Why Climate Is Driving the Agenda for Asset Owners

Environment outweighs social and governance factors among pensions, foundations, and other stewards, Morningstar survey shows.

The “Morningstar Voice of the Asset Owner Survey” provides an annual snapshot of what makes asset owners tick, what drives their behavior, and what keeps them up at night. Asset owners are investors who lead investment strategy for a range of institutions including pension funds, insurance company general accounts, foundations, and endowments. They play a prominent role in the financial system as stewards of large blocks of capital. A recent Thinking Ahead Institute report estimates that the seven largest pension markets alone control over $50 trillion in assets.

It’s instructive for all investors to understand asset owner thinking because it influences asset managers and the companies they invest in, and these investment practices spill over into funds available to retail and wealth investors.

For most asset owners, as we found in our third annual “Morningstar Voice of the Asset Owner Survey,” environment and climate are top of mind, trumping social and governance factors. Within the environmental pillar, climate is the most financially relevant topic. And if climate is financially relevant for the largest and most influential institutional investors, we can be sure that climate is going to be on the radar for the companies that they invest in.

This summer, with the help of Opinium Research, we surveyed 500 global asset owners representing more than $18 trillion in assets to gain insights into investment policies, perspectives on regulatory change, their key stakeholders and influencers, and the role of environmental, social, and governance factors and approaches in their investments.

Three years on, we can begin to discern trends related to these topics. Responses regarding the materiality of ESG factors, fiduciary duty, market engagement, and perspectives on ESG data stand out in this complex and consequential field of investment.

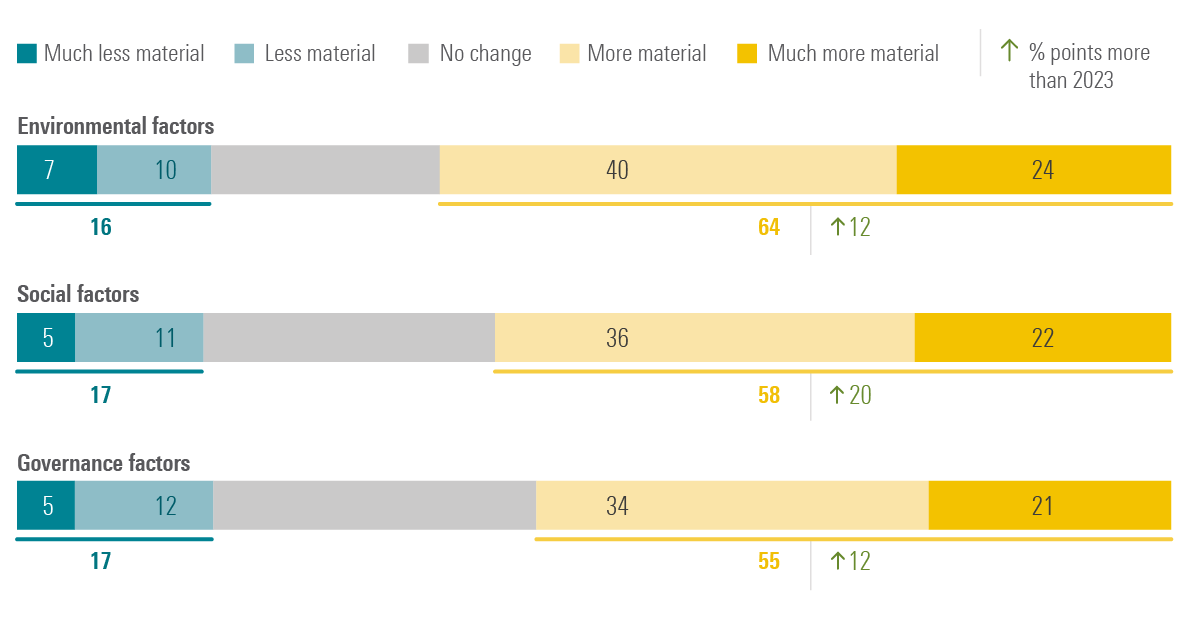

Some 64% globally feel that environmental factors have become more material, or financially relevant, over the past year, up from 52% in 2023, indicating that environmental considerations are increasingly top of mind.

