Which Enterprise Software Stocks Are Best Weathering the Macroeconomic Storm?

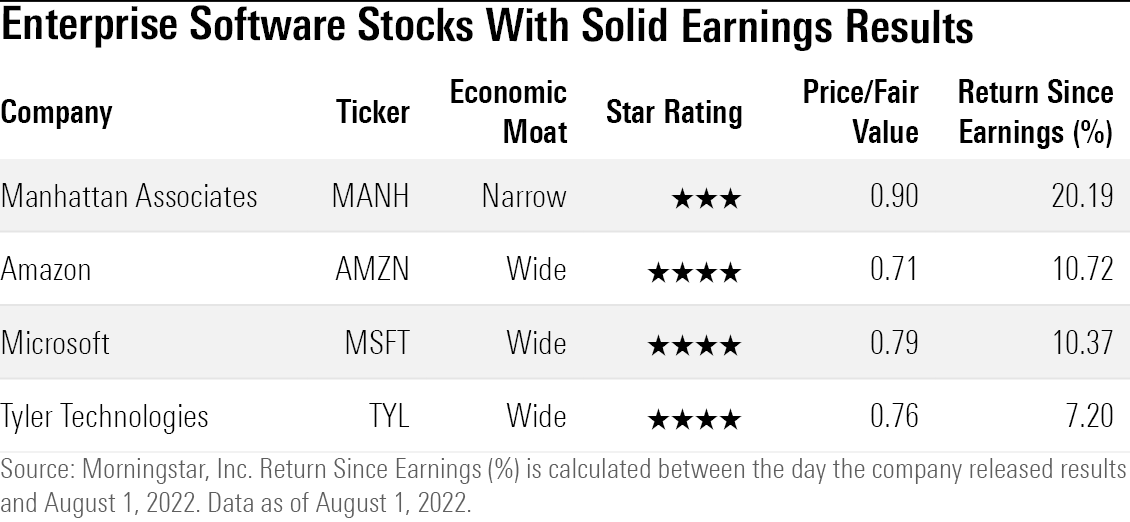

Microsoft, Amazon, Tyler Technologies, and Manhattan Associates are among those that Morningstar analyst Dan Romanoff highlights for posting solid second-quarter results.

As fears of a recession grew this spring, software stocks were among the groups taken out to the woodshed. But as second-quarter earnings have come in, results for many top enterprise software names are showing they are navigating economic headwinds better than expected.

This includes market leaders such as Amazon AMZN and Microsoft MSFT, both of which had fallen more than 15% this year, but have bounced back 30.6% and 13.5%, respectively, since the broad market hit a low on June 16. "The massive selloff in software over the last nine months suggested a recession is pending. However, I haven't seen a 'recession' in results thus far," says Dan Romanoff, Morningstar senior equity analyst.

Key Takeaways From Enterprise Software Company Earnings

- Demand remains intact and healthy.

- Software stocks with positive earnings have generally outperformed the market in the last week.

- Companies are taking a more disciplined approach to maintaining or expanding profit margins against a tough macroeconomic environment.

- The strength of the U.S. dollar against other currencies has been a bigger headwind for earnings than had been expected.

Had fears of a decline in demand due to an economic slowdown materialized, Romanoff says, firms would be reporting cutbacks in existing relationships with customers and a slowdown in deals for new software agreements. Romanoff, who specializes in companies that provide software solutions to enterprise-level customers, saw generally positive news in the earnings results from the firms he covers.

"Demand has been better than feared in the face of swirling macro issues. There are a few pockets of weakness, which has been more a function of company-specific issues," he says. "Then again, enterprise software is not the most obvious spot to look for signs of a recession since the revenues are sticky and recurring." What has been a greater concern is the bigger-than-expected impact from a strong U.S. dollar, which was "far worse than what was guided to," Romanoff says. As the greenback strengthens, it cuts into earnings generated in foreign currencies. Microsoft, in particular, saw earnings reduced by this effect. At the same time, Romanoff sees many firms on his coverage list taking steps to be more disciplined in maintaining and expanding profit margins to mitigate against the impact of a harsher macro climate.

