Markets Brief: The Uncertain Path to Neutral Interest Rates

Plus: Core inflation, the US dollar, and government bonds.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Fed Starts the Cutting Cycle

The US entered a new phase of the monetary policy cycle last week as the Federal Reserve cut interest rates for the first time since the onset of the covid-19 pandemic. While this cut reduces the drag of higher borrowing costs on economic growth, interest rates remain above the “neutral” rate of 2%-3% that neither stimulates nor slows down the economy. Morningstar’s senior US economist Preston Caldwell expects interest rates to reach that level in late 2025. As monetary policy has a delayed impact, we may witness growing concerns about the economy for many months before the effectiveness of this new policy direction can be judged. Most investors are expecting a half-point cut in either November or December with a quarter-point cut at the other meeting, according to CME FedWatch. For those curious about the impacts of previous interest-rate cuts, check out this article from Morningstar Wealth.

Energy Stocks Rise, Defensive Stocks Struggle

The Morningstar US Market Index rose 1.52%, pushing the US market further above Morningstar analysts’ estimate of fair value. However, in contrast to the previous week, energy stocks led the gains alongside other economically sensitive sectors such as basic materials, financial services, and industrials. In contrast, traditionally defensive sectors such as consumer defensive stocks and healthcare fell. You can find out more on Morningstar’s new markets page here.

Government Bonds Are Preferred Diversifiers

As a reminder that short-term asset price movements are often surprising, US Treasury yields rose last week. In contrast, the credit spreads (the additional yield demanded by lenders for accepting default risk) on higher-risk bonds fell sharply, indicating that investors are more tolerant of risk. This reminds us that not all bonds are effective diversifiers. These unusually low spreads provide little cushion for investors and consequently appear to offer poor value compared with government bonds in most economic scenarios. Morningstar’s Investment Management team therefore continues to favor government bonds as diversifying assets in portfolios.

US Dollar Remains Expensive

The US dollar fell slightly and is now 11% below the peak it reached in September 2022. Despite this, the dollar remains expensive relative to most other currencies, according to the Morningstar multi-asset research team, so overseas investments are likely to benefit from a currency tailwind if the dollar continues to move toward its fair value.

With Markets, Gravity Wins in the End

Although market commentators will confidently express their view on the effectiveness of the Fed’s action, investors know that there is only a weak link between the economic cycle and longer-term investment returns. Events such as last week’s generate a lot of market noise and can affect sentiment, leading to short-term price moves. However, it is unlikely to significantly affect the fair value of an asset, which acts like gravity over the longer term, pulling prices toward it.

Like a ball thrown into the air, prices can defy this gravity for a time. However, the patient investor can be confident that valuation will triumph as the force that contended with it dissipates. In the meantime, gaps between value and price pose both a risk (as we are not naturally patient creatures) and an opportunity to buy or sell at attractive prices. To do this effectively, we must have a good estimate of an asset’s fair value and the humility to accept that our estimate cannot be perfectly accurate, so only large deviations from this estimate need attract our attention. You can find Morningstar equity analysts’ estimate of fair value for the US market here.

Core Inflation Expected to Rise

The attention of investors this week will be focused on the release of the Fed’s preferred measure of inflation, core PCE, on Friday. This annualized measure of this data is expected to rise slightly to 2.7% from 2.6% last month. However, numerous planned comments by Fed officials will also be reviewed carefully for hints of future policy decisions. While this is useful for filling the airwaves and column inches, it should not distract investors from the patient pursuit of investment returns. You can find out more about what is happening this week on Morningstar’s new market calendar page here.

Highlights of This Week’s Market and Investing Events

- Monday, Sept. 23: Purchasing Managers Index Composite

- Tueeday, Sept. 24: Consumer Confidence Survey

- Wednesday, Sept. 25: New-Home Sales

- Thursday, Sept. 26: Durable Orders, Initial Unemployment Insurance Claims report for the week ended Sept. 21, earnings from Costco Wholesale COST

- Friday, Sept: 27: Personal Income and Outlays report

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended Sept. 13

- The Morningstar US Market Index rose 1.49%.

- The best-performing sectors were energy, up 3.98%, and communications services, up 3.19%.

- The worst-performing sector was real estate, down 1.04%.

