3 Stocks to Watch in the Drug Distribution Industry

These main players dominate the US drug supply chain.

The market has rallied behind the US drug distribution industry recently because of the popularity of GLP-1s, easing generic drug deflation, and an increase in specialty asset investments. Drug distributors purchase pharmaceuticals from biopharma firms, store them, and safely deliver them to pharmacies, physician offices, clinics, and hospitals—which allows manufacturers and healthcare providers to focus on their core competencies.

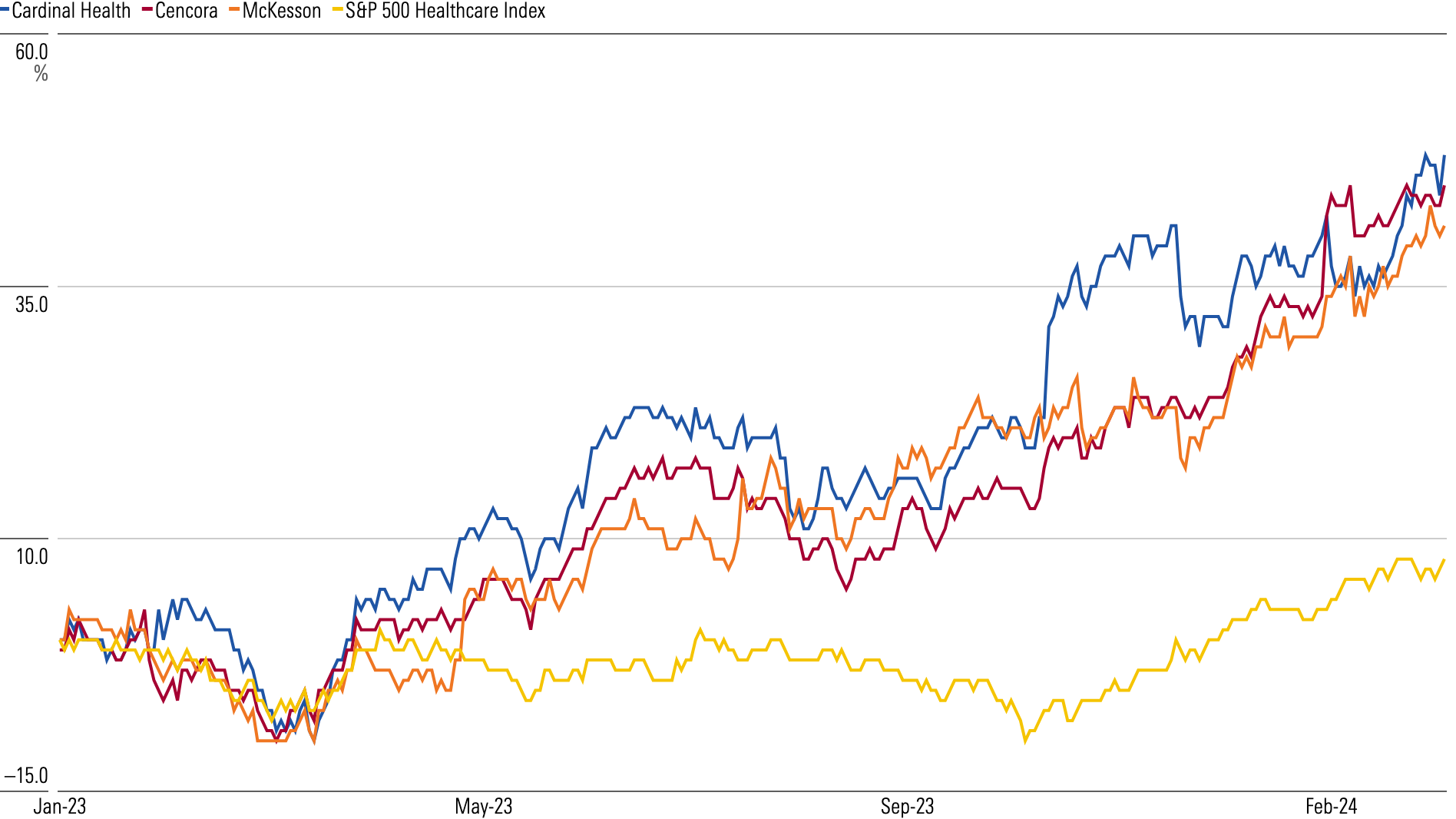

Since the beginning of 2023, the big three distributors in this space—Cardinal Health CAH, Cencora COR, and McKesson MCK—have delivered on average a 45% gain compared with the S&P 500 Health Care Index’s 8% gain.

