What to Know About the New TSP I Fund

The TSP I Fund gets worldlier, though it bypasses China and Hong Kong as it steps into new markets.

With almost $900 billion and more than 7 million participants, the US Federal Government’s Thrift Savings Plan is the largest retirement plan in the world. This series of articles answers some of the most frequently asked questions about the TSP, and you can send your questions through Morningstar’s TSP feedback survey.

Questions: I’ve heard that the TSP I Fund will be changing benchmarks. What’s happening to the I Fund, and what does it mean for my portfolio?

Answer: The TSP I Fund is transitioning from exclusively owning non-US stocks in developed markets to adding emerging-markets companies to the portfolio. The fund, also known as the International Stock Index Fund, will go from owning roughly 750 companies in 21 countries to more than 5,500 companies in 44 countries. The TSP I Fund is making this update by changing its benchmark index, and it will fully follow the new index by the end of 2024.

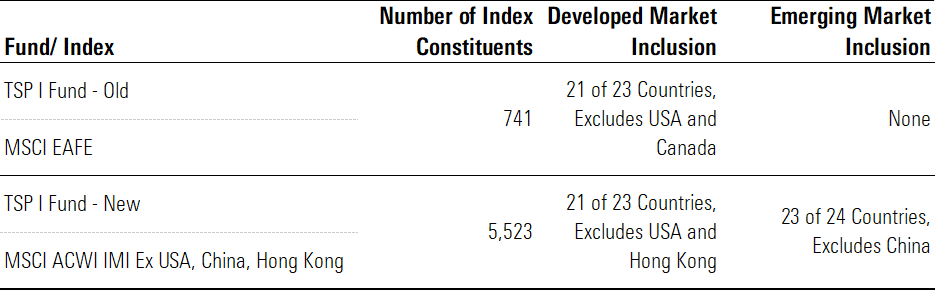

Exhibit 1 summarizes some of the major differences between the old and new TSP I Fund.

Exhibit 1. TSP I Fund Before and After Index Change

As a passive index fund, the TSP I Fund previously sought to match the returns and holdings of the MSCI EAFE Index. This index is a common performance bogy for investment managers of non-US, developed-markets stock strategies; or those focusing on Europe, Australia, and Far Eastern countries like Japan—the EAFE in its name. The MSCI EAFE Index excludes Canadian companies, as it does not include North American developed markets.

By the end of 2024, TSP I Fund will follow its new benchmark, the MSCI ACWI IMI Ex USA, China, Hong Kong Index. This mouthful of an index has a few things going on within it: “ACWI IMI” stands for “All Country World Index Investable Market Index” (yes, the new index’s name includes the word “index” three times). This acronym refers to the index’s inclusion of the stock of companies from emerging markets, such as the Czech Republic, Greece, and Hungary in Europe and Brazil, Chile, and Columbia in South America. The new TSP I Fund also will still invest in most of the same developed markets as the old one, plus Canada.

The index’s name says “Ex USA, China, and Hong Kong” because this version of the “All Country World” index leaves out the US, China, and Hong Kong. TSP investors can get exposure to large and small US-based companies via the TSP C Fund and TSP S Fund, respectively.

Why the New TSP I Fund Doesn’t Include China and Hong Kong

Excluding China and Hong Kong was a more complicated decision, and it brought issues of politics and national security into the consideration process.

The TSP I Fund was about to change its benchmark to the MSCI ACWI IMI ex USA Index on June 1, 2020, to add emerging-markets exposure, as the plan’s governing board, the Federal Retirement Thrift Investment Board, had decided in 2017. The Trump administration, however, intervened via a letter from the Department of Labor, telling the FRTIB in May 2020 to halt the transition. The missive arrived amid mounting trade tensions between the US and China and heightened concerns from some legislators that federal employees’ retirement dollars could be invested in companies linked to China’s People’s Liberation Army.

At a meeting called after the administration’s order, at least one board member said members of the US military and federal workforce shouldn’t have to invest in “China and/or any other adversaries.” Others said law, fiduciary duty, and best practices argued in favor of following the original plan, which was undertaken to improve TSP I Fund’s diversification and risk/reward profile. Ultimately, the board voted to pause the change because the board’s membership was about to change. In November 2023, the current board started switching to a recently built index that excludes China and Hong Kong.

