Help Center

Welcome to the Morningstar® Retirement ManagerSM

Frequently Asked Questions

More information on Morningstar® Retirement ManagerSM and your personalized retirement strategy.

Your Personalized Strategy

If you’ve signed up for the managed accounts service through Morningstar Retirement Manager, your retirement savings and investments are being managed by Morningstar Investment Management LLC, a registered investment adviser and subsidiary of Morningstar, Inc.

Our team specializes in supporting workplace retirement plans and includes people who have spent decades working in the investment industry, helping us develop specialties in asset allocation, portfolio construction, and manager selection. We also have a global team of investment professionals who focus on creating fund-specific portfolios in line with our investment methodology, while reflecting our latest research and investment thinking.

All this real human experience shapes the service provided through Morningstar Retirement Manager to help you save and invest with a strategy tailored to your life and retirement goals.

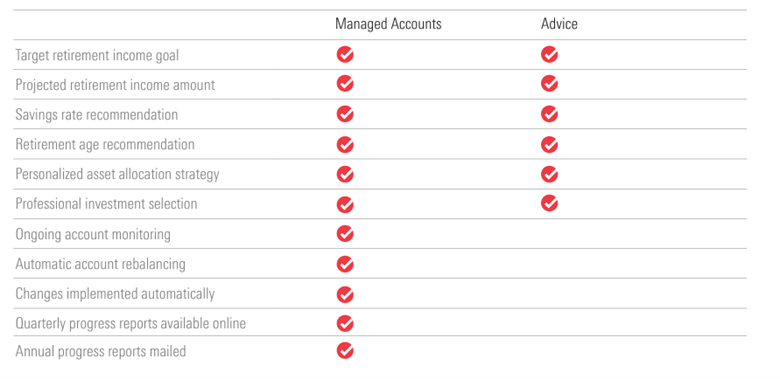

After entering your information and generating your personalized retirement strategy in Morningstar Retirement Manager, you have the option to sign up for our managed accounts service or you can choose our advice option.

With managed accounts, your tailored retirement strategy and portfolio will be put into place, and our investment professionals will manage your investments for you on an ongoing basis. This means we’ll monitor your portfolio and rebalance it every three months if necessary, keeping you updated on your progress and any changes made. Managed accounts is an ideal option for those who would rather have professionals keep an eye on their portfolios for them, whether it’s because they’re not comfortable doing it themselves or are simply short on time.

With our advice option, your personalized strategy will still go into effect once you submit it, but Morningstar Investment Management will not monitor or rebalance your investments for you from that point forward. We recommend revisiting Morningstar Retirement Manager every three months to check your information and re-submit your strategy. This will effectively rebalance your portfolio for you. To note—forgetting to rebalance your portfolio can mean being in a strategy that may not be best-suited to meet your retirement goals.

Here’s a closer look at what’s included in our managed accounts vs. our advice offerings:

We don’t ask for your risk preference because we prefer to base our advice on what we call your risk capacity. We believe risk capacity is a more reliable estimation and less subject to change. We use the data you’ve provided, like your income and existing savings, to determine what your current capacity for risk may be.

Once we’ve determined, Morningstar Retirement Manager assigns you to one of 589 possible investment combinations—all with varying levels of risk. As a result, the "risk level" you may see within the service is based on your unique factors that went into calculating your risk capacity. From there, our team of investment professionals’ goal is to create a diversified portfolio that aims to maximize the expected return (or amount of profit your investments can make) for your specific risk level.

As retirement approaches, your risk level and investment strategy can evolve and generally go from being more aggressive (with a higher concentration of stocks) to more conservative (with a higher concentration of bonds).

We designed Morningstar Retirement Manager to help retirement savers save more and find the ideal investment strategy for their unique situations. We don’t allow changes to your strategy or portfolio because, put simply, we wouldn’t be able to stand behind them. Morningstar Retirement Manager is designed to be an ideal option for those who want a personalized and professionally designed investment and savings strategy built for them by professionals. It’s perfect for those of you who feel you don’t have the time, knowledge, or interest in setting up and maintaining a retirement portfolio to meet your goals.

However, if there are specific funds you do not want to be invested in, you can select up to four to exclude from your strategy on the accounts page in Morningstar Retirement Manager. To note, the service may not be able to honor every selection if doing so means we can’t properly diversify your investment portfolio based on the information you provided, and the risk capacity determined for you.