All Three Big Drug Distributors Have Delivered Solid Gains Compared With Overall Healthcare Sector

We think these three firms are well positioned to enjoy macro trends and should see mid-single-digit compound annual growth rates over the next five years.

We outline our expectations for the industry and share a few investing opportunities.

3 Key Themes for US Drug Distribution

Our outlook for the drug distribution industry is centered on three key themes:

- Covid-19 contributions ease, but GLP-1s drive growth. As the US phases out of the covid pandemic and utilization rates for updated vaccines remain soft, contributions from kitting, tests, and vaccines are diminishing. However, sales in recent quarters have shown impressive double-digit year-over-year growth thanks to significant tailwinds from GLP-1s (diabetes and weight-loss drugs). We estimate that about one fourth of the big three distributors’ growth in the past 12 months was from GLP-1s. We expect continued strong tailwinds from these drugs in the near and medium term.

- Drug pricing dynamics weigh down margins. While distributors’ sales overwhelmingly come from branded drugs, their margins are heavily driven by generic drugs. Since 2015, the decline in generic drug prices has weighed down distributors’ margins. The growth of branded and specialty therapies, which both have lower margins than generics, has also played a part in margin compression. While distributors benefited from high-margin covid vaccines in 2021, these contributions started to ease in 2022 and margin shrinkage continued.

- Investments in specialty assets bolster offerings. To combat margin headwinds from generic drug price erosion and growing expenditures on branded drugs, the big three distributors have invested in their specialty assets to offer higher-margin services to manufacturers, pharmacies, clinics, and hospitals. These investments are usually in oncology and other specialty therapeutic areas. The vertical integration of distribution and services positions the big three as not only distributors but also data, business strategy, and insights providers.

3 Main Players in the Drug Distribution Space

Taken together, Cardinal Health, Cencora, and McKesson make up 95% of the overall US drug distribution market. As we have not seen any major acquisitions of a competitor by these distributors over the last five years, we do not expect any material market share shift in the near term.

As you can see below, these firms hold a number of similarities.

