MQR Analysis

A Framework that Utilizes the Decision Process of Our Analysts

MQR Analysis illuminates the opinions of the Morningstar Quantitative Rating by translating the data and analytics that are driving the rating into opinion-based text. When investors can access reliable investment research, ratings, and the justification behind it, they will be empowered to spend more time connecting with clients, growing their business, and making more informed investment selection decisions.

Proven Methodologies,

Trusted Expertise

Rely on the independence and expertise of the Morningstar Quantitative Rating and Analyst Rating to conduct comprehensive research for open-ended funds and ETFs.

Depth of Insight and Contextualization

Inform comparisons, distill insights, and communicate investment recommendations by accessing context on a fund’s strength, weakness and suitability.

Increased Breadth of

Coverage

Screen within an asset class or category, detect trends, and provide the necessary information to help clients aim for stronger investment outcomes.

Build a Better Investment Portfolio

MQR Analysis answers this core investor question at scale: Why does Morningstar think this investment will deliver excess returns, in comparison to its peers, over the long term?

MQR Analysis expands Morningstar's written coverage of managed investments from 4,000 funds to 40,000 funds: a 10x increase in coverage.

Close the Gap Between Complexity and Communication

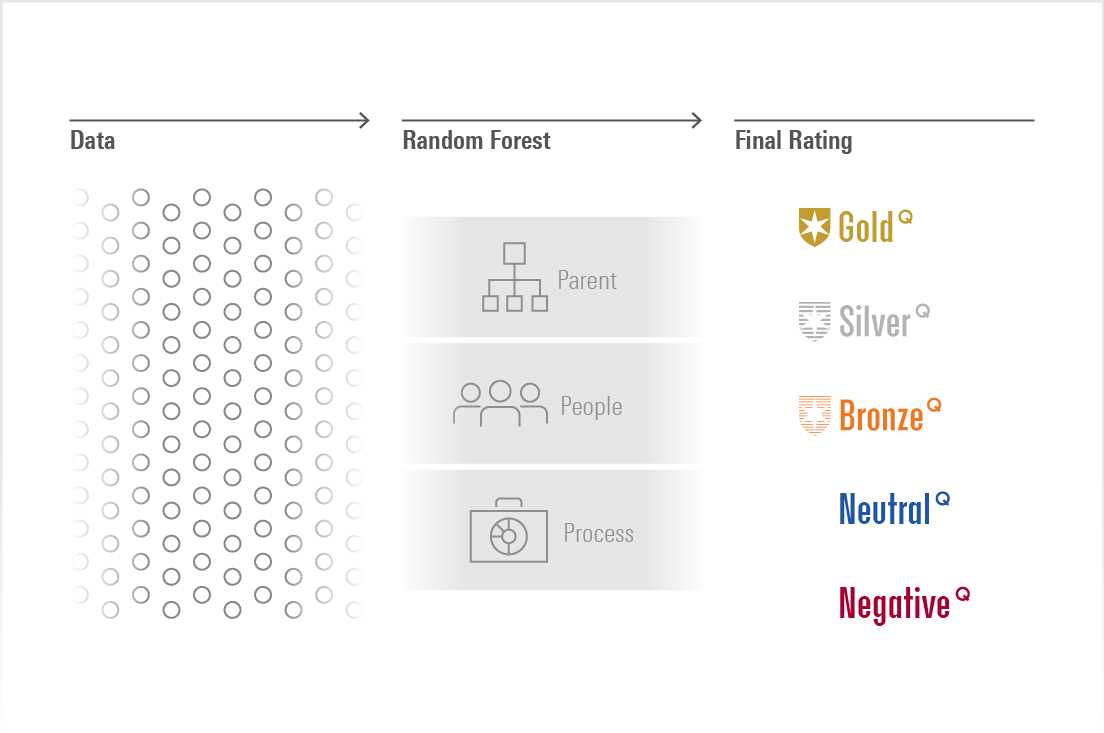

About the Quantitative Rating: The Quantitative Rating consists of a series of seven individual models working in unison that were designed to provide a best approximation for the Analyst Rating on the global universe of open-end funds and ETFs. Visually, you can think of the estimation as a two-step process. First, we estimate the pillar ratings for each fund, and then we estimate the overall rating. To estimate the pillar ratings, we chose a machine-learning algorithm known as a "random forest" to fit a relationship between the fund’s pillar ratings and its attributes. After the pillar ratings are estimated, we needed to aggregate them into an overall fund rating. To do this, we apply the analyst ratings framework. The result is the Morningstar Quantitative Rating™ for funds.