If you’re signed up for our managed accounts service, we take care of the rebalancing for you. This is important because over time your portfolio can stray from its initial asset allocation. So, when we rebalance, we make any necessary changes to realign your portfolio with your goals. We automatically rebalance your portfolio every three months if needed, or whenever you update your profile with information that materially changes your situation (e.g., if you get married).

If you’ve chosen our advice option, we recommend revisiting Morningstar Retirement Manager every three months to check your information and re-submit your strategy if necessary. This will effectively rebalance your portfolio for you. To note—forgetting to rebalance your portfolio forgetting to rebalance your portfolio can mean being in a strategy that may not be best suited to meet your retirement goals.

We design your strategy using information from three different sources: your employer, the retirement savings industry, and—of course—you. The data your employer provides includes your income, savings rate, age, company match, and more. From the industry, we gather data like federal and state tax rates and Social Security retirement benefits. Finally, you, through Morningstar Retirement Manager, provide us with information on any other retirement savings you have, other sources of income, and any large expenses you expect to have in retirement. Using all these details then allows us to create your personalized portfolio recommendation that considers your goals across your various financial accounts.

If you notice changes to your account, they’re likely due to a recent rebalance. If you’re signed up for our managed accounts service, we rebalance your portfolio every three months if needed, or whenever you update your profile with information that materially changes your situation. Rebalancing is important because over time your portfolio can stray from its initial asset allocation. When we rebalance, we make any needed changes to realign your portfolio with your goals.

Beyond rebalancing regularly, we’ll also adjust your strategy over time as you near retirement or when you provide any new information that materially changes your financial situation.

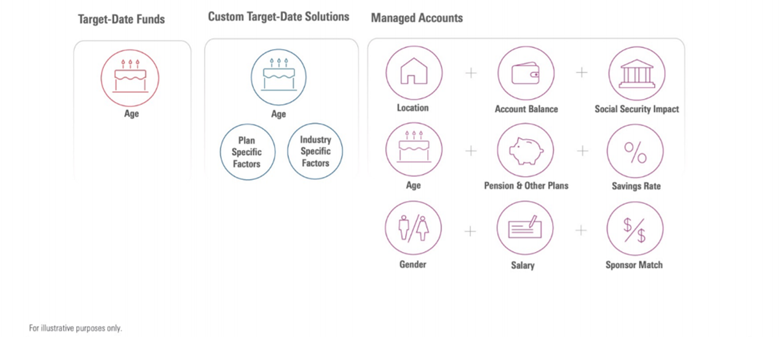

Everyone has a different set of needs and goals when it comes to saving and investing for the future. That’s why Morningstar Retirement Manager takes into account a range of factors to provide you with a retirement strategy that’s tailored to you.

Taking a closer look, our approach is designed to capture a holistic picture of your financial life to help us provide you with the appropriate strategy and portfolio. To do this, we consider a range of personal details—like your job, age, and location—and combine those with relevant financial information—including your savings and sources of income. Then we conduct an in-depth analysis of your financial situation and projected future earnings and determine the appropriate risk level for you to help us match you with the right balance of stocks and bonds. From there, our investment team creates a diversified retirement portfolio just for you using the investments available in your plan.

As you can see illustrated in the chart below, it’s this personalization that truly sets Morningstar Retirement Manager apart from other common retirement investment options. To help us tailor your portfolio and retirement strategy as much as possible, we encourage you to share with us as much information as you can.

Market Volatility

While there’s no way to protect our invested savings from market volatility, we believe having a diversified portfolio with the right asset allocation for your goals and situation can help you minimize any negative effects. Morningstar Retirement Manager aims to provide just that—a personalized retirement portfolio that’s built upon decades of market research and diversified for your retirement goals.

Our team of investment professionals forecasts various market scenarios throughout the development of what we call our ‘asset allocation models’—which form the basis of participant portfolios. Our models are stress-tested and designed to withstand changing market environments in the long-term. This means that every year, we rigorously study a wide range of asset classes to estimate how they may behave under varying market conditions. Our goal is to invest your portfolio to reflect an amount of risk suited to your personal circumstances. If you’re older, you’re more likely to be invested conservatively because you will have less time than a younger investor to recover from possible market losses.

Even if it’s inevitable, market volatility can be scary. That’s why we believe we're diligent in our practices to design portfolios that attempt to minimize the effects of volatility and keep you on track for your goals in all market conditions.