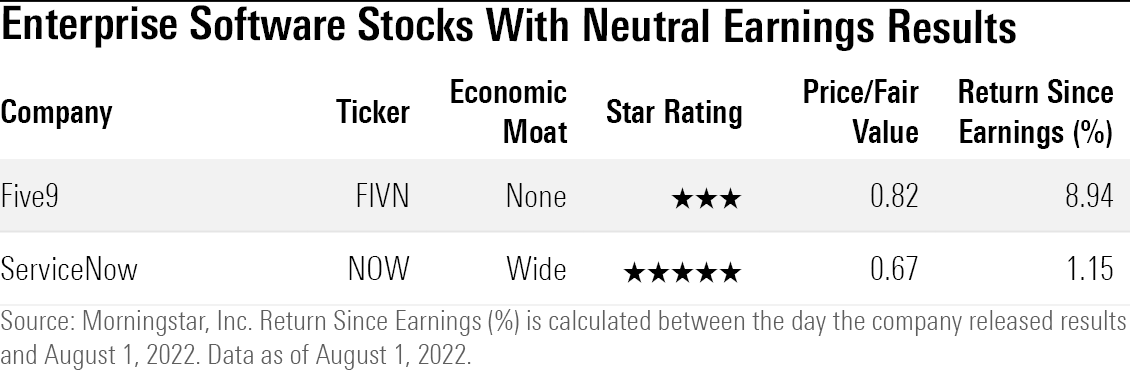

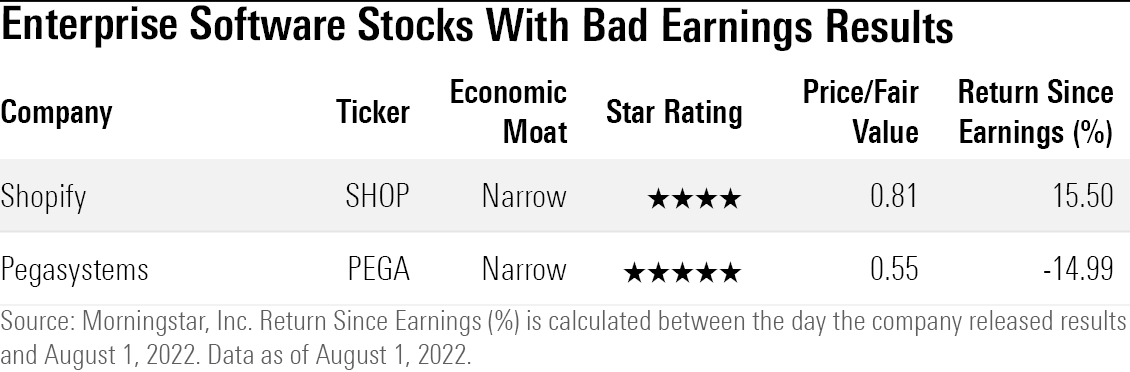

Among the companies he covers, Romanoff classified four as reporting solid results, two that were neutral, and two that disappointed. Here’s a look at those eight enterprise software stocks.

Which Software Stocks Had Good Earnings?

- Amazon

- Microsoft

- Tyler Technologies TYL

- Manhattan Associates MANH

Amazon

Amazon’s second-quarter results came in mixed, with revenue at $121 billion, above FactSet consensus of $119 billion, while earnings per share came in at a loss of $0.20 versus an estimated profit of $0.12 per share. Driving most of the company’s revenue growth was Amazon Web Services, the company's cloud computing platform. But Romanoff sees another hero in the company’s results.

“The more important takeaway this quarter is that retail-related businesses, especially third-party seller services, are coming back and even delivered some upside compared with our expectations,” he says.

Amazon shares are at a 29% discount to their fair value estimate.

Microsoft

Microsoft missed both earnings and revenue consensus estimates for the quarter. Romanoff sees its fundamentals as solid, saying “the company was hurt mainly by things beyond its control, such as a stronger U.S. dollar, persistent supply chain issues, further scaling back in Russia, and general macroeconomic pressures.”

Revenue grew 12% year over year to $51.87 billion. Cloud revenue also rose past $25 billion over the last four quarters for the first time.

“Key pillars of our growth narrative from the quarter included year-over-year growth as reported in Azure of 40%, Dynamics 365 of 31%, and LinkedIn of 26%,” Romanoff wrote.