What’s New in the TSP I Fund Portfolios

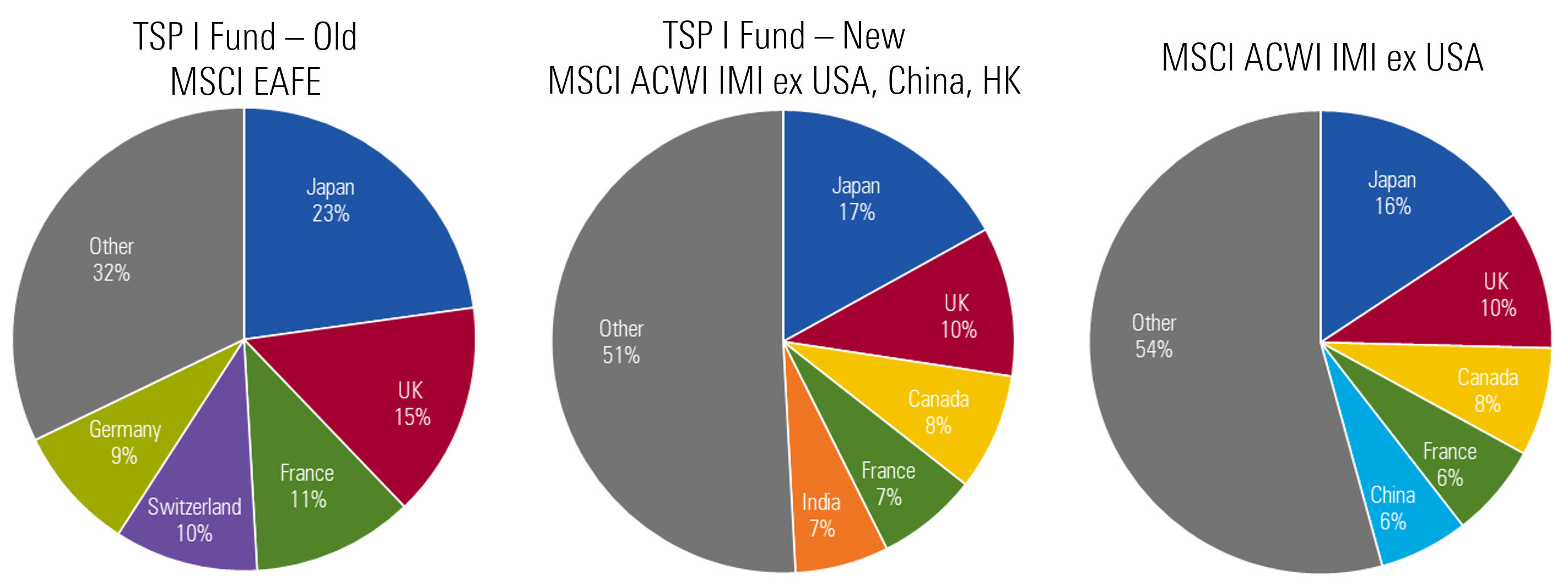

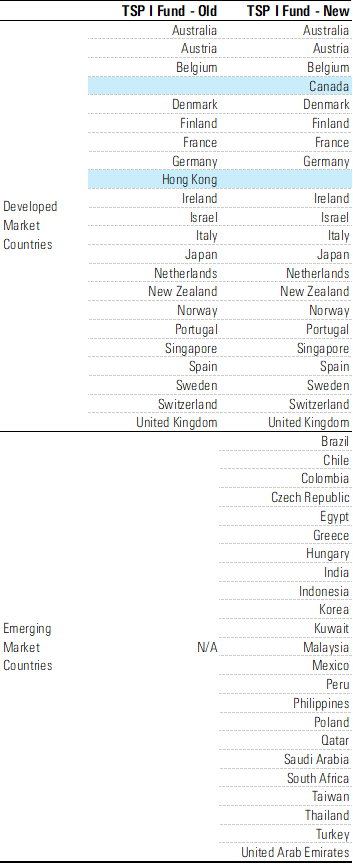

The new TSP I Fund’s portfolio will look much different. For example, Switzerland and Germany drop out of the fund’s top five countries; Canada and India take their place next to Japan, the UK, and France. If the board had stuck with the MSCI ACWI IMI ex USA Index, China would have replaced India as a top five holding. Exhibit 2 summarizes these country exposures, while Exhibit 4 lists each country included in the old and new TSP I Fund.

Exhibit 2. TSP I Fund and Index Country Allocations

Hong Kong, which was about 2% of TSP I Fund’s old MSCI EAFE benchmark, makes up roughly 1% of the MSCI ACWI IMI ex USA Index. The TSP I Fund’s new index avoids about 7% of the non-US developed and emerging markets.

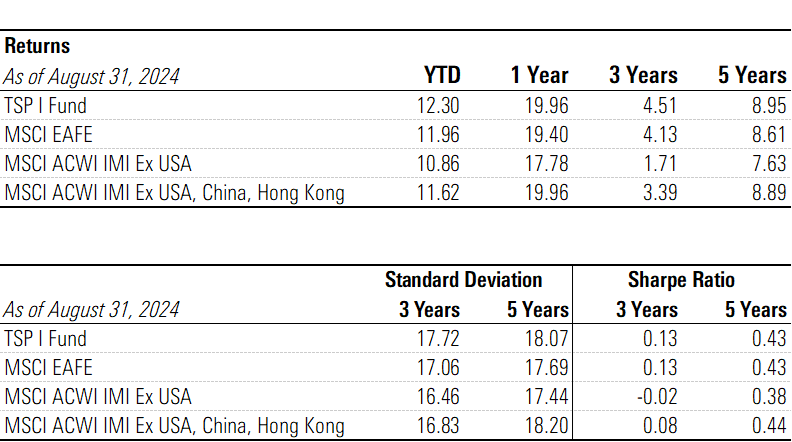

The effects of these decisions on TSP investors’ results are still to be determined. The MSCI ACWI IMI ex USA, China, Hong Kong Index is also untested. It is a little more than a year old and not a commonly used benchmark; it doesn’t have much performance history, and what’s available is mostly backtests. Those results, shown in Exhibit 3, are in line with recent years’ market trends, in which developed-markets equities have outpaced emerging-markets stocks.

Exhibit 3. Return and Risk Statistics for TSP I Fund and Related Indexes

More to come in future articles: The new TSP I Fund excludes China and Hong-Kong listed companies for reasons ostensibly related to national security issues. But there’s more to the world than domicile. A breakdown of TSP I, C, and S Fund holdings by Morningstar’s Revenue Exposure by Region methodology shows that exposure to China remains strong.

Exhibit 4. TSP I Fund Country Inclusions

Correction: (Sept. 24): This article was updated to correct Exhibit 4 to remove China.

Correction: (Sept. 24): This article was revised to indicate that the index that excludes China and Hong Kong was recently built, not custom-built.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EM5S5PPZOBAPZAXTPIQY2RBDYI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F4LLDEXKHBDARJDJB7US5S66YU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GMMWQCGBLBHCNCOH6F52MYB57A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)