- Yield on the 10-year US Treasury notes rose to 3.73% from 3.66%.

- West Texas Intermediate crude prices rose 3.13% to $71.77 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 469, or 67%, were up, five were unchanged, and 235, or 33%, were down.

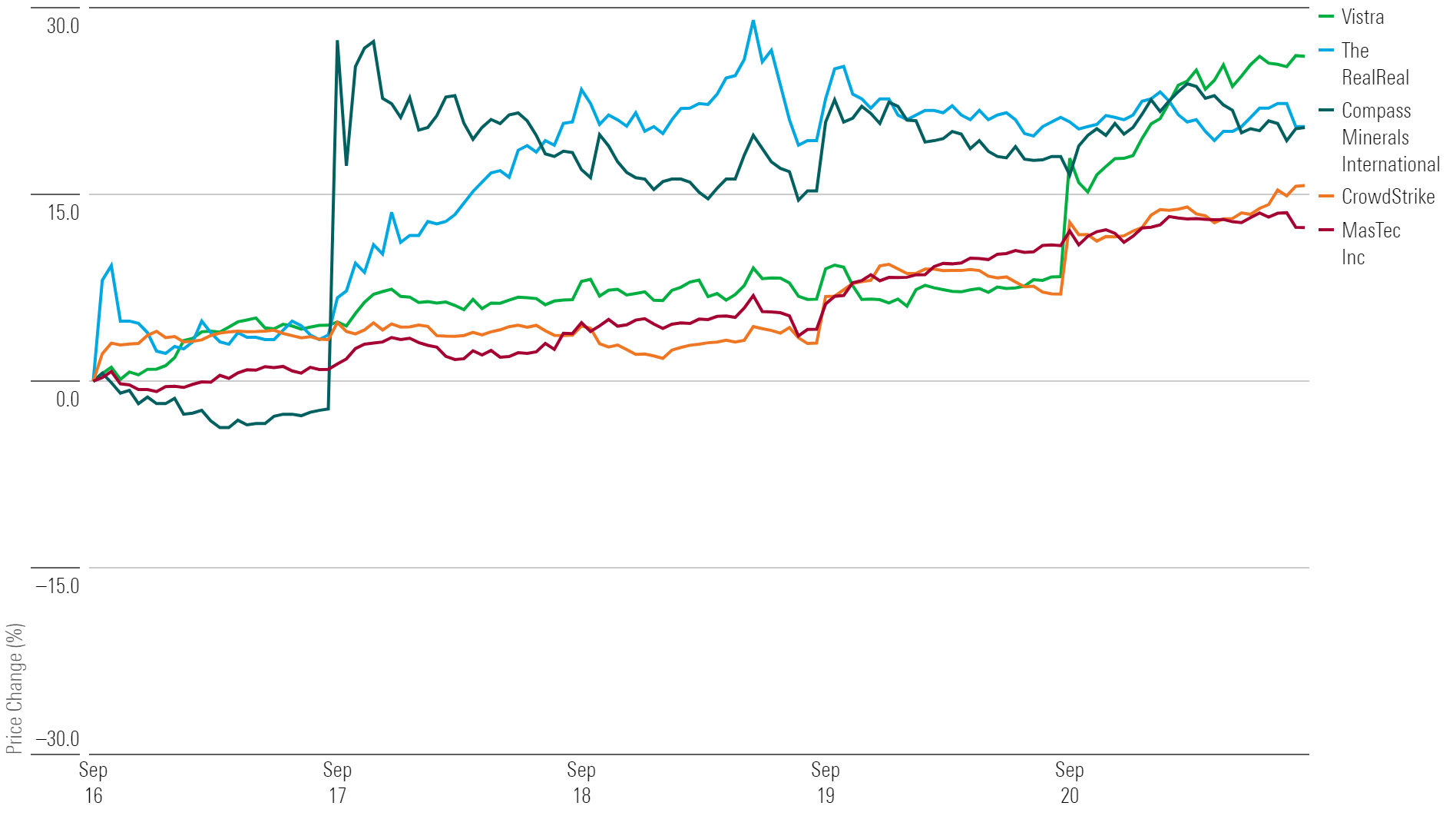

What Stocks Are Up?

