Markets Brief: Optimism for Interest Rates

Plus: The dollar dives, bonds rise, and AI remains in the spotlight.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Investors Appear Optimistic About Interest Rates

Equity markets rose last week as confidence grew in a September interest rate cut from the Federal Reserve. Per CME FedWatch, investors ascribe a 64% probability to cuts amounting to at least 1% by the end of the year. The Morningstar US Market Index rose 1.6%, led by economically sensitive real estate (up 3.5%) and consumer cyclical (up 2.7%) companies. For more details on these movements and the impact on the valuation of equities, check out Morningstar’s new Markets page.

The Dollar Dives

Currency markets are also reflecting the expectations for interest rate cuts. The US Dollar Index fell 1.7% over the week, boosting returns in overseas markets for dollar-based investors. Despite this, Morningstar’s Investment Management team believes the dollar remains expensive compared with most other currencies. If they’re correct, the gravitational pull of currencies toward this “fair” value over time should support international investments. To learn more about the team’s views, check out this interview with Morningstar Wealth CIO, Americas Philip Straehl.

Bonds Benefit

Expectations of falling interest rates were also evident in the bond market, with the yield on the 10-year Treasury bond falling from 3.9% to 3.8% over the week. This led to a rise in the Morningstar US Core Bond Index of 0.66%. Due to the dollar’s weakness, Global Treasury bonds did even better, rising 1.34%. The yield on the 10-year Treasury has now fallen over 1% since its recent peak in October 2023, but the Morningstar Investment team believes it’s still a little above its fair value. Credit spreads (the additional yield an investor receives to compensate for the risk of default by corporate borrowers) remain very tight, indicating bond investors are unusually optimistic about policymakers’ ability to engineer a soft landing.

Beware of Correlation

While investors may cheer the rise in both the equity and bond portions of their portfolios, the purpose of bonds in most portfolios is to provide diversification, and this is predicated on a low correlation between the price movements of bonds and equities. When all assets in a portfolio respond to the same impetus by rising together, it would be naïve to expect a diversified response if that impetus is reversed. A good portfolio should be ready for a range of outcomes rather than depend on a single economic path.

Investors should not necessarily make changes in response to a short period of correlated returns. Still, this is an opportunity to review your portfolio and consider how it would respond if the correlated rise in prices was replaced by a correlated decline. It is always better to make investing decisions during calm conditions, when we are less prone to emotional responses and can think more clearly about the long term.

AI and Inflation

Inflation will remain in the spotlight this week, with the latest reading on the PCE index due Friday. Economists expect a slight rise in core inflation over the last 12 months. A significant deviation from this outcome would likely cause some volatility.

Nvidia NVDA releases earnings this week. This company is a key beneficiary of the boom in AI and a bellwether for investor sentiment toward this technology. Nvidia’s earnings will therefore likely impact the broader market, and expectations are high. While the stock’s price has risen 161% over the year to date, Morningstar analyst Brian Colello believes most of this gain has been justified, and he’s raised his fair value estimate for the company by 118% over the period.

Highlights of This Week’s Market and Investing Events

- Monday, Aug. 26: July Durable Orders

- Tuesday, Aug. 27: Aug. Consumer Confidence Survey

- Wednesday, Aug. 28: Earnings from Salesforce CRM, Nvidia NVDA

- Thursday, Aug. 29: Q2 GDP, Initial Unemployment Insurance Claims report, earnings from Lululemon Athletica LULU

- Friday, Aug. 30: July Personal Income and Outlays report, August Chicago PMI

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended Aug. 23

- The Morningstar US Market Index was up 5.50%.

- The best-performing sectors were technology, up 8.36%, and consumer cyclical, up 7.63%.

- The worst-performing sector was energy, up 0.85%.

- Yields on 10-year US Treasury notes fell to 3.81% from 3.89%.

- West Texas Intermediate crude prices fell 4.01% to $74.92 per barrel.

- Of the 704 US-listed companies covered by Morningstar, 579, or 82%, were up, and 125, or 18%, were down.