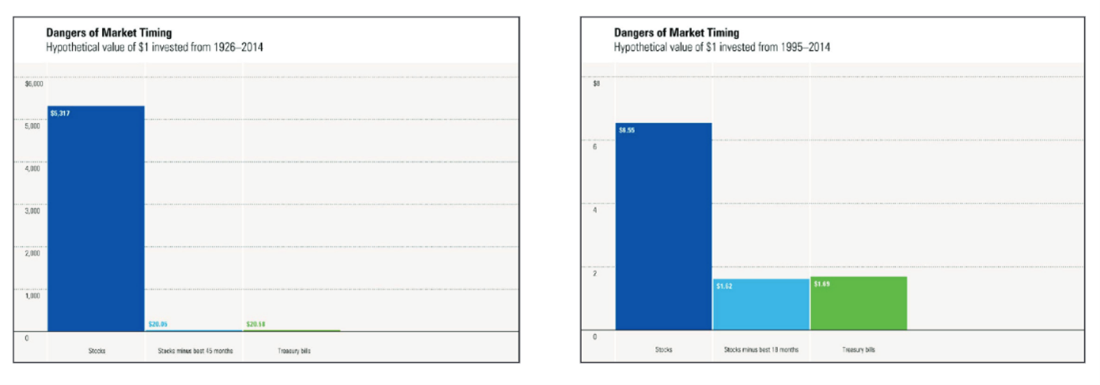

Morningstar Investment Management believes in and takes a strategic, long-term approach to investing in retirement portfolios, because retirement is a long-term goal. We don’t make bets or try to time the market because studies have shown that investors tend to do poorly when they do, often selling when investment prices are low and buying when they’re high.1

We’ve designed our methodology to provide personalized, long-term investment strategies and encourage Morningstar Retirement Manager users to stick with them. While no one enjoys a market downturn, trying to avoid them may lead to missing an upturn, which can negatively impact your savings.

Of course, even when keeping all of this in mind, we know it can be hard to focus on your long-term goals during unsteady times. Don’t forget that while the markets can drastically shift in the short term, returns are usually positive over the long term. Over the past 100 years, the stock market has earned investors about 8% per year, on average.2

1 Morningstar, Inc. data – Market-Timing Risk, Dangers of Market Timing I and II. Stocks are represented by the Ibbotson® Large Company Stock Index. An investment cannot be made directly in an index. The data assumes reinvestment of income and does not account for taxes or transaction costs.

2 Based on the compound annual growth rate of the S&P 500 from January 1, 1919 to December 31, 2019. Annual returns data provided by Shiller and Yahoo Finance.

Your account balance will change as you contribute money to it, but it will also change as the value of the investments in your portfolio fluctuates, which can happen daily and is completely normal. Larger fluctuations can be a result of volatility in the financial markets—a to-be-expected part of investing. But keep in mind that while the markets can drastically shift in the short term, returns are usually positive over the long term. Over the past 100 years, the stock market has earned investors about 8% per year, on average.2

2 Based on the compound annual growth rate of the S&P 500 from January 1, 1919 to December 31, 2019. Annual returns data provided by Shiller and Yahoo Finance.

Your Subscription

You can cancel Morningstar Retirement Manager at any time by launching the platform through your plan provider’s website (your plan provider is the company that "holds" your retirement account). In the bottom right corner, you’ll find a button that says, "Cancel Service." This button will prompt you to fill out an exit survey, and after doing so, your enrollment will be canceled. You are free to sign back up at any time.

You may sign up for Morningstar Retirement Manager again at any time though your plan provider’s website (your plan provider is the company that "holds" your retirement account). If you require assistance signing up, please contact either your plan provider or us at 312-424-4288 or MorningstarRetirement@morningstar.com.

To speak to someone about withdrawals, rollovers, or correcting personal information tied to your retirement account, please contact your employer or plan provider.

To speak to someone at Morningstar Investment Management, please contact us at 312-424-4288 or MorningstarRetirement@morningstar.com.

Fees

There is an annual account management fee to use Morningstar Retirement Manager if you select the managed accounts option to have investment professionals perform ongoing management of your retirement account. If you choose our advice option, there is no management fee, as we won’t be performing any ongoing management for you.

There is an annual account management fee if you choose the managed accounts service to have the professionals at Morningstar Investment Management perform ongoing management of your retirement account for you. The exact fee depends on your provider, but it will amount to less than 1% of your account balance. For example, with a 1% fee, you would pay $350 each year for an account with $35,000.

You can confirm your exact fee by calling your plan provider or by selecting the “Fee Calculator” link in the footer of Morningstar Retirement Manager.

The account management fee for Morningstar Retirement Manager covers the cost of the investment professionals at Morningstar Investment Management performing ongoing management of your retirement account for you. We do the work, so you don’t have to spend the time monitoring and rebalancing your portfolio every three months—which is especially helpful if you don’t feel you have the time, knowledge or interest to do so.