Exhibit 11a: Whether Environmental, Social, and Governance Factors Have Become More or Less Material in the Past Year (%)

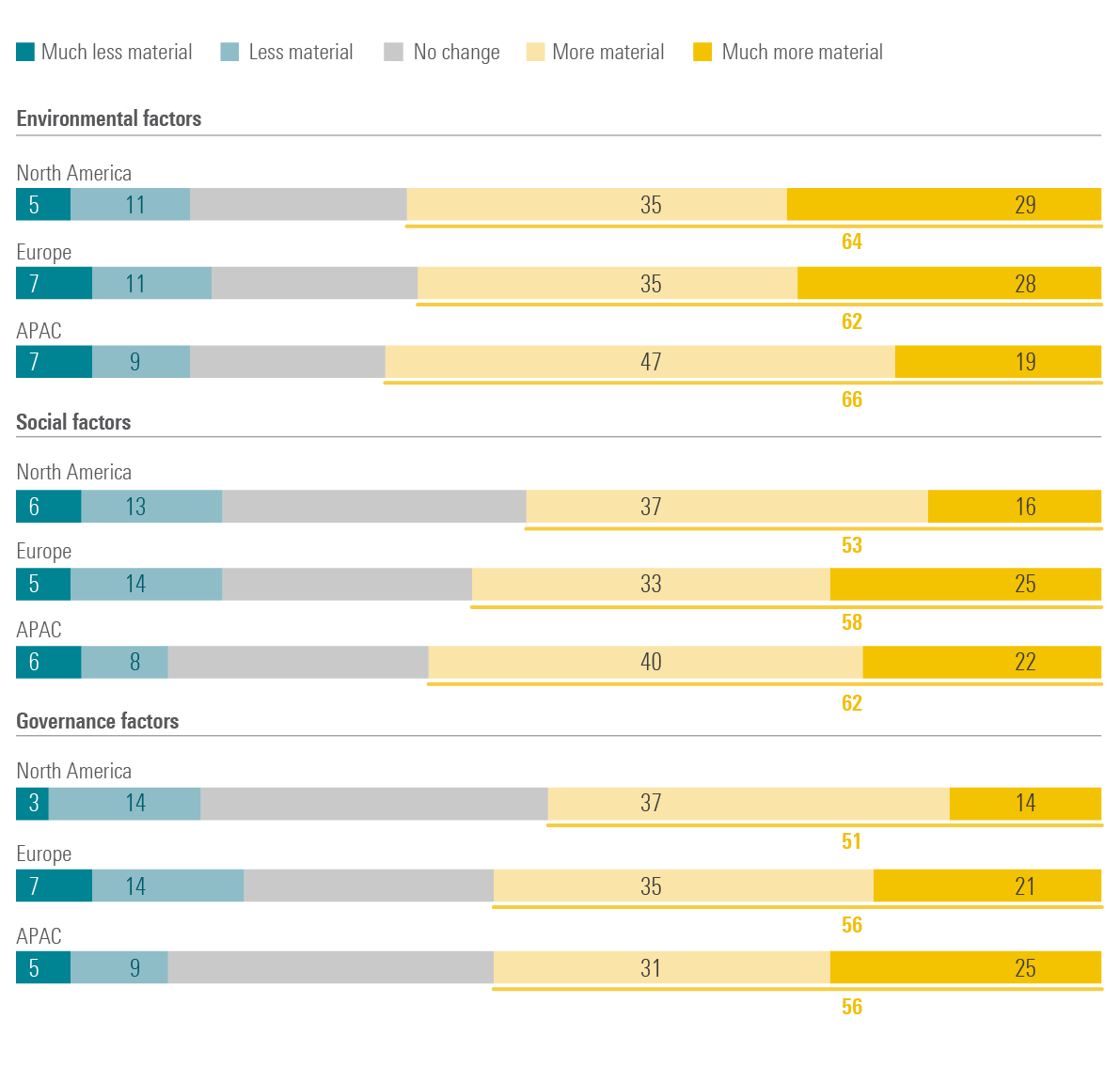

Meanwhile, more than six in 10 asset owners in North America believe environmental factors have become more or much more material in the past year, roughly in line with Europe and Asia-Pacific. That trend has occurred even though, in the US, a number of states have pushed for investors to ignore environmental, social, and governance factors.

