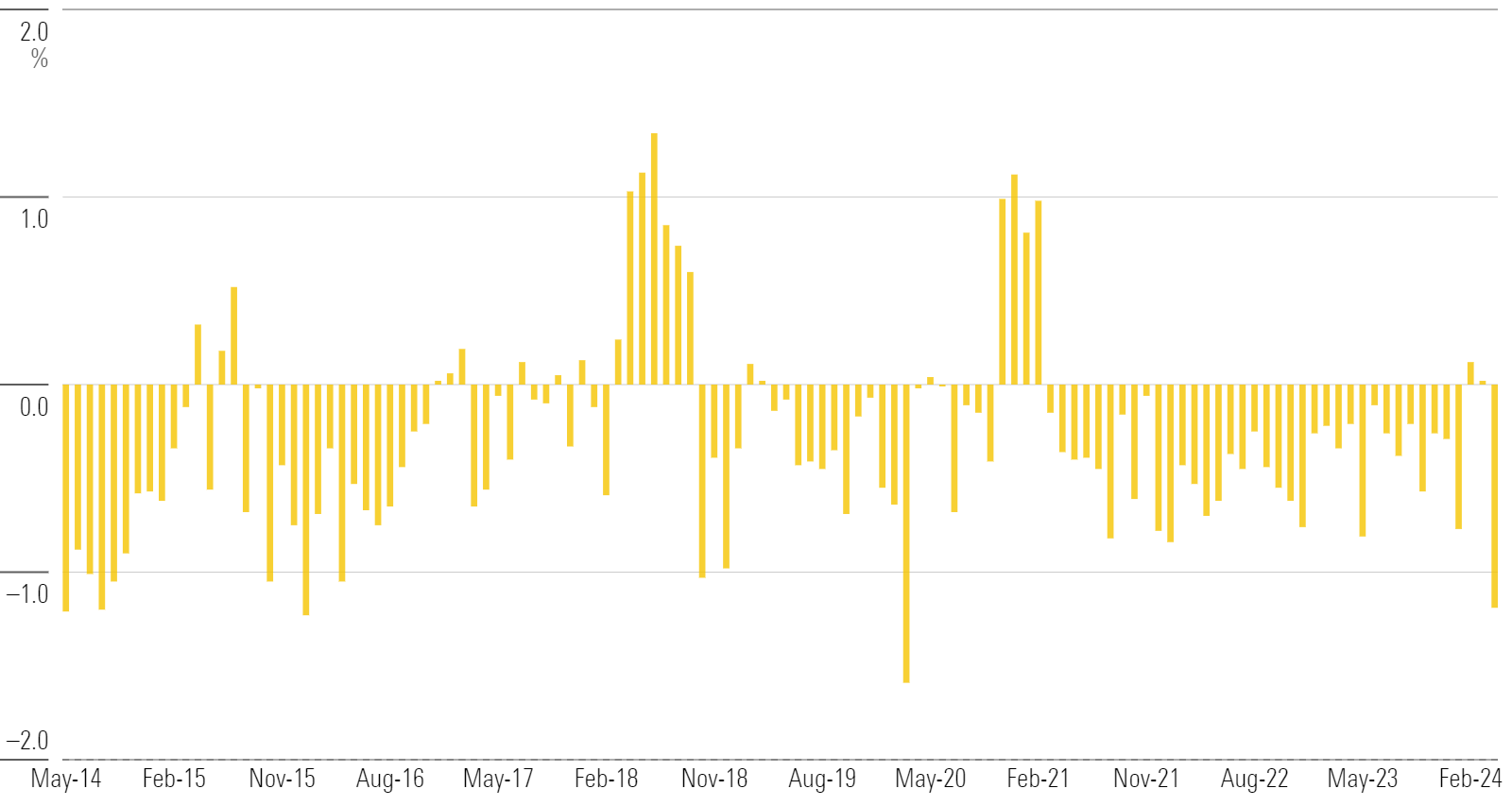

After a strong showing in March, investors pulled $21 billion from US equity funds in April. Six of the group’s nine categories suffered outflows. Notably, small-growth funds saw over $3 billion leave, equivalent to the worst organic growth rate since March 2020, and the fifth worst over the past decade. The category typically sees outflows as investors move to passive small-blend funds.