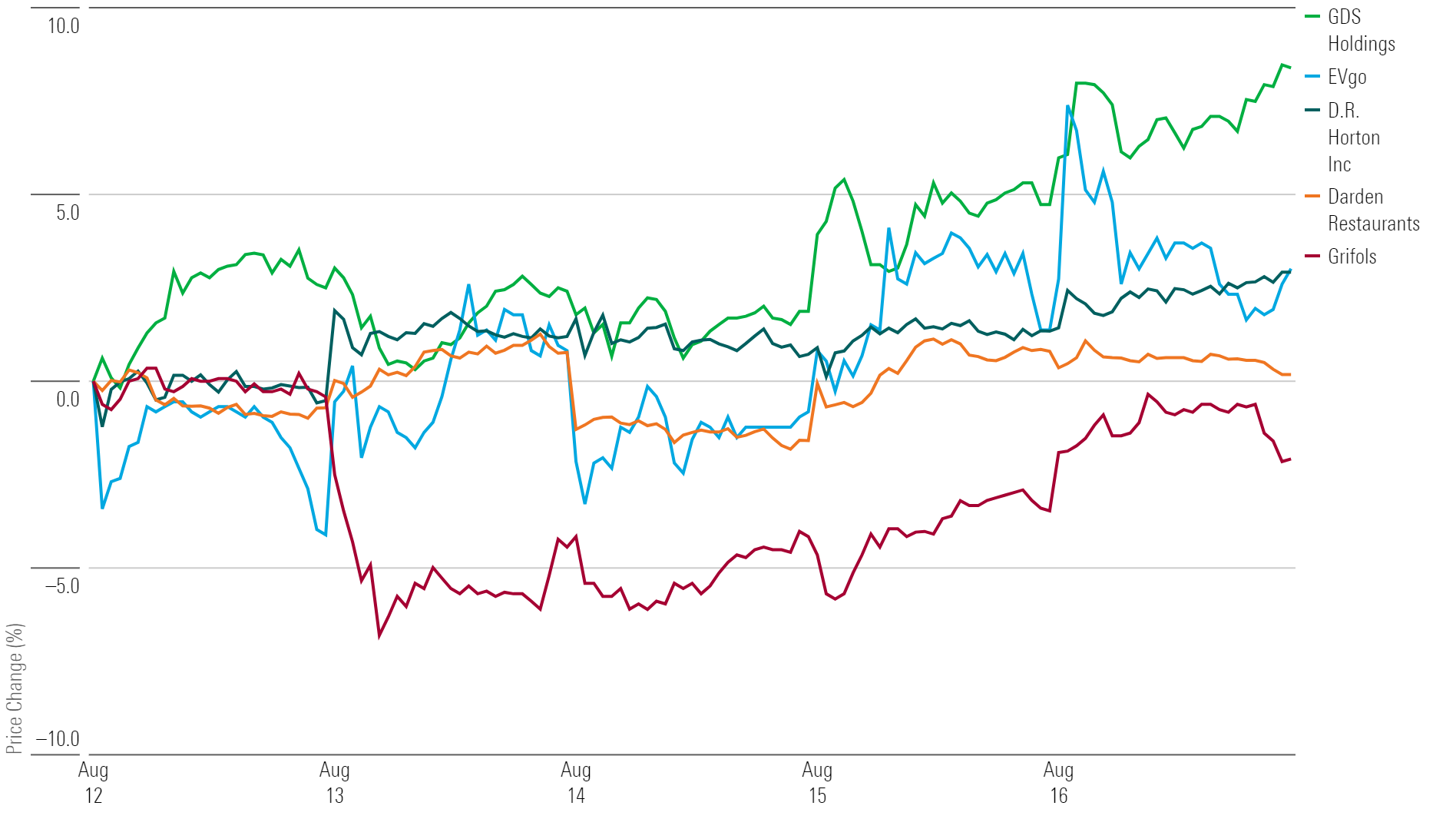

What Stocks Are Up?