Vistra VST, RealReal REAL, Compass Minerals International CMP, CrowdStrike Holdings CRWD, MasTec MTZ

Best-Performing Stocks of the Week or Worst-Performing Stocks of the Week

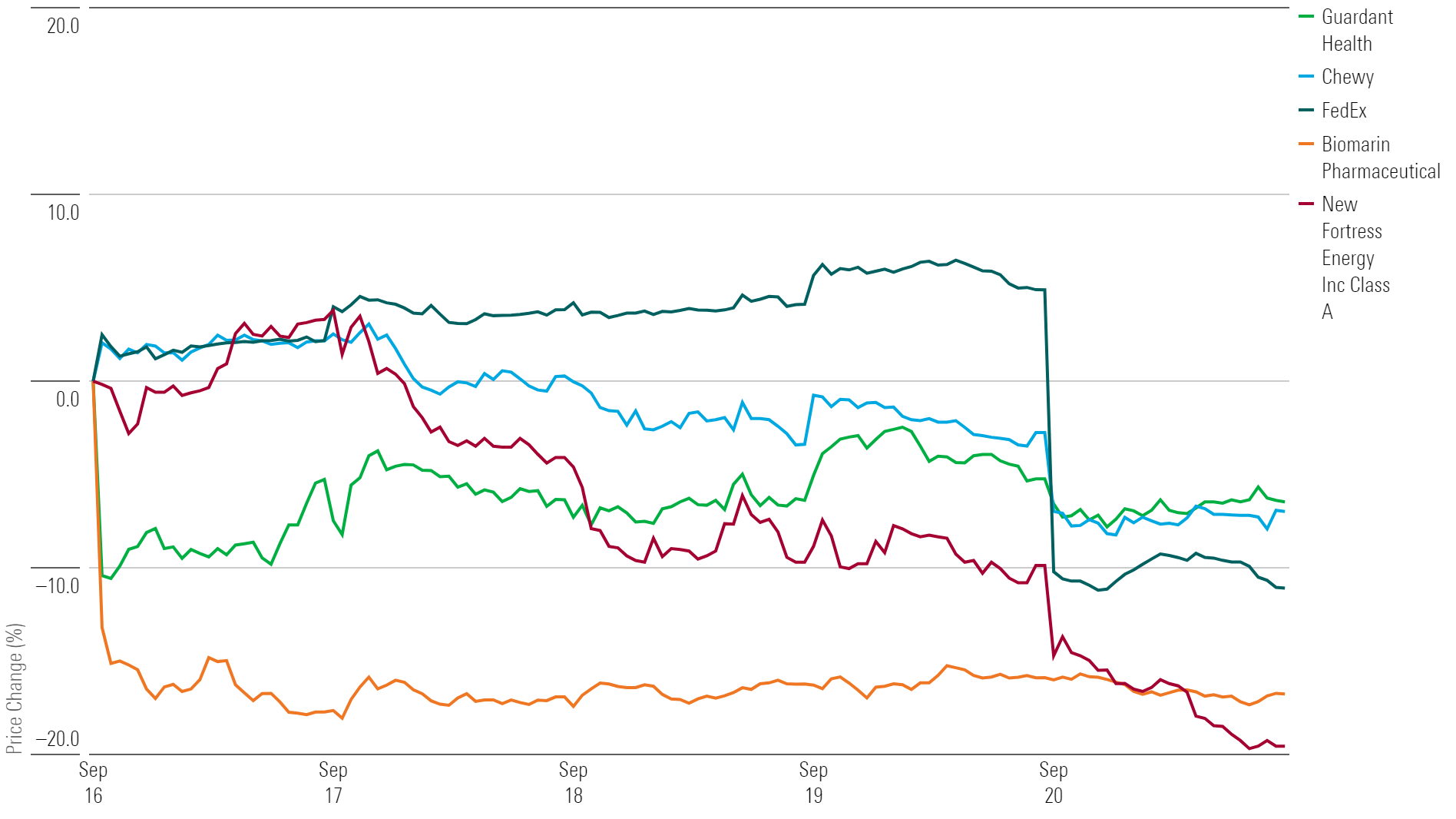

What Stocks Are Down?

New Fortress Energy NFE, BioMarin Pharmaceutical BMRN, FedEx FDX, Chewy CHWY, Guardant Health GH

Worst-Performing Stocks of the Week or Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)