Small-Growth Organic Growth Rates

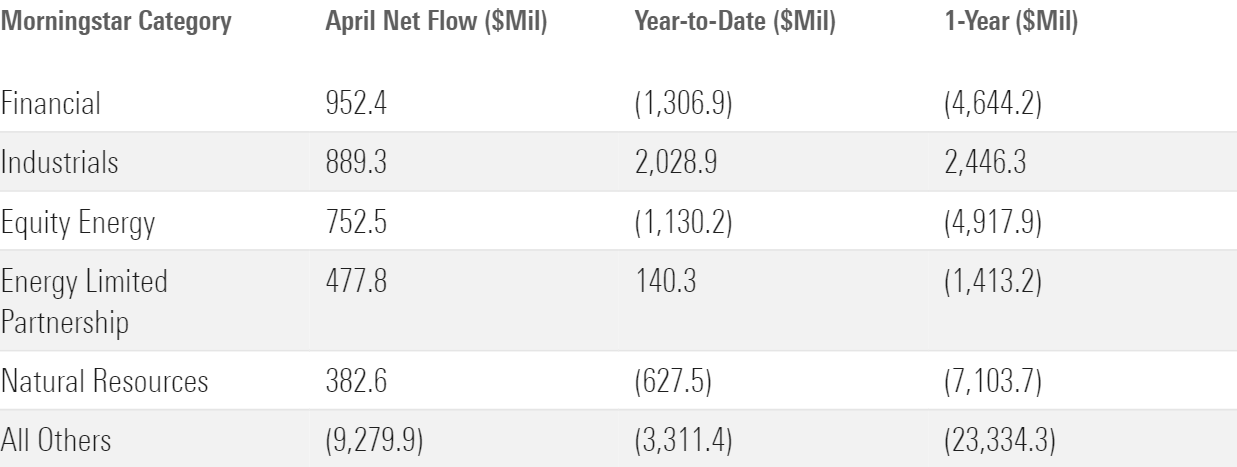

Most Sector Funds Slump

Sector-equity funds broke out of a downward trend in March, but a declining equity market sapped their strength in April. The category group had $5.8 billon of outflows during the month, bringing their trailing 12-month cumulative outflow to $39 billion. However, certain cyclical categories that could benefit from higher inflation and interest rates enjoyed inflows.