GDS Holdings GDS, Grifols GRFS, EVgo EVGO, DR Horton DHI, Darden Restaurants DRI

Best-Performing Stocks of the Week

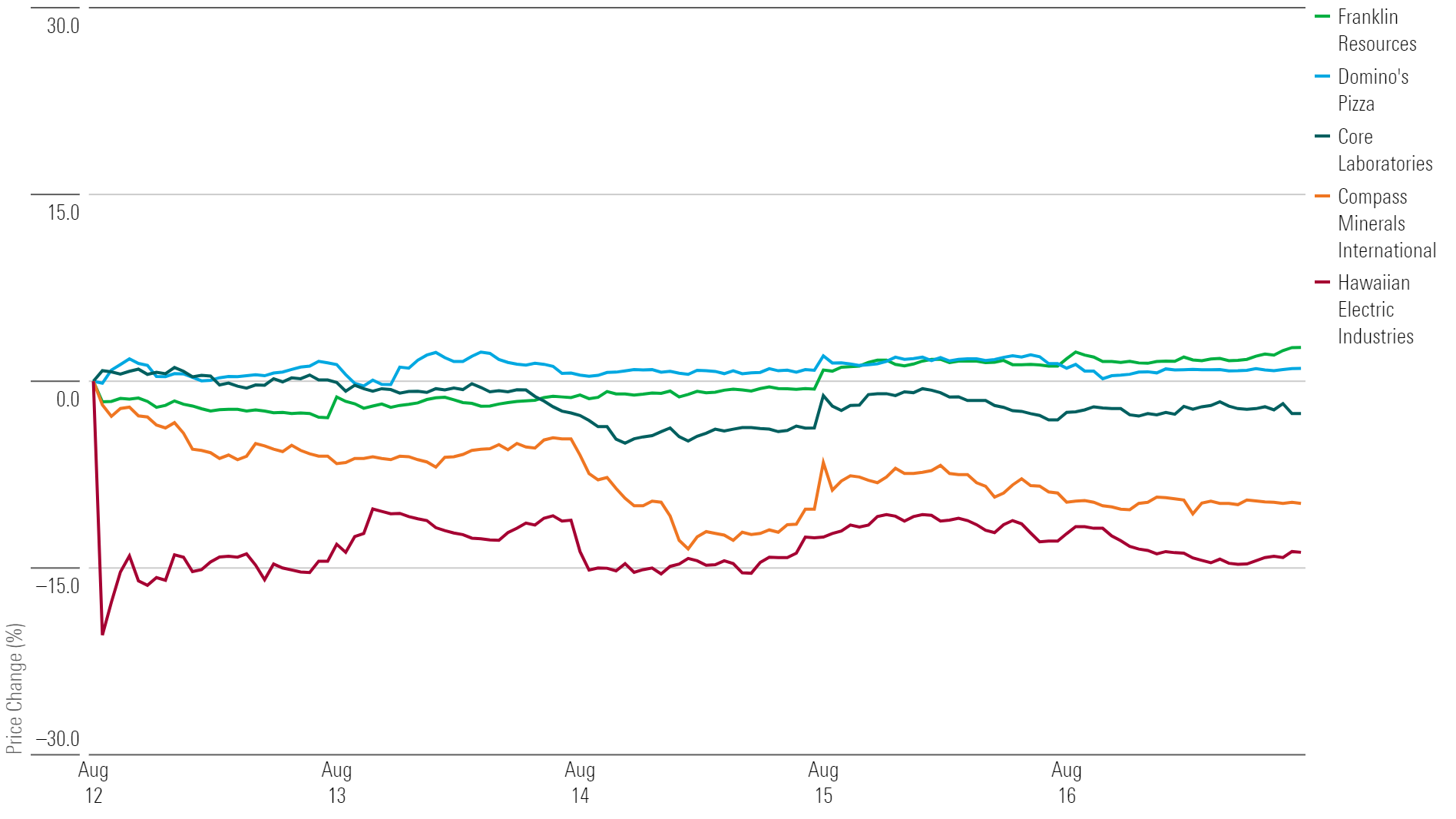

What Stocks Are Down?

Hawaiian Electric Industries HE, Franklin Resources BEN, Core Laboratories CLB, Compass Minerals International CMP, Domino’s Pizza DPZ

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)