Whether Environmental, Social, and Governance Factors Have Become More or Less Material in the Past Year, Regional (%)

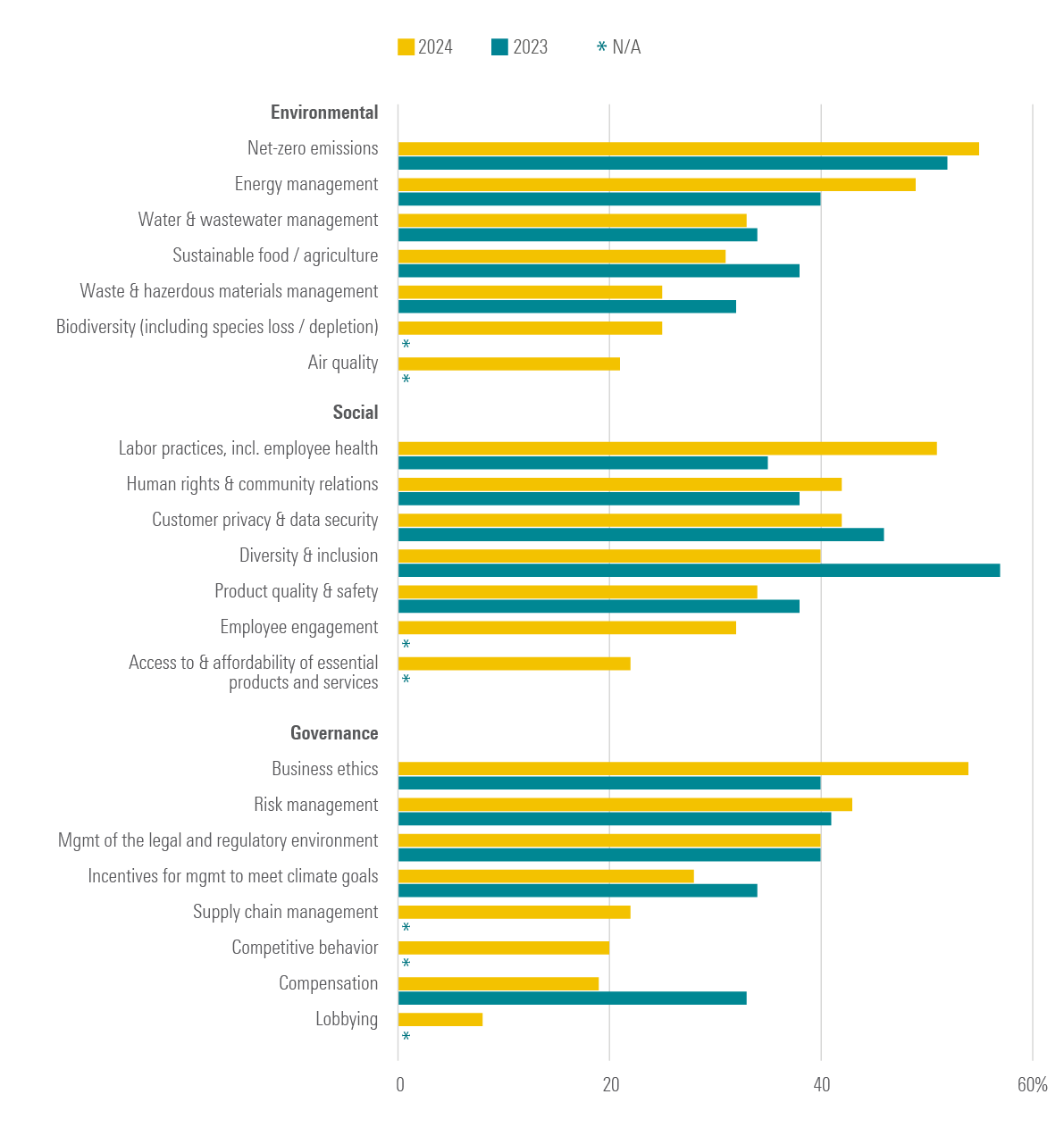

Given the urgency of tackling climate change, it is not surprising that asset owners view the transition to net zero emissions as the environmental factor most material to their decision-making (55%), up from 52% in 2023, followed by energy management (49%), up 9 percentage points from 2023. New to the list of top three issues is water & wastewater management (33%), replacing sustainable food/agriculture, which ranked third in 2023 at 33%.

Exhibit 12: Issues Most Material to Asset Owners’ Investment Decisions (Top 5)

One reason for the climate focus is that data quality, availability, and consistency for environmental factors were perceived as much better than those for social and governance factors. “Climate is the lead and that’s because the data that’s available is better,” said one US corporate pension fund in our survey.

Yet, while climate maintains its position as the most material topic in the most material ESG pillar, some surprises surface when we dig into the data.

Materiality. Not surprisingly, this year’s survey shows that two thirds of respondents believe ESG factors have become more material in the past five years, in line with our two previous surveys. Surprisingly, this year we saw significant material gains in social and governance factors, in addition to environmental factors. When asked which of the three ESG pillars had become the most material in the past year, all of them made substantial gains (cited as either “More material” or “Much more material”). Social, which had the largest gain this year, was at 58% in 2024, up 20 percentage points from last year, while environmental (64%) and governance (55%) each gained 12 percentage points. Within social, labor practices led the way, followed by human rights and community relations, customer privacy and data security, and diversity and inclusion.

Fiduciary Duty. Materiality is generally seen as a crucial precondition for institutional investors to take account of ESG factors in their portfolios. If ESG issues are material—meaning they have risk and return implications for investment decisions—then they are within the purview of fiduciary duty (that is, asset owners take them seriously). And fiduciary duty is the foundation for trust in the financial system for anyone not making their own investment decisions. Indeed, according to this year’s survey, eight in 10 asset owners see ESG as a neutral to positive influence on their fiduciary duties.