Sector-Equity Flows

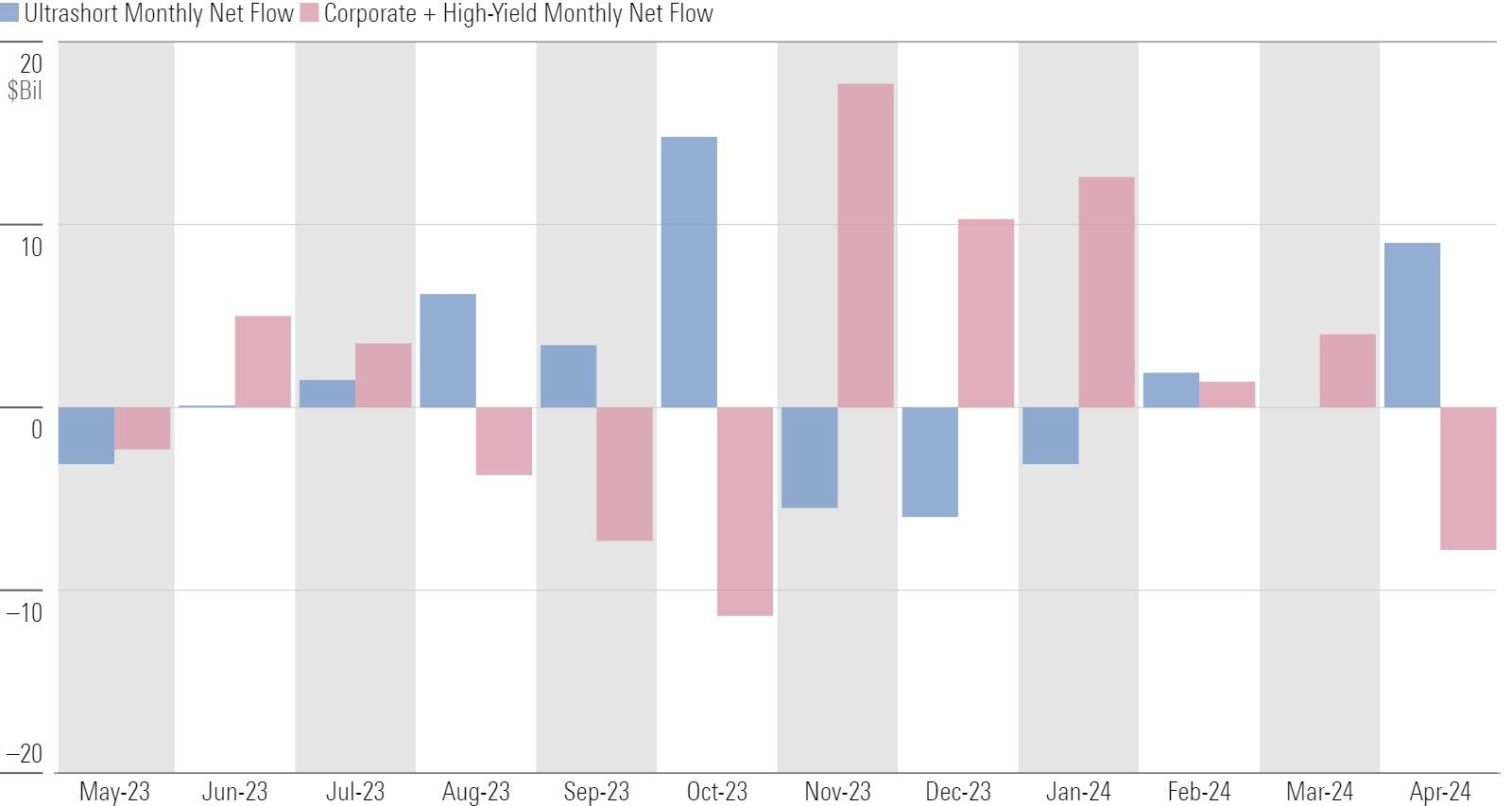

Bond-Fund Investors Play It Safe

Taxable-bond funds collected $25 billion in April, a solid sum but their lowest in 2024. Sinking markets and high interest rates directed flows to the group’s safest corner. Investors poured $9 billion into cashlike ultrashort bond funds and pulled a combined $8 billion from the riskier corporate- and high-yield bond categories in April—a reversal from the months before it.

Taxable-Bond Category Flows

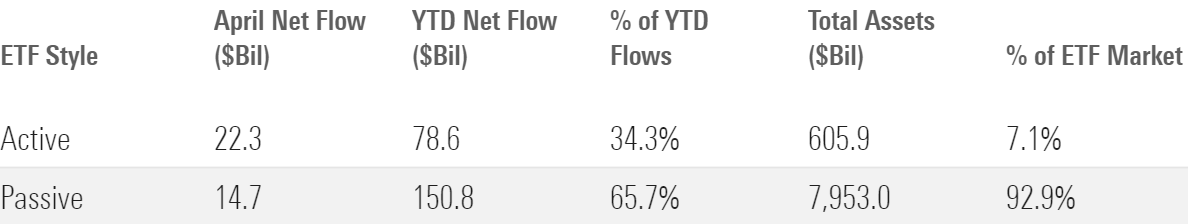

Active ETFs Outpace Passive Peers in April

Active ETFs pulled in $22 billion to passive ETFs’ $15 billion in April, their widest margin of victory in a month where both groups finished with inflows. Active ETFs have collected more than one third of all ETF flows in 2024 despite representing only 6% the market at the start of the year.