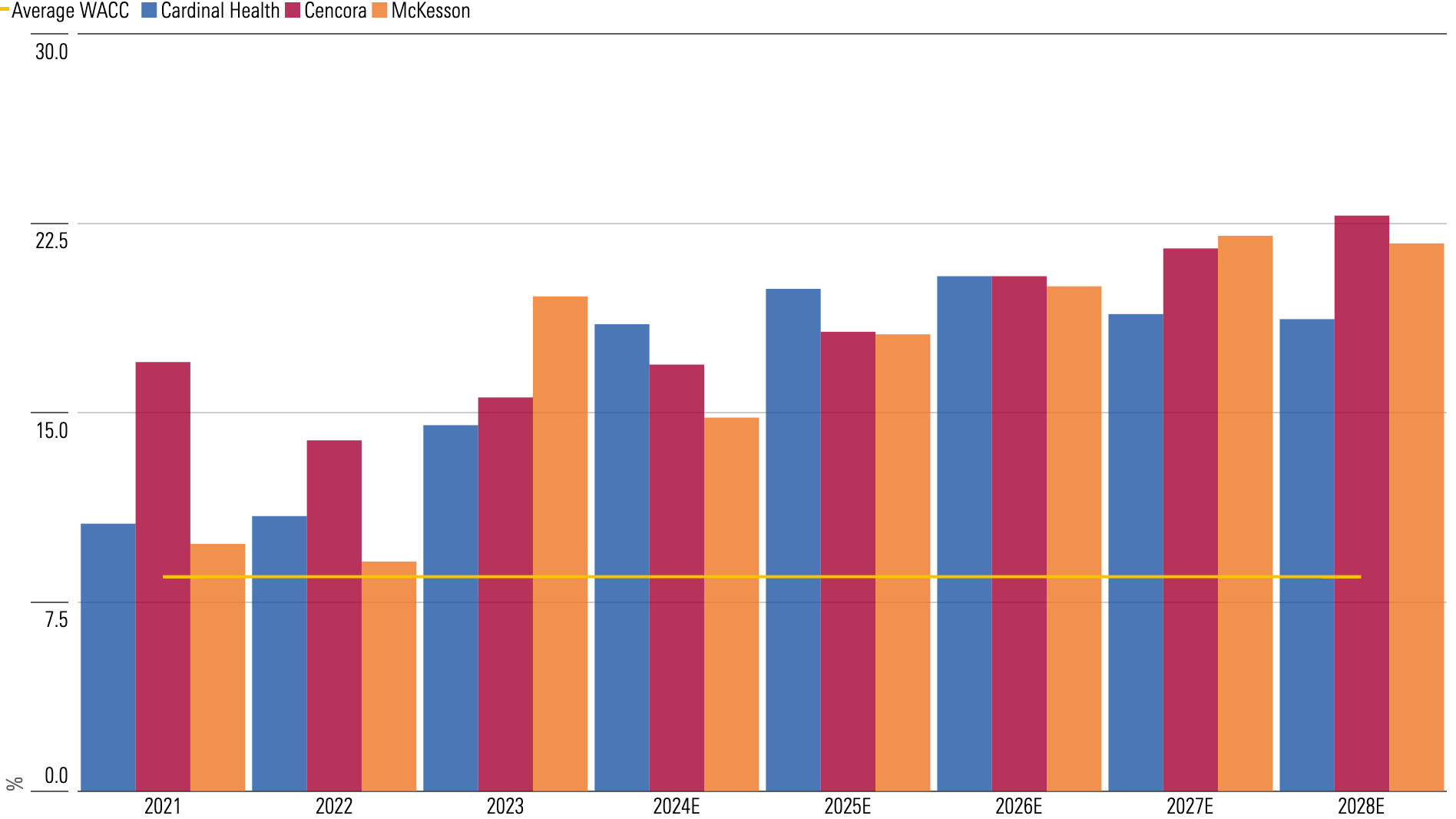

For one, they all carry narrow economic moats. We think they are all positioned to enjoy solid returns on invested capital above their weighted average cost of capital over the next 10 years and are highly unlikely to face any material competitive pressures from the market or regulatory actions that could inhibit their ability to generate excess returns.

While intangible assets is the main source among companies with moats in our coverage, customer switching costs is the sole moat source for these three firms. We think the deep relationships that the big three distributors have established over years of partnership with their customers are unlikely to materially deteriorate over the next decade. We think these relationships are augmented by generic sourcing joint ventures formed between the distributors and the retailers that help drive generic purchasing power.

While potential regulatory changes and market dynamic shifts in the overall drug supply chain keep us from awarding these three companies wide moat ratings, we think deep switching costs between distributors and their customers afford them narrow ones.

