3 Steps to Uncovering Your True Financial Goals

A process to help you identify what really drives you.

What are your top financial goals?

Most of us tend to have an idea of our answer to this question. But have you ever considered how stable or consistent your answers are? Or have you noticed that your goals may change with time or context? “What are your goals?” could be one of those questions that looks easy but is unexpectedly difficult.

If your goals are hard to pin down, or seem to drift, you’re not alone.

Research suggests that, even when considering important goals, people tend to answer with whatever is top-of-mind, which may not always reflect their true, long-term goals. For example, let’s say your social-media feed is recently inundated with friends’ photos from amazing vacations. After scrolling through yet another cinema-like video of a friend traveling through northern Italy, you decide to put down your phone and write down your financial goals.

At that moment, when considering your top, long-term financial goals, what comes to mind as a priority is to “travel more and take exciting vacations,” even though you may have not considered travel as all that important before.

Now, this doesn’t mean travel may not be a priority for you. And it’s also not a sign that you aren’t trying your best to think seriously about your financial goals. It just means that you’re human, and when faced with such a big and demanding question, our minds tend to take shortcuts, like the availability heuristic that equates “easy to recall” with “deserves more attention.”

In situations like this, it can be helpful to implement ready-made processes that help us be less of a stranger to ourselves and better understand our deeper motivations, rather than fixate on top-of-mind recollections.

3 Key Steps to Better Goals

We’ve used our research to inform a three-step process that can help investors more strategically identify their financial goals. This process forces investors to slow down and consider the topic holistically.

In practice, it provides the space and structure that people benefit from as they think deeply about what they want to do over the long term with their hard-earned resources. Here’s what the steps look like.

Step 1: Slow Down

First, take out a notepad and write down your top three investing goals.

- Most important goal

- Second most important goal

- Third most important goal

Think of this as a brainstorming session, which can be useful to get things rolling. But remember that it’s just the first step, and anything written here should be considered “written in pencil.”

Step 2: Use a Process

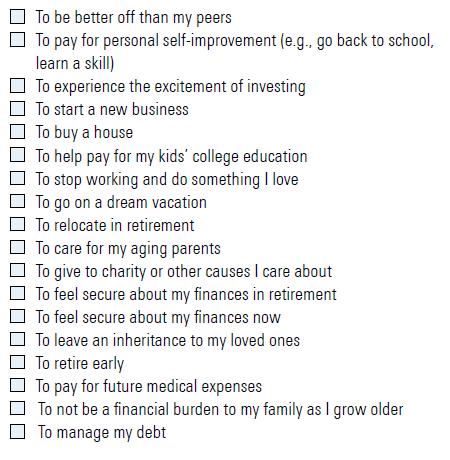

Next, set the notepad aside and review an established list of common investing goals (see below). Consider each alternative, and mark off the goals on the list that are important to you. As you go along, cross out goals that don’t resonate with you.

Now, there’s nothing magical about this master list. The benefit is that it gives people a different perspective on what they might be motivated by, and moreover the opportunity to just evaluate options, rather than having to generate ideas and evaluate them at the same time. Doing two things at the same time is hard (think about trying to drive and read a text message simultaneously).

Step 3: Think Carefully

Now, taking both your initial list from the notepad and the marked-up list of common goals into consideration, think about your top three investing goals. Write them down on a new piece of paper. Has your list of top goals changed since Step 1? If so, how?

A Simple but Effective Approach: Build a Master List

If your goals changed, you’re not alone. In our research, we found about 70% of people changed at least one of their top three goals after going through this simple three-step process.

After considering the master checklist, some people who initially thought of their goals in broad, vague terms began to formulate ideas that were more specific and vivid. The master list also helped many respondents shift from initial goals that focused solely on financial outcomes (which tend to be impersonal and potentially unmotivating) to reframe their goals in terms of their emotional and personal values. This process helped them better understand their why (not just their what).

To Wrap Up

If there’s one thing you take away from this article, let it be this: Accurately identifying your financial goals is not easy, but there are vetted processes that we can use to help us unpack this important but deceivingly simple decision.

So, next time you are faced with the big, scary question of financial planning—“What are your overarching, 30-year, long-term financial goals?”—try using the steps above to aid your decision-making and break the problem down into manageable steps. It can help you make sure that you find your true goals, and not just things that are top of mind. This helps investors be less of a stranger to themselves and to identify their why as they move toward where they want to go.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EM5S5PPZOBAPZAXTPIQY2RBDYI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F4LLDEXKHBDARJDJB7US5S66YU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GMMWQCGBLBHCNCOH6F52MYB57A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)