The fee is deducted from your account balance either quarterly or monthly depending on your plan provider.

Withdrawals and Rollovers

We recommend treating early withdrawals (before age 59 ½) from your 401(k) or other retirement account as a last resort as you’ll typically be charged a 10% penalty fee for doing so, not to mention deplete your savings. Some employers allow hardship withdrawals for emergency expenses, which would allow you to avoid the penalty. Reach out to your plan provider to learn more about your withdrawal options.

For all questions regarding account rollovers, please contact your plan provider.

For all questions regarding account rollovers, please contact your plan provider.

Updating Your Profile

On the “Our Advice” dashboard, in the "Overall Annual Savings" column, Morningstar Retirement Manager will recommend how much you should save based on your goals. If you’d like to adjust that amount, click the Edit buttons both in the top right corner (near the "Social Security Benefit" column) and again under the "Overall Annual Savings" header. Here, you’ll have the option to update your contribution amount. Don't forget to save and submit your changes.

On the "Accounts/Expenses" page in Morningstar Retirement Manager, select "Add Other Retirement Income." Once you've entered the appropriate information, click "Save."

On the "Review Your Profile Information" page, scroll down and select the "Add a Spouse or Partner" button. Here, you can fill out their personal details. To finish adding, click "Save."

On the "Our Advice" dashboard, click the Edit buttons both in the top right corner (near the "Social Security Benefit" column) and again under the "Social Security Benefit" header. Here, you can compare various withdrawal ages, edit your withdrawal age, and more. Once adjusted, select "Save."

Navigating Morningstar Retirement Manager

You can view your quarterly/progress reports within the Morningstar Retirement Manager platform by clicking on Notifications in the upper right corner. Then click "Select a Notification Type," followed by "Progress Reports." You will also receive a yearly summary report in the mail.

You can check your allocation and your balance by logging into your plan provider's website and/or by visiting Morningstar Retirement Manager.

Double-check that you are enrolled by launching Morningstar Retirement Manager through your plan provider’s website. Then, click on Profile. Under profile information, the platform will tell you whether you are enrolled.

You can access Morningstar Retirement Manager through your plan provider’s website (your plan provider is the company that "holds" your retirement account). Once you log onto the website, there will be a link to access Morningstar Retirement Manger. You’ll be able to confirm some information about yourself and your financial situation and, in about five minutes, you will have a personalized plan for saving for retirement.

We’re about putting investors first – all investors.

Our Mission

Our mission is to help more people achieve the retirement they want through our cutting-edge products and services that assist you in saving and investing for the future.

Our History

Founded in 1999, the Workplace Solutions Group of Morningstar Investment Management LLC is a team of investment analysts and researcher with unshakeable standards. Our parent company, Morningstar, Inc., has been helping investors reach their financial goals since 1984.

Our Commitment

We don’t get paid extra to recommend certain securities to you. We work for you—your bottom line is the only one that matters.

©2025 Morningstar Investment Management LLC All rights reserved. The Morningstar name and logo are registered marks of Morningstar, Inc. For information and/or illustrative purposes only. Not for public distribution. The information contained within is the proprietary material of Morningstar Investment Management LLC. Reproduction, transcription or other use by any means, in whole or in part, without the prior written consent of Morningstar Investment Management LLC, is prohibited. Opinions expressed are as of the current date; such opinions are subject to change without notice.

Advisor Managed Accounts is offered by Morningstar Investment Management LLC and is intended for citizens or legal residents of the United States or its territories. The portfolios available through Advisor Managed Accounts are created by an investment adviser (the “IA”) chosen by a plan sponsor. Morningstar Investment Management LLC, a registered investment adviser and subsidiary of Morningstar, Inc., is responsible for participant portfolio assignment from those portfolios created by the IA. The IA is not affiliated with Morningstar Investment Management and Morningstar Investment Management is not responsible for the portfolios the IA creates. The IA is not responsible for the portfolio selection made by Morningstar Investment Management, nor for other recommendations made by Morningstar Investment Management through Advisor Managed Accounts. Investment advice delivered by Morningstar Investment Management is based on information provided and limited to the investment options available in each retirement plan. Projections and other information regarding the likelihood of various retirement income and/or investment outcomes are hypothetical in nature, do not reflect actual results, and are not guarantees of future results. Results may vary with each use and over time.

All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Morningstar Investment Management does not guarantee that the results of their advice, recommendations or objectives of a strategy will be achieved.