Consumer Cyclical: Firms Exposed to E-Commerce, China Have Advantage

Brexit uncertainty, trade tension, and political unrest have pressured consumer cyclical stocks.

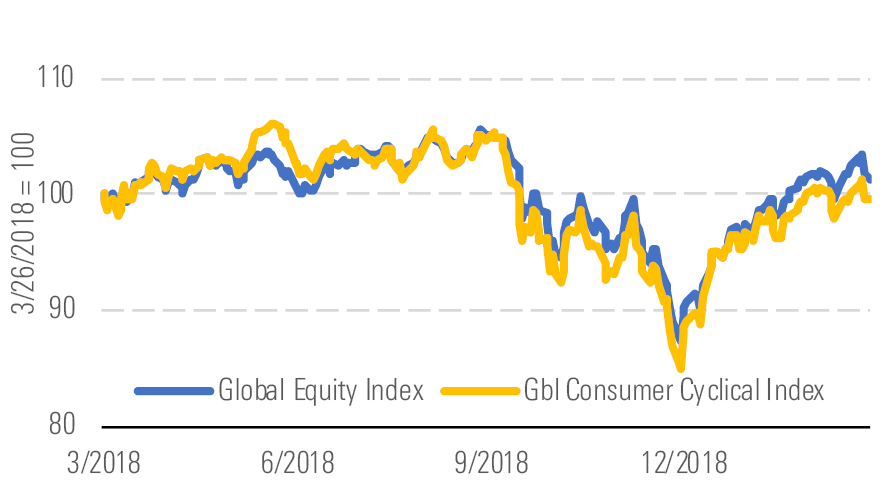

Through March 25, the Morningstar Global Consumer Cyclical Index has rebounded 11% from its recent lows of late December, roughly in line with the broader global equity market. That said, the sector remains 6% below its June 2018 peak, as concerns around global growth amid a slowdown in China, Brexit uncertainty in the U.K., trade tensions with U.S. partners, and political protests in Europe have weighed on consumer cyclical performance.

Cyclical stocks are in line with the broad market - source: Morningstar Analysts

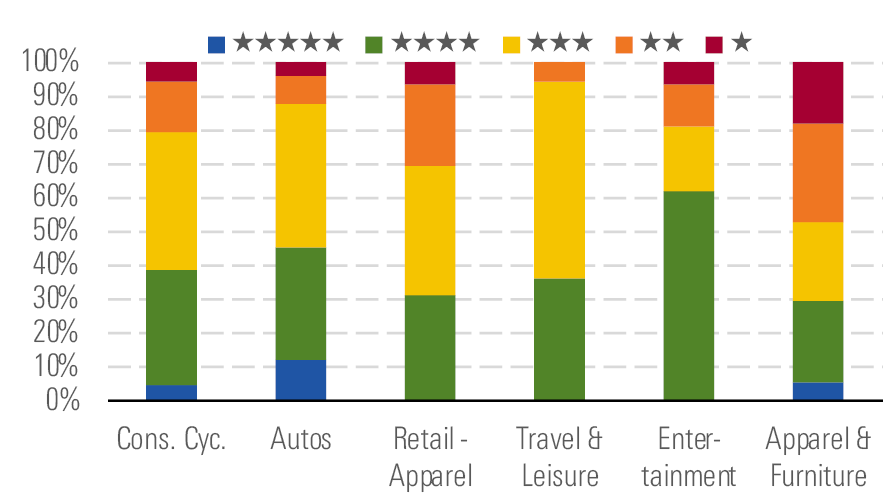

The median stock we cover trades at a 10% discount to our fair value estimate, providing opportunities for investors. Roughly 40% are 4- or 5-star-rated, with the auto, retail/apparel, travel and leisure, and entertainment industries trading at the most attractive valuations.

Auto, travel and leisure, and entertainment appear attractive - source: Morningstar Analysts