Microsoft shares are at a 21% discount to their fair value estimate.

Tyler Technologies

Tyler Technologies supplies software for a variety of government operations, such as financial management, human resources, and tax billing. Among the companies covered by Romanoff that have released earnings, Tyler is the one least affected by the macro environment, namely a strong dollar, as nearly all its revenue is earned in the U.S.

“Business momentum continues with strong bookings, growth in software subscriptions and transactional revenue, and incremental signs of cross-selling success between its products,” Romanoff wrote.

Money from the American Rescue Plan is expected to be a tailwind for Tyler as governments look to upgrade their systems.

“Governments have until the end of 2024 to spend these funds,” Romanoff wrote. “While planning is underway and Tyler is seeing some deals influenced or aided by these funds, we suspect there is a fair amount of fluidity within spending intentions.”

Tyler Technologies shares are at a 24% discount to their fair value estimate.

Manhattan Associates

Supply chain and inventory management software provider Manhattan Associates had second-quarter results that beat Romanoff’s expectations, leading him to increase the company's fair value estimate to $155 per share from $149. Earnings came in at $0.69 per share, above the estimate of $0.55, and revenue was $192 million, beating the $180 million estimate.

While margins are expected to be pressured as Manhattan accelerates its shift to the cloud, Romanoff sees those efforts paying off over the next few years.

“We believe Manhattan’s cloud-based portfolio combined with new cloud products and persistent global supply chain challenges leaves the company uniquely poised to benefit,” he wrote.

The company proceeded to increase its outlook for 2022 after it posted results, and sees total revenue of $733 million to $741 million, up from $720 million to $727 million. “We view guidance as achievable, but we are wary of macroeconomic factors that are affecting companies throughout our coverage,” Romanoff says.

Manhattan Associates shares are at a 10% discount to their fair value estimate.

Which Software Stock Earnings Were Neutral?

- Five9 FIVN

- ServiceNow NOW

Other stocks Romanoff saw with neutral earnings results included those who are in the process of being acquired, such as Zendesk ZEN and Citrix Systems CTXS.

Five9

Five9, which provides cloud software for customer services, sales, and marketing, had a good quarter, according to Romanoff. Top- and bottom-line results both beat estimates, with revenue at $189 million versus $180 million, and EPS at $0.34 beating the estimate of $0.18.

Despite the encouraging results, Romanoff sees some trends in the company’s business starting to tick down.

“When considering the encouraging release coupled with macro uncertainty, we are maintaining our fair value estimate of $130 per share and view shares as undervalued,” he wrote.

Five9 shares are at an 18% discount to their fair value estimate.

ServiceNow

IT software provider ServiceNow provided mixed second-quarter results. Revenue was $1.75 billion, shy of estimates of $1.76 billion, but EPS came in ahead at $1.62, above estimates of $1.57.

Similar to many other software names, results were affected by macroeconomic factors. “Results that would have been ahead of consensus if not for a greater-than-anticipated headwind from currency,” Romanoff says. In response, he cut his fair value estimate to $675 per share from $700.

“Our main takeaway, however, involves current remaining performance obligation, or CRPO, where guidance for the third quarter is decelerating and below what we were expecting. CRPO growth should reaccelerate in the fourth quarter but is a risk,” Romanoff says. Lengthier sales cycles also reduced the subscription revenue growth outlook for the year, further clouding results.

“All things considered, we view shares as attractive after a severe selloff in software stocks and believe that macro factors are not unique to ServiceNow,” Romanoff wrote.

ServiceNow shares are at a 33% discount to their fair value estimate.

Morningstar

Which Stocks Disappointed?

- Shopify SHOP

- Pegasystems PEGA

Shopify

Shopify missed earnings for the second time in a row as revenue came in at $1.29 billion, below estimates of $1.33 billion. Earnings came in at a loss of $0.03 per share versus expectations for a profit of $0.02.

Revenue growth year over year decelerated to 16%, and down from 23% in the previous quarter. Compounding issues was Shopify’s decision to lay off 10% of its workforce. “It is unusual for a medium-size, rapidly growing software company to undertake a material reduction in force,” Romanoff says.

“The key takeaway as we see it is that the company will see adjusted operating losses materially worsen in the third quarter that then improve in the fourth quarter but are still worse than the second quarter,” he wrote.