Market Engagement. Asset owners use active ownership as a crucial tool for their ESG policy. This is a way to use their considerable investment clout to have a voice with the companies in which they invest. Undertaken to effect change in portfolio holdings or to influence public policy, active ownership serves as a complement to portfolio construction for implementing their ESG strategies. Nearly eight in 10 (78%) of asset owners surveyed indicated that active ownership is useful. In this context, respondents cite direct engagement as the most important approach, followed by public policy engagement, collective engagement (such as Climate Action 100+) and supporting ESG-related shareholder resolutions. They see proxy voting as table stakes, the least influential of their options.

ESG Data. Data is the lifeblood of ESG investment strategies, whether used for ratings, portfolio construction, engagement, or index construction. Evaluating the relative usefulness of data, ratings, and indexes, asset owners overwhelmingly point to ESG data as the most useful (43%), relative to ESG ratings (24%) and indexes (23%). This marks a recent trend favoring the flexibility offered by granular data over aggregated ESG ratings among institutional investors. Asset owners also note that there is room for improvement in ESG data, citing the need for more accuracy, more standardized reporting, and more relevance. This reinforces asset owners’ message from earlier surveys to service providers, regulators, and corporations that continuous improvement is imperative for progress in sustainable investment.

A host of other insights emerge from our Voice of the Asset Owner Survey results, including about asset owner attitudes toward regulation and their expectations about the impact of artificial intelligence on ESG. See the full results for yourself.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available at indexes.morningstar.com/investable-products. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FPI4DOPK5VFUNIOGY5CVTI6NCI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)