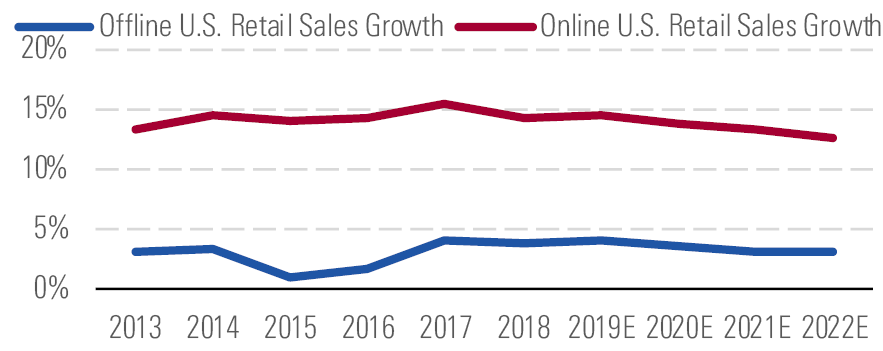

We see opportunities for long-term investors to own structurally advantaged companies that have been held back because of cyclical pressures. For instance, companies with competitive advantages exposed to e-commerce or the Chinese consumer remain well-positioned for long-term growth. In the U.S., we expect e-commerce growth to remain robust in the years ahead, with online retail growing at a double-digit clip through 2022 versus less than 4% for the brick-and-mortar channel. Also, economic downturns have historically offered e-commerce marketplaces opportunities to lock in new buyers and sellers, which then engage in other higher-margin products and services as conditions stabilize.

We expect U.S. online retail growth to outpace U.S. offline retail - source: Morningstar Analysts

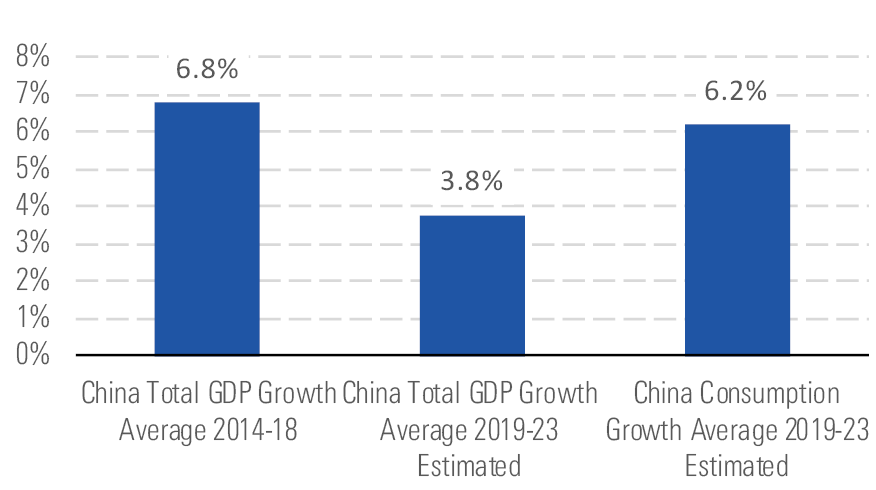

As for China, although we expect GDP growth to slow to 3.8% in real terms on average over the next five years from 6.8% during the previous five years, we believe that its mix is shifting to consumption, as we project household consumption growth to average 6.2% during the next five years, which supports operators exposed to its consumer. Further, the Chinese consumer remains relatively healthy, backed by wage growth, access to consumer credit, and potential government stimulus.

We expect Chinese consumption growth to outpace near-term GDP growth - source: Morningstar Analysts

Top Picks Wyndham Hotels & Resorts WH

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: $72

Fair Value Uncertainty: Medium

We expect Wyndham Hotels & Resorts to gradually expand room share in the hotel industry and sustain its brand intangible asset and switching cost advantage. This view is supported by the company's roughly 40% share of all U.S. economy and midscale branded hotels and the industry’s fourth-largest loyalty program by membership, which encourages third-party hotel owners to join the platform. Also, Wyndham has 15% and 5% share of existing U.S. and global hotel rooms, respectively. Financially, nearly all of its 9,000-plus hotels are managed or franchised, giving Wyndham an attractive recurring-fee model that generates healthy ROICs.

Hanesbrands HBI

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $27

Fair Value Uncertainty: Medium

We view narrow-moat Hanesbrands shares as attractive. We think the market has been overly focused on short-term issues (inventory reductions and leverage) and overlooks longer-term opportunities that arise from its intangible-asset-sourced narrow moat. We expect low-single-digit sales growth over our forecast and think that Hanesbrands has significant potential for margin expansion. We estimate adjusted operating margins will gradually improve to 16% by 2023 from 13.9% in 2018, as the firm extracts inefficiencies from its operations and instills best practices in its acquired businesses.

L Brands LB

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: $42

Fair Value Uncertainty: High

The firm's economic moat stems from its brand intangible asset in an industry characterized by the prioritization of quality and fit, along with a rising global awareness, with a good long-run growth opportunity in China. We remain cautious over the near term as Victoria's Secret's operating margin attempts to stabilize (the fourth quarter marked the 12th consecutive quarter of operating margin declines for the segment), but we see promise in the medium term from discontinued categories being comped, bralette penetration stabilizing, Victoria's Secret Beauty improving, less structured and more innovative bra introductions, and swimwear.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JA7LQ2INFNFTZFBJLSDUZGIPJQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)