All Three Big Distributors Have ROICs Over Weighted Average Cost of Capital

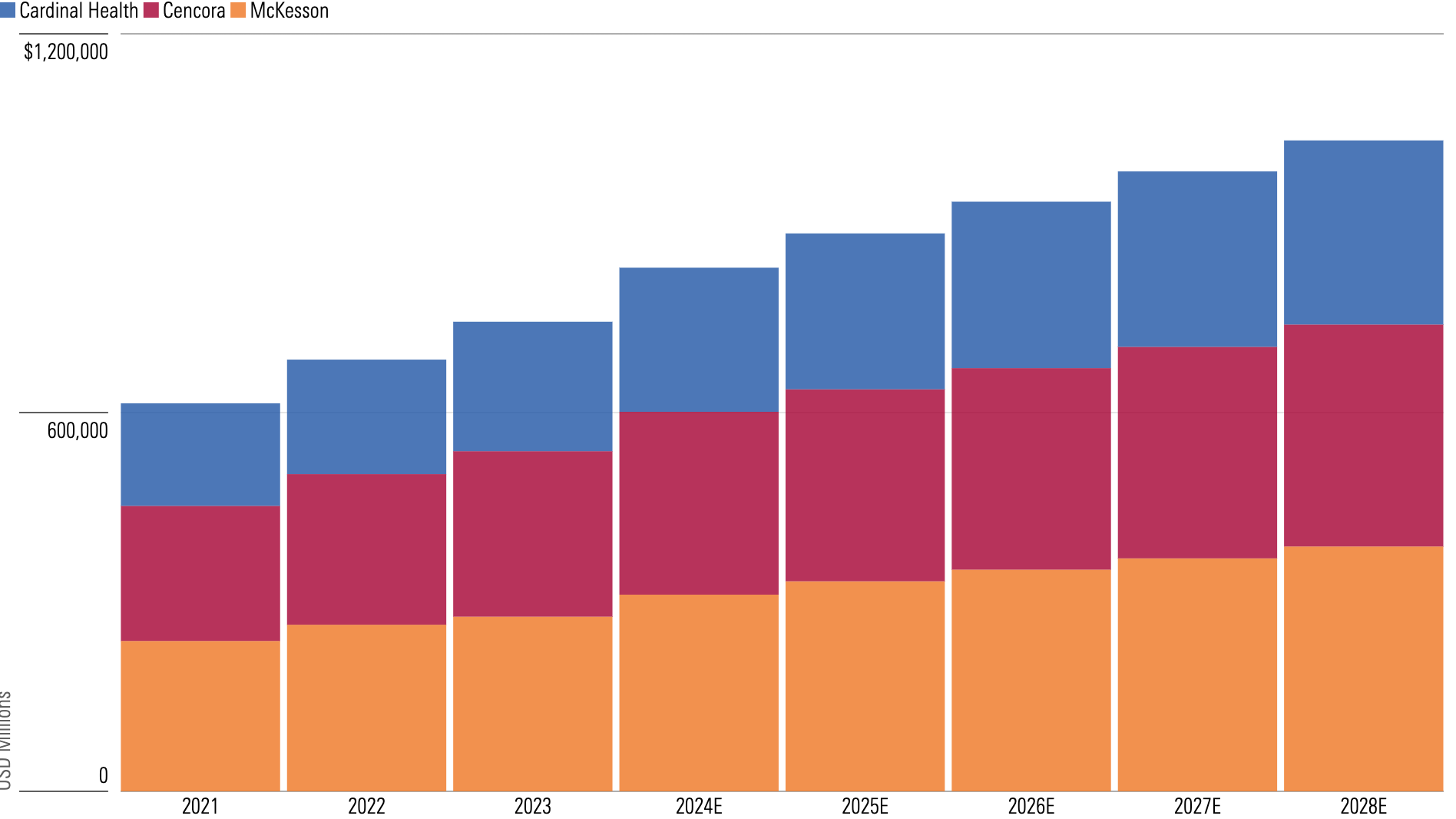

All Three Drug Distributors Should Enjoy Mid-Single-Digit Growth Through 2028

We think these three distributors will continue to control the market over the next five years and that they are all well positioned to benefit from macro trends such as an aging population, growth in prescription expenditures, and increasing access to healthcare.

These drivers should provide a nice tailwind to distributors’ top lines and help them achieve mid-single-digit compound annual growth rates over the next five years. Taken together, we think their sales will surpass $1 trillion by 2028.

We Forecast Combined Sales for Big Three Distributors to Surpass $1 Trillion

We do foresee headwinds from expiring patents (such as Stelara, Eylea, and Tysabri), though we expect manufacturers and distributors to offset these losses through growth of other already-approved therapies and through pipeline assets. Areas like oncology, rare diseases, and neurology remain pivotal for near-term pipeline assets to drive growth in the industry.

Rising healthcare costs for Americans have also put a spotlight on drug price inflation and were a major driver behind the Inflation Reduction Act. This regulation caps price increases across Medicare channels or manufacturers must pay rebates for price increases above the rate of inflation. It also significantly reduces prices on older blockbuster drugs.

While this creates certain headwinds for distributors’ sales, we think new drug launches will be more than enough to drive mid-single-digit growth for the three big distributors over the next five years.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b76d1412-e5af-4b94-8222-8cb66fe23dbe.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b76d1412-e5af-4b94-8222-8cb66fe23dbe.jpg)