Has the Sell-Off Created Opportunities?

Premium member exclusive: The market still doesn't look cheap as a whole, but we still see a few emerging pockets of value.

Monday was another rough day in the market, and Tuesday looks set to be another volatile one for investors. It's tempting to look at those kinds of declines and think there must be some great buying opportunities, but as of now we don’t think the market as a whole looks particularly cheap yet.

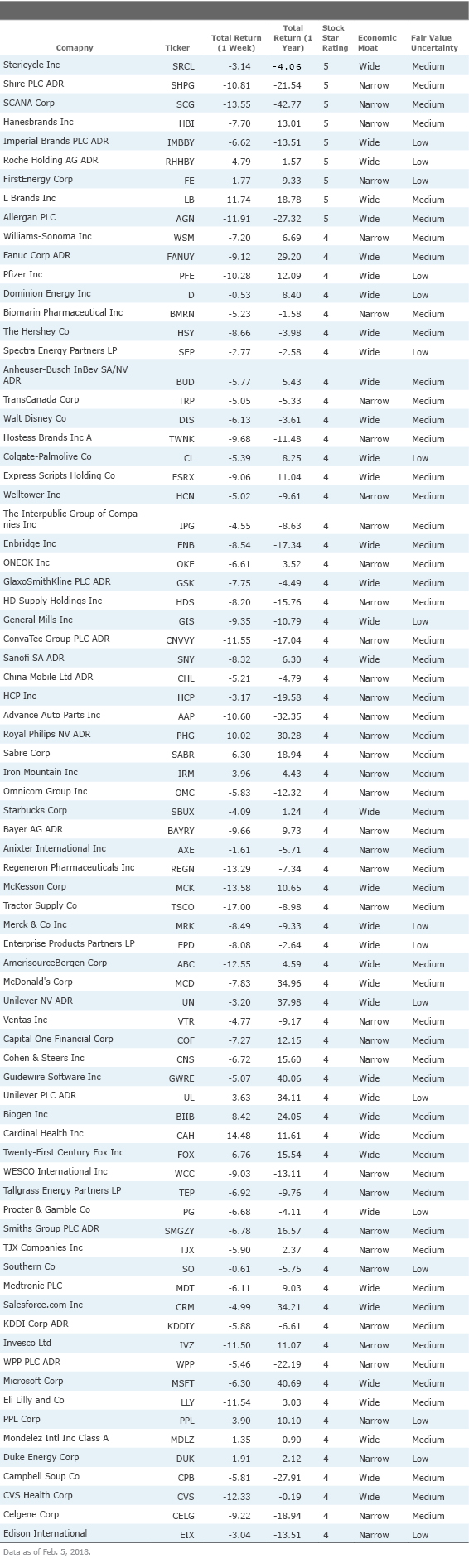

That's simply because stocks looked pricey heading into February. Our market price/fair value ratio, which measures how over- or undervalued the median stock in our coverage universe is, started the month off at 1.10. That's not far from the all-time high of 1.14 hit in 2004. After this week's sell-off, that ratio stood at 1.02 (as of Monday night). That is to say, even after the declines, the median stock in our coverage universe is still trading at a 2% premium. For context, the cheapest we've ever seen stocks was in November 2008 when the median stock was trading at a 46% discount to fair value. Even after this week's market plunge, there are only 11 stocks that earn our highest 5-star rating.

What does this mean for investors? From an asset allocation standpoint we don't think anything that has happened in the last few days necessitates a change. This is a good time, though, to make sure your portfolio actually is in line with your desired allocation. If you've let your stocks ride since 2009, you may find your portfolio is much riskier than it should be. If it is, this could be an opportunity to rebalance. Christine Benz has written about how in these cases, it can be OK to sell! It's important that the risk level in your portfolio lines up with your own capacity to take on risk.

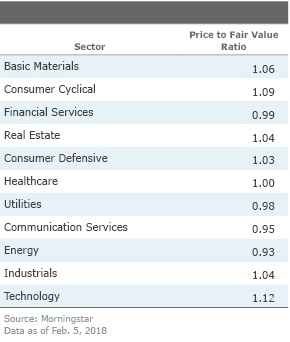

Opportunistic investors, and those that have been sitting on cash waiting for a chance to get into the market, have been given a chance to do so now. Although the market is fairly valued, some sectors are looking a bit more attractive than others. The table below has the price/fair value for all sectors.

Energy looks the least expensive today, while technology is the priciest.

As measured by moat, higher-quality firms look a bit more attractive today with wide-moat companies (price/fair value of 0.98) and narrow-moat companies (price/fair value of 1.00) trading at a discount to no-moat firms (price/fair value of 1.07).

What individual names should investors have on their watchlist? We focused on high-quality wide- and narrow-moat firms, with fair value uncertainties of medium or low that are trading in 4- or 5-star range. The firms that pass the screen are below.

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JA7LQ2INFNFTZFBJLSDUZGIPJQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)