Shopify shares are at a 19% discount to their fair value estimate.

Pegasystems

Customer relationship software provider Pegasystems posted results that disappointed on both earnings and revenue in the second quarter. Revenue was $274 million, below estimates of $332 million, while earnings came in at a loss of $0.38 per share, versus estimates of a profit of $0.05.

Hurting the company’s performance was “a highly turbulent macro environment involving currency headwinds, inflationary pressure, and accelerating adoption of Pega Cloud,” Romanoff says. Management lowered their total revenue outlook this year to $130 million, a cut of $120 million, in response to the macro pressures. Similar to competitor ServiceNow, they also expect longer sales cycles, which may slow annual contract value growth.

Romanoff cut his fair value estimate for Pegasystems' stock to $74 from $104 in response. And although Pegasystems has significant upside at current prices, he suggests investors be cautious, citing the recent uneven results, a messy transition to cloud-based products and services, and a $2 billion judgment awarded to Appian APPN in May generates too much uncertainty around the firm.

Pegasystems shares are at a 45% discount to their fair value estimate.

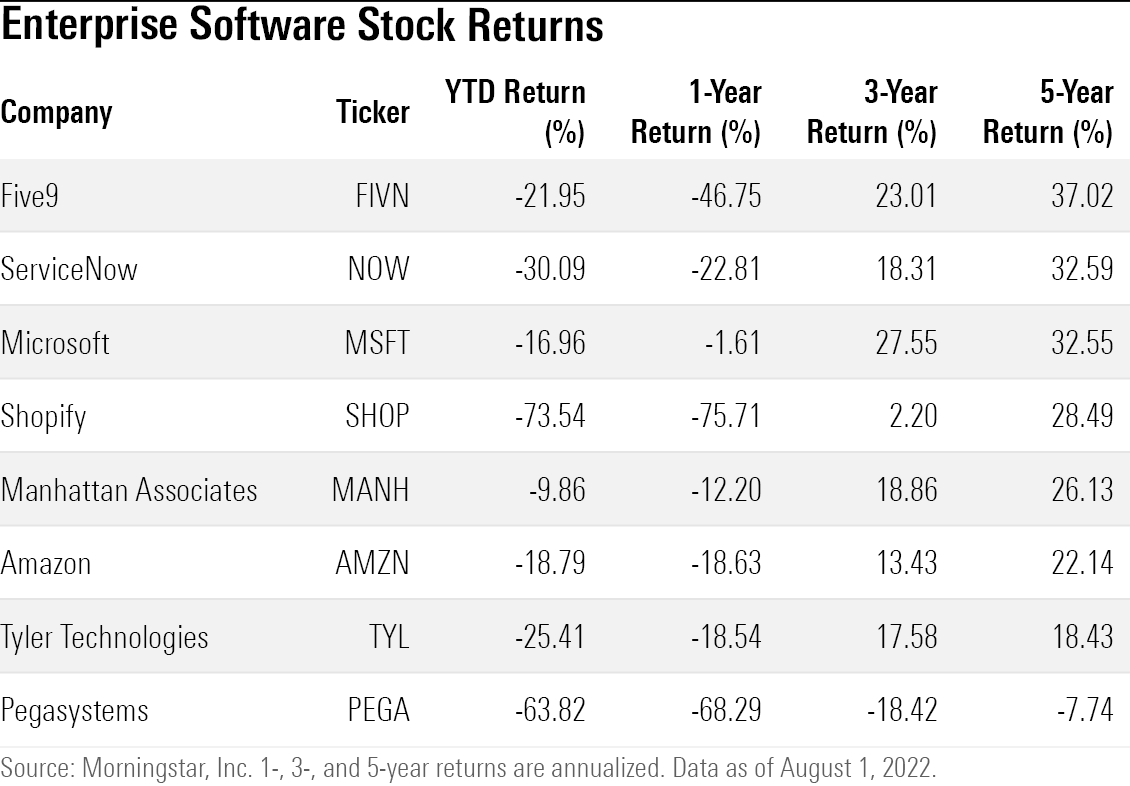

Here's a look at how these eight enterprise software stocks have performed over the short and longer term.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JA7LQ2INFNFTZFBJLSDUZGIPJQ.png)