MQR Analysis generates opinion-based text (not automated text)

We derive analyst-like opinions from data by assigning a pillar score and creating a thesis. Analysts then choose between mental modes that support their thesis.

The opinions of the MQR Analysis are that of the Morningstar Quantitative Rating model. MQR applies analyst-written content wherever possible. With MQR Analysis, the Morningstar Quantitative Rating system offers the same core elements as the Morningstar Analyst Rating, helping investors make sense of what’s driving our quantitatively-derived ratings.

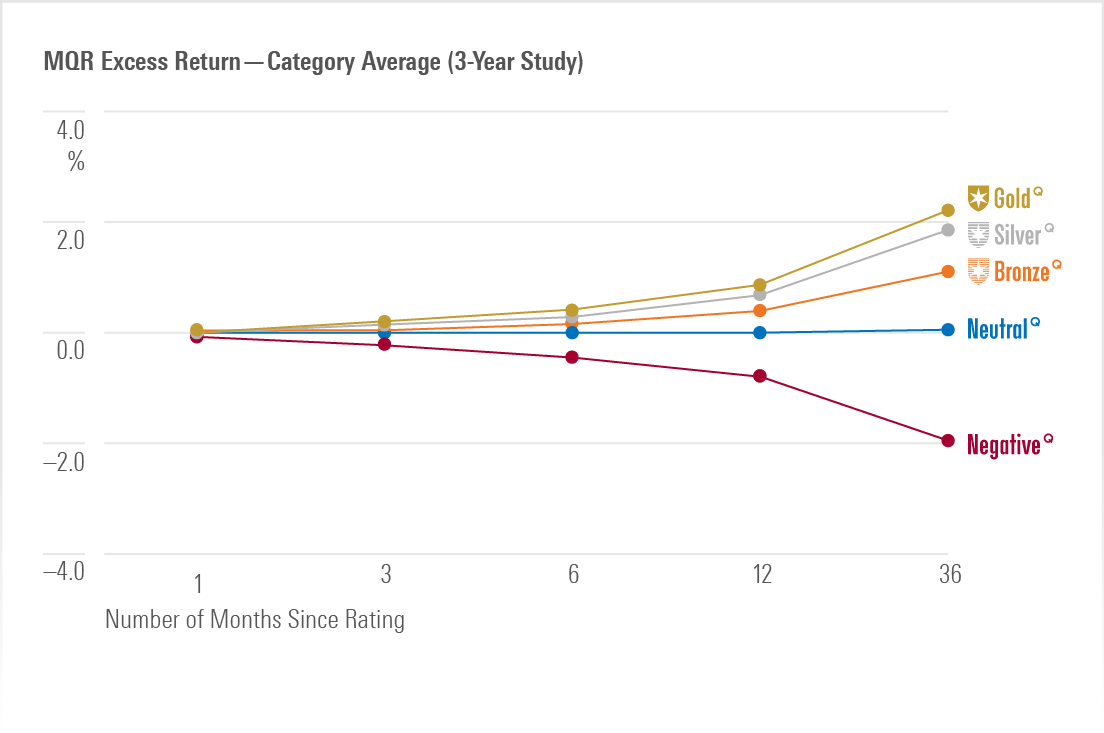

Source: Morningstar Quantitative Rating Three-Year Event Study, Data as of Dec 31, 2020.

MQR is a good predictor of excess returns

In short, the Morningstar Quantitative Rating is very effective at predicting future overperformance (or underperformance). In a three-year event study, funds initially rated gold outperformed similar funds during a full market cycle. When MQR does not recommend a fund (negative or neutral), there is a high likelihood of underperforming.

The Morningstar Analyst Rating and The Morningstar Quantitative Rating have a proven track-record of effectively identifying managed investments that will outperform or underperform their peers.

Where to Find MQR Analysis

MQR Analysis is immediately accessible through our software solutions and feeds.

What You Should Know

Learn More About MQR Analysis and Morningstar Research

Contact us for more information. Or view our entire Research offering here

©2021 Morningstar. All Rights Reserved. Morningstar's Credit Ratings & Research is produced and offered by Morningstar, Inc., which is not registered with the U.S. Securities and Exchange Commission as a Nationally Recognized Statistical Rating Organization (“ RSRO”). Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.