ETF Flows

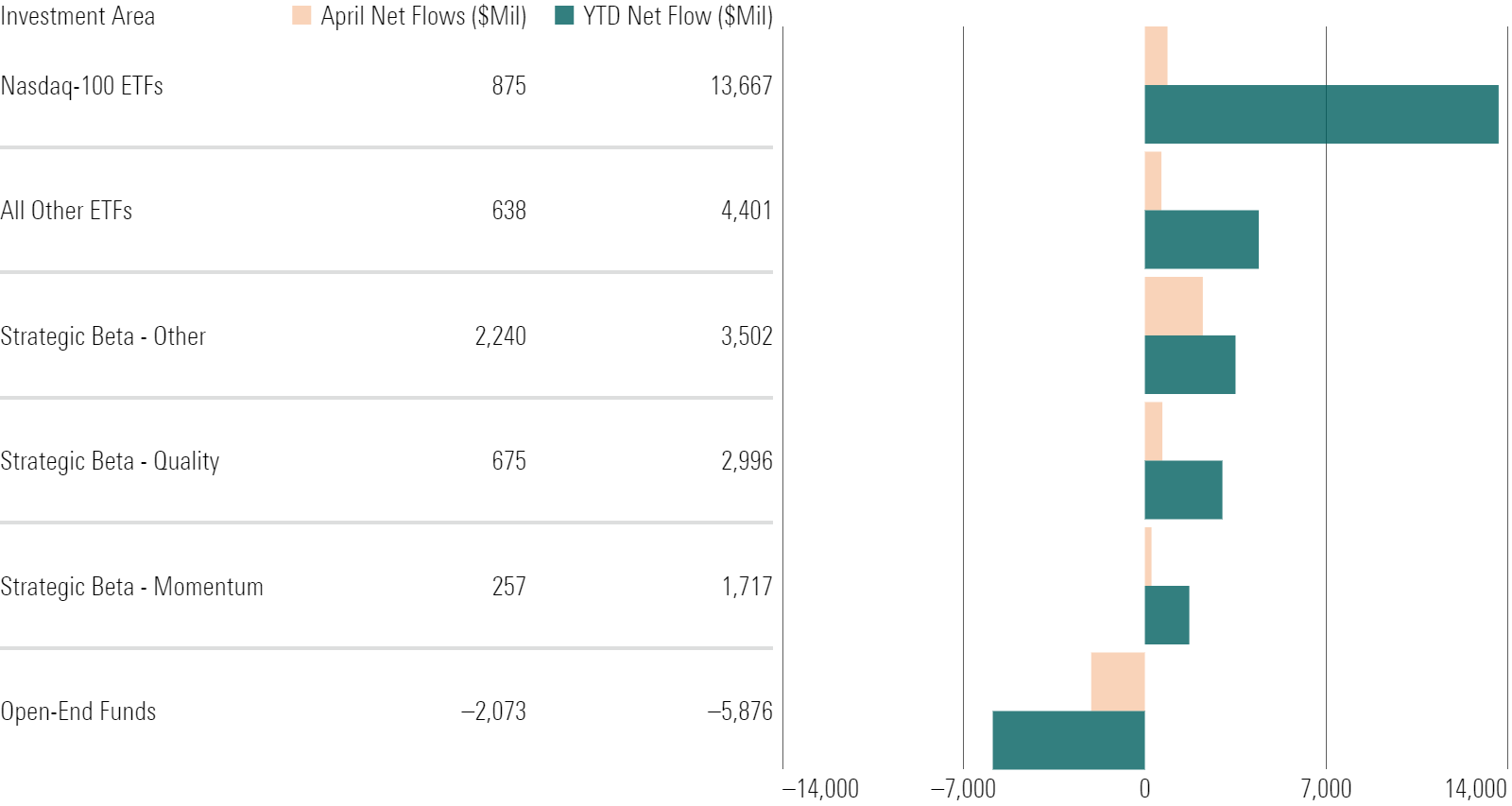

A Look Inside Invesco

Invesco collected about $3 billion in April to push its year-to-date inflows to $20 billion—fourth among all fund families. All that money (and then some) rushed into its lineup of ETFs. The ones that track the Nasdaq-100 did the heavy lifting, but strategic-beta ETFs that build equal-weighted, high-quality, and high-momentum portfolios provided an additional boost.

Invesco Flows

This article is adapted from the Morningstar Direct US Asset Flows Commentary for April 2024. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_68607a5db29e471d8bf1a155ea356f7c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WXR46JX6VF2HMOMAWQGCO67DM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)